EBS Accounts Receivable (AR)

AR Transaction Types

We have 6 transaction types in AR:

1. Invoice

2. Deposit

3. Guarantee

4. Debit Memo

5. Credit Memo

6. Chargeback

Difference between Debit Memo and Credit Memo

Debit Memo – We need to get the amount from Customer. They have +ve value. Like freight/ additional charges need to be levied from customer.

Credit Memo – We need to pay the amount to Customer. They have -ve value. Like initially we charged more amount and later on the amount need to given to customer.

Accounting Entry in AR

Before payment

Receivable A/C Dr

Revenue A/C Cr

After payment

Cash A/C Dr

Receivable A/C Cr

AR Workbench

We have four AR Workbenches.

- Transactions Workbench

- Receipts Workbench

- Bills Receivable Workbench

- Collections Workbench

- Transactions Workbench – We can create new invoices, update existing invoices, debit memos, credit memos and so on

- Receipts Workbench – We can create receipt batches and enter, apply, reverse, reapply and delete individual receipts.

- Bills Receivable Workbench – We can create, update, remit and manage bills receivable.

- Collections Workbench – We can review customer accounts and perform collection activities such as recording customer calls and printing dunning letters.

Initial Setups

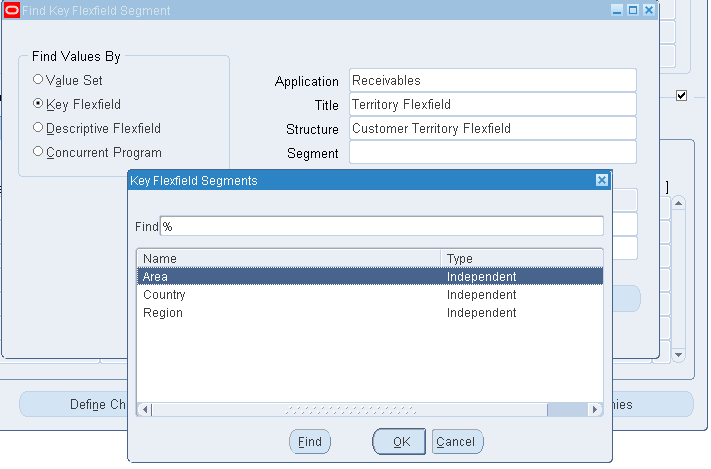

We have Territory and Sales Tax Location as KFF’s in AR

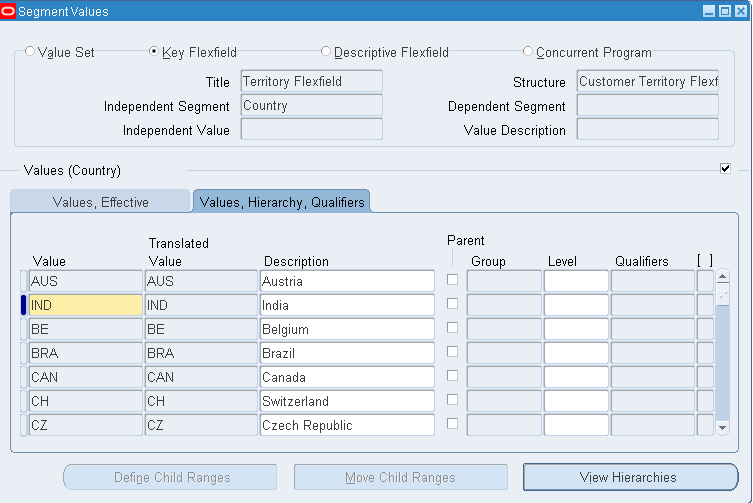

Receivables >> Setup >> Financials >> Flexfields >> Key >> Values

The structure is Customer Territory Flexfield and select Segment as Country >> Find >> Create a Country India with value as IND >> Save

Similarly for query for Region segment and create value if required.

Similarly for query for Area segment and create value if required.

Now go to Setup >> System >> QuickCodes >> Receivables >> Query for Category CUSTOMER_CATEGORY and create new code/ meaning (say something like WHOLESALE) >> Save

FOB: Free on Board – The point where the ownership ends.

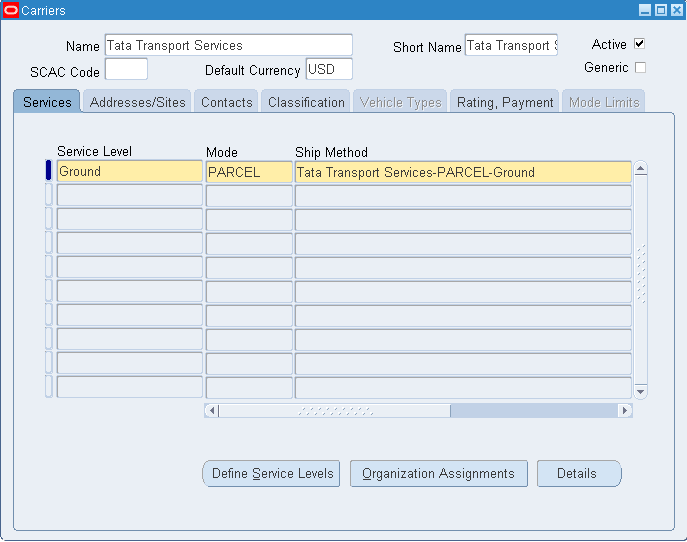

Freight Carriers – Using which transport we are going to supply our material

Setup >> System >> QuickCodes >> Receivables >> Freight Carriers

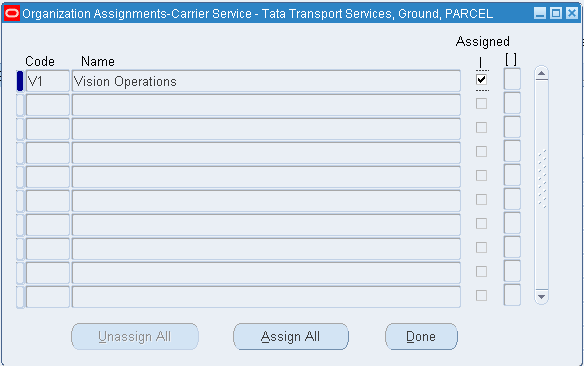

Click on Organization Assignments >> Check Vision Operations

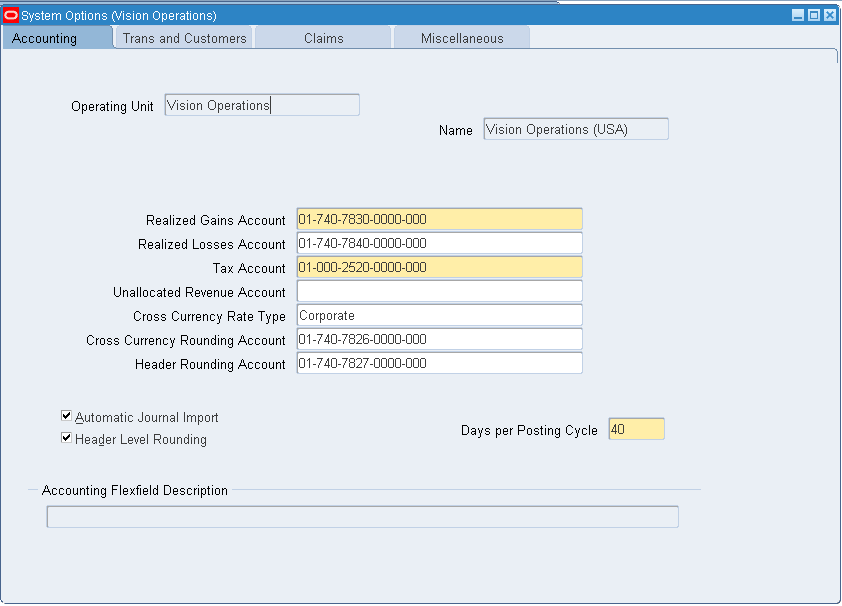

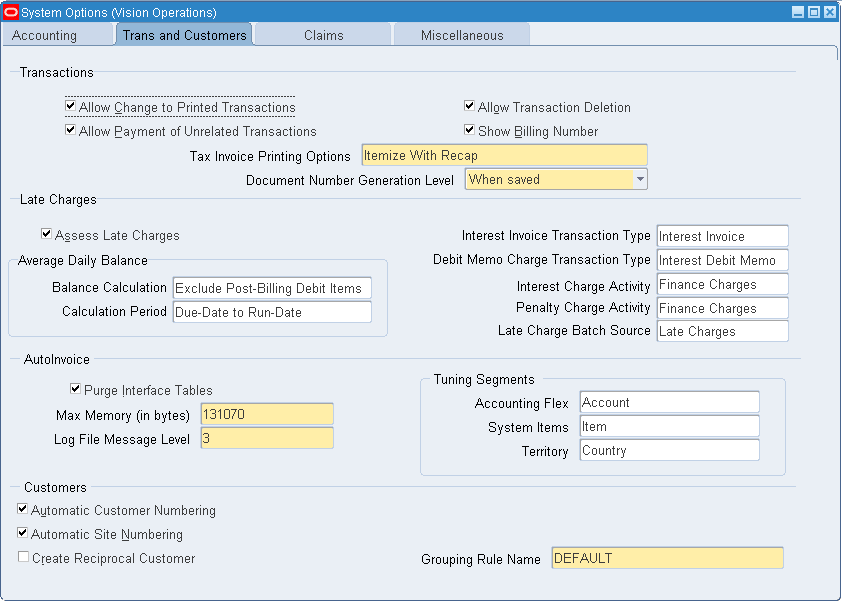

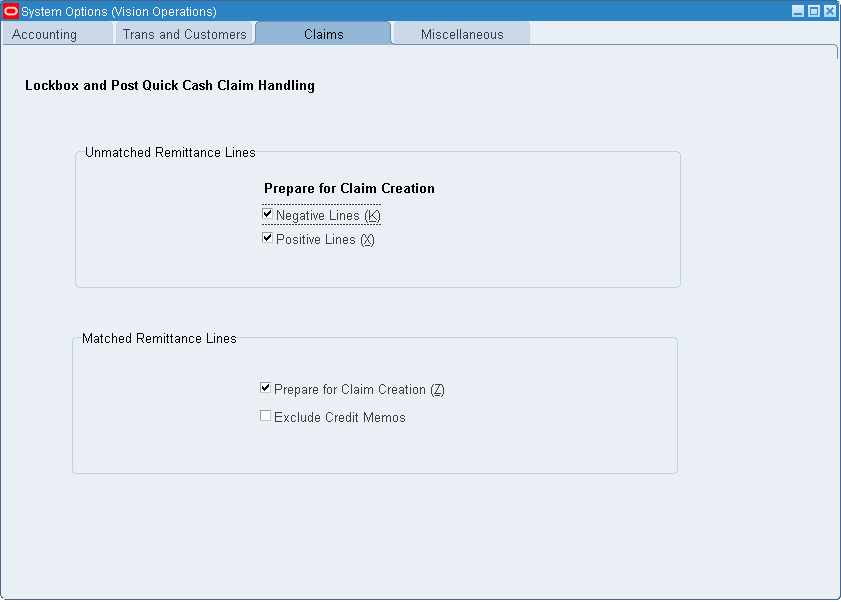

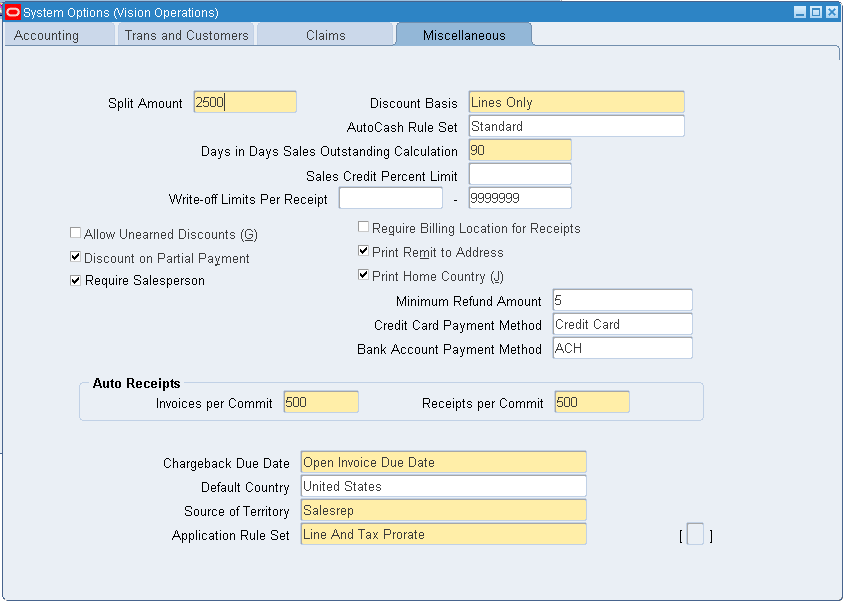

System Options

Receivables >> Setup >> System Options

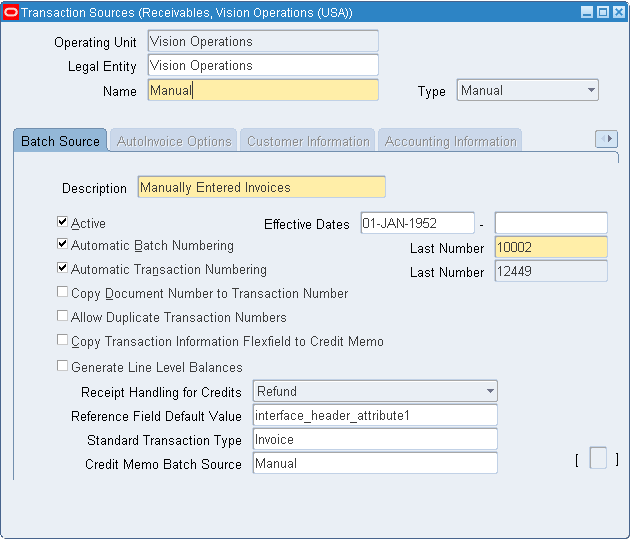

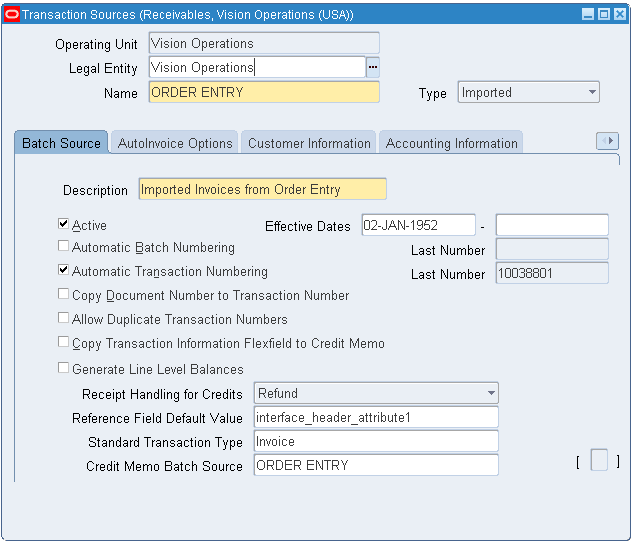

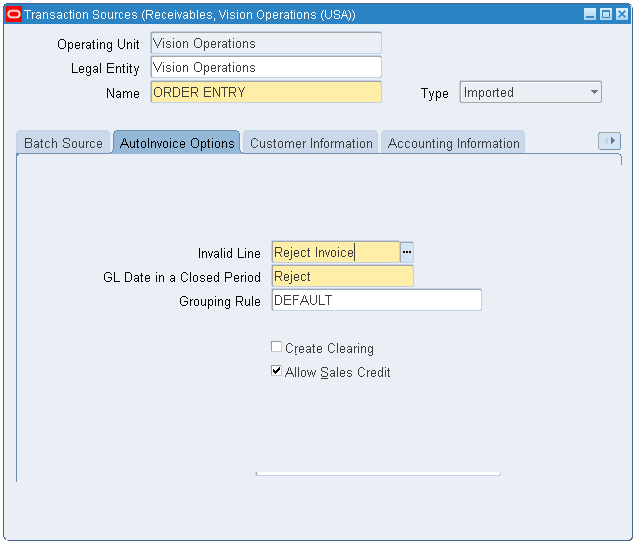

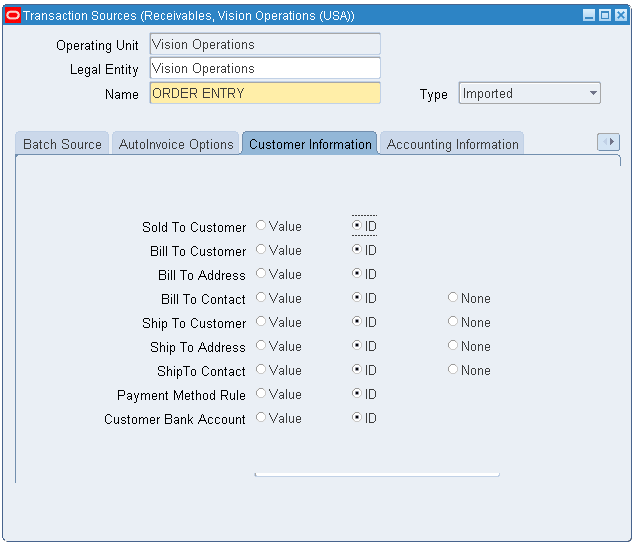

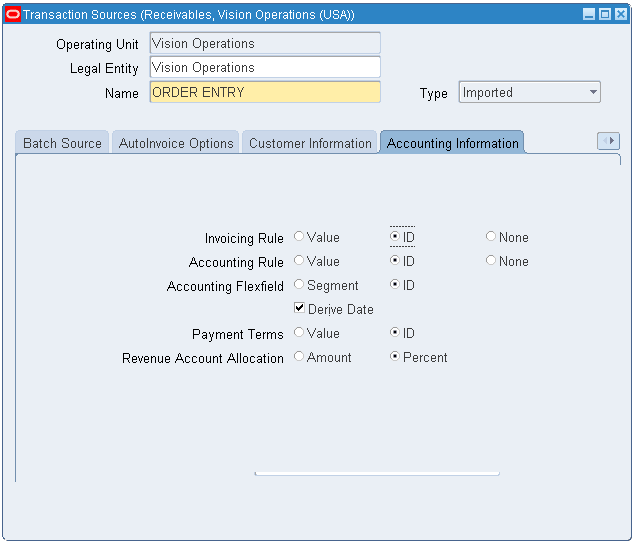

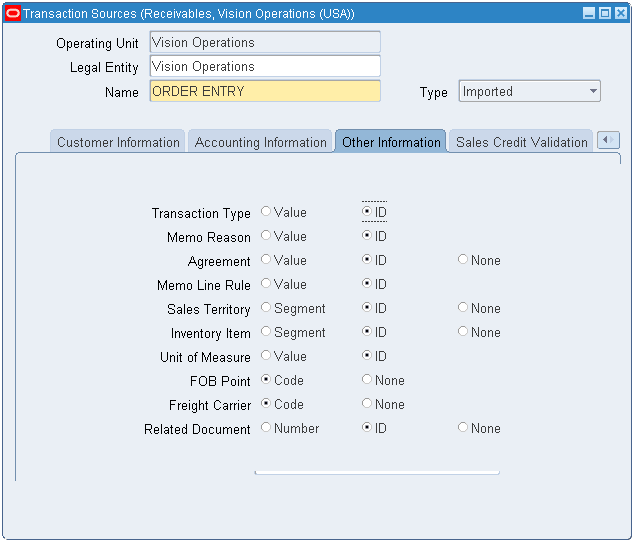

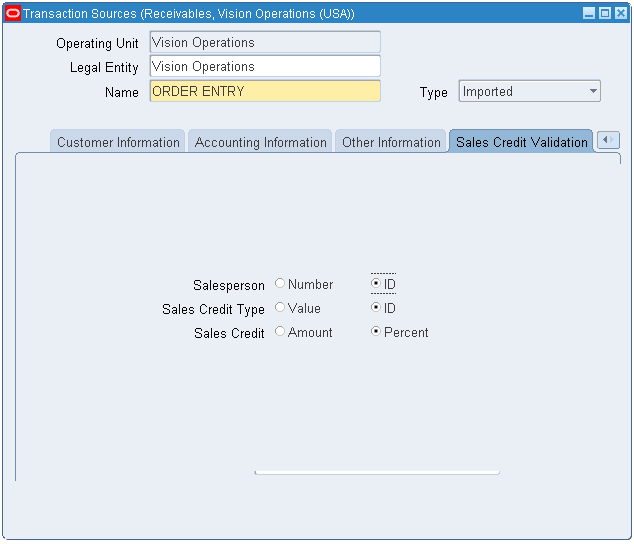

Transaction Source

Receivables >> Setup >> Transactions >> Sources

Manual

Imported

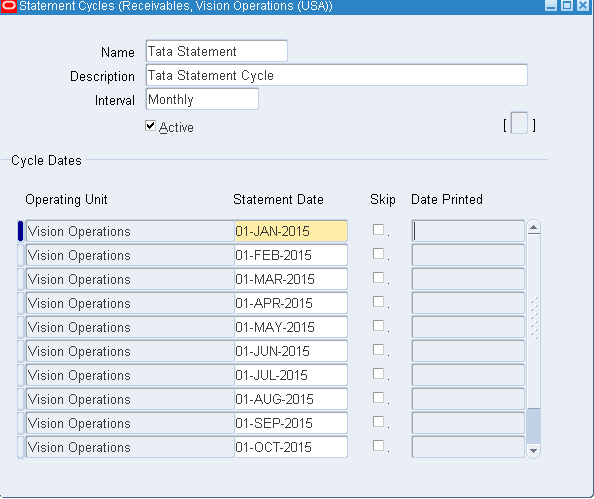

Frequency of sending statements to customers

Setup >> Print >> Statement Cycles >> Here I am sending statement on first day of every month >> In case we use skip then statement wont get generate for that particular month

Collector – Collects the amount from customers who don’t pay on time

Setup >> Collections >> Collectors >> Create collector if required

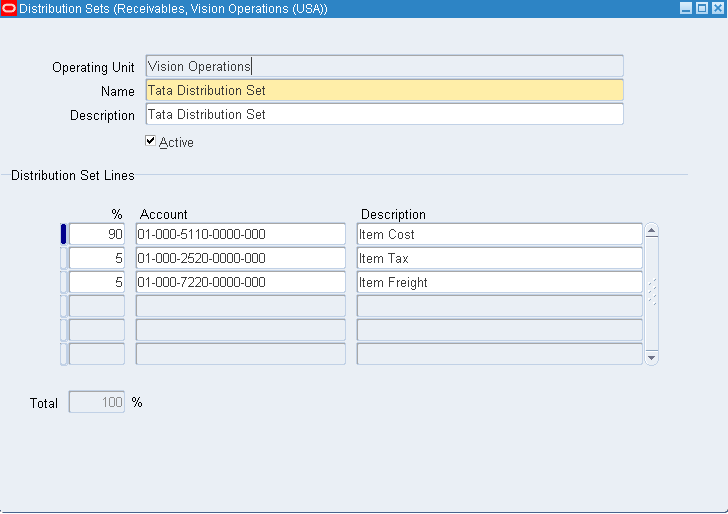

Distribution Sets – In Payables we have Full and Skleton where in Full we get distribution of item cost/ freight/ tax charges. In Skeleton we have values as 0, 0 and 0. Here supplier is not going to disclose the % of amount which he will charge.

In Receivables we don’t have such types.

Setup >> Receipts >> Distribution Sets >> Create new distribution set as below

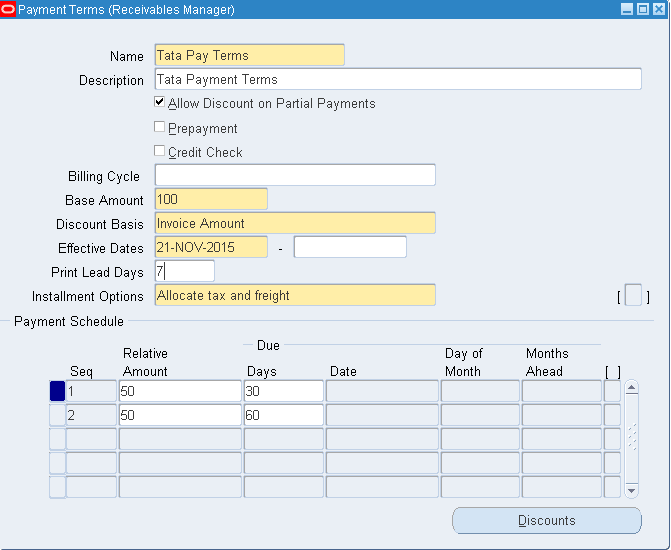

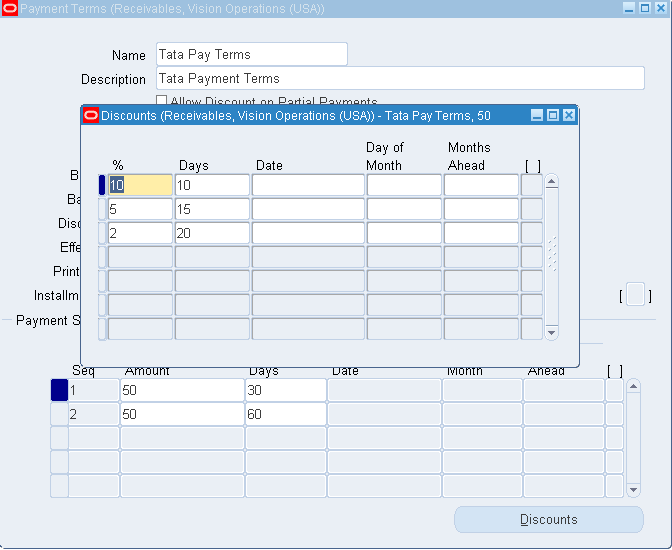

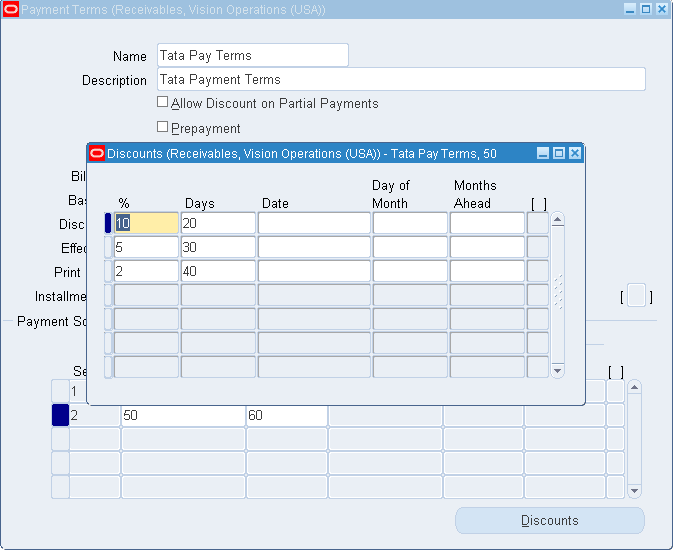

Payment Terms

Setup >> Transactions >> Payment Terms

Base amount 100 siginifies the 100% which is splitted in two installments i.e 50% and 50%. The first 50% amount needs to be paid by 30th day and balance 50% by 60th day.

Check Allow Discount on Partial Payments in case you need.

Print Lead Days – Print list of customers who are due to pay on next 7th day. (Here we considered 7)

Installment Option – Whether to include tax and freight in first installment or need to be segregated across next installments

Note: In Payables we are allowed to give till three discounts only but in AR we can have n number of discounts.

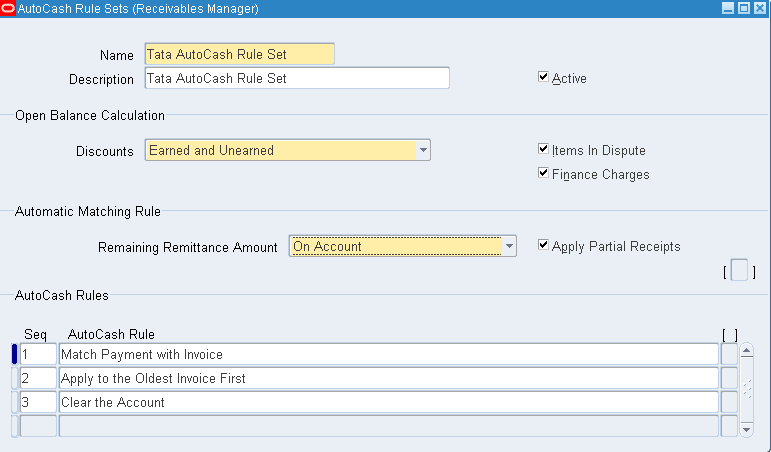

AutoCash Rule Sets: How we match the payment/ want to apply against the customer invoice

Receivables >> Setup >> Receipts >> AutoCash Rule Sets

We have AutoCash Rules defined above.

In case the customer paid more than either we issue a credit memo with -ve entry or the amount goes to Remaining Remittance Amount – On Account. We will adjust here for his next purchasal.

Here Discounts signifies that the customer is entitled to take discount. He wont bargain here.

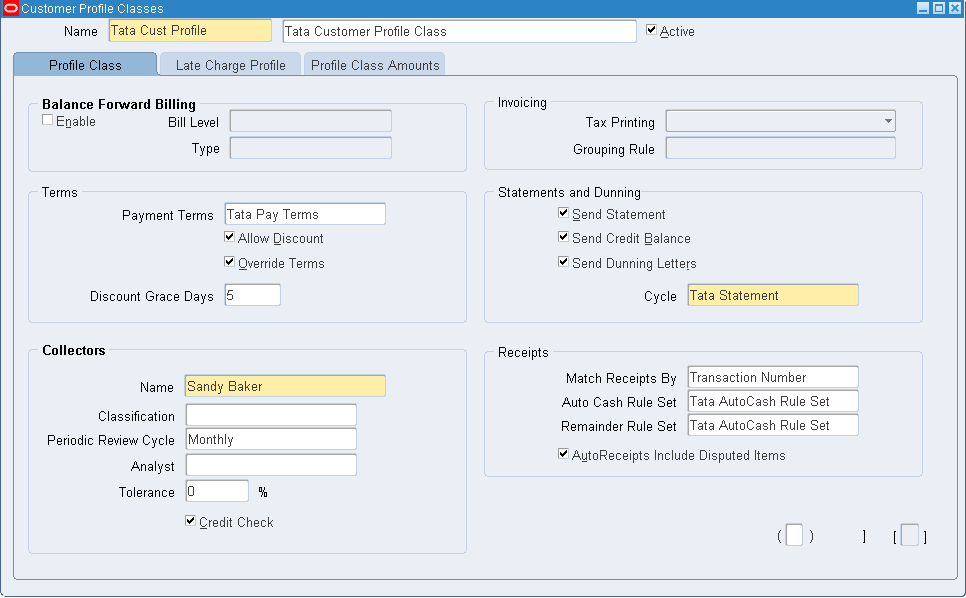

Customer Profile Class: Determines the profile of customer like Excellent/ Good/ Bad. We assign this profile to customer.

Receivables >> Customers >> Profile Classes

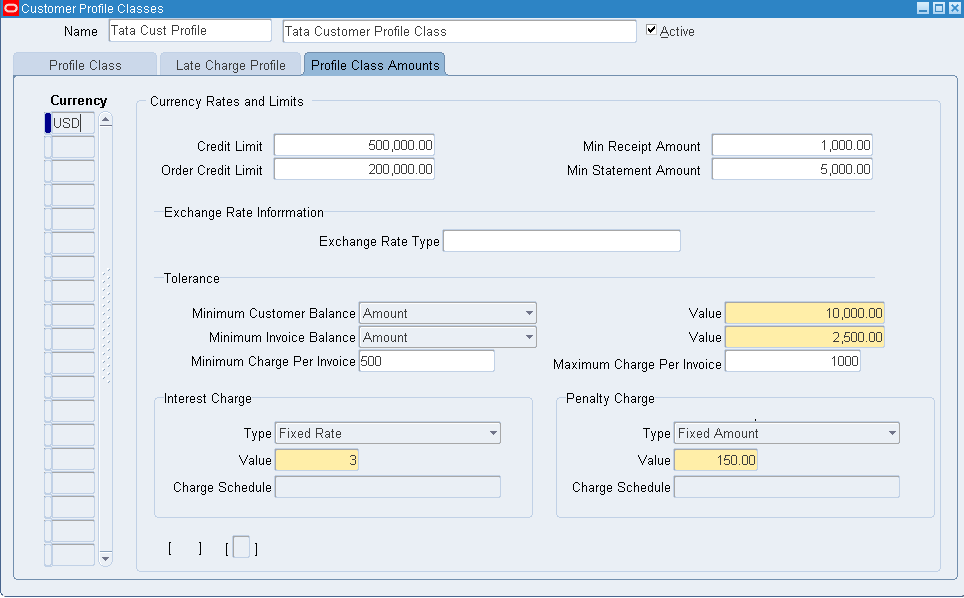

Minimum charge per invoice = Minimum interest amount which we are going to charge. Say the actual interest amount is 200, since we have limit of 500, customer has to pay 500. Similar is the case with Maximum charge per invoice.

Penalty Charge = Extra Charge

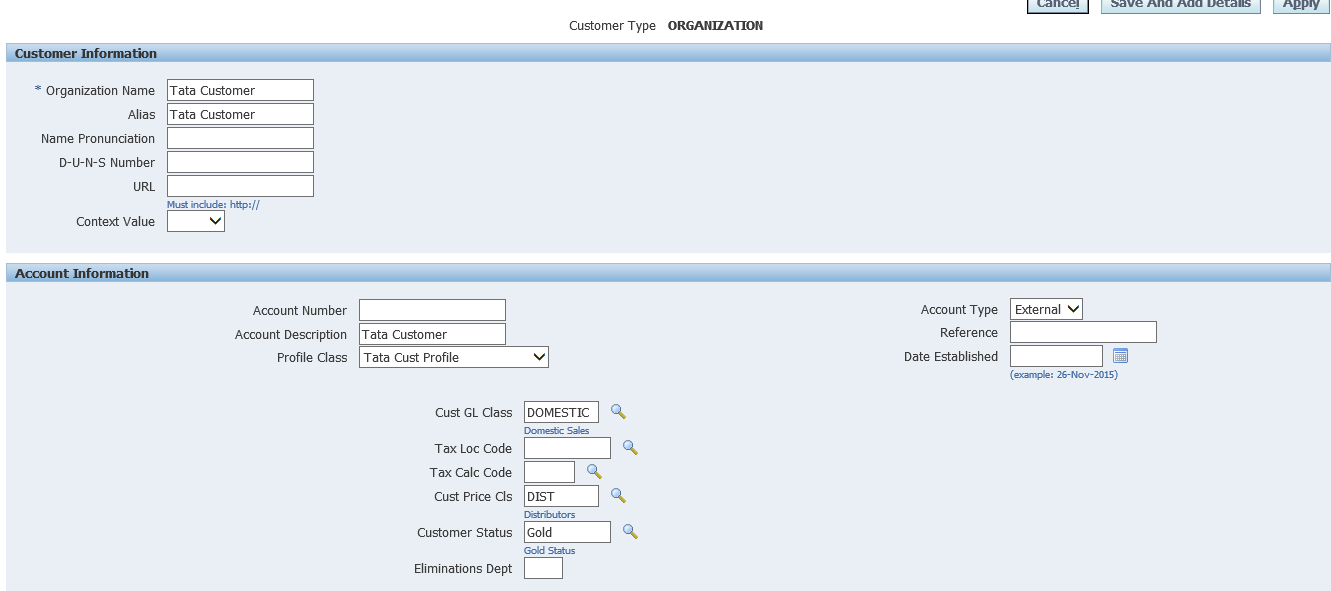

From Receivables we wont be able to create Customers, we will be able to view. For creation of customer we use Trading Community Manager responsibility.

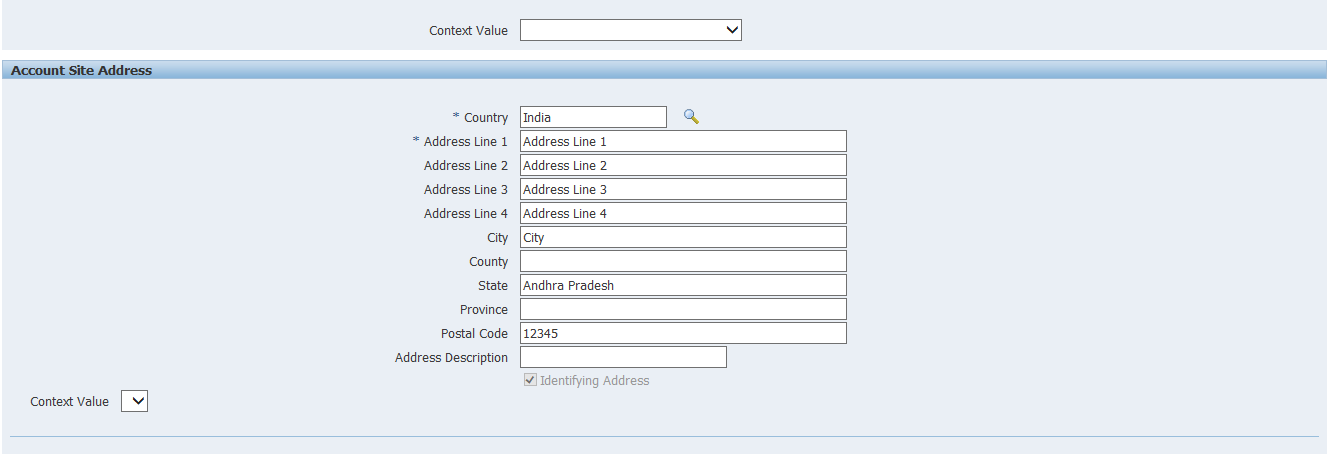

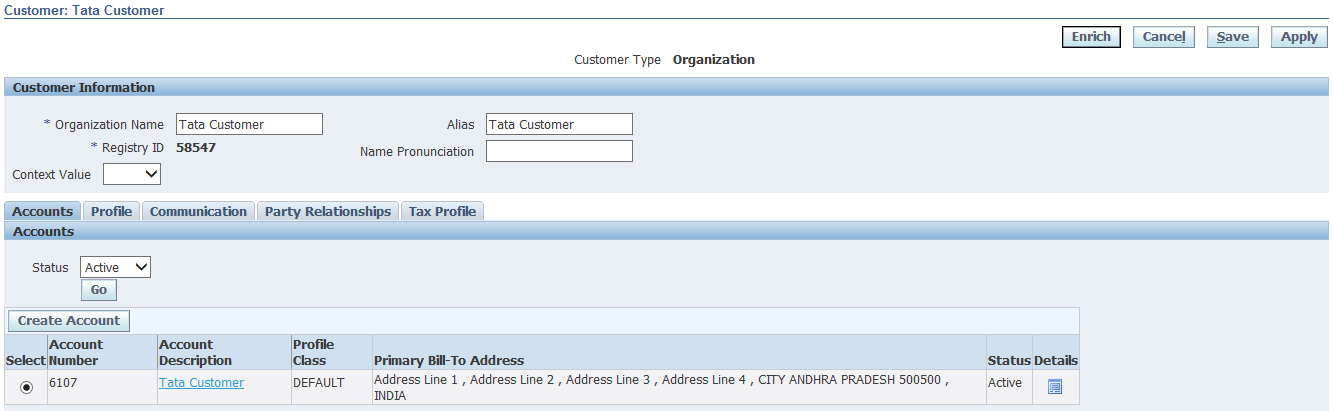

Creation of Customer:

Trading Community Manager >> Trading Community >> Customers >> Standard >> Create

Dunning Letter = Reminding Letters to customers

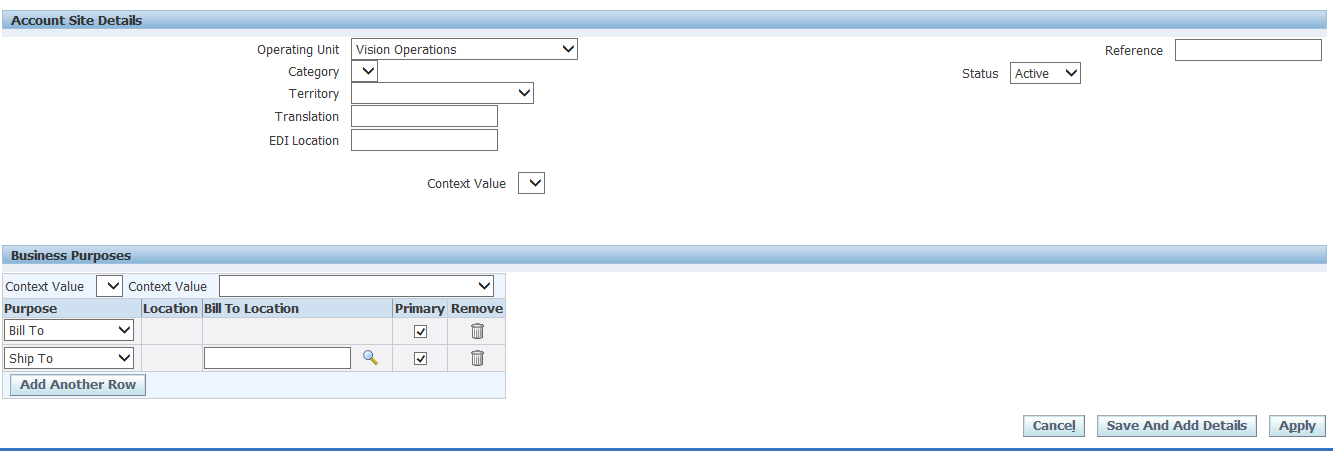

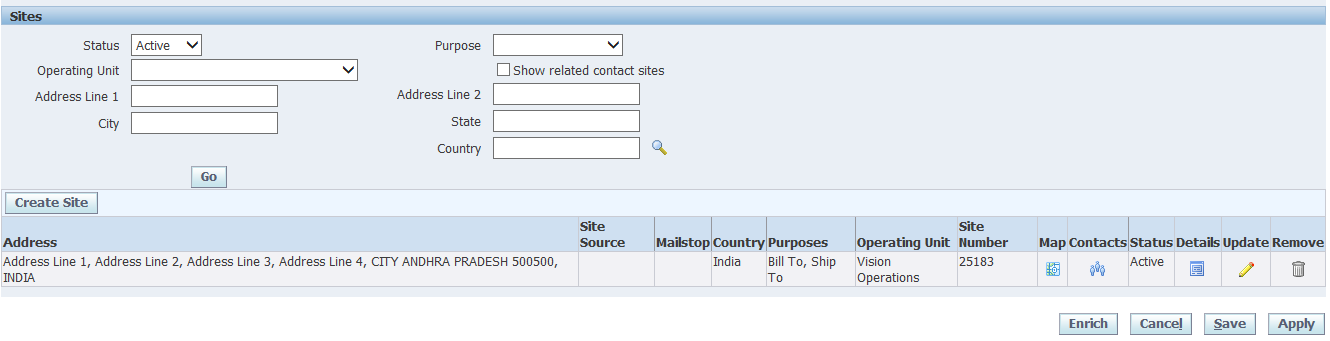

The Bill To and Ship To are mandatory

Apply

We get default profile class. Edit and choose appropriate profile class. Click on Details >> Go to Account Profile tab and select desired profile. Under Profile Amounts tab delete the currencies except USD. The values auto populates from profile class definition. Enter Min Dunning Amount and Min Dunning Invoice Amount.

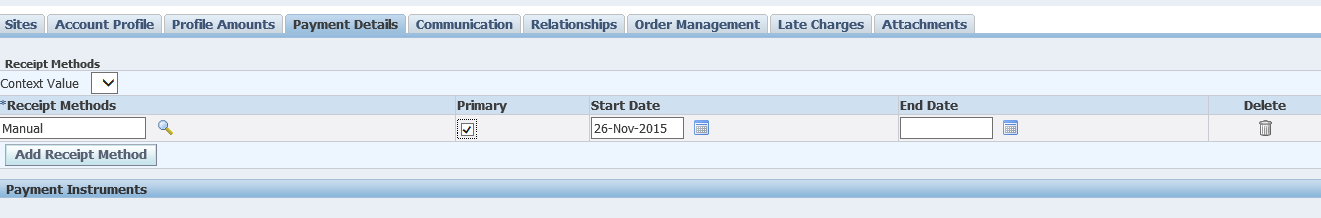

Go to Payment Details tab >> Add Receipt Method >> Enter Receipt Method as Manual and check Primary >> Save

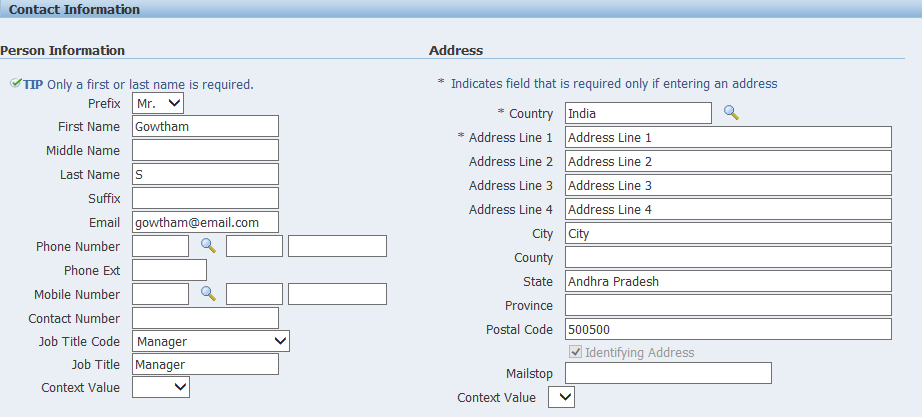

Communication tab >> Create Contact >> Enter contact details with address and select bill to as contact role. Similarly create one more contact for ship to purpose.

Relationships >> Create Account Relationship >> No changes to do

Reciprocal = Supplier as well as Customer. Supplies raw material and purchase end product.

Late Charges >> Enable Late Charges

Customer creation completed.

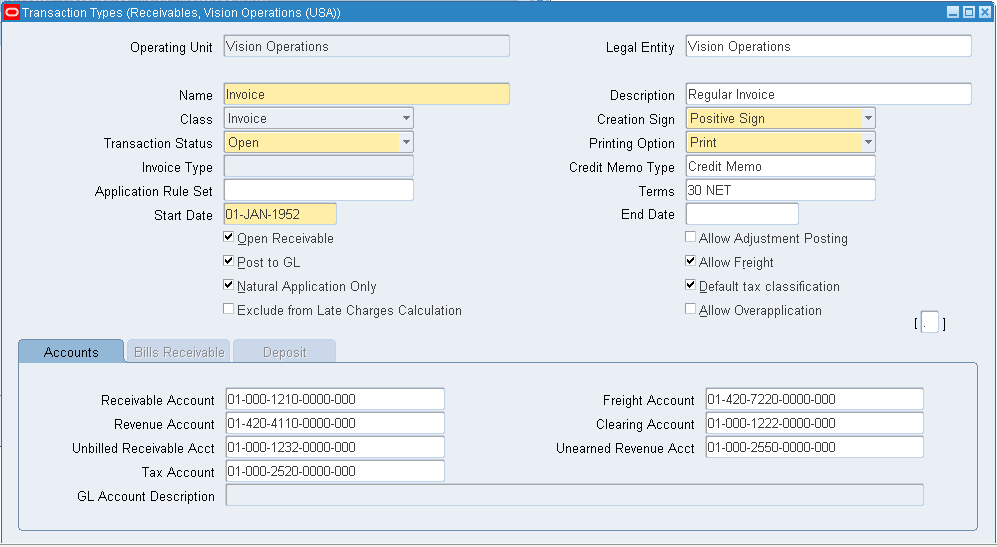

Transaction Tyes: In Payables we wont be able to define Invoice types whereas in Receivables we can create own transaction types. We use transaction types to define the accounting for debit memos, credit memos, on-account credits, chargebacks, commitments, invoices and bills receivable.

Receivables >> Setup >> Transactions >> Transaction Types

We can get the Reconciled (Settled) information in Payables >> Payments >> Entry >> Payments. Query for Reconciled in Status field and document number denotes the cheque number.

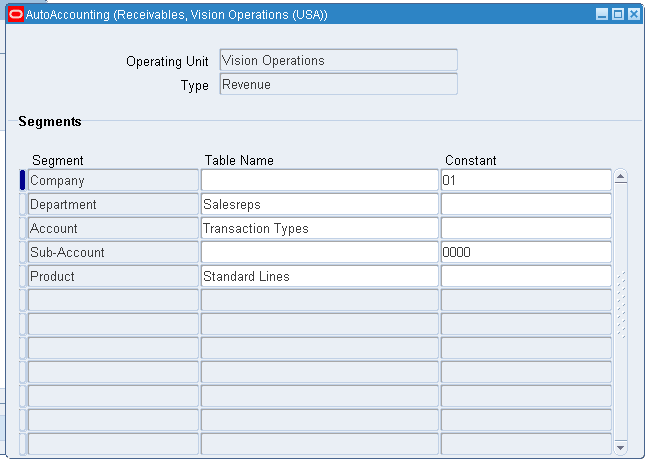

Auto Accounting

Define auto accounting to specify how you want receivables to determine the general ledger accounts for transactions that you enter manually or import using autoinvoice.

Receivables >> Setup >> Transactions >> AutoAccounting

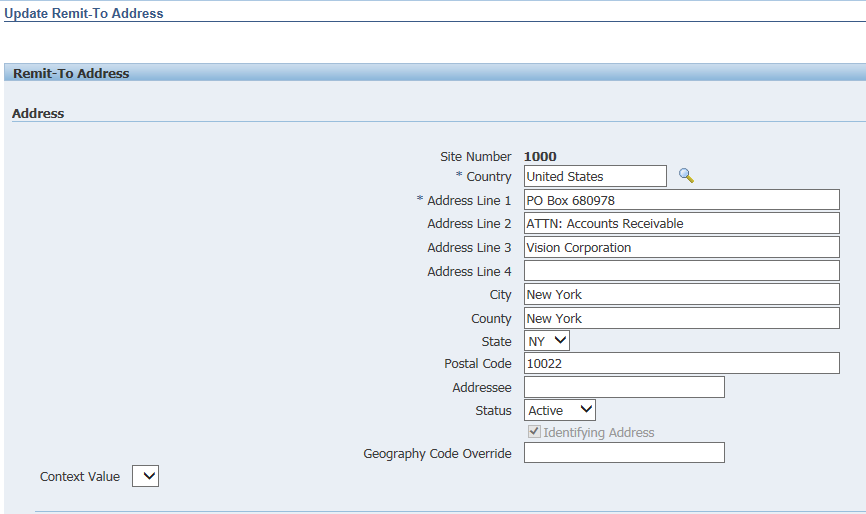

Remit-To Address

Receivables >> Setup >> Print >> Remit-To Addresses

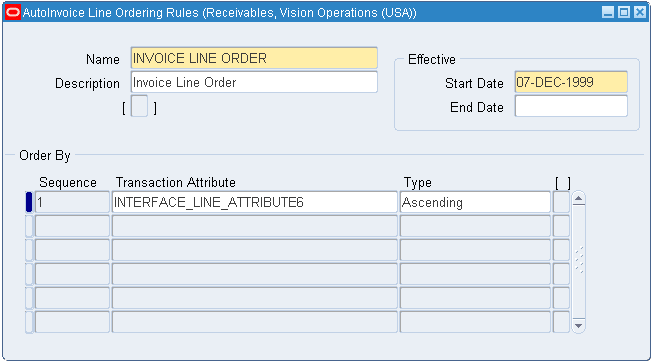

Auto Invoice Line Ordering Rules

Navigation – Receivables >> Setup >> Transactions >> AutoInvoice >> Line Ordering Rules

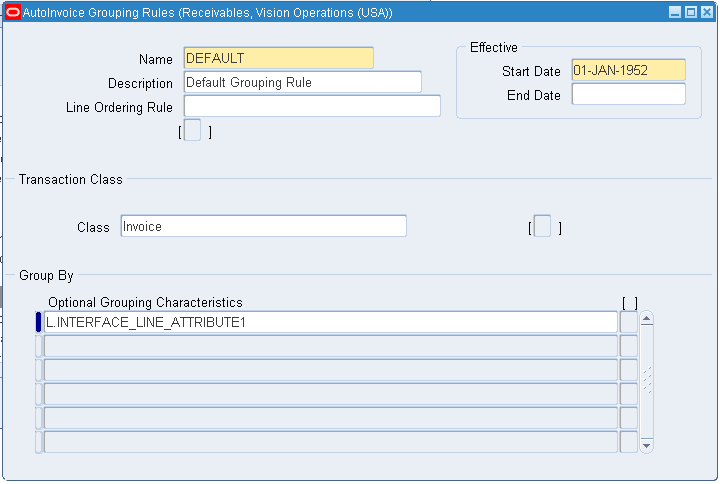

Auto Invoice Grouping Rules

Define grouping rules that auto invoice will use to group revenue and credit transactions into invoices, debit memos, credit memos. Grouping rules specify attributes that must be identical for lines to appear on the same transaction.

Navigation – Receivables >> Setup >> Transactions >> AutoInvoice >> Grouping Rules

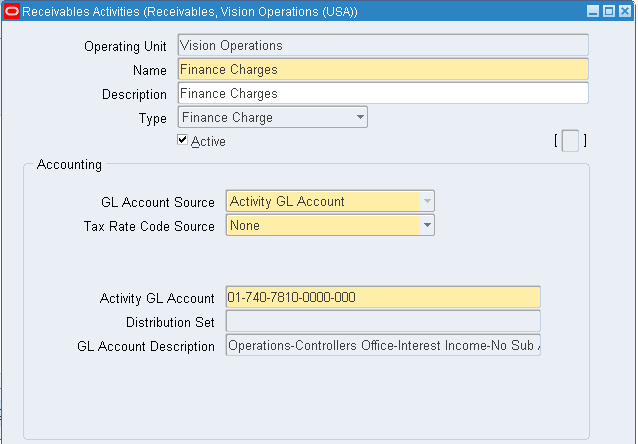

Receivable Activities

Receivable activities are defined to default accounting information for miscellaneous receipt, finance charge, chargeback and adjustment transactions. The activities defined here appear as list of values choices in the Receipt and Adjustment window. We can defined as many activities as we need.

Navigation – Receivables >> Setup >> Receipts >> Receivable Activities

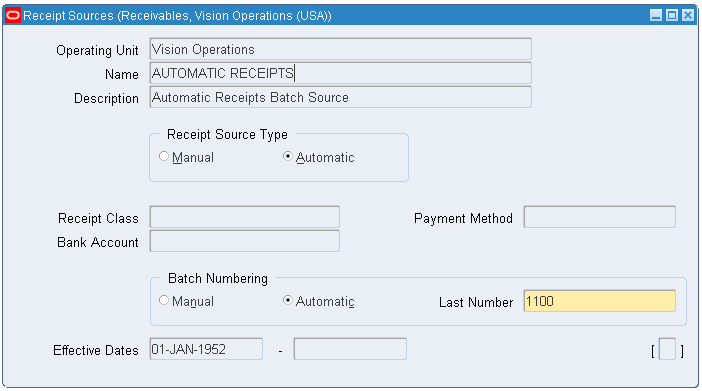

Receipt Sources

We define to provide default values for the receipt class, payment method and remittance bank account fields for receipts you add to a receipt batch.

Navigation – Receivables >> Setup >> Receipts >> Receipt Sources

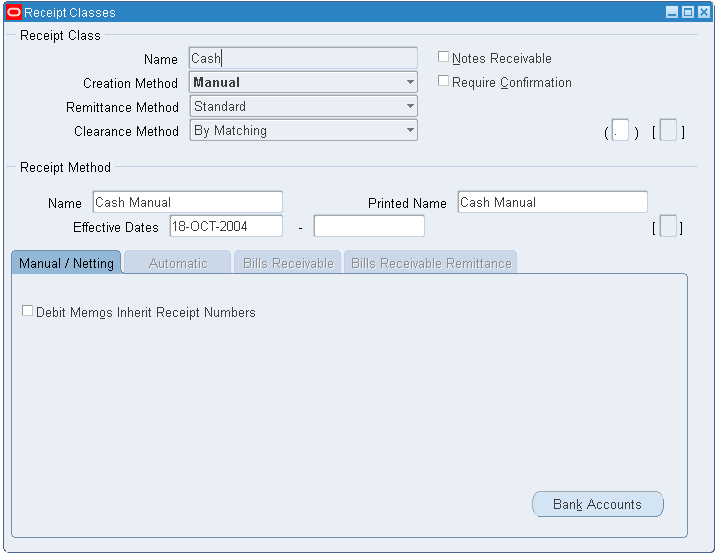

Receipt Class

We define to determine the required processing steps for receipts to which you assign payment methods with this class. These steps include confirmation, remittance and reconciliation.

Navigation – Receivables >> Setup >> Receipts >> Receipt Classes

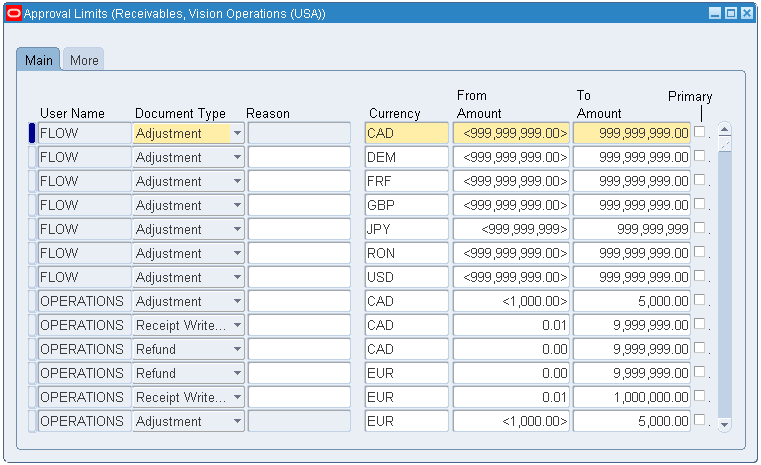

Approval Limits

Enter the username to define the approval limit.

Navigation – Receivables >> Setup >> Transactions >> Approval Limits

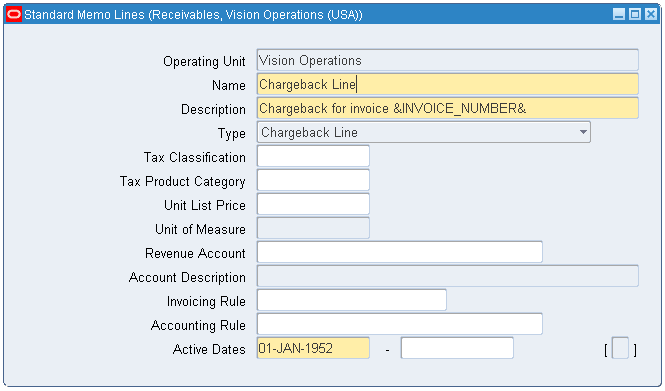

Standard Memo Line

These are defined to enter pre-defined lines for debit memos, on-account credits and invoices. When we define standard memo lines, we can specify whether a line is for charges, freight, line or tax.

Navigation – Receivables >> Setup >> Transactions >> Memo Lines

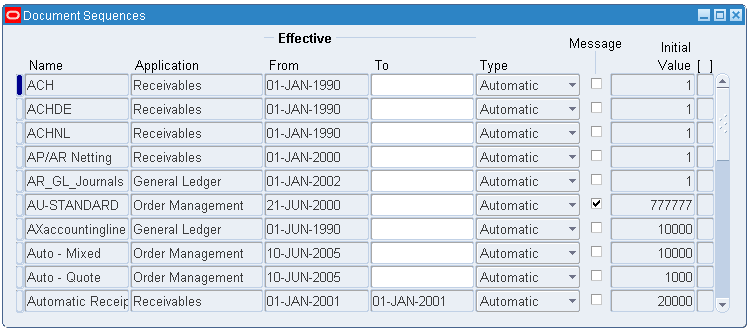

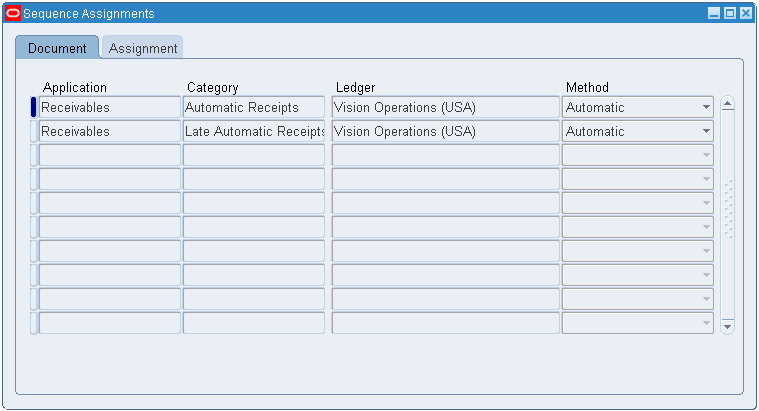

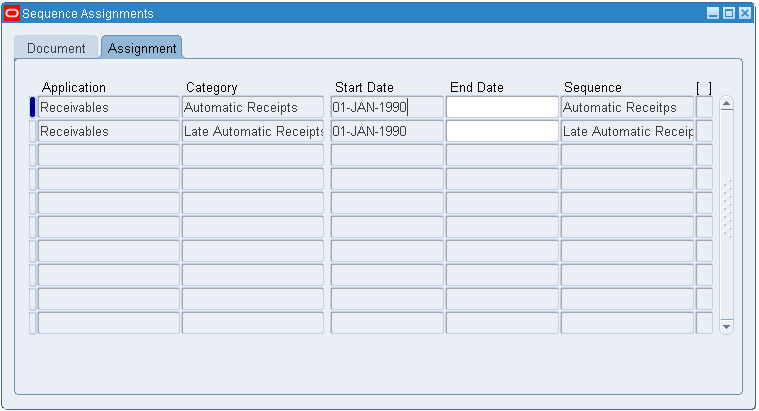

Document Sequence

Auto assigning of sequential numbers while creating Transactions

Navigation – General Ledger >> Setup >> Financials >> Sequences >> Document >> Define & Then Assign

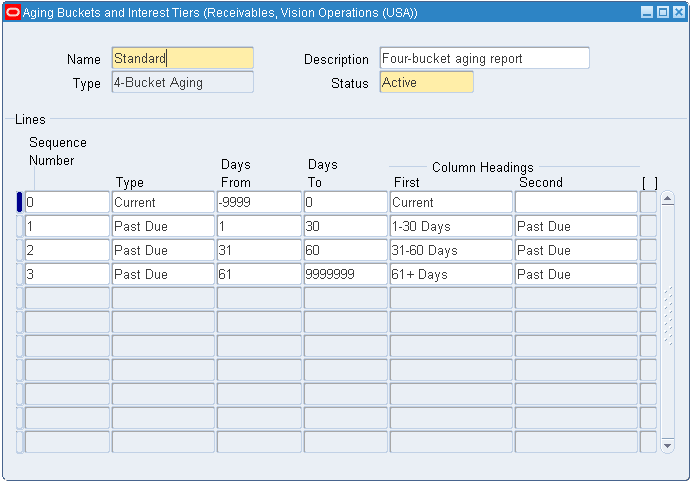

Aging Buckets

Aging buckets are time periods you can use to review and report on your open receivables.

Navigation – Receivables >> Setup >> Collections >> Aging Buckets and Interest Tiers

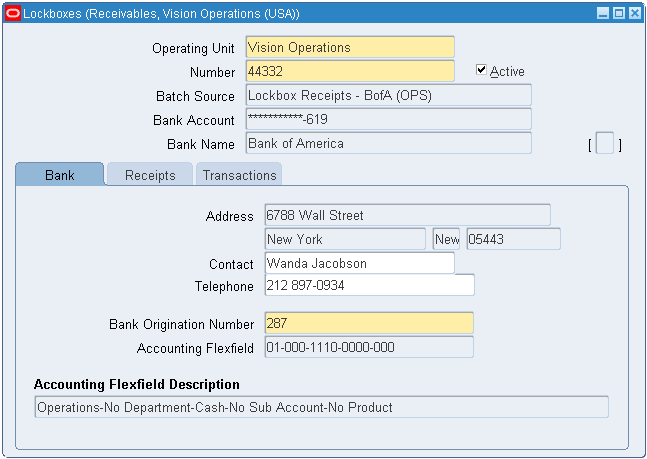

Lockbox

Navigation – Receivables >> Setup >> Receipts >> Lockboxes >> Lockboxes

Clear Transactions: To clear the cheques which are not deposited by Supplier post 90 days, coz even banks wont accept cheques which crosses 90 days.

Non-Reconciled (Non-Settled) amounts will be displayed under Cash Management >> Bank Statements >> Manual Clearing >> Clear Transactions >> Check only AP Payment >> Enter bank account number >> Find >> Here we get list of all non-reconciled cheques >> Check the type and click on Clear Transaction.

In case you selected wrong document number and cleared transaction then Cash Management >> Bank Statements >> Manual Clearing >> UnClear Transactions >> Check AP Payment >> Enter the document number (if you have) >> Find >> Check the relevant Type and click on Unclear Transaction