Oracle Fusion

Oracle Fusion Applications made up of:

1) Best features from Oracle EBS, Oracle PeopleSoft, Oracle Siebel, Oracle JD Edwards

2) Based on Oracle Fusion Middleware, using SOA

3) Using Application Integration Architecture (AIA), Industry specific pre-built SOA integration packs

4) Rich UI design

→ Launched in 2010

→ On-premise solutions: Code customization

→ Cloud solutions: Unavailability of code

→ Fusion doesn’t have Database server

→ In the web link till first . (dot) we call as POD (Platform on Demand). Ex: https://abc-dev.login.us.oraclecloud.com. The POD name changes from client to client.

→ Oracle provides user ID and password for POD account and most of the times its the client IT administrator will be the account manager for particular account. This user will be one of the employee in Organization so user ID will be firstname.lastname@clientname.com. That particular account is the implementation user account not the employee account. So Oracle creates user ID and assigns IT security administrator role to that account holder. When we first login we create our own user and we should deactivate that particular user which was provided by Oracle. When we actually go live that particular account manager exists in PROD and there will be clash during data migration because that person will be migrated as an employee so the same email address will exist for implementation user as well as actual employee who is being migrated.

[table id=1 /]

[table id=4 /]

[table id=5 /]

Santhosh Notes:

→ Moved from 12 to 13 version

→ Fusion application will be in folder structure

→ Responsibilities (apps) = Business functions (fusion)…In navigator we can we see different business functions which are assigned to user…

→ Role = level of access

→ BI Reports = XML Publisher reports…this can be accessed only by BI user…cant create pkg/ db objects..only option provided is BI report…nothing but extract…

BI Reports Navigation: More >> Reports and Analytics >> Click on Browse Catalog >> Shared Folders (Everyone can see the development) – Can you see multiple folders like Custom, Financials, Procurement >> Go to My Folders (Personal Development) >> Here BI report looks in Orange color book type and OTBI report looks like blue color circle >> During patch release everything (all folders) will be overwritten so place all dev components in Shared Folders in Custom Folder >> We cant edit standard reports…we need to go to xmlpserver (its a link like https://abc-dev.fusion.oracle.com/xmlplserver)and push (beneath report click on More and then Custom) the standard report to custom folder and make changes…priority of report will be Custom report then standard report >> In xmlpserver we can download and upload BI reports >> In Analytics we can archive and unarchive OTBI report to push to test instances. In Analytics we can see both BI and OTBI reports where as in xmlpserver we have only BI reports.

In BI report:

Here Open means runs the report and can see the output by passing input parameters based on ‘Report Properties’ ‘Auto Run’ option. If Auto Run is uncheck the it looks for input parameters to be passed to then click on Apply. Edit means to edit the report.

Create Custom Report:

Mainly comprises of Data Model and Report

Data Model:

Navigation: New >> Data Model

Different Tabs in Data Model:

1) Diagram – Write SQL Query in Query Builder box…

2) Structure – Here we can see tree structure…we will have Groups, xml tag name and display name…

3) Data – Here we can make use of ROWNUM, View – can view data

4) Code – XML Code will be displayed

When we download data model .xdmz file gets downloaded

Click on Save as Sample Data

Report:

Navigation: Either click on ‘Create Report’ in the same page or go to New >> Report

Report = layout/ template (rtf/ excel/ xpt/ pdf/ others)

Under Select Layout: Select required layout >> It goes directly to Create Table. Here drag the required columns >> Next and Finish >> Save As and report gets created in My Folder

When we download report .xdoz file gets downloaded

Bursting = Sending file via Email or FTP

My Workforce business function is for HRMS…

Navigation: Tools >>

1) Reports and Analytics:

Click on Browse Catalog

My Folders: Personal work station

Shared Folders: Can view all other sources/ all users can see

Custom = new customization’s here

→ Schedule Process:

Schedule process in Fusion = Concurrent program in E-Biz

Create ESS job when you want to run from schedule process (concurrent program) else if you want to see in front end so no need to create ESS

Navigation to see registered concurrent programs: Navigator >> Set up and Maintenance >> Search for Manage%Ent%Sch% >> All programs will be defined under specific TOP >> Click on Create to create new program. Here display name will be concurrent program name.

Navigation to run concurrent program: Schedule process

Navigation to see Value sets: Navigator >> Set up and Maintenance >> Search for Manage%Val%Set%

→ Security Console:

Here you can verify login details under User Accounts.

→ OTBI reports (Oracle Transaction Business Intelligence)

OTBI report looks like blue color circle

Navigation: Navigator >> Same as BI report >> Analytics >> Analysis

Here we have Subject Area which is nothing but pre-defined sql query.

1) Subject Area (sql query) appear in orange color box surrounded by blue box. Select the required Subject Area. You can see multiple folders beneath Subject Area. Facts (description) column appear 3*3 blue boxes and Dimensions (value) column appear one single blue box..in this select queries are pre-defined..you can need to drag n drop required columns…

2) Next go to Results section which gives output

3) Prompts = Input parameters

4) Advanced: Here we see xml structure and sql query

Transaction data means day to day data.

Select Data Source = OBIEE when you copy sql query from OTBI Advanced section

→ HCM Extract

My workforce, Payrolls, Benefits Adminstration and so on…

Navigation: My Workforce >> Data Exchange >> Right hand top you can see tasks >> Under HCM Extracts select Manage Extract Definitions

For existing report use Search option >> Click on name >> Under Define you can see input parameters and other details >> Design – which sql query gets executed. Here we can see user entity >> Delivery – email or sftp >> Validation – Here we can see fast formula.

HCM we have User Entity and in BI report we have data model and in OTBI we have Subject Area.

Diff between SAAS and PAAS

SAAS: We use SAAS in Fusion…mainly used for reports…like BI reports, OTBI reports, HCM extracts. Client owns DB and application server.

PAAS: We can create DB objects and developers own DB and application server.

Workforce lifecycle process

Introduction

Workforce lifecycle process covers all stages of worker’s relationship with the enterprise, from creation of person record through termination of work relationships. The following business activities are performed by Human Resource (HR) specialists and Line Managers.

o Add Person

o Manage Employment Information

o Change Employment

o Promote worker

o Transfer Worker

o Terminate Worker

o Manage Personal Information

HR specialists get Add Person task from New Person work area. Remaining all the other Workforce Lifecycle tasks from Person Management work area.

In our document we focus on how to add person and how to create work relationship.

Add Person

Person Record Creation

—————————

You create a person record when

o Hiring an employee

o Adding a contingent worker

o Adding a non-worker

o Adding a pending worker

In Oracle fusion, Person records are global and independent of Employers. Only once person records are created for any person. The person record remain to be present in the enterprise even after the person exit the company. If the person exit the company, you will end his work relationship with the enterprise. If the person re-joins the company, you create new work relationship.

The following scenarios explains when you will create person record.

Adding a Person

Raj is joining as ‘Contingent Worker’ with a legal employer in the enterprise. Raj has never been an employee, contingent worker or nonworker, an emergency contact, dependant or beneficiary of another employee anywhere in the enterprise. Therefore Raj is not having any person record in the enterprise. Now you can add Raj as a contingent worker by creating both his person record and his first work relationship with the enterprise.

Rehiring an Employee

Raj starting his employment with the enterprise in France from next month. Raj had worked for the enterprise in the United States for long time, but resigned 2 years ago. Because Raj was an ex-employee in the enterprise, he already has a person record. When you attempt to hire Raj, the application finds his existing person record. When you confirm that the existing person record is Raj’s, you continue the rehire process by creating an employee work relationship with Raj’s new legal employer in France.

Hiring a Nonworker

Raj has a nonworker work relationship with the legal employer. Raj recently applied for employment with the same legal employer and it was successful. When you attempt to hire Raj, the application finds his person record. When you confirm that the person record is Raj’s, you continue the hire process by creating new work relationship with the legal employer. Now Raj will have both nonworker and employee work relationship with the same legal employer.

Pending Worker

For example, Recruiting manager has informed HR that Raj is going to join in the enterprise on 25th of this month. The HR has the option to create Raj’s person record before the hire date. That is before the hire date the person record is effective. When the new placement is finalized, then Raj will become active employee in the enterprise.

Hiring a Contact

Sneha starting her employment with the enterprise from tomorrow. Sneha has never been an employee, contingent worker, or nonworker in any legal employer in the enterprise. Sneha’s husband Raj is working in the enterprise as a contingent worker and gave his wife Sneha name as emergency contact. When you attempt to hire Sneha, you will find Sneha has already person record in the enterprise. If there is enough information in her record, you continue to hire process by creating work relationship with her new employer.

Practice: Hiring an Employee

Sign In and Navigate

Navigator -> Workforce Management -> New Person – opens the New Person work area as follows.

Click on Hire an employee. It opens Identification details page.

Enter values for Hire Date field, Hire Action list, Legal Employer field, Last Name field, First Name field and click on next, it opens Person Information page.

Under Home address details, enter values for Address Line 1 field, Zip Code field. On the basis of the ZIP code entered, values for the city, state and country automatically will appear. Enter required information under Phone details, Email details, Legislative Information, Citizenship and Visa Information and Contacts. Click on next, it opens Employment Information Page.

Under Employment Terms tab enter values for Business Unit field, Department field. Click the Assignment tab.

The department is automatically populated from the employment terms. Under Job section, enter values for Job field, Grade field. Under Assignment tab, enter value for Manager Details Section. In the Manager Details section enter value for Name field. Under Salary section enter values for Salary Basis field, Salary Amount field.

Click on next, it opens Roles page.

Use the Roles page to assign roles to the new employee.

Click on next, it opens Review page.Review all the information that you entered so far.

Click on submit and you will get a warning dialogue box as follows.

Click Yes, which causes the Confirmation dialog box to appear

Click OK to return to the New Person work area.

Work Relationships

———————–

A work relationship is a relationship between a person and a legal employer. When we create a person record, you also create first work relationship for that person. All work relationships must have at least one assignment.

Work Relationship Types

There are three types of Work relationships: Employee, Contingent Worker and Nonworker.

Practice: Creating a Work Relationship

Navigator->Workforce management->Person Management to open search person page.

In the search section enter value for Name field and click search.

In the Search Results section, click Bill, Smith.

In the Tasks pane, click Create Work Relationship under Personal and Employment to open the Create Work Relationship: Identification page.

Use the Identification page to enter details, such as the legal employer, personal details, and national identifiers, such as the employee’s social security number.

Enter values for Start Date field, Action field, Legal Employer field and click on next, it opens Person Information page.

Use the Person Information page to provide address details, and other modes of communication. In this example, there are no changes to the personal information. Click on next, it opens Employment Information page

Use the Employment Information page to record details, such as service dates and payroll relationship details. Enter values for Business Unit field, Job field and click on next, it opens Roles page

Use the Roles page to assign roles to the new employee. In this example, you retain the predefined role that is already assigned to the worker. Click on Next, it opens Review page.

Click Submit, which causes the Warning dialog box to appear.

Click Yes, which causes the Confirmation dialog box to appear.

Click OK to return to the Person Management work area.

Reference: NA

Overview of Fusion Benefits:

Fusion HCM Benefits without making use of fast formula

→ Login into Oracle Fusion HCM instance

→ Login as user who has benefits administrator

→ Savings plan has already been configured in the instance which

a) unrestricted benefits plan

b) Savings plan coverage starts: on the day on which employee submits new investment pledge

c) Savings plan coverage ends: one day prior to the day on which employee submits the investment pledge

Click Benefits Administration >> Plan Configuration >> Under Programs and Plans >> Go to Plans tab >> Search with Plan Name: ABC; Effective as of date: 01/01/17>> Click on Search >> Click on Plan name >> Click on Enrollment >> Go to Life Event tab >> ABC Savings Plan has saved as Coverage Start Date as Event >> Previous Coverage End Date as 1 day before event >> Cancel >> Now sign off from current user and test the configuration from another user who is a benefits user >> Now login as different user who is a benefits user and verify if the settings have been configured correctly.

Click on About Me >> Go to Benefits >> Click on Change Benefit Elections >> Continue >> Click ABC Employee Savings Plan >> Expand ABC Employee Savings Plan >> Select >> Change Employee Rate >> Select >> Next >> Divide % among beneficiaries >> Next >> Submit>> Here you can verify Coverage Start Date (should be the same day when the pledge submitted) >> Done >> No

Fast Formula:

Let us consider that we are implementing Fusion HCM Benefits solution in ‘ABC’ company. Here the savings plan need to be configured with a set of rules and this savings plan has following policy:

→ Every employee in company is eligible for savings plan

→ The contribution amount is employees choice

→ The plan is open for inputs throughout the year

→ The contributed amount will be automatically deducted from employees respective payroll based on the set of rules defined in policy.

Scenario:

• The employees contribution start date will be evaluated based on the date on which he submits the investment amount as below:

– 1st of the month if contributed between 1st and 14th of the month

– 1st of the next month if contributed after 15th of the month

[table id=6 /]

Create Fast Formula:

Navigation: Settings and Actions >> Setup and Maintenance >> In search bar type ‘Manage Fast Formulas’ and search >> Click on Manage Fast Formulas >> Under Search Results click on + icon (Create icon) >> Give Formula name (‘ABC_SavingsPlan_EnrollmentStartDate’) >> Give Type (we have various types and here we selected ‘Enrollment Coverage Start Date’) >> Enter Description (This formula provides the coverage start date for ABC savings plan) >> Legislative Data Group (if we don’t select any particular LDG then this fast formula will be applicable to all, here we selected US LDG) >> Effective Start Date: 01/01/17 >> Click on Continue

Under Formula Text:

/*****************************************************************************

Formula Name: ABC_SavingsPlan_EnrollmentStartDate

Formula Type: Enrollment Coverage Start Date

Description: This formula provides the coverage start date for ABC savings plan

*******************************************************************************/

/******************************************************************************

Change History:

Name Date Description

——————————————————————————————————

Developer_Name 01-Jan-2018 Initial Version

******************************************************************************/

/******************************************************************************

Formula Logic: This formula will be triggered when an employee submits the investment pledge amount for the savings plan. If the submission date is before 15th of the month then 1st of the on-going will be considered for coverage start date else 1st of the next month will be considered for coverage start date.

******************************************************************************/

/*Default Section – Initialize local variables*/

default for l_effective_date is ‘2017/01/01 00:00:00’ (date )

/*for non numeric variables we need to explicitly define data type*/

default for l_date is 01

default for l_month is 01

/*Input Section*/

/*Effective date context is automatically available for this formula type. It can thus be retrieved through get_context functionality (delivered). */

l_effective_date = GET_CONTEXT(effective_date, to_date(‘2017/01/01 00:00:00’))

/*Calculations Section*/

/*The day and month part needs to be extracted from the effective date retrieved from the context.*/

l_date = to_num(to_char(l_effective_date, ‘DD’))

l_month = to_num(to_char(l_effective_date, ‘MM’))

/*If the pledge submission date is between 1st and 14th of a month, the coverage start month will be the on-going month else it will be the next month.*/

if l_date >= 15 then

l_month = l_month + 1

/*The formula’s return value should be the date on which the coverage should start. Day will always be 01. Month will depend on the decision made above and the year will be same as that of the effective date year. A temporary string can be constructed to have the date in the correct format.*/

l_tempStr = to_char(l_effective_date, ‘YYYY’)||’/’

l_tempStr = l_tempStr || to_char(l_month)||’/’

l_tempStr = l_tempStr || ’01 00:00:00′

/*String needs to be converted into date type variable*/

l_effective_date = to_date(l_tempStr)

/*Return Statement*/

return l_effective_date

/*End of Formula*/

—————————————————————————–

Click on Save button >> Click on Submit button >> Click on Compile button >> Click on Ok (confirmation) >> Click on Refresh >> Any compilation errors can see at bottom of page >> Compile status should turn to Green Color >> Click on Done

We will now create second fast formula that will call the first fast formula.

The second fast formula is created to calculate the end date of employees savings plan. This is similar to what we have created for first fast formula i.e EnrollmentStartDate

Navigation: Settings and Actions >> Setup and Maintenance >> In search bar type ‘Manage Fast Formulas’ and search >> Click on Manage Fast Formulas >> Under Search Results click on + icon (Create icon) >> Give Formula name (‘ABC_SavingsPlan_EnrollmentEndDate’) >> Give Type (we have various types and here we selected ‘Enrollment End’) >> Enter Description (This formula provides the coverage end date for ABC savings plan) >> Legislative Data Group (if we don’t select any particular LDG then this fast formula will be applicable to all, here we selected US LDG) >> Effective Start Date: 01/01/17 >> Click on Continue

Under Formula Text:

/*****************************************************************************

Formula Name: ABC_SavingsPlan_EnrollmentEndDate

Formula Type: Enrollment End

Description: This formula provides the coverage end date for ABC savings plan

*******************************************************************************/

/******************************************************************************

Change History:

Name Date Description

——————————————————————————————————

Developer_Name 01-Jan-2018 Initial Version

******************************************************************************/

/******************************************************************************

Formula Logic: This formula will be triggered when an employee submits the investment pledge amount for the savings plan. This formula will call another formula ‘ABC_SavingsPlan_EnrollmentStartDate’ which returns the date from which the new coverage starts. On-going coverages end date will be one day prior to this new coverage start date.

******************************************************************************/

/*Default Section – Initialize local variables*/

default for l_new_coverage_start_date is ‘2017/01/01 00:00:00’ (date)

/*for non numeric variables we need to explicitly define data type*/

default for l_prior_coverage_end_date is ‘2017/01/01 00:00:00’ (date)

/*Input Section*/

/*The other formula ‘ABC_SavingsPlan_EnrollmentStartDate’ needs to be called to retrieve the new coverage start date*/

if is_executable(‘ABC_SavingsPlan_EnrollmentStartDate’) then

(

execute(‘ABC_SavingsPlan_EnrollmentStartDate’)

l_new_coverage_start_date = to_date(get_output(‘l_new_coverage_start_date’, ‘2017/01/01 00:00:00’))

)

else

l_new_coverage_start_date = to_date(‘2017/01/01 00:00:00’)

/*Calculations Section*/

/*The coverage end date will be one day prior to this retrieved state*/

l_prior_coverage_end_date = add_days(l_new_coverage_start_date, -1)

/*Return Statement*/

return l_prior_coverage_end_date

/*End of Formula*/

—————————————————————————–

Click on Save button >> Click on Submit button >> Click on Compile button >> Click on Ok (confirmation) >> Click on Refresh >> Any compilation errors can see at bottom of page >> Compile status should turn to Green Color >> Click on Done

We will now update the savings plan settings to refer these formulas.

Go to home page >> Click on Benefits Administration >> Plan Configuration >> Under Programs and Plans >> Go to Plans tab >> Plan Name: ABC; Effective as of date: 01/01/17>> Click on Search >> Click on Plan name >> Click on Enrollment >> Go to Life Event tab >> Under Actions select Correct >> Select Coverage Start Date as Formula >> Coverage Start Formula: ABC_SavingsPlan_EnrollmentStartDate >> Previous Coverage End Date: Formula >> Previous Coverage End Formula: ABC_SavingsPlan_EnrollmentEndDate >> Save and Close >> Now sign off from current user and test the configuration from another user >> Now login as different user and verify if the fast formulas we created are working as expected

Click on About Me >> Go to Benefits >> Click on Change Benefit Elections >> Continue >> Click ABC Employee Savings Plan >> Expand ABC Employee Savings Plan >> Select >> Change Employee Rate >> Select >> Next >> Divide % among beneficiaries >> Next >> Submit>> Here you can verify Coverage Start Date (Verify fast formula has applied or not) >> Done >> No

HCM Implementation:

Go to Settings and Actions >> Setup and Maintenance

Here Offerings = Modules in EBS like Core HR, Time and Labor, Absence Management, Payroll…

We can see multiple offerings in square boxes.

Offerings – All ==> All offerings/ modules provided by Oracle

Offerings – Provisioned ==> Offerings which client has bought licences/ for which client is allowed to do set up

Offerings – Subscribed ==> Offerings which client has started implementation/ enabled

Workforce Deployment Offering: Core HR set up

Workforce Development Offering: Talent Management, Performance Management set up

First we go with Core HR set up only then we can perform Talent/ Performance Management set ups….We dont have Customization in Fusion so understand client requirement and start doing set ups accordingly…

Define Geography:

[table id=7 /]

Settings and Actions >> Setup and Maintenance >> Under Offerings click ‘Workforce Deployment’ >> Under Search Tasks bar enter ‘Manage Geographies’ and search >> Click on Manage Geographies >> Search for Country Code GB >> Here you can see Geocoding Defined means when you define a location, system understands the latitude and longitude of that particular place. This is not of much importance from HR perspective but important in Oracle mobile applications. If you to enable you need to click tick mark and run process called ‘Generate geo codes’. >> Click on Structure Defined icon >> Here you can select elements from either ‘Add Geography Type’ drop down or use ‘Create and Add Geography Type’. Lets assume we have taken County and Post Town>> Save and Close >> Click Hierarchy Defined >> Here we created hierarchy as United Kingdom as Country, Berkshire as County, Reading as Post Town >> Click Validation Defined – Here validation can be enabled either using ‘Enable List of Values’ or ‘Geography Validation Control’. Error in Geography Validation Control specifies no new address can be added other than the values from drop down and No Validation in Geography Validation Control specifies new address can be entered.

File Based Import process — File which you get from third party and load into system.

Define Enterprise Structure/ Organization Structure:

[table id=8 /]

The main difference between fusion and ebiz work structure is that there are multi levels of hierarchy supported in e-biz as there everything is defined as ‘Organization’. But in Fusion it is defined as only 3 different types of entities: LE, BU and Department. These entities do not link with each other in the definition screen. The only way they get linked is when you add these to employee level. So in order to show the hierarchy to the user, we take the organization details from the employee data and create BI report to show how they are linked. In Fusion, an employee needs to be mandatorily attached to a LE and BU. You can make Department mandatory if required (screen personalization).

Introduction to Oracle Financials Cloud

Modules in Financials Cloud (FFOPACT)

1. Financial Management

2. Financial Reporting and Analytics

3. Order Capture, Revenue and Collections = Order to Cash + Collections

4. Procure to Pay

5. Asset Life Cycle Management — With Asset system

6. Cash Management — We can reconcile bank statements, create cash forecasts and cash positions using Cash Management

7. Travel and Expense Management

The financials cloud manage these end-to-end functions completely.

→ We can use OTBI (Oracle Transactional Business Intelligence) for adhoc queries.

→ There’s full multi-GAAP, multi-currency, multi-entity support as well.

→ There’s also multi-dimensional reporting because there’s Essbase cube built into the GL.

→ Infolets: Appears on homepage on welcome springboard. They are controlled at top of the page using the dots. Ex: to show sub ledger is still open, to show period close status, how many journals need to be posted — all these can be shown in General Accounting Infolets

→ Infotiles: Appears on work area. Ex: Payables Invoices work area has number of infotiles. They provide single click access to complete things like approval or release of holds.

→ We can also use some spreadsheets for some reporting and analyses as well. So we can enter information like journal entries, accounts payable invoices using spreadsheets.

→ Centralized accounting engine: Allows to generate accounting for your subledger transactions. Also contains Global Tax engine.

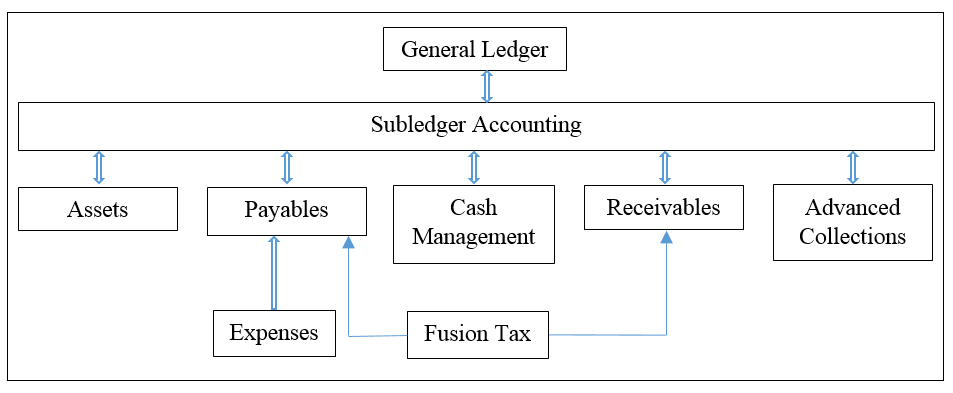

Oracle Cloud Financial Modules: Integrated Together

In Expenses we will be entering expense reports.

Functional Setup Manager

The primary area to configure ‘Master Data Objects’. We will bundle all’Master Data Object’ from dev environment and import in PROD.

Functional Setup Manager implementation life cycle

Offerings >> Configure Offerings >> Offering Setup or Implementation Projects >> Export Offering Setup Data or Manage Configuration Packages >> Task Search

Navigation: Setup and Maintenance

Offerings:

i) Oracle Fusion Financials Offering: Includes Oracle Fusion General Ledger, Oracle Fusion Sublegder accounting application features and atleast one of the subledger financial application.

ii) Oracle Fusion Accounting Hub Offering.

Browsing Offerings

Offerings are groups of application functions representing one or more typical business processes.

Offerings could be Financial, CRM, Project Portfolio Management, Procurement, Sales, Marketing, Order Orchestration, and Workforce Deployment.

Navigation: Right top under User ID >> Setup and Maintenance >> We can see multiple offerings and select Financial offering which is lined at number 4 >> Under ‘About Financials’

i) Offering Content Guide — Describes all processes that are related to financial offering — Click on HTML >> Open with default browser >> We can see all processes.

ii) Associated Features — Represent the functionalities that are optional — Click on HTML >> Open with default browser

iii) Setup Task Lists and Tasks –List of all master data objects — Click on Excel

iv) Related Business Objects — Shows the list of all set up data including the prerequisites — Click on HTML >> Open with default browser

v) Related Enterprise Applications — List of all Java enterprise applications Click on HTML >> Open with default browser.

Configure Offerings Demonstration

Navigation: Right top under User ID >> Setup and Maintenance >> We can see multiple offerings and select Financial offering which is lined at number 4 >> Actions >> Change Configuration >> Just have a look on Description, Enable for implementation, Features and Implementation status >> Click on Setup >> This page is ‘Legal Structures Functional Area’ >> Click on ‘Legal Structures’ >> If you click in Shared icon you can see other features as well >> Towards right side under Task, we have ‘Master Data Objects’ >> Click on Show ‘All Tasks’ to get complete list of ‘Master Data Objects’>> For ‘Manage Legal Entity’ click on Select >> Legal Entity: Select and Add >> Apply and Go to Task >> This gives list of all LE’s which were configured earlier >> Search for Name ‘US’ >> Select US1 Legal Entity >> Save and Close >> We are into ‘Master Data Object’ >> Cancel

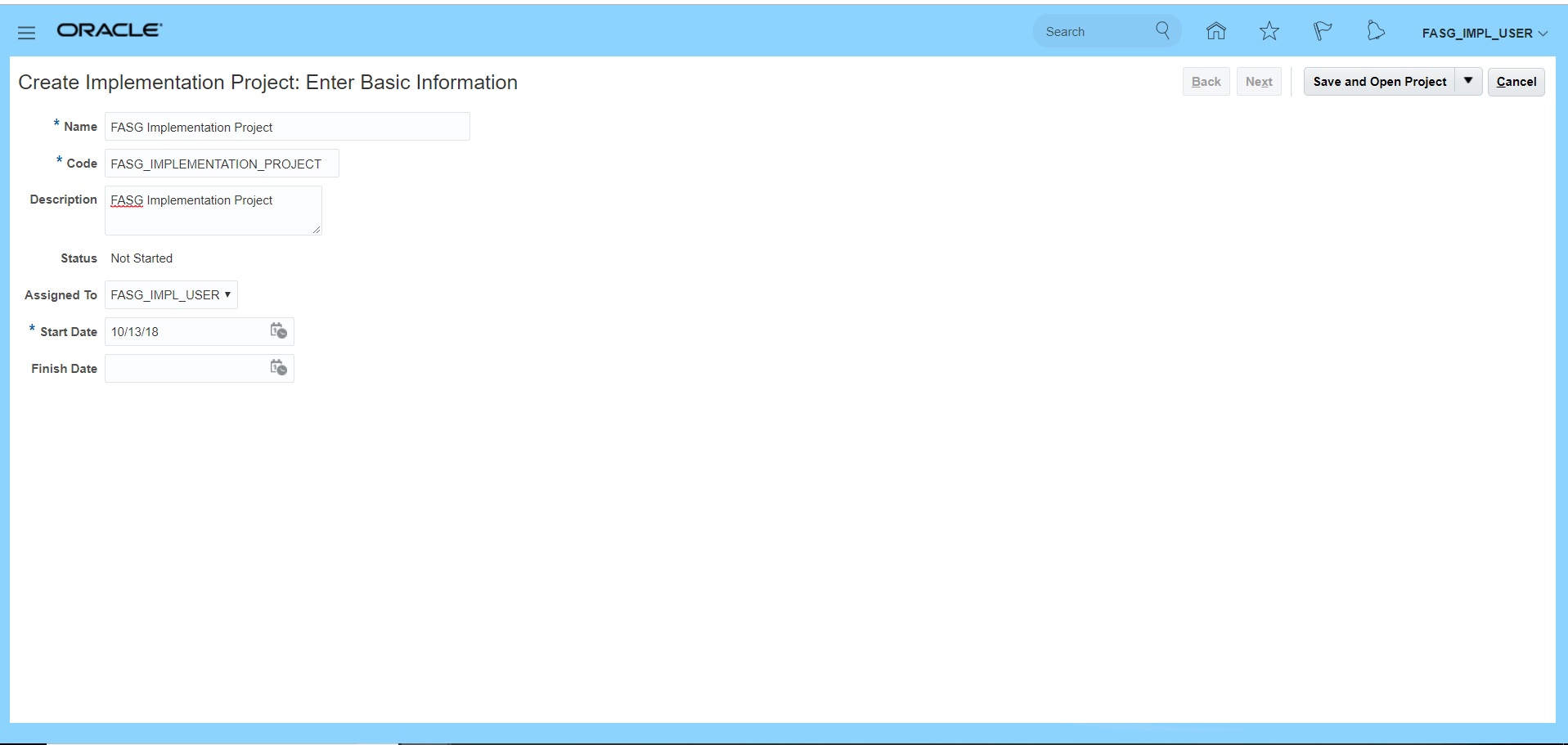

Creating an Implementation Project

Keeping all the related offerings at one place.

Navigation: Right top under User ID >> Setup and Maintenance >> Click on ‘Implementation Projects’ button >> Click on ‘+’ icon which indicates – Create >> Name: XXImplementation Project, here XX is some random number and press tab >> Leave the defaults as-is for Code and Description >> Click on Next >> Expand “Financials” offerings >> Check the Include option for relevant Financial offerings and all of the nested offerings. Except ‘Budgetary Control and Encumbrance Accounting’ and ‘Financial Business Intelligence Analysis’, I have selected others >> Click on ‘Save and Open Project’.

In case we have to add further ‘Task Lists and Tasks’ then click on ‘+’ icon which is known as ‘Rapid Implementation’>> Search for ‘%Rapid%’ name >> For our purpose we select ‘Define Financials Configuration for Rapid Implementation’ >> Apply >> Done >>

To eliminate Hyperion >> Expand Financials >> Select ‘Define Hyperion Financial Management Integration’ and click on ‘x’ icon >> Yes >> Done

Rapid Implementation Task List

Rapid Implementation Spreadsheets could be Accounting, Financial Reporting, Projects, Procurement, Security, Purchasing.

• Manage Geographies

• Create COA, Ledger, LE and BU’s in spreadsheet.

• Upload COA, Ledger, LE and BU’s.

• Create Cross Validation rules.

• Create Banks, Branches and Accounts.

• Manage Tax Regimes.

• Run Jurisdiction and Rates upload program.

• Manage Taxes.

Security Methodology

WHO, WHAT and WHICH

• WHO — The user

• WHAT — Action which an individual user can perform

• WHICH — Set of data which an user can access

Security console — In R11 only new clients can use this where as in R12 everybody can use.

Integration and Interfaces

• Available integration options

• Use of web services

• ADFdi installation and its use

• Identify ADFdi templates

• External data integration services for Oracle cloud

• Available FDBI templates for financials

• Financials data extract

• Reporting tools for extraction of data

• Interface exceptions

Integration:

Oracle Financials cloud service is built with Oracle ADF (Application Development Framework). The different integration methods are:

i) ADF services (also referred as web services)

ii) ADF desktop integration

iii) File-based data import

iv) Financials data extract

v) Reporting tools

ttps://www.youtube.com/watch?v=ChuILWNw7Z0 — Oracle Fusion Financials Training – User Creation – Recorded Class Videos Available

ttps://www.youtube.com/watch?v=WjEEDctCIJk — Oracle Fusion Financials Training – Implementation Project Creation

ttps://www.youtube.com/watch?v=AbMIxiHOVlw — Oracle Fusion Financials Training – Calendar & COA Creation

User Creation and Assign Roles

Roles:

EBS ————————–Fusion Application

Menu————————-Job Role –Ex: Payables Manager

Submenu/ Function————–Duty Role — Ex: Invoice Process

Responsibility——————Role

Assign primary ledger to resp.——Assign primary ledger to Job role (System automatically performs)

—————————–Data role = (Primary Ledger + Job role) — Ex: India Payables Manager. The use of data role is similar to responsibility in R12.

—————————–Abstract role = (Employee role)

Users:

| Implementation user | Employee/ Business/ Application user |

| Should be able to complete all setups with limited access to other functionalities. | Should be able to perform most of the functionalities. |

| Supplier site cant be created by implementation user | Supplier sites can be created |

| Implementation user will be created using Security console. | Employee user will be created in HCM |

| Pre-requisite to create Employee user, we require Legal Entity and Business Unit. | |

| We should have LE, BU and LDG(Legislative Data Group {while creating LE we create LDG}) before creating employee user. | |

| Only ‘Employee user’ can be created as ‘Procurement Agent’. Only ‘Procurement Agent’ (Buyer) can create supplier site. Only ‘Procurement Agent’ (Buyer) can create Requisitions, Purchase Orders. |

Create user from OIM/ IDM

Login into OIM/ ADM link using xelsysadm/ password.

Create on ‘Create User’ >> Enter basic details like last name, organization(select seeded ‘Xellerate Users’) >> User type (select ‘Consultant’) >> User Login >> Password >> Confirm Password >> Search for Role ‘Application Implementation Consultant’ and ‘IT Security Manager’ and assign these to user.

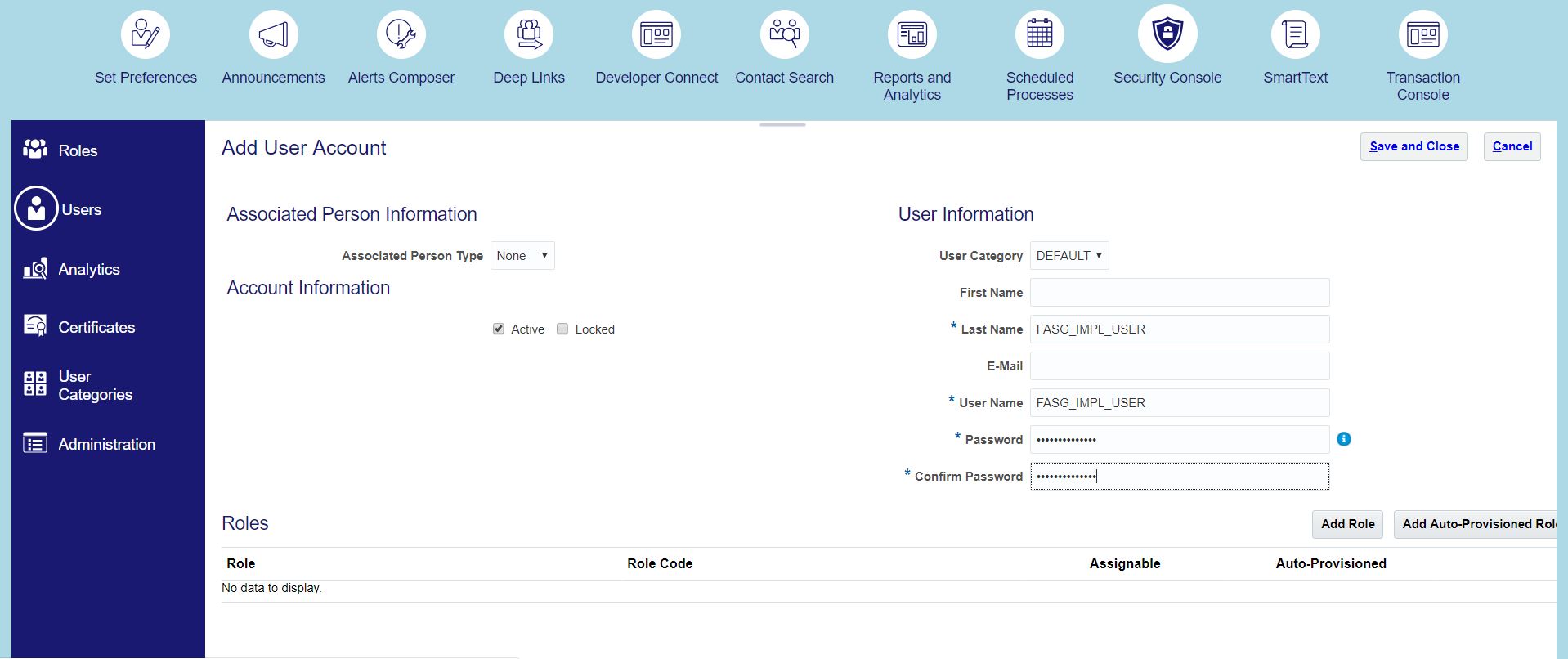

Login using SCM_IMPL user >> Navigator >> Tools >> Security Console >> Users >> Add User Account >> Enter details as below >> Save and Close {FASG_IMPL_USER/ Oracle123}

Users >> Search for new user >> Click on hyperlink (User Login) >> Edit >> Add Role >> Add below three roles.

i) Application Implementation Consultant — Gets access to FSM – In FSM all module related configurations can be performed (Select code starting with ORA — ORA_ASM_APPLICATION_IMPLEMENTATION_CONSULTANT_JOB) >> Add Role Membership

ii) IT Security Manager — Gets access to Security Console (Select code starting with ORA — ORA_FND_IT_SECURITY_MANAGER_JOB) >> Add Role Membership. From Security console, we can create new user, assign roles, create custom roles.

iii) Employee — Able to run reports (Select code starting with ORA — ORA_PER_EMPLOYEE_ABSTRACT) >> Add Role Membership >> Done >> Save and Close >> Done. SRS in Oracle Apps = ESS Job Page (Enterprise Scheduler Service)

iv) General Accounting Manager — Add this role to get ‘General Accounting’

To sync Users with Roles run a job ‘Retrieve Latest LDAP Changes’. This is optional process still you can run this job in test instances. LDAP = Light Weight Directory Access Protocol

Navigation: Navigator >> Tools >> Scheduled Processes >> Schedule New Process >> Search ‘Retrieve Latest LDAP Changes’ >> Submit >> Check for status ‘Succeeded’

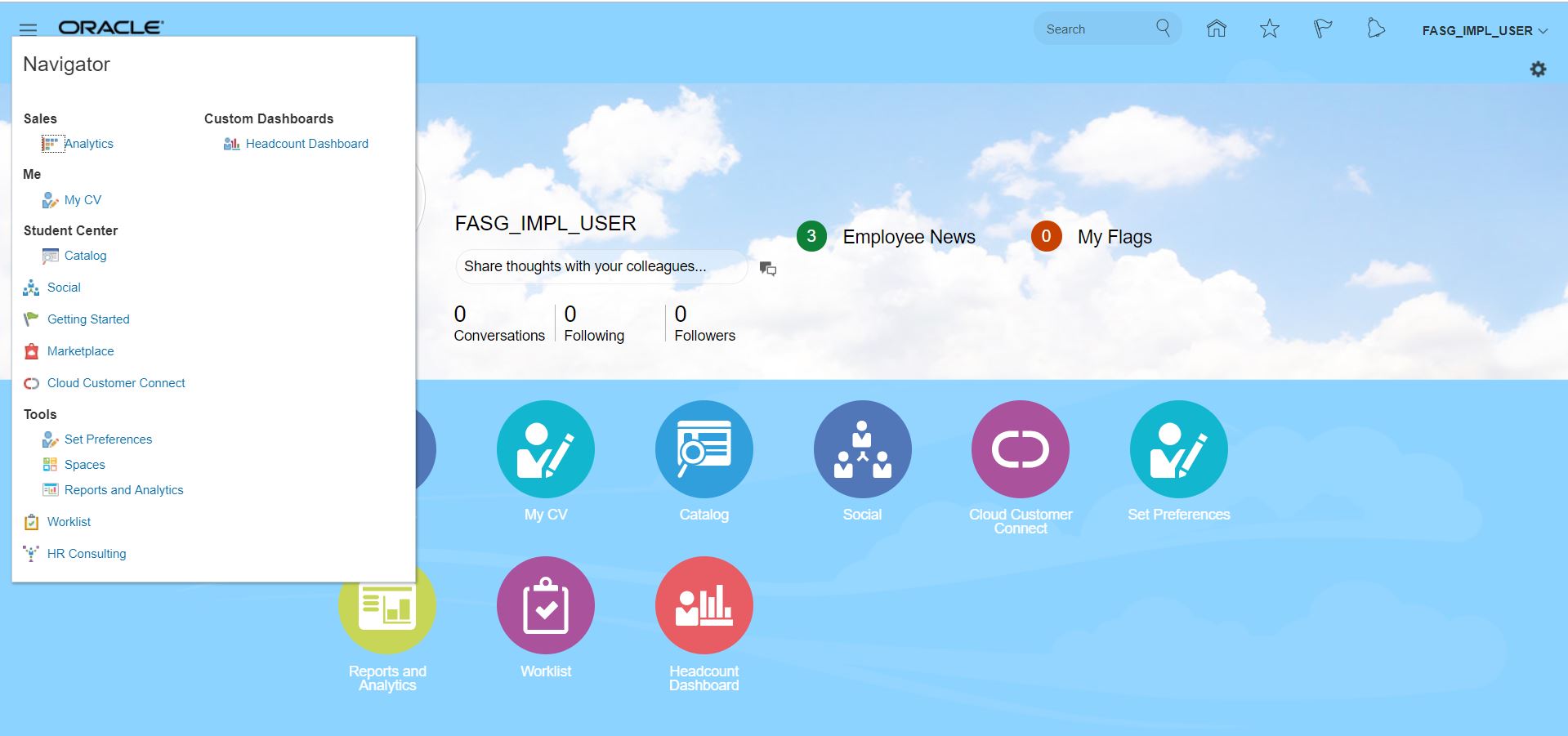

Login to newly created user

Before assigning roles:

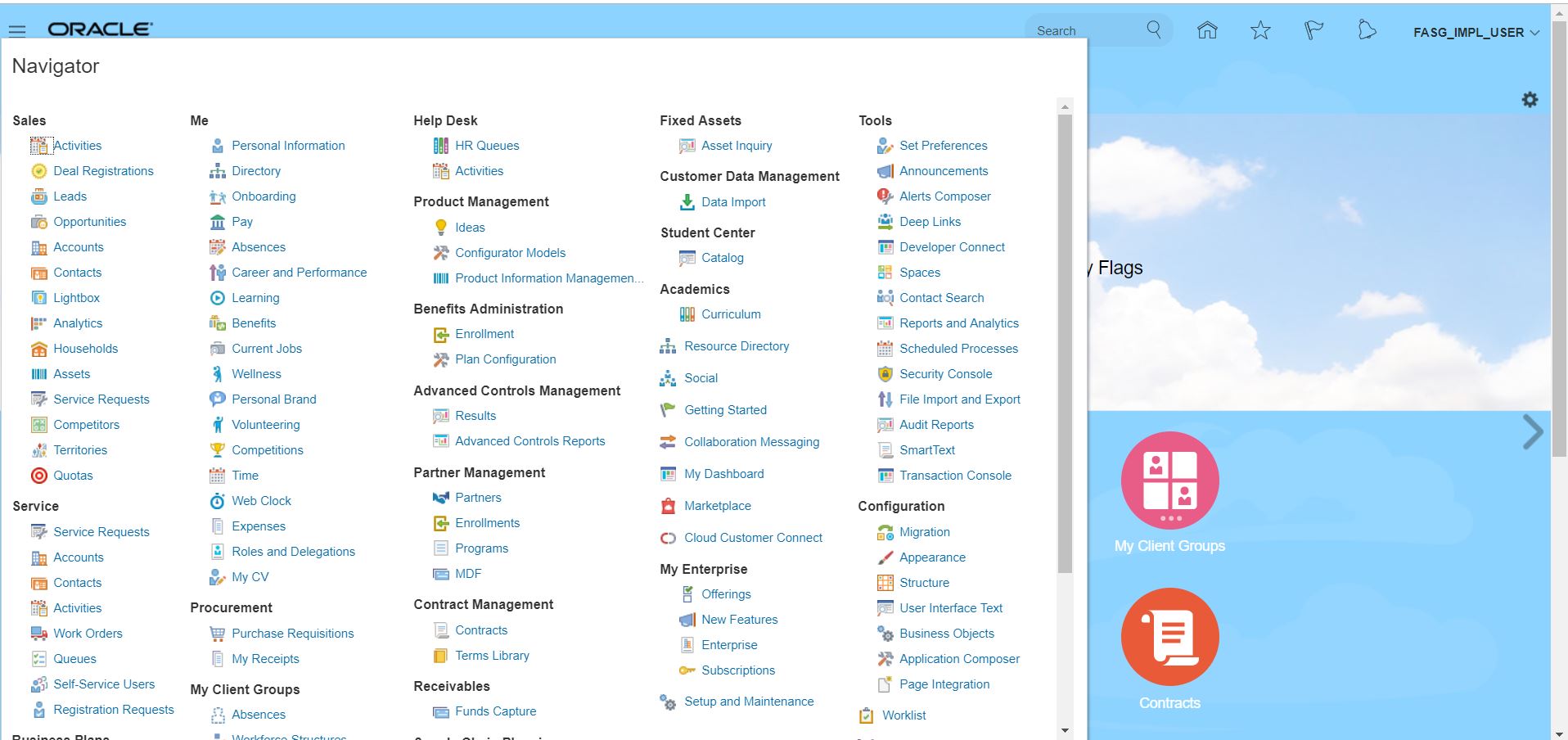

After assigning roles:

Under FASG_IMPL_USER >> Setup and Maintenance. Here Setup and Maintenance = FSM

Enterprise Structure

Enterprise >> Division >> Primary Ledger >> Legal Entity >> Business Unit >> Inventory Organization

EBS—————————-Fusion

Business Group——————-Enterprise

——————————-Division (Optional)

Primary Ledger——————-Primary Ledger

Legal Entity———————-Legal Entity

Operating Unit——————–Business Unit

Inventory Organization————-Inventory Organization

Offerings

i) Financials — Different options like GL, AR, AP, CM

ii) Procurement

iii) HCM

iv) PPM

The following activities can be performed in FSM

Enable Offerings and Options >> Create Implementation Project (by selecting offerings and options) >> System generates task list >> We can assign Offerings/ Option/ Tasklist/ Tasks to team member >> Start with System Configuration >> We can have track of progress of project.

Also we can perform data export and import. We can execute reports as well.

Under FASG_IMPL_USER >> Setup and Maintenance >> Actions >> Go to Offerings >> Select Financials

Creating an Implementation Project

Keeping all the related offerings at one place.

Navigation: Right top under User ID >> Setup and Maintenance >> Click on ‘Implementation Projects’ button >> Click on ‘+’ icon which indicates – Create >> Name: XXImplementation Project, here XX is some random number and press tab >> Leave the defaults as-is for Code and Description >> Click on Next >> Expand “Financials” offerings >> Check the Include option for relevant Financial offerings and all of the nested offerings. Except ‘Budgetary Control and Encumbrance Accounting’ and ‘Financial Business Intelligence Analysis’, I have selected others >> Click on ‘Save and Open Project’.

In case we have to add further ‘Task Lists and Tasks’ then click on ‘+’ icon which is known as ‘Rapid Implementation’>> Search for ‘%Rapid%’ name >> For our purpose we select ‘Define Financials Configuration for Rapid Implementation’ >> Apply >> Done >>

To eliminate Hyperion >> Expand Financials >> Select ‘Define Hyperion Financial Management Integration’ and click on ‘x’ icon >> Yes >> Done

To assign tasks to different users >> Select Task >> Click on Assign Tasks

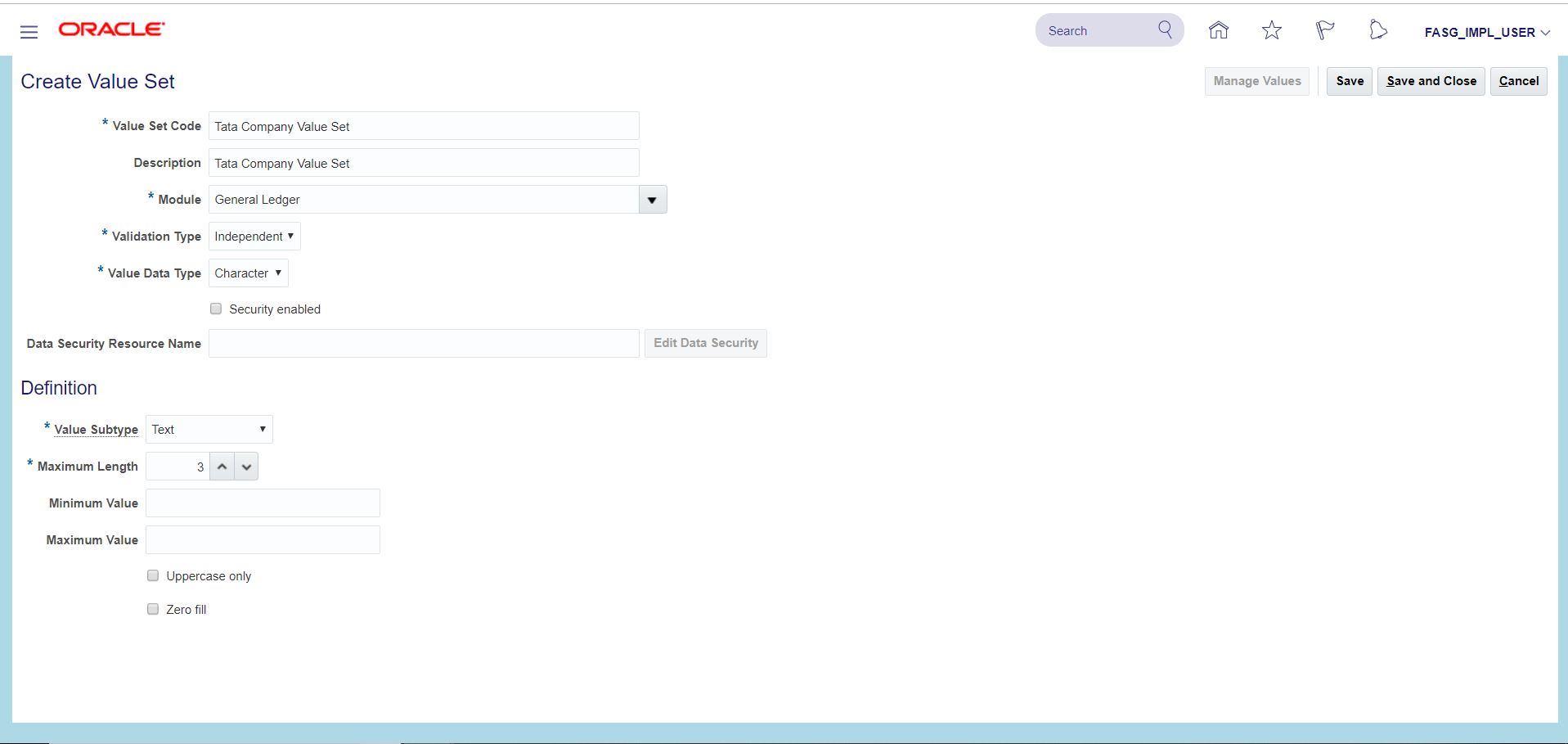

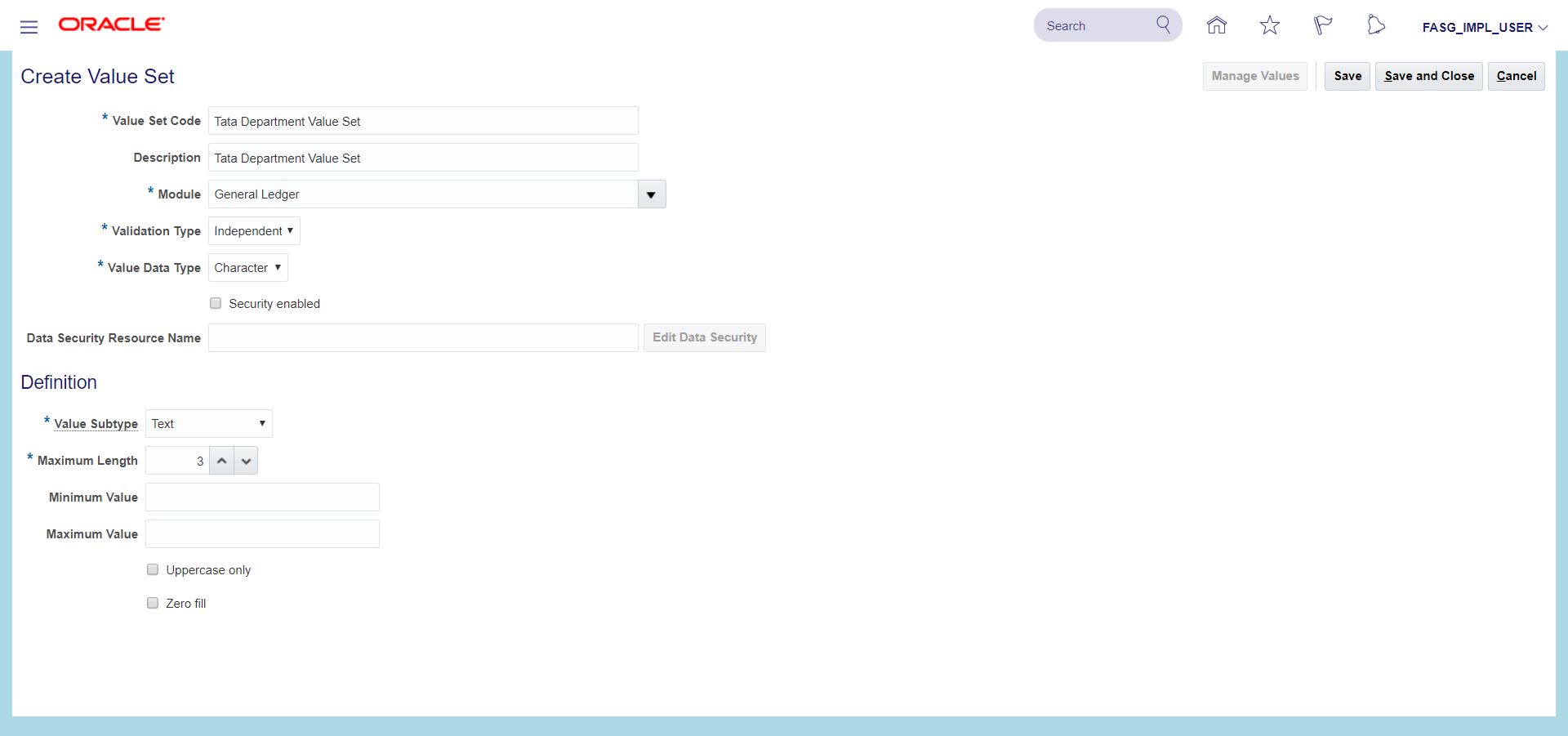

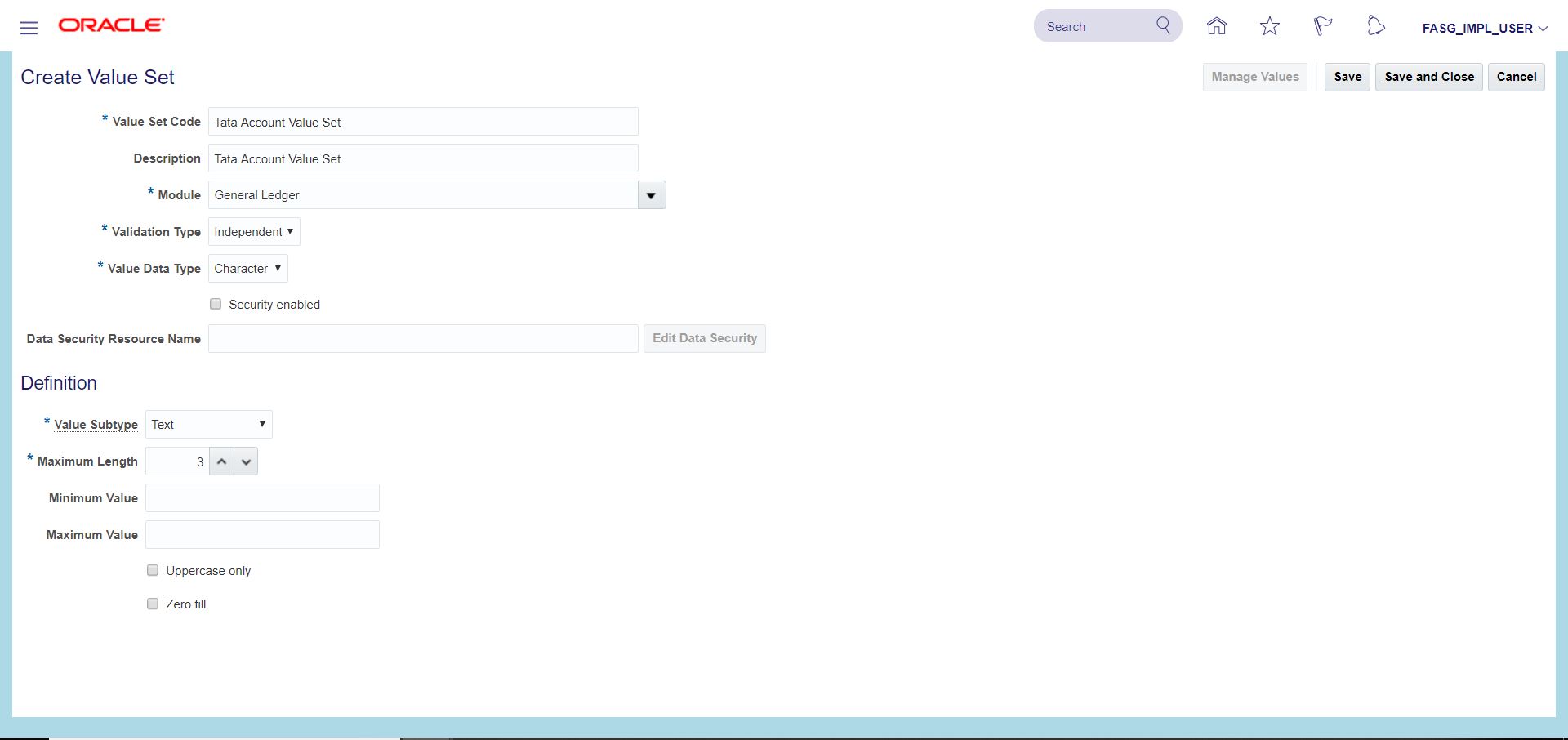

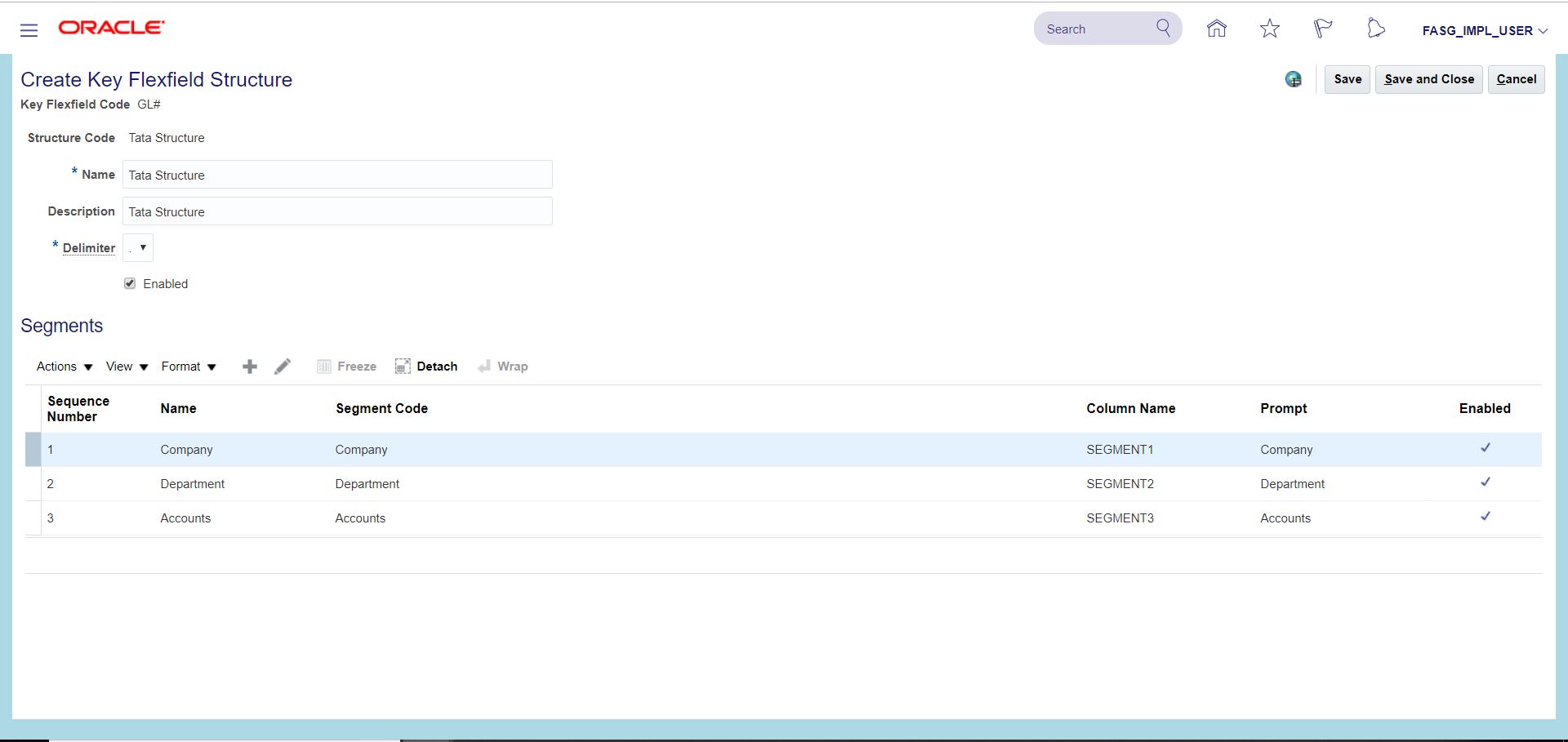

Chart of Accounts (COA)

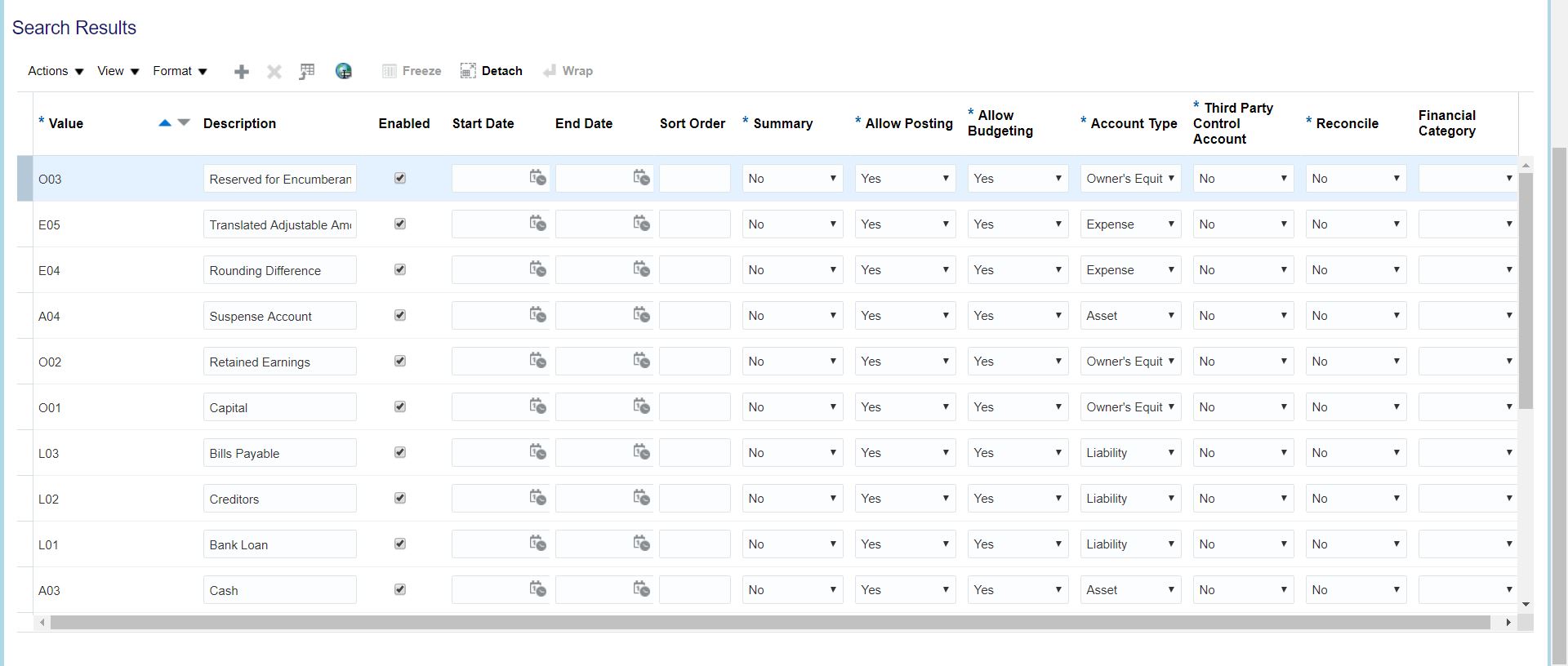

i) Create value sets

ii) Create COA structure

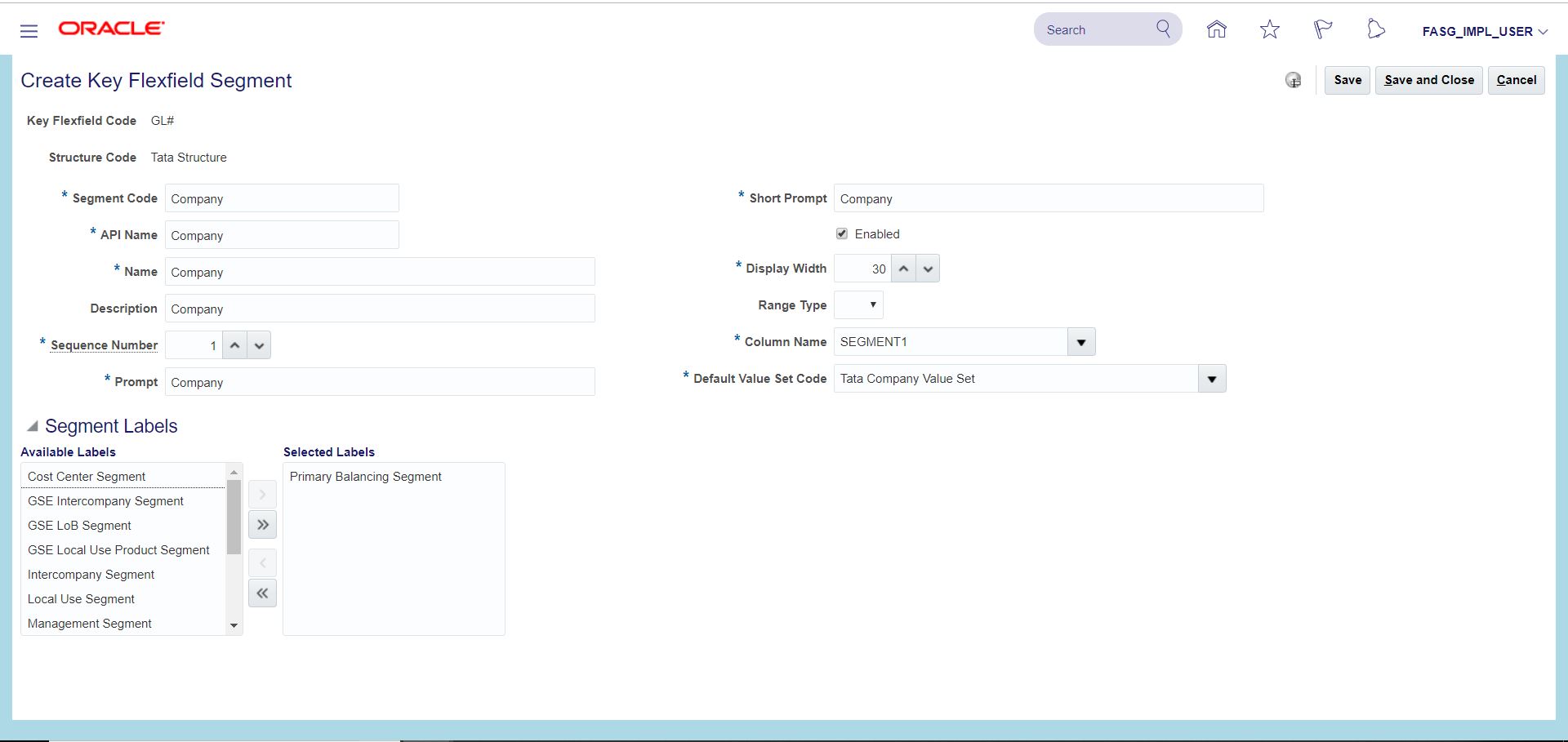

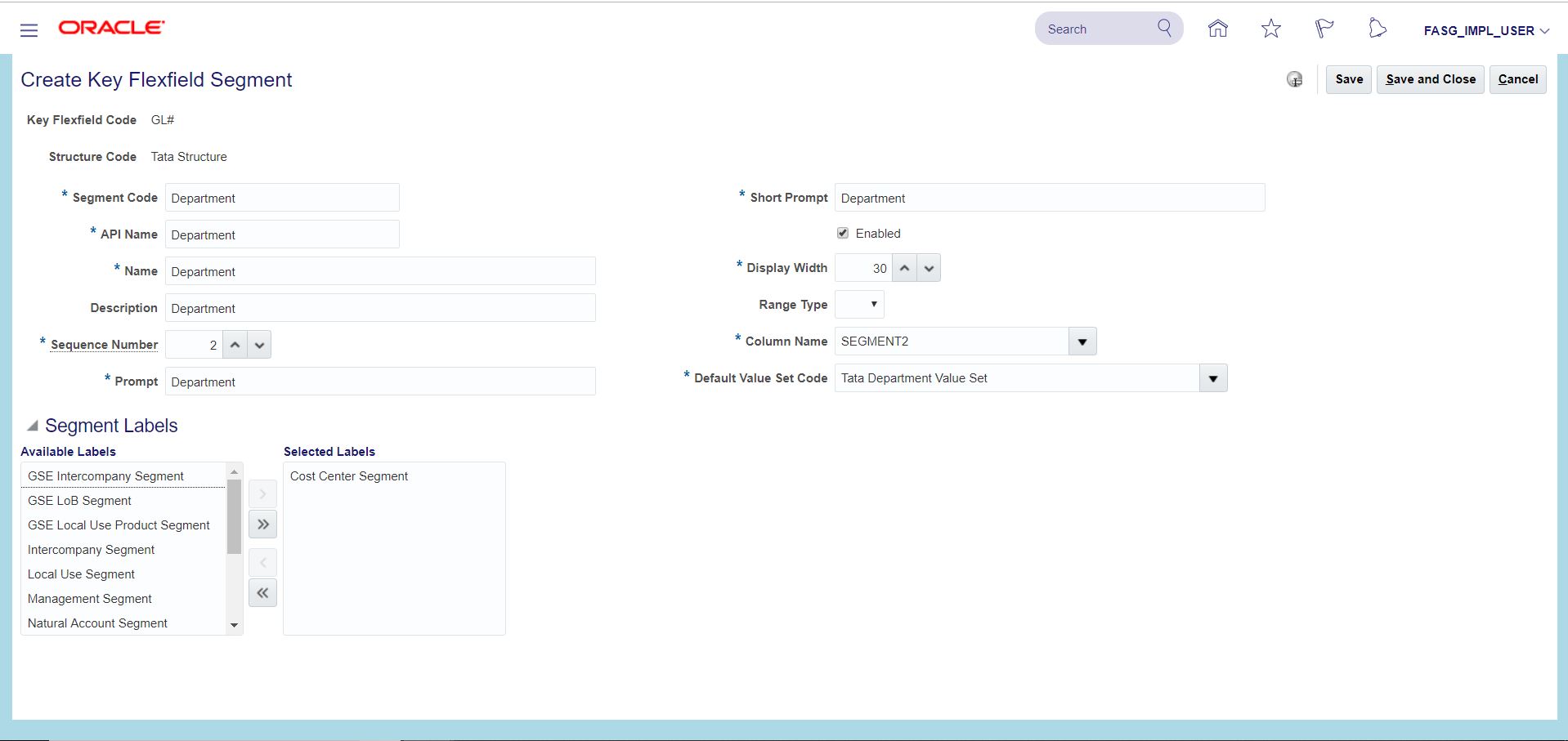

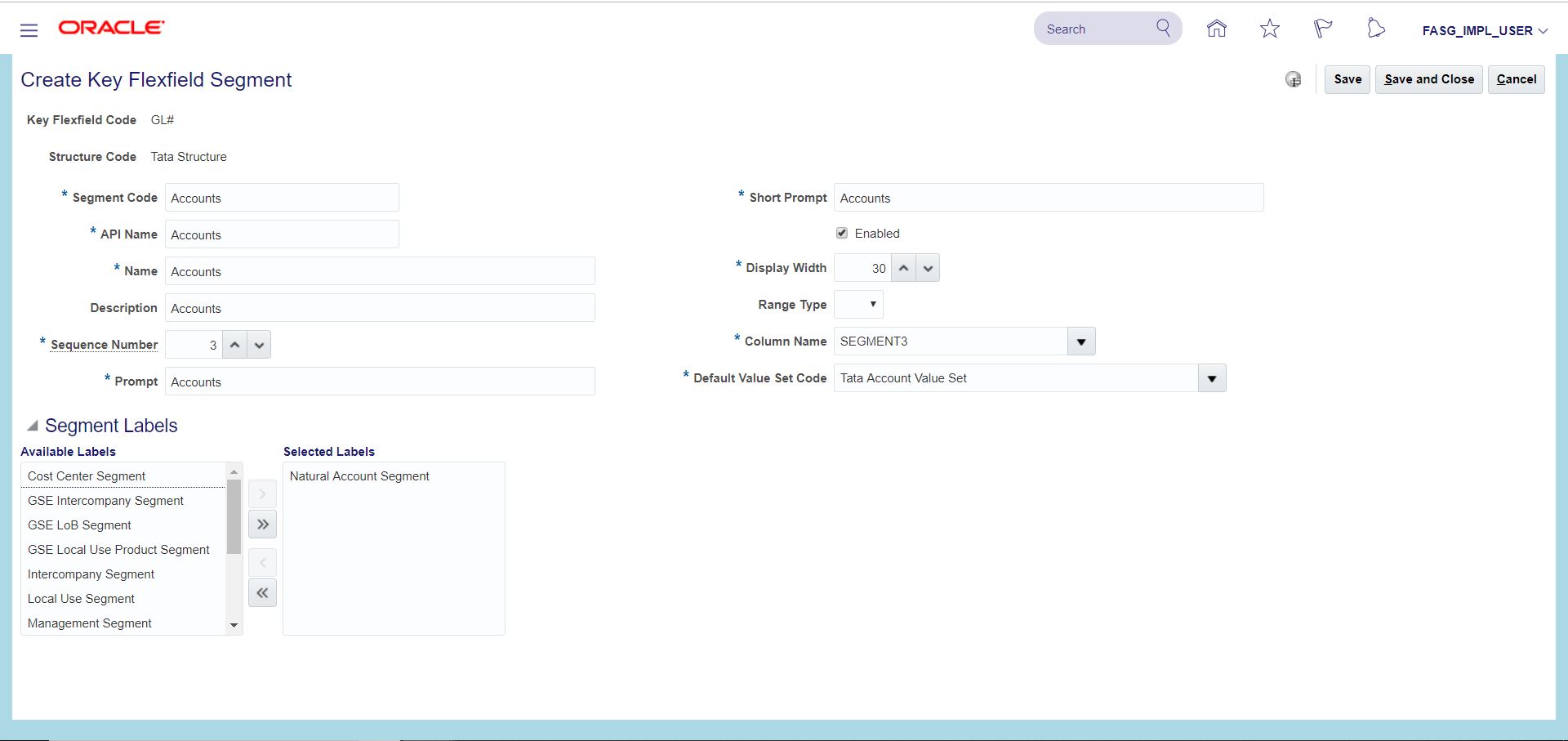

iii) Create COA segments

iv) Create COA segment labels

v) Create COA structure instance

vi) Deploy COA

vii) Create segment values (value set values)

viii) Assign value attributes to segment values

Navigation: Manage Implementation Projects >> Search for your project {FASG Implementation Project}

i) Search for task ‘Manage Chart of Accounts Value Sets’ >> Click on ‘Go to Task’ >> Click on Create icon (+)

Creation of Company, Department and Account value set

ii) Search for task ‘Manage Chart of Accounts Structures’ >> Search Key Flexfield Name with ‘Accounting Flexfield’ >> Go to ‘Manage Structures’ >> Click on Create icon (+)

After entering above details click on save to enter segment details.

Save and Close

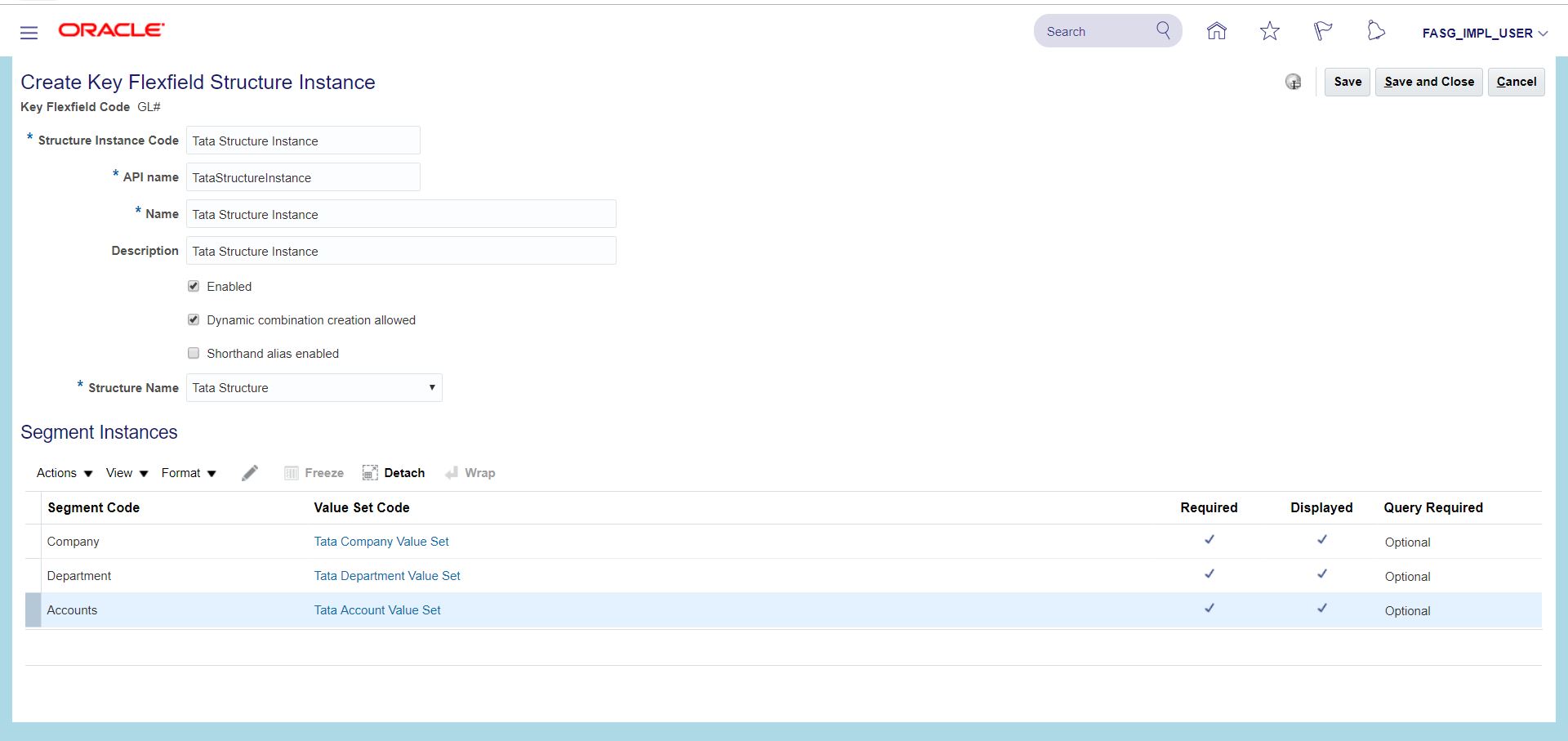

iii) Search for task ‘Manage Chart of Accounts Structure Instances’ >> Search Key Flexfield Name with ‘Accounting Flexfield’ >> Go to ‘Manage Structures Instances’ >> Click on Create icon (+) >> Enter details as below and Save and Close

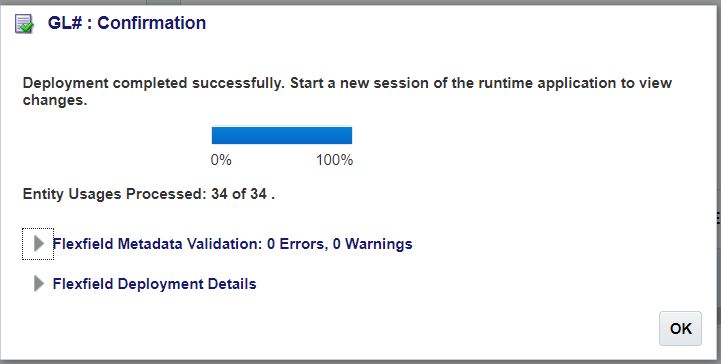

Click on ‘Deploy Flexfield’ tab for completion of process.

iv) Creation of value set values

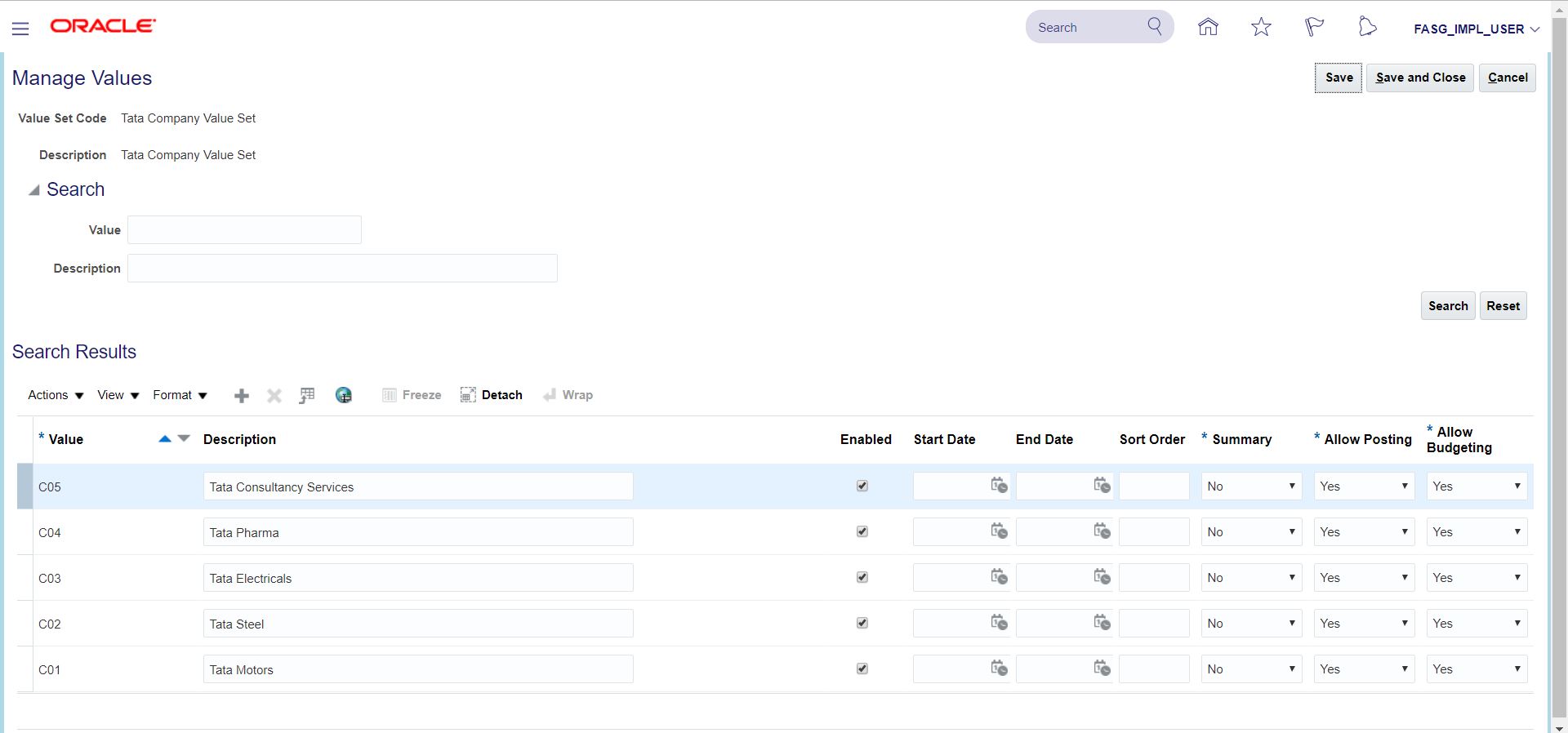

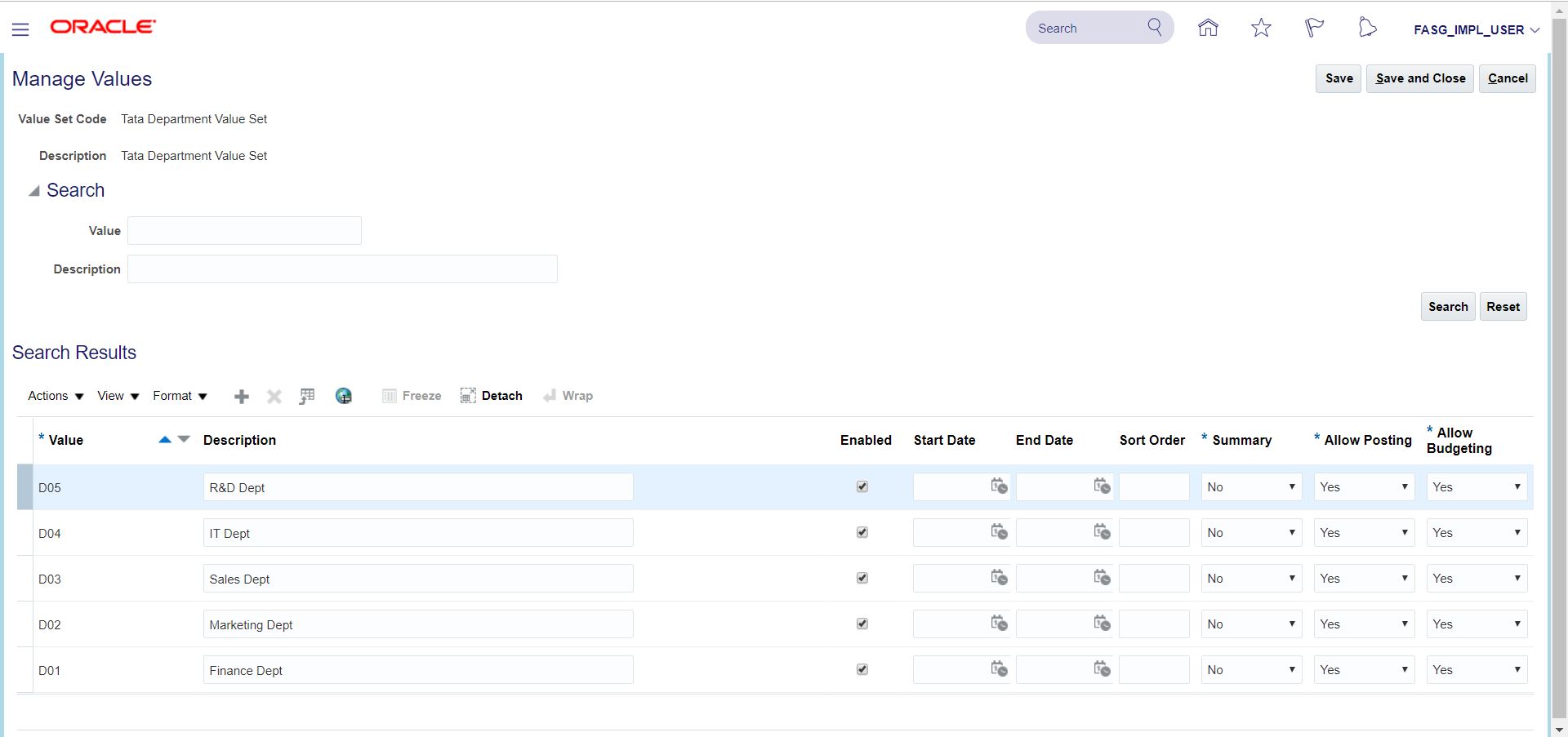

Search for task ‘Manage Chart of Accounts Value Set Values’ Click on ‘Go to Task’ >> Click on Create icon (+) >> Search for Value Set Code ‘Tata Company Value Set’ >> Click on ‘Manage Values’ >> Click on Create icon (+)

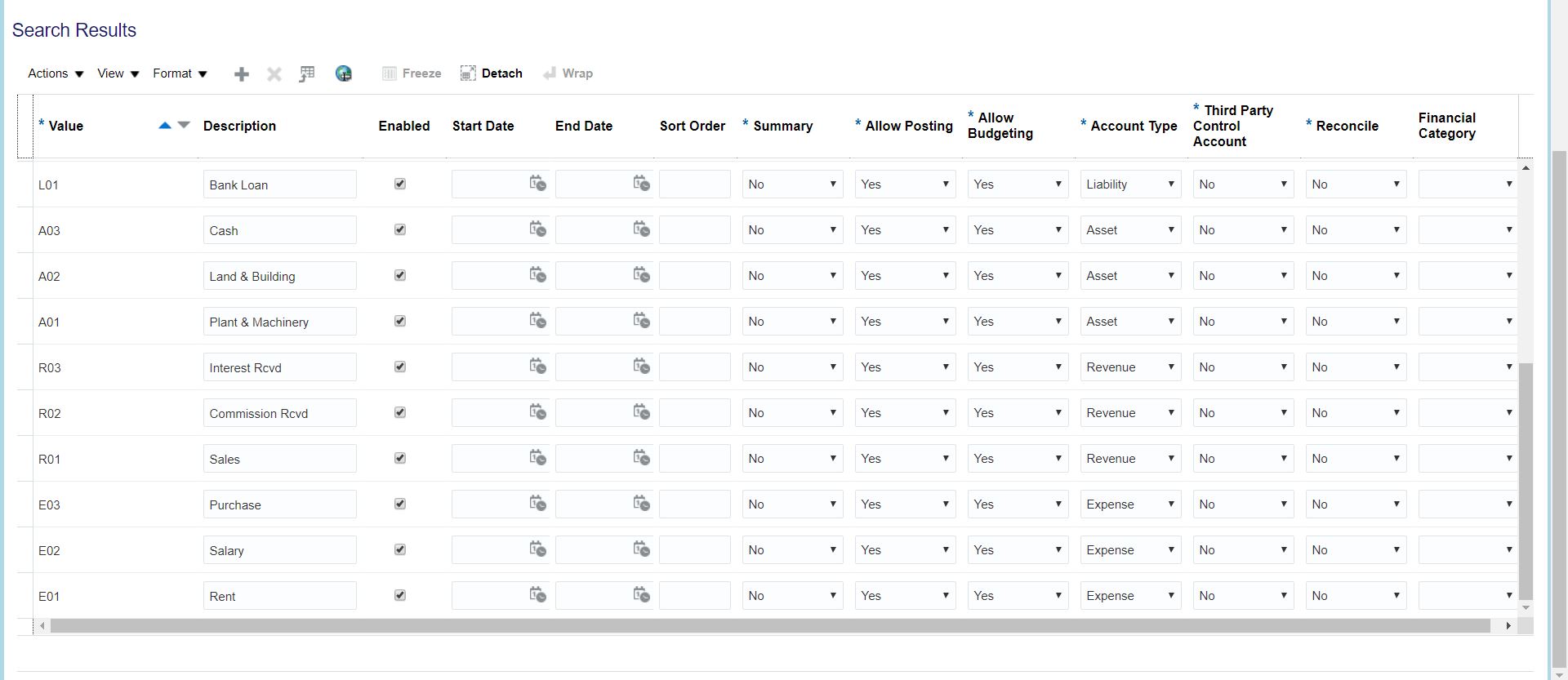

Manage Geographies

Setup and Maintenance >> Search for task ‘Manage Geographies’ >> Click on hyperlink >> Search for Country Code ‘US’ >> Make sure all are enabled/ completed.

Calendar

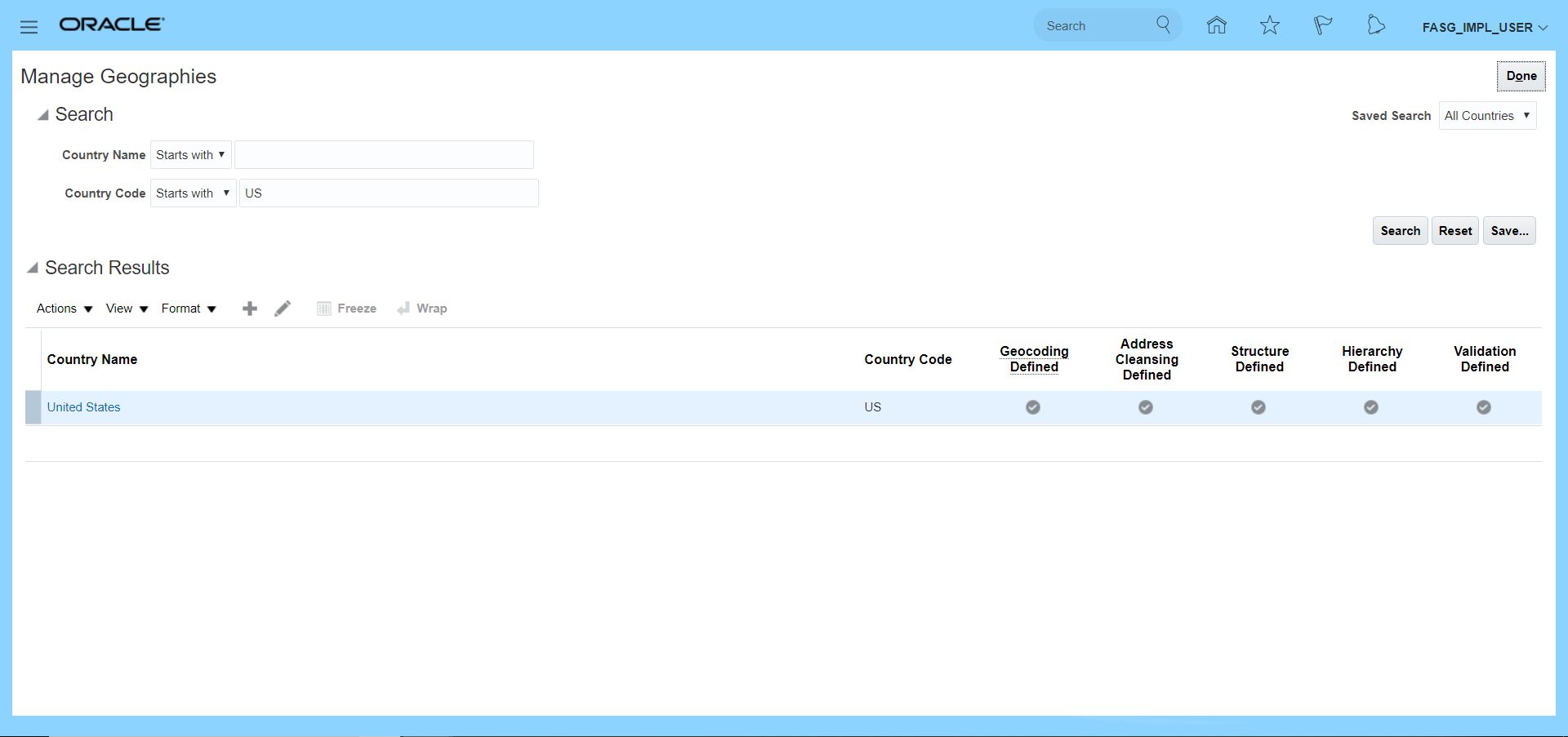

Navigation: Manage Implementation Projects >> Search for your project {FASG Implementation Project} >> Search for task ‘Manage Accounting Calendars’ >> Click on ‘Go to Task’ icon >> We can see all existing calendars >> Click on Create icon

Next >> Just go through Period Details >> Save and Close

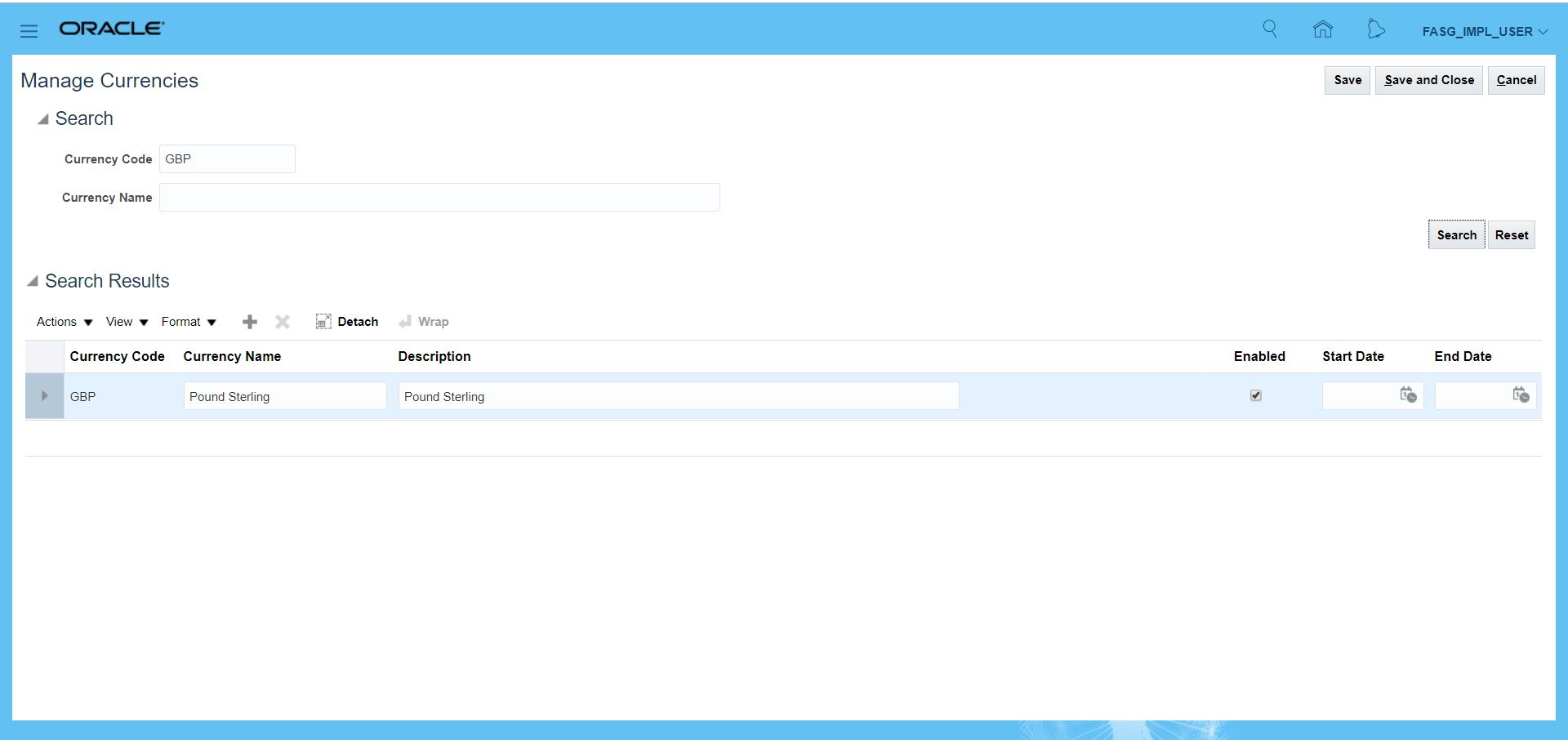

Currencies

Navigation: Manage Implementation Projects >> Search for your project {FASG Implementation Project} >> Search for task ‘Manage Currencies’ >> Search for your currency and make sure its enabled.

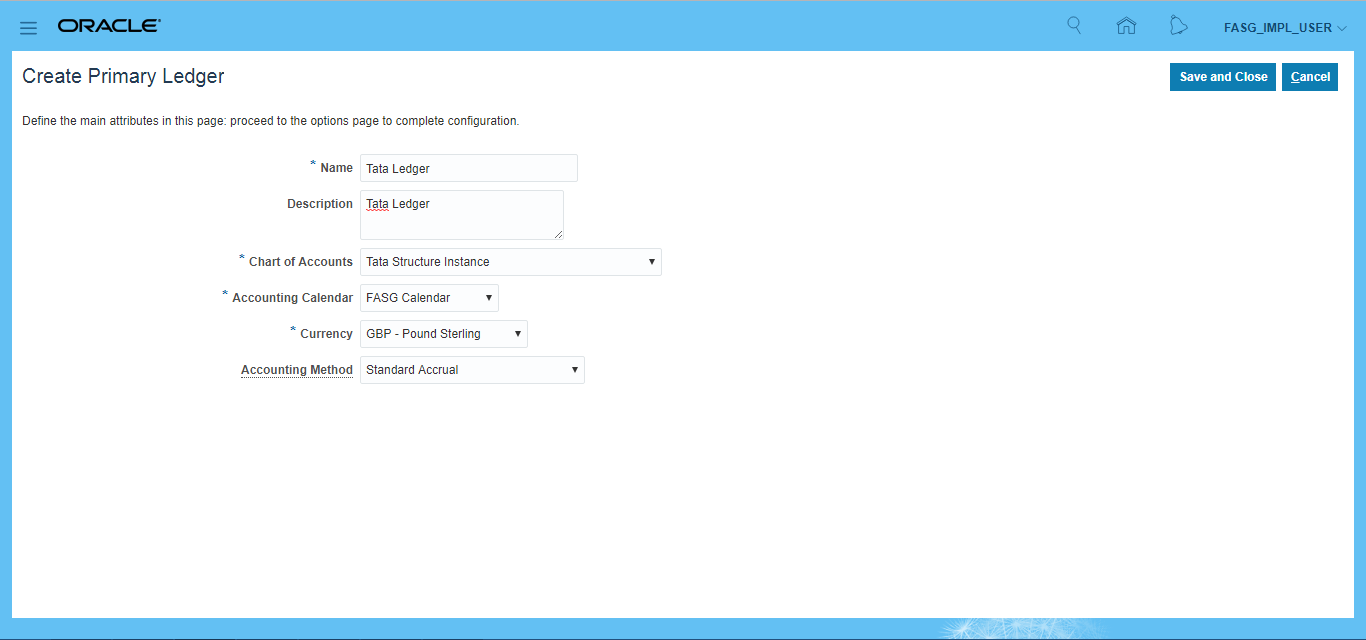

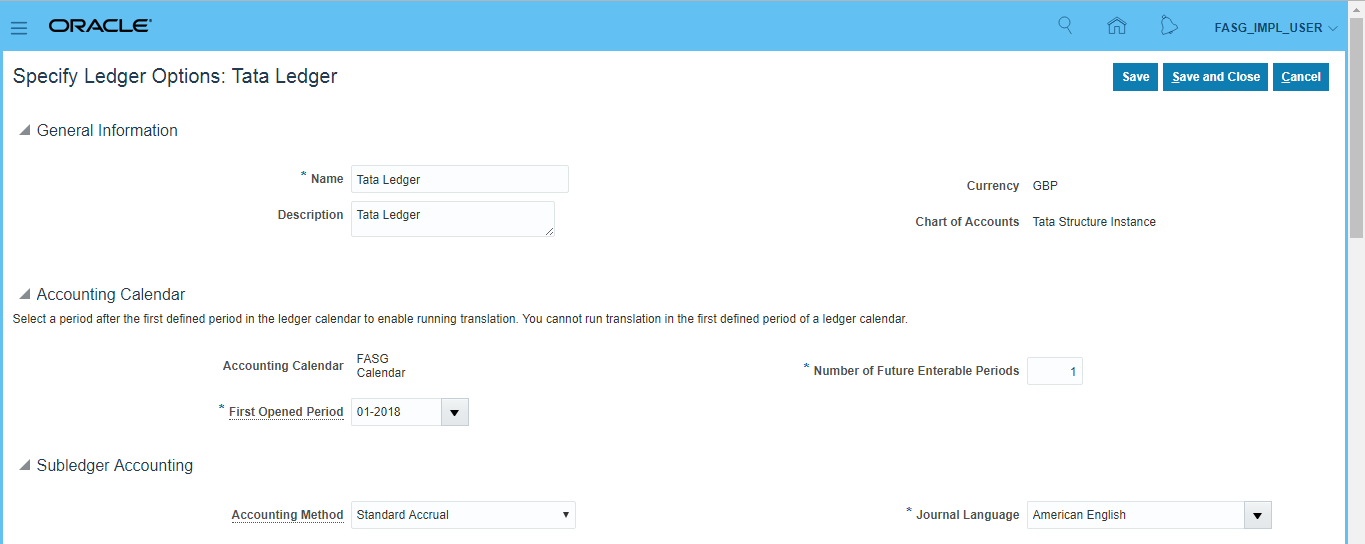

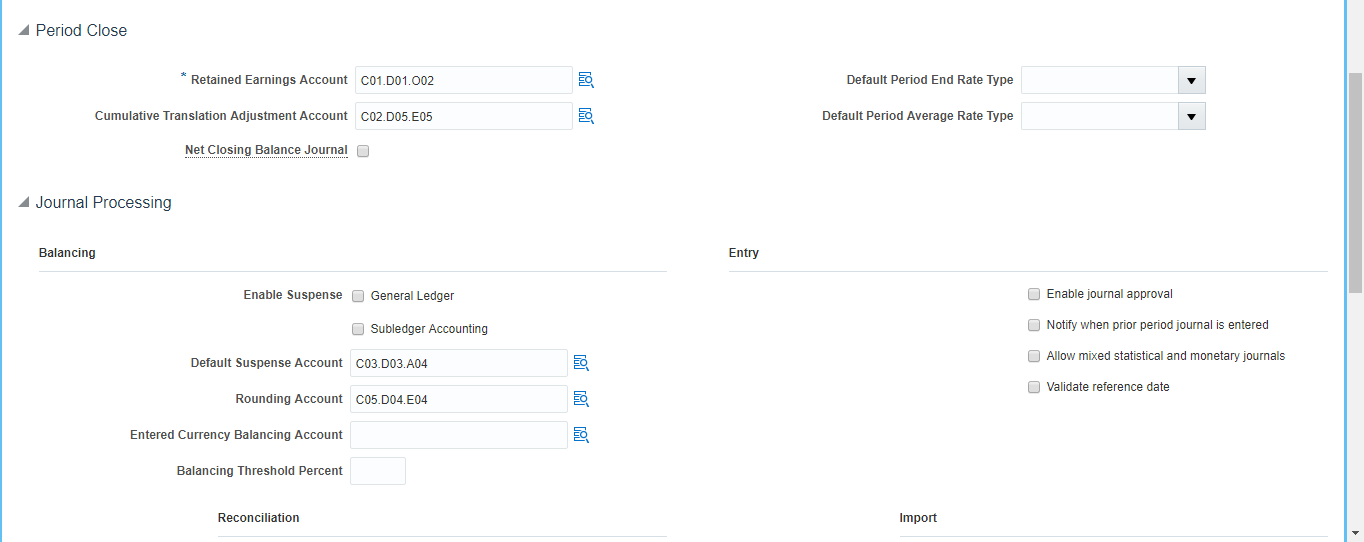

Ledger Creation

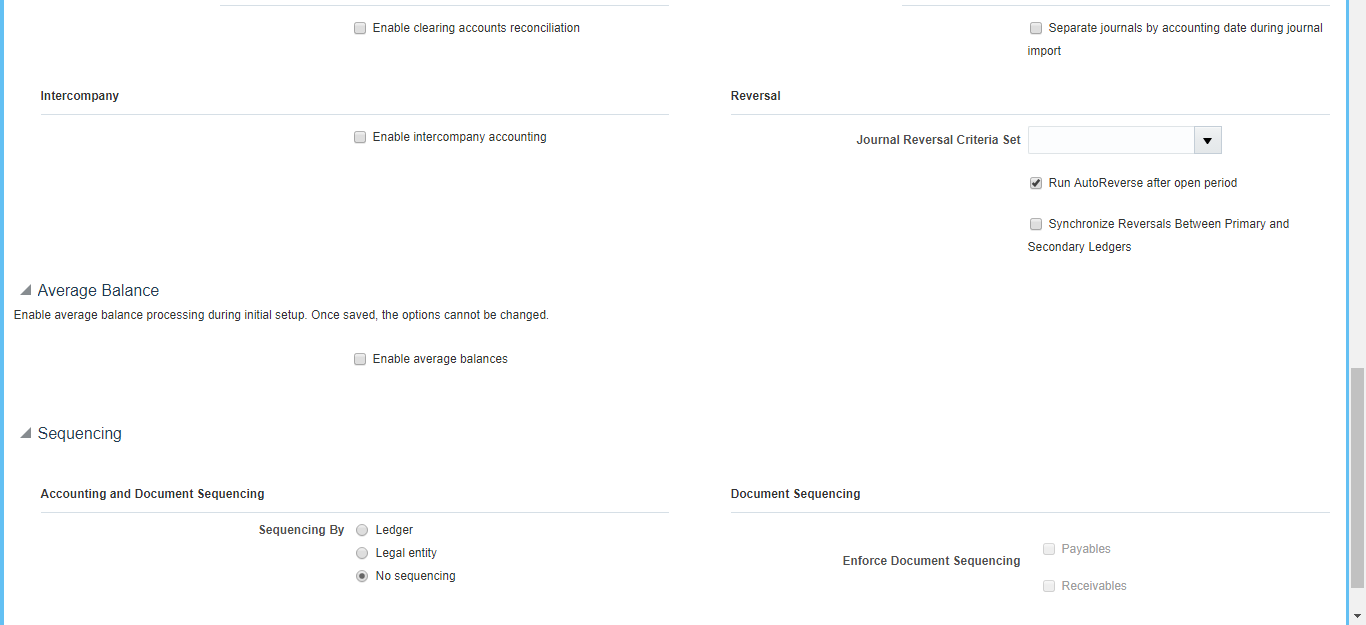

Search for task ‘Manage Primary Ledgers’ >> Click ‘Go to Task’ >> Click on Create icon (+) >> Enter details as below >> Save and Close

Search for task ‘Specify Ledger Options’ >> Click ‘Go to Task’ >> Enter accounting values >> Save and Close

Search for task ‘Review and Submit Accounting Configuration’ >> Click ‘Go to Task’ >> Submit

Since we have assigned Employee Job Role to User (ORA_PER_EMPLOYEE_ABSTRACT), we should be able to see requests. Tools >> Scheduled Processes >> See the Succeeded status.

Sync changes

Submit ‘Retrieve Latest LDAP Changes’ which is similar to ‘Replicate Seed Data’ program in EBS.

Tools >> Scheduled Process >> Schedule New Process >> ‘Retrieve Latest LDAP Changes’

Open a Period

Make sure ‘General Accounting Manager’ role is assigned to user only then we get ‘General Accounting’ under Navigator.

General Accounting >> Period Close >> Select Data Access set >> Click on General Ledger >> Start opening from first period till current period

Creation of Journal

General Accounting >> Journals >> Under tasks select ‘Create Journal’ >>

Legal Entity Address creation

Setup and Maintenance >> Search for task ‘Manage Legal Addresses’ >> Click on create icon >> Enter address details >> Save and Close

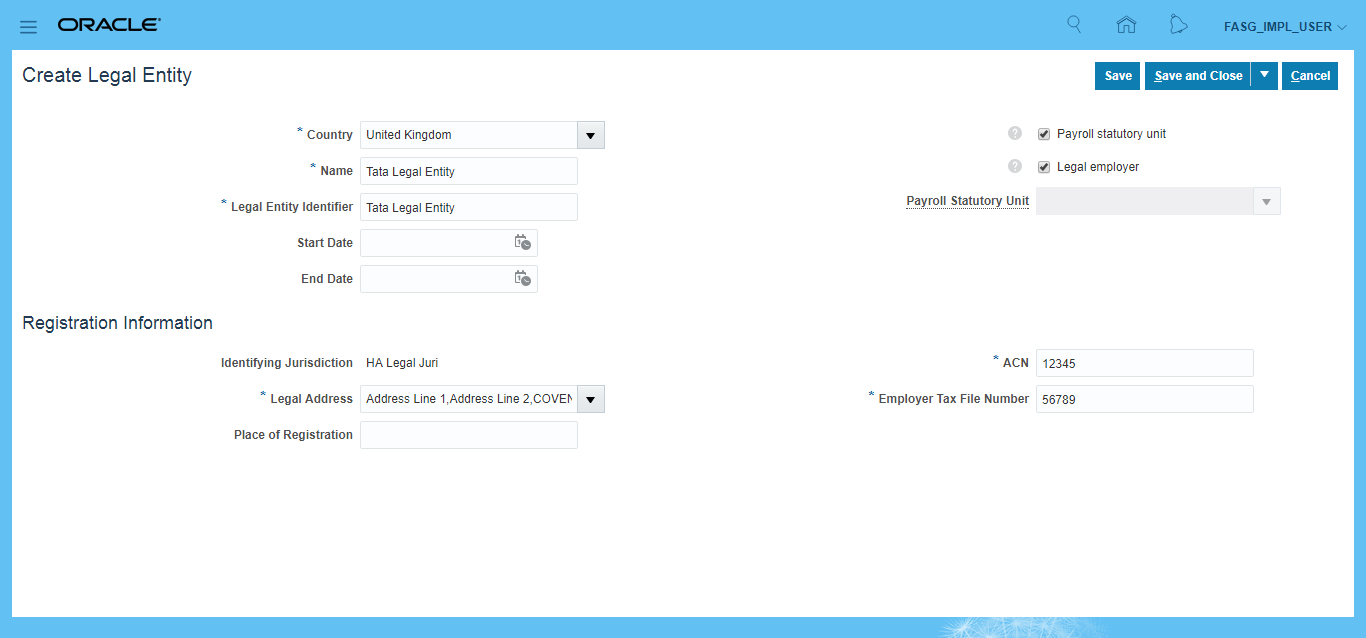

Legal Entity creation

Setup and Maintenance >> Search for task ‘Manage Legal Entity Registrations’ >> Checkbox ‘Manage Legal Entity Registrations’ and ‘Create New’ >> Apply and Go to Task >> Click on Create icon >> Enter details as below >> Save and Close

Association of Legal Entity with Ledger

Setup and Maintenance >> Search for task ‘Assign Legal Entities’ >> Click on ‘Go to Task’ >> Click on Select and Add >> Search for your LE and add >> Save and Close

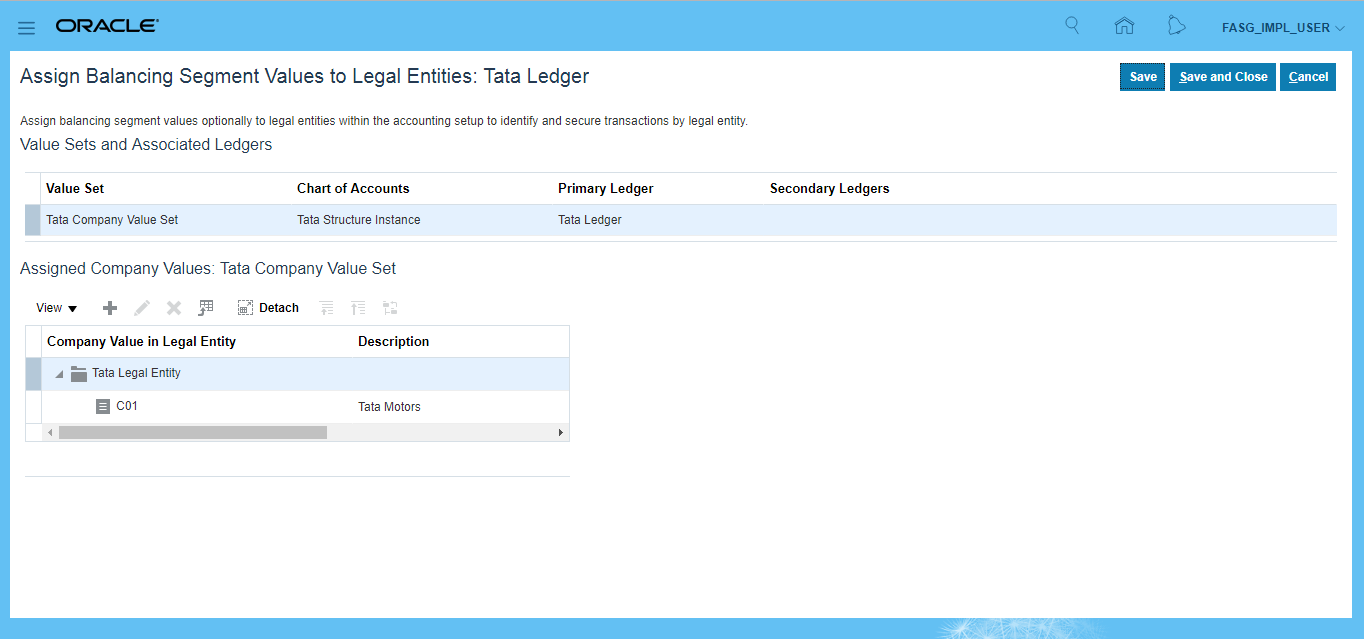

Assign Balancing Segment Values to Legal Entities

Setup and Maintenance >> Search for task ‘Assign Balancing Segment Values to Legal Entities’ >> Click on ‘Go to Task’ >> Click on Create >> Here we are trying to calculate tax only for C01 company hence we selected only one. For other companies we will create another legal entities and assign them to ‘Tata Ledger’.

Financials reporting using Multi dimensional analysis

→ Multi-dimensional analysis on live data

i) Account monitor

ii) Account inspector

iii) Smart view

→ Financial reporting and analysis

→ Overview of financial reporting studio

→ Revaluation and Translation

→ Allocation

Essbase cube is a multi-dimensional database which stores the data in pre-aggregated form. Different dimensions in Essbase cube are Date; Account; Ledger; Currency; Cost Center. Essbase cube is used only for GL Balances related reports like balance sheet, P&L report, cash close statements.

Paremeter 1: All COA segments will be parameters for Essbase cube. Either specific segment or specific values.

Parameter 2: Time dimension

Parameter 3: Ledger

Parameter 4: Actuals and budget

i) Account Monitor:

Navigation: General Accounting >> General Accounting Dashboard >> we can see Account Monitor section, Intercompany Transactions section, Journals section, Close status section and Process Monitor section.

Account groups will be created in Account monitor. Account groups are like few roles which you want to display in your dashboard.

Under Account Monitor >> View >> Account Group >> Create >> Enter details and create Accounts >>

Exam: 76 questions – 2 hours

Dumps

NO.1 You need to integrate Fusion Accounting Hub with external source systems used for Billing.

Identity the step that is not correct when implementing this integration.

A. Analyze external system transactions.

B. Capture accounting events.

C. Determine the accounting impact of transactions.

D. Create the accounting in the source system and then import the journal entries into subledger

accounting.

Answer: D

NO.2 You need to build a complex account rule. Which four value types can you use in your

definition?

A. Value Set

B. Constant

C. Existing Account Rule

D. Account Combination

E. Mapping Set

F. Source

Answer: A,B,C,F

No.3 You are reconciling your Payables the Receivables balances against the General Ledger. You are using the Payables to Ledger Reconciliation report.

You notice discrepancies between the balances in the subledgers, subledger accounting, and general ledger.

Which three factors are responsible for these out-of-balance situations?

A. All subledger transactions have been entered but do not have complete accounting.

B. Subledger transactions have been accounted and transferred to General Ledger but have not been posted.

C. There were manually entered journals against the Payables and Receivables accounts that were posted in General Ledger.

D. Intercompany transactions have not been fully processed.

E. Period Close processes,such as Revaluation, Translation, and Consolidation have not been performed yet

Answer: B,D,E

No. 4: You want to automatically post journal batches imported from subledger source to prevent accidental edits of deletions of the subledger sources journals, which could cause an out -of- balance situation between your sub ledgers and general ledger.

Which two aspects should you consider when defining your AutoPost Criteria?

A. Use the All option for category and accounting period to reduce maintenance and ensure that all imported journals are included in the posting process.

B. Include all of your subledger sources in the AutoPost Criteria. Divide up criteria sets by subledger source only if you need to schedule different posting times.

C. Create your AutoPost criteria using minimal source and categories.

D. Schedule your AutoPostCriteria set to run duringoff-peak hours only

Answer: A, B

No. 5: You need to create a month-end re-porting package for an upcoming Audit Committee meeting. You have 10 financial reports that you will need to share with executives and auditors.

In which three ways do you accomplish this?

A. Using Workspace, assemble multiple reports into a book.

B. Use a Report Batch to run reports at a specific time to create set of snapshot reports based on accounting information at that specific point in time.

C. Users can drill down on snapshot reports for future analysis.

D. The report contained in the book can be printed or viewed individually or as an entire book that includes a table of contents.

E. Snapshot reports can only be viewed online.

Check Answer: A, C, D or A, B, C

No. 6: You are reconciling your subledger balances and you need a report that includes beginning and ending account balances and all transactions that constitute the account’s activities.

What type of report will provide this type of information?

A. An Online Transactional Business Intelligence (OTBI) report to create ad hoc queries on transactions and balances

B. Account Analysis Reports

C. Journals Reports

D. Aging Reports

Check Answer: C or B

No. 7: You want to be notified of anomalies in certain account balances in real time. What is the most efficient way to do this?

A. Perform an account analysis online.

B. Open a Smart View file saved on your desktop.

C. Create an Account Group using Account Monitor.

D. Use Account Inspector.

Check Answer: D or C

No. 8: You must submitted the Accounting Configuration. Which two statements are correct?

A. You must define a Data Access Set to obtain full read/write access to the ledgers in the Accounting Configuration.

B. A Data Access Set with full read/write access to the ledger is automatically created.

C. Open the ledger’s period to begin entering transactions.

D. Verify the data roles created and assign them to the General Ledger users.

Answer: C

No. 9: Your Financial Analyst needs to interactively analyze General Ledger balances with the ability down to originating transactions.

Which three features facilitate this?

A. Account Inspector

B. Smart View

C. Account Monitor

D. Online Transactional Business Intelligence

E. Financial Reports published to Excel

Answer: A, B, C

No. 10: Your customer requires physical invoices to be generated in Fusion Payables and Fusion Receivables for the intercompany payables and receivables transactions.

What statement is correct with regard to setting this up?

A. You must assign the corresponding Receivables and Payables Business Units.

B. You only need to assign the Legal Entity and Organization Contact.

C. You must perform additional setup steps for Fusion Payables and Fusion Receivables.

D. You can only associate one Intercompany Organization per Legal Entity.

Answer: A

No. 11: You customer is a financial Institution that needs to maintain average daily balances (ADB).

Which two statements are true regarding this functionality in Fusion Applications?

A. ADB provides organizations with the ability to track average and end-of-day balances, report average balance sheets, and create custom reports using both actual and average balances.

B. Average balances are stored for both subledger balances and general ledger balances.

C. Average balances are stored in the Essbase cube.

D. Average balances are maintained for both actual and budget balances.

E. When using ADB, you must define a daily calendarand assign it to your ADB ledger.

Answer: A, D

No. 12: You want to define a tree or hierarchy for use in reports and allocations.

What three aspects should you remember when creating the tree?

A. You need to flatten the rows to be able to use drilldown in Smart View and you must publish tree to view the hierarchy in Essbase cubes.

B. You must flatten the columns and publish the tree to view the hierarchy in Essbase cubes.

C. The tree should have at least two tree versions to reduce report and allocation maintenance.

D. You only need to flatten the columns if you plan to use the hierarchy in Oracle Transactional Business Intelligence (OTBI).

E. It is fine to have the same child value roll up to two or more different parent values.

Check Answer: B, D, E or C, D, E

No. 13: Your customer has a large number of legal entities. The legal entity values are defined in the company segment and the primary balancing segment. They want to easily create eliminating entries for the intercompany activity.

What should you recommend?

A. Define an intercompany segment in the chart of accounts. The Intercompany module and the intercompany balancing feature in general ledger and subledger accounting will automatically populate the intercompany segment with the balancing segment value of the legal entity with which you are trading.

B. There is no need to define an intercompany segment. You can track the Intercompany trading partner using distinct intercompany receivable/payable natural accounts to identify the trading partner.

C. Define an intercompany segment and qualify it as the second balancing segment to make sure all entries are balanced for the primary balancing segment and intercompany segment.

D. There is no need to define an intercompany segment, the Intercompany module keeps track of the trading partners for you based on the Intercompany rules you define.

Check Answer: C or A or B

No. 14: You are defining an income statement report. You want to allow viewers of the report to be able to drill down from report balances to the underlying transactions. What do you need to enable?

A. Drill Through in Grid Properties

B. Report Functions

C. Nothing. All report balances are drillable in all FRStudio reports.

D. Allow Expansion

Check Answer: D or A

No. 15: Your customer operates three shared services that perform accounting functions across 50 countries.

What feature allows them to share setup data, such as Payment Terms, across Business Units?

A. Reference Data Sets

B. Business Units functions

C. None. Setup data is partitioned by Business Unit and must be defined separately per Business Unit.

D. Data Access Sets

Check Answer: B or A

No. 16: Your customer is reconciling their Intercompany Receivables accounts.

Which two reports should they use In addition to using the intercompany Reconciliation report?

A. Receivables Aging by General Ledger Account report

B. General I edger Trial Balance report

C. Receivables to General Ledger Reconciliation report

D. AR Aging report

Answer: C

No. 17: What Is Oracle Essbase?

A. A robust reporting and analysis tool

B. A relational database

C. A data ware house

D. A multidimensional Online Analytical Processing (OLAP) server that is embedded in Fusion General Ledger

Answer: B

No.18: How do you hide accounts with no balances showing #Missing in Smart view?

A. Select the Data/Missing check box in the Data Options tab.

B. Use Excel functions to hide rows with #Missing assigned

C. Choose the Suppress Zeros option under Data options.

D. This indicates a database connection issue.Try to reconnect to Fusion Applications.

Answer: A

No.19: What process must be followed to propagate a chart of accounts hierarchy to the Essbase cube?

A. Define the hierarchy, then deploy the chart of accounts.The chart of accounts hierarchies will be generated automatically.

B. Define the hierarchy, make sure the tree version is active, and then run the publish account Hierarchies program or the Publish Chart of Accounts Dimension Members and Hierarchies

C. Define the hierarchy and make sure the tree is active. The hierarchy will be system generated.

D. Define the hierarchy, make sure the tree is active, and the Publish check box is selected for the hierarchy.

Answer: C

No.20: You want to monitor the close process of all your financial subledgers and ledgers.

How can you quickly obtain this information?

A. Access each subledgers calendar and General Ledger’s Manage Accounting Periods page to view the status of each period.

B. Use the Manage Accounting Periods page to view the status of all subledgers and ledgers.

C. Use Close Monitor in General Accounting Dashboard.

D. Run Closing Status reports.

Answer: D

No. 21: Invoices received from a source system need to use a specific account based on 30 different expense types. However, if the invoice is from a specific supplier type, it needs to go to a default account regardless of the account type.

What is the solution?

A. Create two journalline rules with a condition of supplier type.

B. Create an AccountRule with 31rule elements using one condition for each expense type and another for supplier type.

C. Create an Account Rule with two rule elements using one for expense type mapping and the other for the condition of supplier type.

D. Createan Account Rule with three rule elements using one for expense type mapping, one for condition of supplier type,and the other without any conditions.

Answer: C

No. 22: All of your subsidiaries can share the same ledger with their parent company and all reside on the same application instance. They do perform intercompany accounting.

What does Oracle consider the best practice approach to performing consolidations?

A. Use Oracle Hyperion Financial Management for this type of complex consolidation.

B. Use General Ledger’s Balance Transfer programs to transfer subsidiary ledger balances to the parent ledger, and then enter eliminating entries as a separate balancing segment in the parent ledger.

C. Use General Ledger’s Financial Reporting functionality to produce consolidated reports by balancing segment where each report represents a different subsidiary. Any eliminating entries can be entered in yet another separate balancing segment.

D. Create separate ledgers for each subsidiary that shares the same chart of accounts, calendar,currency,and accounting method. Create a separate elimination ledger to enter intercompany eliminations. Then create a ledger set across all ledgers and report on the ledger set.

Check Answer: A or C

No.23: You want to process multiple allocations at the same time. What feature do you use?

A. RuleSets

B. Point of View (POV)

C. Formulas

D. General Ledger Journal entries

Check Answer: D or A or C

No.24: What type of user must be defined before you can create an Implementation Project?

A. None. The FusionApplications Superuser, FAADMIN, has full access to create an Implementation Project.

B. A full-time employee that has the FSM Superuser role assigned

C. None. The OIM systemadministrator user ID, XELSYSADM, which is assigned by the person provisioning the system, has full access.

D. Implementation Users

E. All roles that will be used throughout the implementation

Check Answer: A or E

No.25: After loading your budget data into Fusion General Ledger, you can view budget balances using these feature.

Which feature does not belong on the list?

A. Application Development Framework Desktop Integration(ADFdi)

B. Account Inspector

C. Account Monitor

D. Smart View

Answer: C

No. 26: Which two are prerequisites for creating subledger accounting entries?

A. Completing accounting transformation definition and activating Subledger Journal Entry Rule Set assignments for the Accounting Method

B. Populating supporting reference information in reference objects

C. Selecting source values from transaction objects

D. Creating subledger accounting events

E. Completing pre accounting validation

Answer: B, E

No.27: Which report show you differences between your subledger balances and General Ledger balances?

A. Payables Trial Balance, Receivables Trial Balance, and General Ledger Trial Balance reports

B. Payables and Receivables Aging Reports with the General Ledger Trial Balance report

C. Payables to Ledger Reconciliation Report and the Receivables to Ledger Reconciliation Report

D. GeneralLedger Financial Statements and the Accounts Payable and Accounts Receivables Invoice Registers

Answer: C

No.28: What’s the difference between subject areas that append the word “Real Time” and those that do not?

A. There is no difference.

B. The “Real Time”subject areas are based on real-time transactions and all others are based on Historical data.

C. The “Real Time” subject areas are based on real-time transactions in Fusion Applications, and all others are based on data stored in the Oracle Business Intelligence Applications data warehouse.

D. The “Real time” subject areas are based on sub ledger transactions and all others are based on general ledger balances.

Answer: C

No.29: While creating a Journal Entry Rule Set, you are not able to use an Account Rule recently created.

Which two options explain that?

A. The Account Rule is defined with a different chart of accounts from the Journal Entry Rule Set.

B. The Account Rule’s chart of accounts have no account values assigned

C. The Account Rule’s conditions are not defined.

D. The Account Rule is using sources assigned to different event classes from that of the associated Journal Entry Rule Set.

Check Answer: B, D or A, D

No.30: When working with Essbase, versions of the tree hierarchy as defined in the Fusion not available in the Essbase balances cube.

What should you do to correct this situation?

A. Make sure the tree version was published successfully.

B. Make sure to flatten the rows of the tree version.

C. Make sure the tree is active.

D. Redeploy the chart of accounts.

Check Answer: C or D

No. 31: After submitting the journal for approval, you realize that the department value in the journal is incorrect. How do you correct the value?

A. Delete the journal and create a new journal.

B. Update the journal through workflow

C. Click the Withdraw Approval button in the Edit Journals page and edit the journal.

D. Reverse the journal and create a new one.

Answer: C

No.32: Journal approval uses Approvals Management Extension (AMX).

Which AMX builder method is most effective in routing the journals to the Accounting Manager when the General Ledger Accountant enters the journal?

A. Supervisory level based on HR Supervisors

B. Job level

C. Position

D. Approval Group

Answer: D

No.33: Your company has complex consolidation requirements with multiple general ledger instances. You are using Oracle Hyperion Financial Management to consolidate the disparate General Ledgers. You can typically map segments between your general ledger segment to a Hyperion Financial Management segment, such as Company to Entity, Department to Department, and Account to Account.

What happens to segments in your source general ledger, such as Program, that cannot be mapped Hyperion Financial Management?

A. The data is not transferred.

B. Data is summarized across segments that are not mapped to Hyperion Financial Management

C. Errors occur for unmapped segments. You must map multiple segments from source general ledgers to the target segment in Hyperion Financial Management.

D. The unmapped segments default to future use segments in Hyperion Financial Management.

Answer: C

No.34: Your customer is having issues transferring intercompany transactions to General Ledger..

Identify three reasons for this.

A. The intercompany transaction is not approved.

B. The corresponding Payables and Receivables invoice have not been generated.

C. If they are different,then the exchange rate is missing between the intercompany and ledger currency.

D. The intercompany period is closed.

E. Both the intercompany and general ledger periods are open.

F. Import Payables and Receivables invoices is not run.

Check Answer: B, C, E or A, D, F

No.35: You entered users who are both employees and contingent workers. You want an automated way to assign, reassign, and remove roles from users.

What feature do you use?

A. Oracle Identity Manager Roles Assignment

B. Access Policy Manager’s Role Generation

C. Role Mappings

D. Data Roles

E. You cannot reassign contingent workers.

Check Answer: A or C

No.36: What are the tables or views from which the Create Accounting program takes source data that is used in rules to create journal entries?

A. Transaction Objects

B. Event Entities

C. Mapping Sets

D. Accounting attributes

E. Event Classes

Answer: A

No.37: Which two statements are true regarding the export/import of reports?

A. A set of reports are provided for both exported and imported setup data to validate the export/import processes and setup data.

B. Reports on setup data can be used to compare and analyze how the data might have changed over time.

C. To view errors encountered during the export or import Process, you must use SQL queries to obtain that data because no reports exist.

D. A set of reports lists user names, suppliers, and customers that have been exported/imported

E. The export/import reports are available only for Fusion Customer Relationship Management.

Answer: C, E

No.38: You are defining intercompany balancing rules that are applied to a specific source and category, such as payables and invoices, or a specific intercompany transaction type, such as Intercompany Sales.

Which two statements are correct?

A. You must define rules for every combination of specific categories and sources. Otherwise, the intercompany balancing will not work.

B. You can create a rule for all sources and categories by selecting the source “Other” and the category “Other.”

C. If you choose to have rules at various levels,then intercompany balancing evaluates the rules in this order: Ledger, Legal Entity,chart of accounts, and primary balancing segment value.

D. Set up a chart of accounts rule for every chart of accounts structure you have in order to ensure that Intercompany Balancing will always find a rule to use to generate balancing accounts.

Check Answer: B, C or C, D

No.39: You want to specify Intercompany System Options.

Which three factors should you consider?

A. Whether to enforce an enterprise-wide currency or allow in intercompany transactions in local currencies

B. Whether to allow receivers to reject intercompany transactions

C. Automatic or manual batch numbering and the minimum transaction amount

D. Automatic or manual batch numbering and the maximum transaction amount

E. The approvers who will approve intercompany transactions

Answer: A, B, D

No.40: Your customer has three legal entities, 50 departments, and 10,000 natural accounts. They use intercompany entries.

What is Oracle’s recommended best practice when implementing; a new chart of accounts? How many segments and what segment qualifiers should be used?

A. Define three segments for the company, department, and natural account. The qualifiers should be primary balancing segment, cost center segment, and natural account segment, respectively

B. Define four segments for the company, department, natural account, and intercompany segment. The qualifiers should be primary balancing segment, cost center segment, natural account segment,and intercompany segment, respectively.

C. Define five segments for the company, department, natural account, intercompany,and future use segment. The qualifiers should be primary balancing segment, cost center segment, natural account segment,intercompany segment, and no qualifier,respectively.

D. Define three segments tor the company, department, and natural account. The qualifiers for the first segment should be primary balancing segment and intercompany segment, cost center segment,and natural account segment, respectively.

Check Answer: B or C

No.41: You need to define a chart of accounts that includes an intercompany segment. Your customer plans to use segment value security rules for the Company segment.

What does Oracle consider as best practice to define this chart or accounts?

A. Share the same value set for the company and intercompany segments to reduce chart of accounts maintenance.

B. Use two different value sets for the company and intercompany segment because segment value security rules are at the value set level.

C. Define the company segment only and qualify it as both the primary balancing segment and intercompany segment.

D. Define two different charts of accounts.

Check Answer: B or C

No.42: Your customer wants to have balance sheets and income statements for their cost center and program segments. That is, they want to have three balancing segments.

Which two recommendations would you give your customer?

A. When entering journals manually,the customer will need to make sure that the debits and credits are equal across all balancing segments because the system will not automatically balance the journal.

B. Every journal where debits do not equal credits across the three balancing segments will result in the System generating extra journal lines to balance the entry.

C. Additional intercompany rules will need to be defined for the two additional balancing segments.

D. Ledger balancing rules will need to be defined to instruct the system on how to generate balancing entries for the second and third balancing segments.

Check Answer: A, D or A, C

No.43: Which two methods can your General Ledger accountants use to more easily view large amounts of contained in the tables in their work areas?

A. Detach the table to resize it to the maximum size of the monitor

B. Export the table to Excel.

C. Run a Business Intelligence Publisher report with Excel as the output format.

D. Use the Freeze feature on the tables to scroll through large amounts of data.

Answer: A, C

No.44: Your customer is expanding its operations. You defined a new ledger and several business units. However, you are unable to assign the newly generated data roles to existing Accounts Payables and Accounts Receivables users in the shared service center.

What should you do to correct the problem?

A. Openthe Oracle Identity Management (OIM) and make sure the data roles were created.

B. Open the Manage Users page and make sure the employees at

C. Open Access Policy Manager (APM) and assign the roles manually

D. Make sure you run the Retrieve Latest LDAP Changes program to regenerate the data roles.

Answer: C

No.45: The Accounting Manager requests that a schedule be created to automatically post journals from subledgers at different times.

Which journal attribute should you use to set the automatic posting criteria?

A. Journal Category

B. Journal Source

C. Journal Batch

D. Journal Description

Answer: Check C or D

No.46: What are the two benefits of having the Essbase cube embedded in Fusion General Ledger?

A. General ledger balances are multidimensional, allowing you to perform robust reporting and analysis.

B. You can access real-time results for reporting and analysis because every time a transaction is posted in General Ledger, multidimensional balances are also updated simultaneously.

C. You no longer need to create and maintain hierarchies because the Essbase cubes are created when you create your chart of accounts.

D. Posting performance is much faster.

E. Integrating with third-party systems is easier because the Essbase cube provides chart of accounts mapping rules.

Check Answer: B, E or A, D

No.47: You operate in a country whose unstable currency makes it unsuitable for managing your day-to- day business. As a consequence, you need to manage your business in a more stable currency while retaining the ability to report in the unstable local currency.

What would be your recommendation when defining ledgers?

A. Define Balance-Level Reporting Currencies in the more stable currency and run Translation as often as you need.

B. Use Journal-Level or Subledger-Level Reporting Currencies denominated in the more stable currency.

C. Run Revaluation as often as you need to the more stable currency and report on the more stable currency’sbalances.

D. Create a secondary ledger that uses a different chart of accounts that is denominated in the more stable currency.

Answer: B

No.48: Which two General Ledger work would you assign to all your entry-level General Ledger accountants?

A. Journals Work Area

B. Period Close Work Area

C. Financial Reporting Center

D. General Accounting Dashboard

Answer: A, D

No.49: You need to define multiple allocation rules as efficiently as possible.

Which three components can be reused across allocation rules?

A. Point of View (POV)

B. Run Time Prompts (RTP)

C. Formulas

D. RuleSets

Check Answer: B, C, D or A, B, D

No.50: You need to integrate Fusion Accounting Hub with external source systems used for Billing.

Identity the step that is not correct when implementing this integration.

A. Analyze external system transactions.

B. Capture accounting events.

C. Determine the accounting impact of transactions.

D. Create the accounting in the source system and then import the journal entries into subledger accounting.

Answer: D

No.51: Your customer wants to create fully balanced balance sheets for the Company, Line of Business, and product segments for both financial and management reporting.

What is Oracle’s suggested best practice for doing this?

A. Create a segment that acts as the primary balancing segment and create values that represent a concatenation of all three business dimensions.

B. Use account hierarchies to create different hierarchies for different purposes and use those hierarchies for reporting.

C. Create three segments and qualify them as the primary balancing segment, second, and third balancing segments, respectively.

D. Create two segments where the first segment represents the concatenation of Company and Line of Business, and then enable secondary tracking for the Product Segment.

Check Answer: B or C

No.52: You defined a tree or hierarchy, but you are unable to set its status to Active.

What is the reason?

A. Chart of accounts was not deployed.

B. Accounting Configuration was not submitted-

C. An Audit process needs to be successfully performed before a tree version can be set to Active.

D. Two tree versions were not defined

Answer: C

No.53: You are creating financial statements and want to have charts, such as a bar graph, automatically inserted to improve the understanding of the financial results.

What’s the most efficient way to achieve this?

A. When viewing the report, download to Excel and use Excel’s Charting features to create your bargraph.

B. When designing your financial statement using Financial Report (FR),embed a chart into your report

C. Use Account Inspector that automatically creates graphs on financial balances.

D. Use Smart View, which is and Excel Add-on

Check Answer: C or B

No.54: On which three occasions are Essbase balances updated?

A. Every time the tree version is published

B. Every time journals are posted to the general ledger

C. Every time you run the batch program called “Update Essbase Balances”

D. At report run-time

E. Every time you open a new period

Answer: A, B, D

No. 55: Which two delivered roles can access the full functionality of Functional Setup Manager.

A. Application Implementation Manager

B. Functional Setup Manager Superuser

C. Application Implementation Consultant

D. Any functional user

E. IT Security Manager

Check Answer: B, E or A, B

No.56: Which reporting tool is best suited for submitting high-volume transactional reports, such as invoice Registers or Trial Balance reports, that can be configured to extract the data in Rich Text Format or XML?

A. Financial Reporting Center

B. Oracle Transactional Business Intelligence (OTBI)

C. Business Intelligence Publisher (BI Publisher)

D. Smart View

E. Oracle Business Intelligence Applications (OBIA)

Check Answer: A or C

No.57: Identify three differences between Oracle Transactional Business Intelligence (OTBI) and Oracle Business Intelligence Applications (OBIA).

A. OBIA is based on the universal data warehouse design with different prebuilt adapters that can connect to various source application

B. Both OBIA and OTBI provide a set of predefined reports and dashboards and a library of metrics that help to measure business performance

C. OBIA works for multiple sources including E-Business Suite, PeopleSoft, JD Edwards, SAP, and Fusion Applications.

D. OTBI allows you to create custom reports from real-time transactional data against the database directly

E. Cloud customers can use both OTBI and OBIA.

Answer: B, C, D

No.58: Identify three functions of Functional Setup Manager.

A. Provide a central place to access and perform all of the setup steps across Fusion application product

B. Automatically generate lists of setup tasks in the correct sequence with dependencies highlighted.

C. Automatically mark the status of tasks as Completed after they have been completed.