EBS Fixed Asset (FA)

Assets are of two types

1. Current Asset 2. Fixed Asset

- Current Asset: Which will use in an Organization for less than a year. We don’t have depreciation value. Volatile.

Ex: Cash, Marketable Securities, Pre-Paid Expenditures, Inventory Goods etc, Recurring Deposits - Fixed Asset: Which will use in an Organization for more than a year. We have depreciation value.

Ex: Land & Building, Vehicles, Plant & Machinery, Computers etc.

Depreciation: Cost decreases over a period of time. We calculate depreciation on yearly basis, not monthly.

The main purpose of Fixed Asset is to track depreciation and track asset location and to track asset category like lease asset or own asset.

KFF’s in FA are Asset Key, Asset Location, Category

Say Vehicles is a major category then we have 2/3/4 wheelers under minor category.

Asset location determines the location of asset.

Note:

1. Only one structure we can have for FA. Unlike in GL for Accounting Flexfield where we have multiple structures, we cant have in FA.

2. Only one open period we have for FA.

3. FA doesn’t support Multi Org Structure

Structure in FA:

Fixed Assets Manager >> Setup >> Financials >> Flexfields >> Key >> Segments >> Query for Application Assets. Here we find three Location Flexfield, Asset Key Flexfield and Category Flexfield under Flexfield Title

Also we wont be able to create new structure.

Segment values in FA:

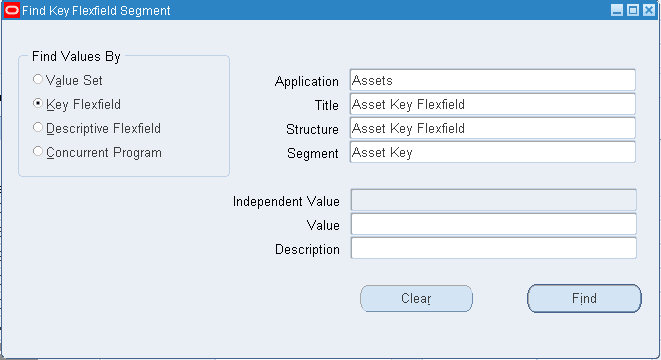

Fixed Assets Manager >> Setup >> Financials >> Flexfields >> Key >> Values >> Enter values as below >> Find

Here we created a value VH with description Vehicles.

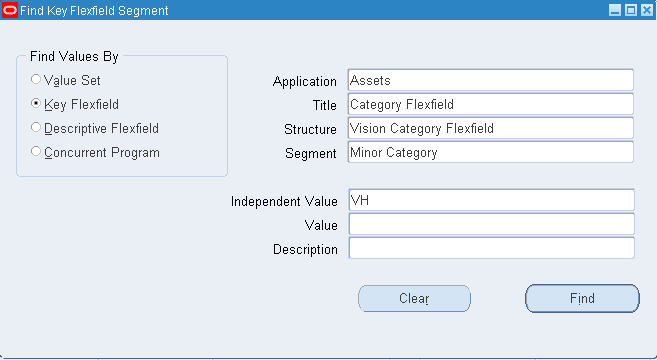

Similarly for Category Flexfield for segment Major Category (Vehicle) and Minor Category segment (2-Wheeler and 4-Wheeler) create new values.

To assign the Minor Category segment (2-Wheeler and 4-Wheeler) values enter Independent value VH and enter the values.

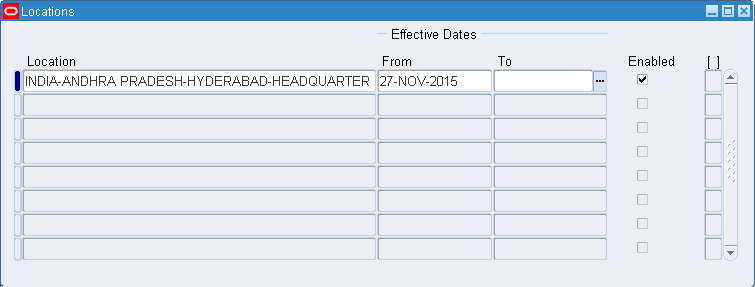

Similarly for Location Flexfield for segment Country (India), State (ANDHRA PRADESH), City (Hyderabad), Building (HEADQUARTER)

Now we need to register the location.

Fixed Assets Manager >> Setup >> Asset System >> Locations >> Enter details as below >> Save

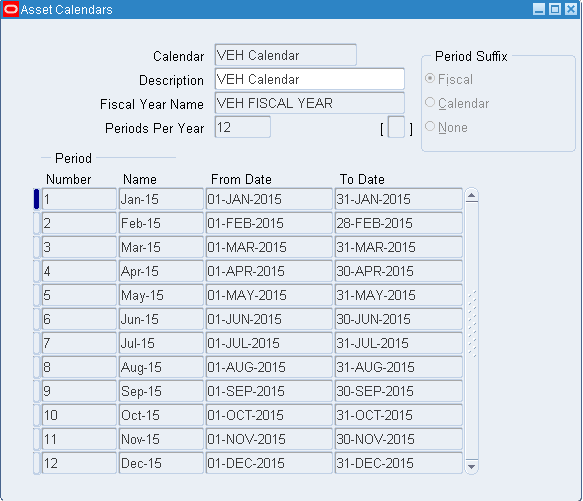

Asset Calendar:

We have three types

1. Fiscal 2. Depreciation 3. Pro-Rate Convention

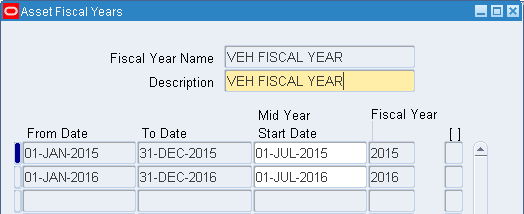

- Fiscal: Jan-Dec (Accounting) or Apr-Mar (Fiscal)

Fixed Assets Manager >> Setup >> Asset System >> Fiscal Years

Ensure we enter next year also

- Depreciation Calendar: Used to close FA books which break fiscal calendar into periods. The depreciation period name should match with GL period name (like Jan-15, Feb-15, Mar-15).

Fixed Assets Manager >> Setup >> Asset System >> Calendars >> Create a calendar with period name = GL period name.

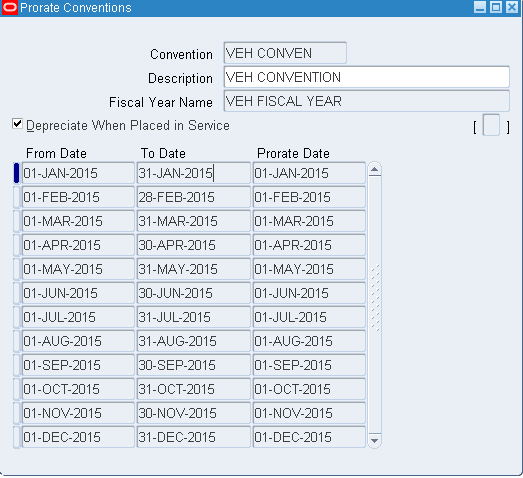

- Pro-Rate Convention: Used to calculate depreciation of an asset. Say we defined prorate from 01-OCT-2015 to 31-OCT-2015 and we purchased item on 15-OCT-2015. The actual depreciation should start from 15-OCT-2015 since we defined pro-rate it starts from 01-OCT-2015

Fixed Assets Manager >> Setup >> Asset System >> Calendars

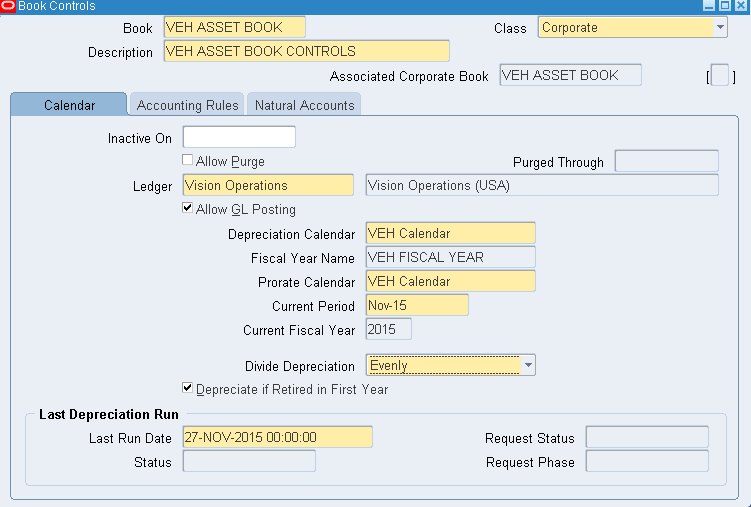

Depreciation Books (Book Controls) : Asset Information

Fixed Assets Manager >> Setup >> Asset System >> Book Controls

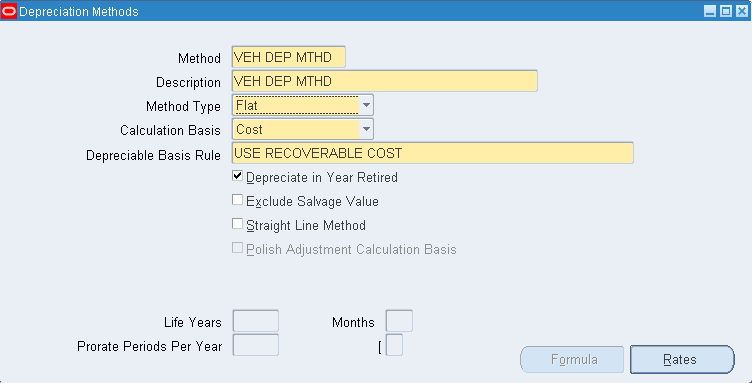

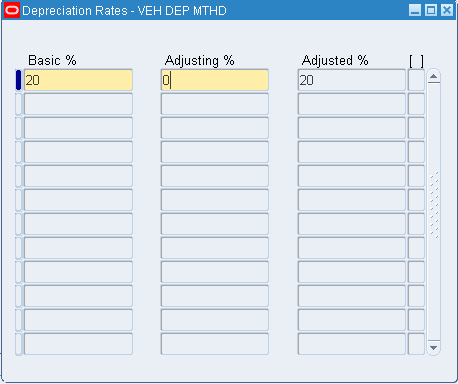

Depreciation Methods and Rates

Commonly used depreciation methods are STL(Straight Line Method) and Flat Rate

1. STL – Asset cost/ asset life in years. Also known as Calculated Method

30000/4 years = 7500 yearly depreciation

2. Flat Rate – Flat depreciation for asset.

FA >> Setup >> Depreciation >> Methods

Click on Rates

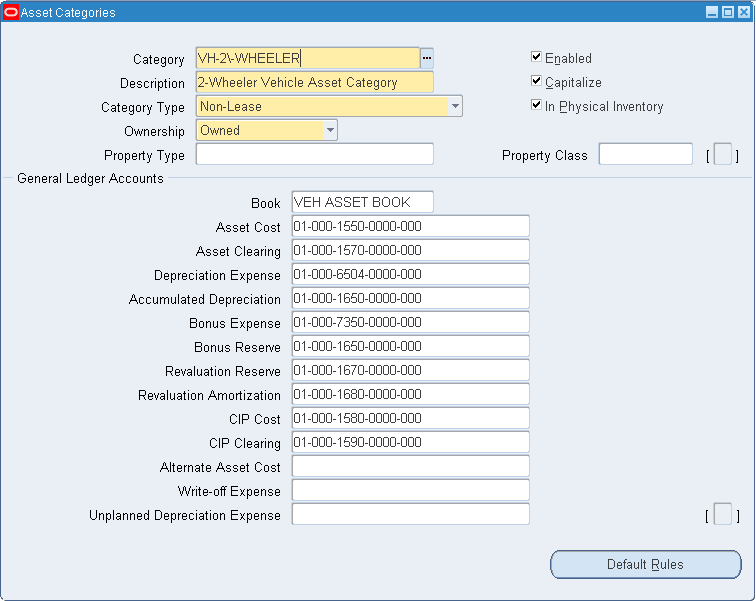

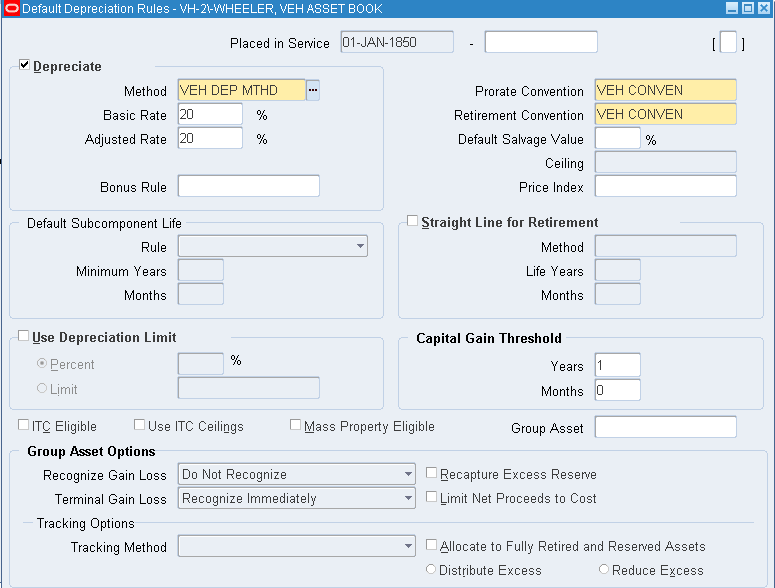

Asset Category

Fixed Assets Manager >> Setup >> Asset System >> Asset Categories

The asset bought in India has one value and bought outside India has other value.

Click on Default Rules

Save

Asset Types:

1. Capitalize Asset 2. CIP Asset 3. Group Asset

- Capitalize Asset– Which is ready to use. Ex: Laptop

They have depreciation as well as cost - CIP– Construct in Process or Work in Process

Which is not ready to use. Doesn’t have cost or depreciation. This gets converted into Capitalize asset. Ex: Spare parts of vehicle - Group Asset– Grouping assets by 2-wheeler group. Ex: Pulsar, Splendor, CBZ

Grouping assets by 4-wheeler group. Ex: BMW, Jaguar, Bentley

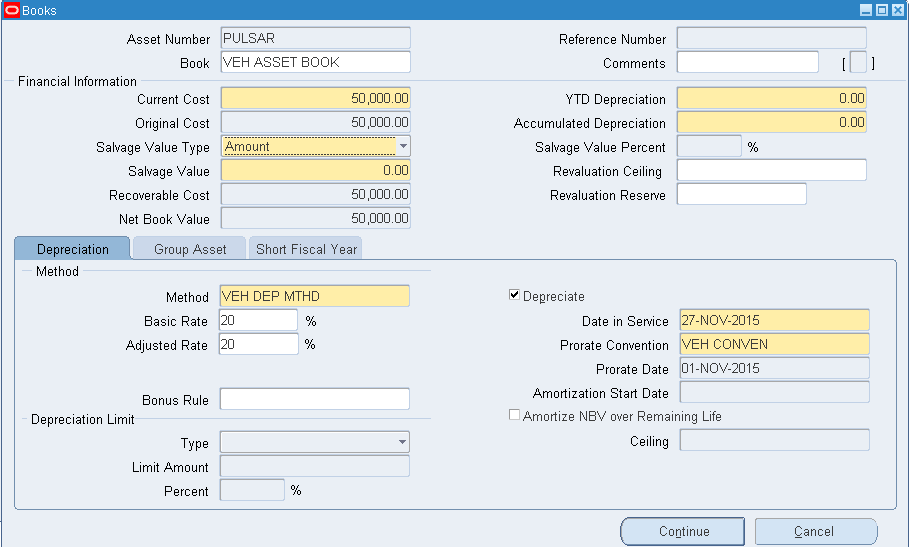

Transaction on Asset (Addition of Asset)

Asset Cost (Minus) Accumulated Depreciation = NBV (Net Book Value)

Fixed Assets Manager >> Assets >> Asset Workbench

FA_15 image should come here

Click on Continue

Click on Continue

Click on Done

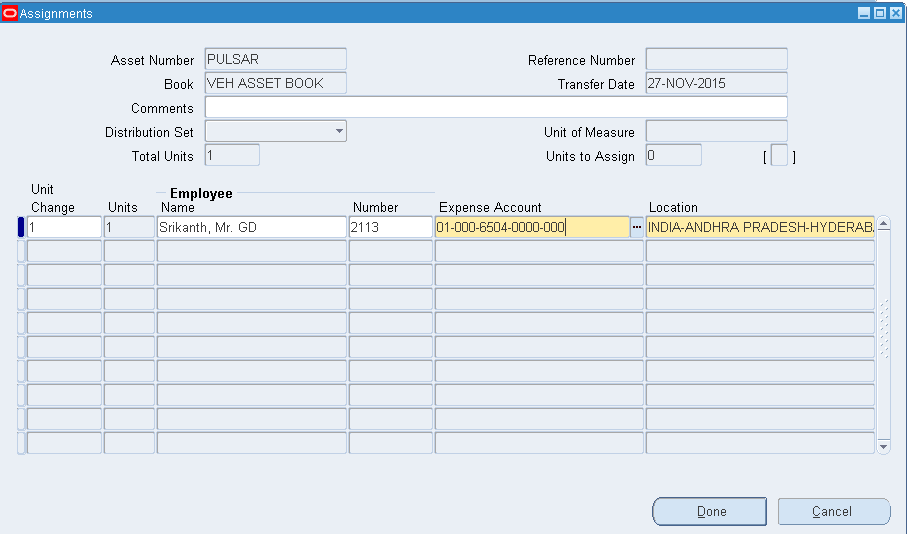

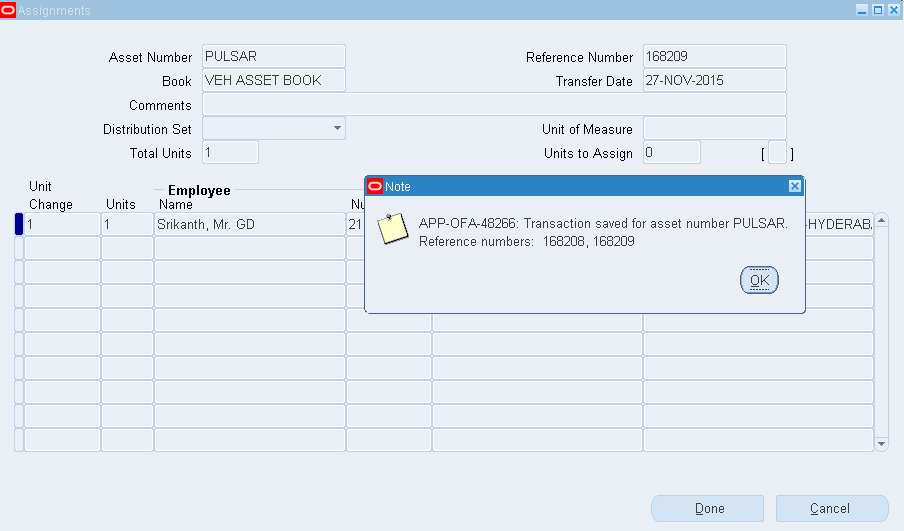

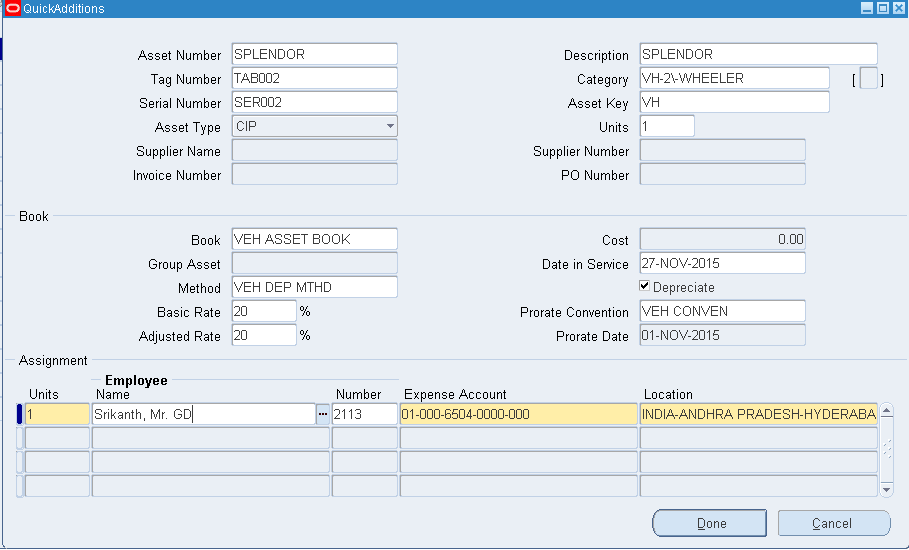

Transaction on Asset (Quick Addition of CIP Asset)

Fixed Assets Manager >> Assets >> Asset Workbench >> Quick Additions

In normal addition (done top) we have three forms for adding whereas here all information can be updated in single form.

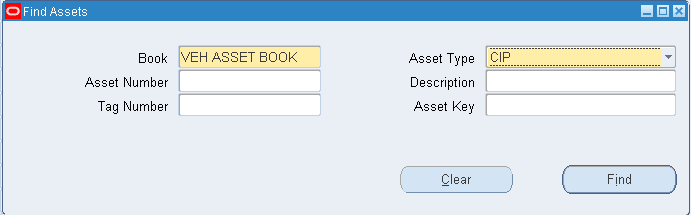

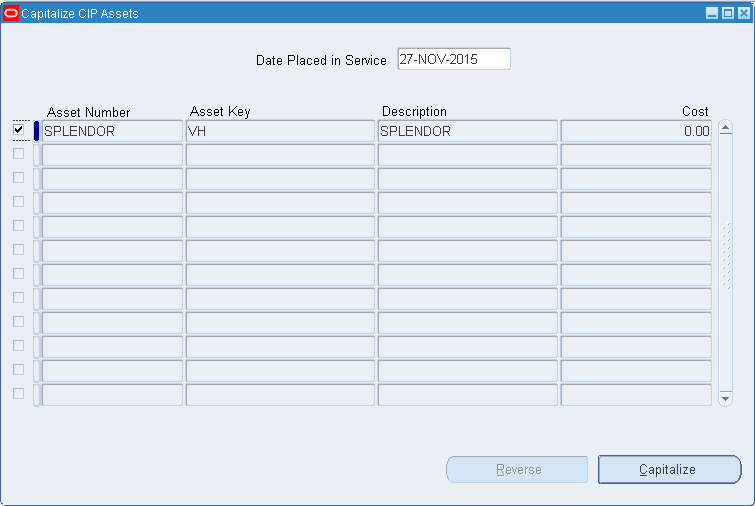

Capitalizing a CIP asset:

Fixed Assets Manager >> Assets >> Capitalize CIP Assets >> Enter Book Control name >> Find

Check and click on Capitalize

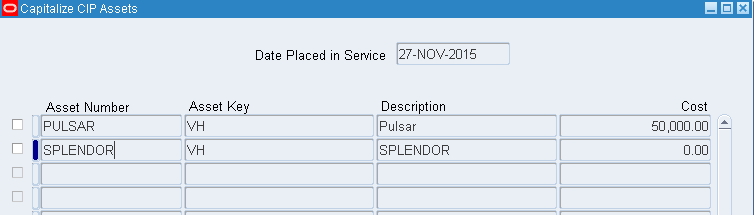

Now we have both the assets under Capitalized. Also we can reverse the transactions by clicking on Reverse button.

Now add value to CIP asset which has been capitalized.

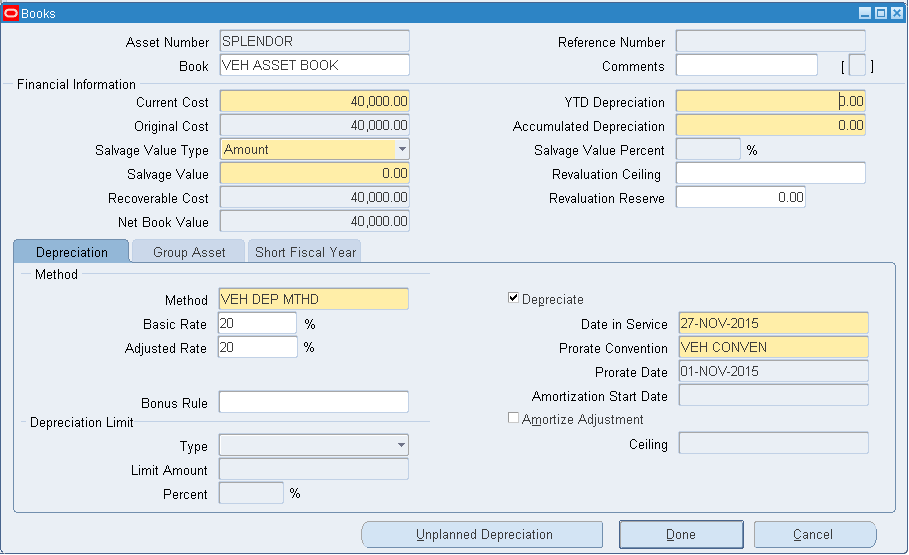

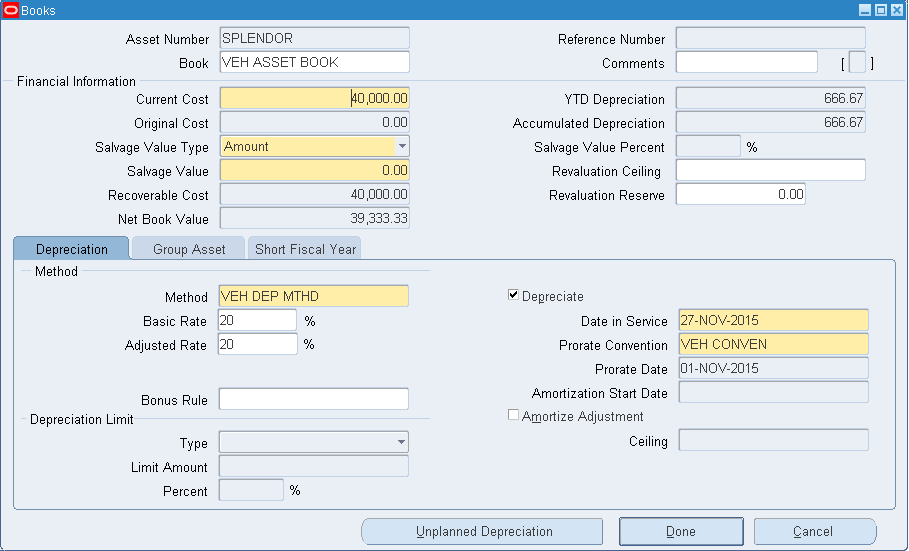

Fixed Assets Manager >> Assets >> Asset Workbench >> Enter Book control name >> Find >> Select Splendor >> Click on Books >> Enter values as below >> Done

Salvage value = Wastage Value

Click on Financial Inquiry to get the cost.

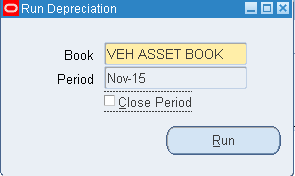

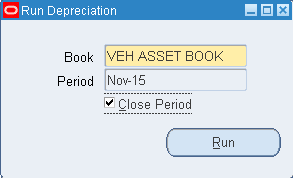

Fixed Asset Month End Cycle

1. Soft close depreciation – No need to enable “Close Period” option

2. Hard close depreciation – Need to enable “Close Period” option

Soft close depreciation – No need to enable “Close Period” option

Run depreciation and close current period.

Fixed Assets Manager >> Depreciation >> Run Depreciation

Without enabling the close period if we run then it is soft close else its hard close.

Ensure the program successfully completes.

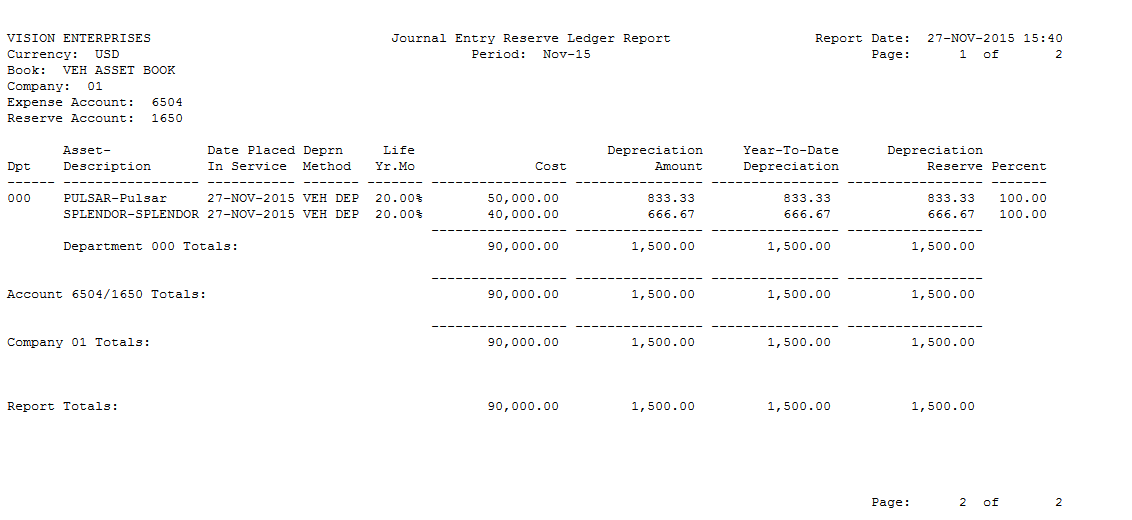

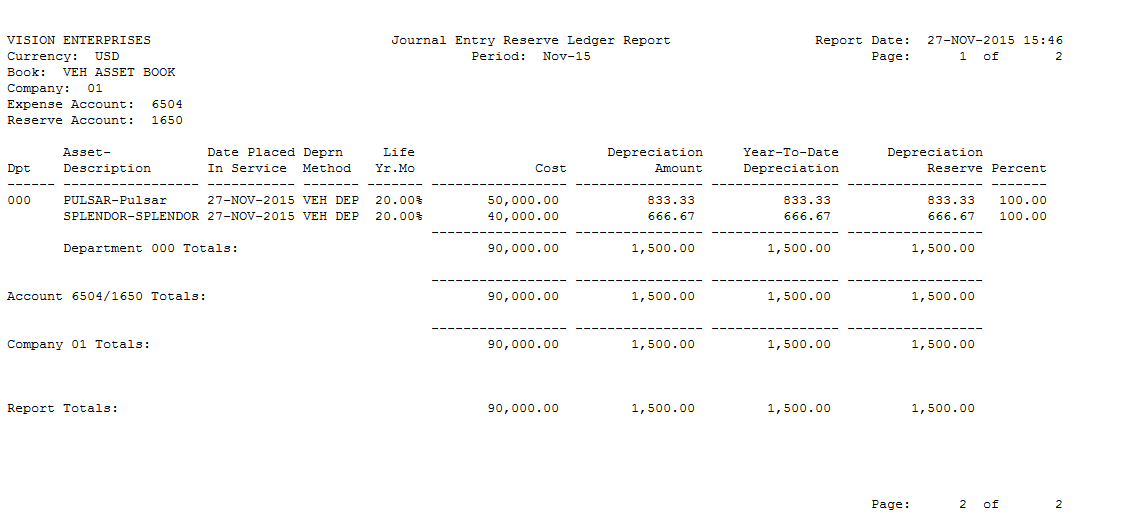

Check the o/p of ‘Journal Entry Reserve Ledger Report’ program

Now go with hard close

After hard close we wont be able to open the same period again.

Review of depreciation

Fixed Assets Manager >> Assets >> Asset Workbench >> Enter the book control name >> Find >> Select any asset >> Books >> Here we find the depreciation values

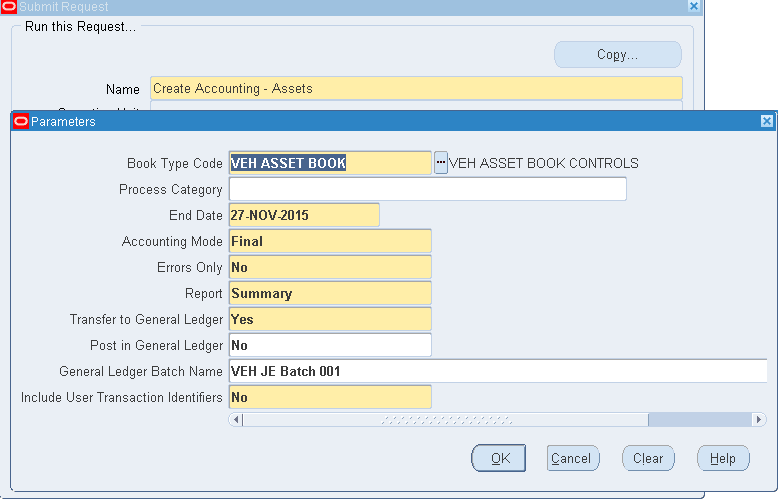

Create Accounting

Fixed Assets Manager >> Create Accounting

After successful completion of program to check the entries in GL, login to operations users.

General Ledger Super User >> Journals >> Enter >> Enter batch name ‘%VEH JE Batch 001%’ >> Find >> Review the journals.

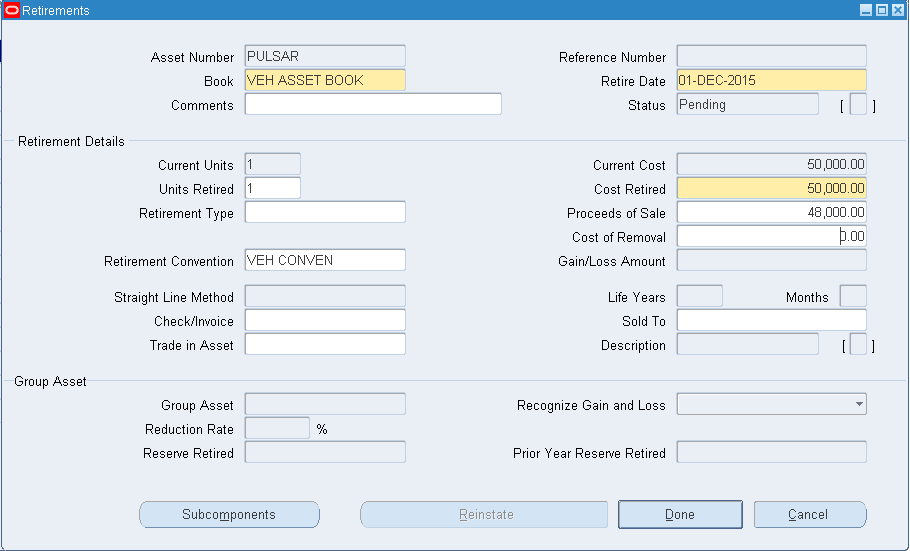

Retirement/ Sale of an Asset

FA >> Assets >> Asset Workbench >> Enter book control name >> Find >> Select the asset and click on Retirements

Done >> Ensure the program successfully completes.

For asset retirement we need to run ‘Calculate Gains and Losses’ program which is very much mandatory.

FA >> Depreciation >> Calcualte Gains and Losses >> Enter BOOK name and submit

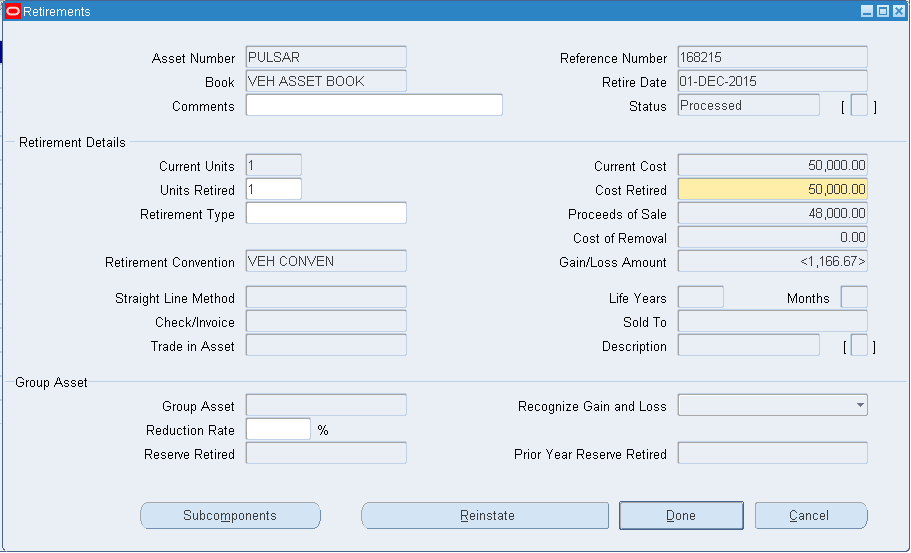

Assets >> Asset Workbench >> Enter book name >> Find >> Select above asset and click on Retirements >> Control + F11 >> Instead of having 2000 loss we have <1,166.67>. The rest 833.33 amount has been eliminated under depreciation. Status is Processed.

We can use Reinstate to recover back the record. Here the status will be Deleted.

Accounting Entries

Mandatory accounts in FA

Module – Account

INV – AP Accrual A/C

AP – AP Liability A/C

FA – Asset Clearing A/C