EBS General Ledger (GL)

Flexfield

1. Descriptive Flexfield – Capture additional information. Stored in attributes. Display in form as [ ]. DFF’s are of two types:

a) Global : Always appear on form

b) Context-Sensitive : May/ may not appear. Depends on form field

2. Key Flexfield – Predefined by Oracle. Made up of segments where each segment has value and meaning. Set of segments is called Code Combination

Tables: fnd_flex_value_sets and fnd_flex_values

General ledger application >> Accounting Flexfield >> Structure >> Segments >> Segment Values

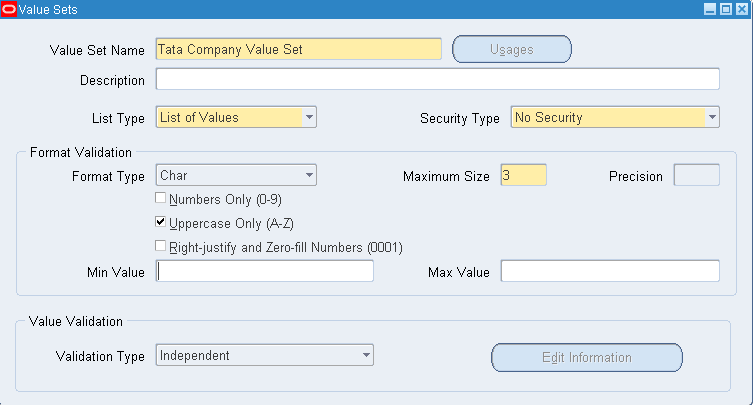

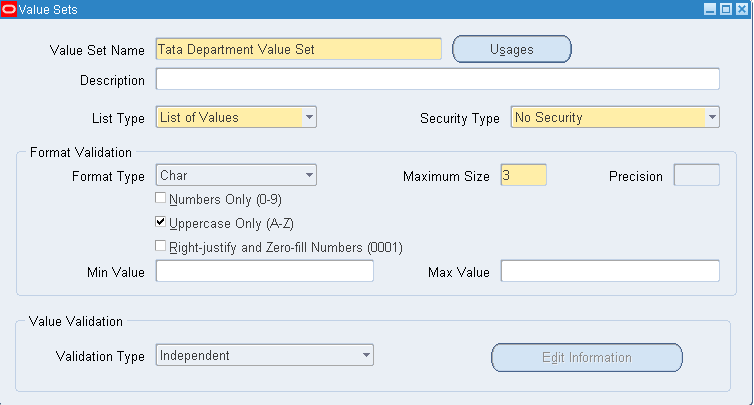

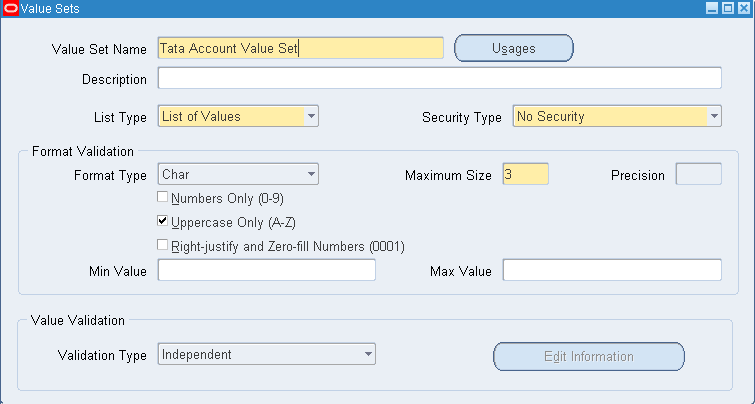

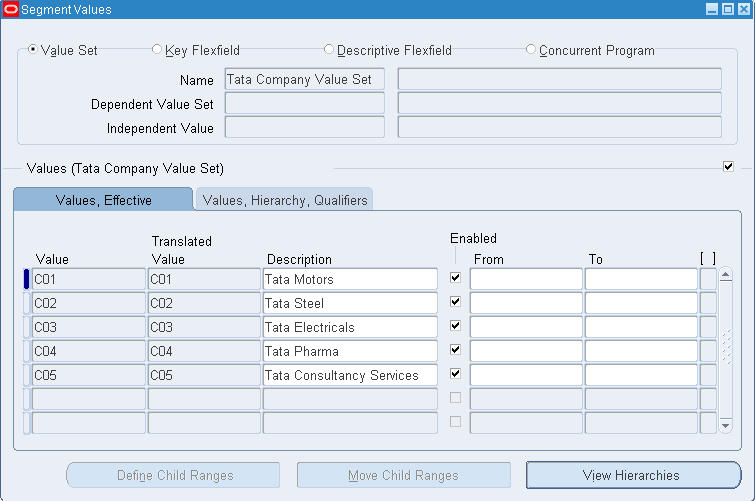

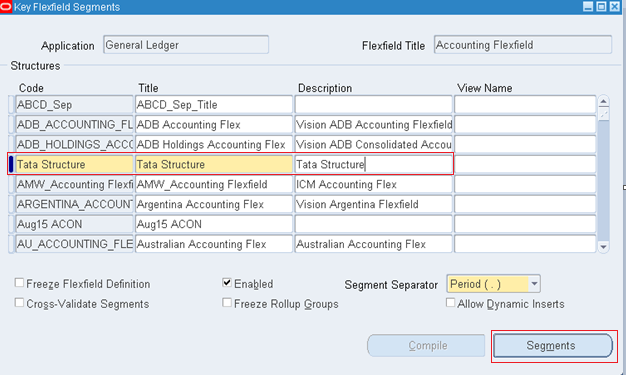

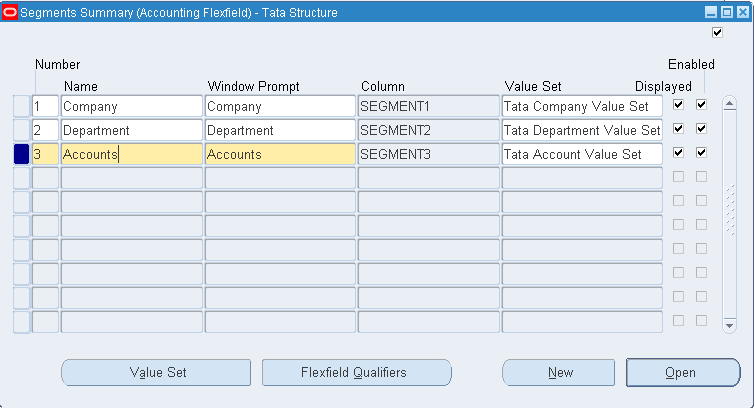

We create the structure using Accounting Flexfield (KFF) in General Ledger. Each structure can have max 30 segments and min 2 segments (Company and Accounts). Say we have Tata as structure and this consists of three segments like Company, Department and Account. Each segment will have values like for Company C01, C02, C03 and for Department like Education & Research, Sales, Marketing, Finance, HR and for Account Expense, Revenue, Assets, Liability and Ownership.

We define these values under value set. {In case min & max value are not specified and the max size is defined as 3 having NUMBER format type, then system automatically defaults the min value to 001 and max value to 999. Similarly if the format type is CHAR with max size as 3 then we n number of combinations for min & max value, like 001-999, AAA-ZZZ, A01-A99, B01-B99, AB1-AB9, 1DA-9DA & so on}.

Value Set Navigation:

Setup >> Financials >> Flexfield >> Validation >> Sets

(or)

Application Developer >> Application >> Validation >> Sets

Creation of Company, Department and Account value set

Assigning values to each value set:

Setup >> Financials >> Flexfields >> Key >> Values >> Select Value set >> Query for value set name >> Click on Find >> Enter values for Company

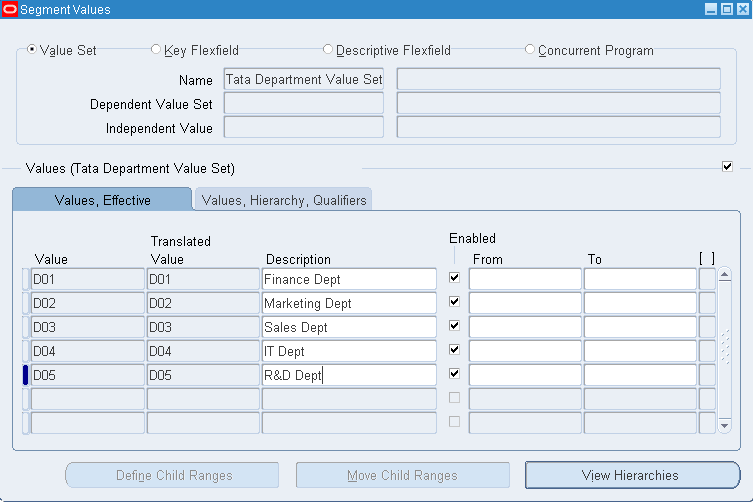

Similarly enter values for Department

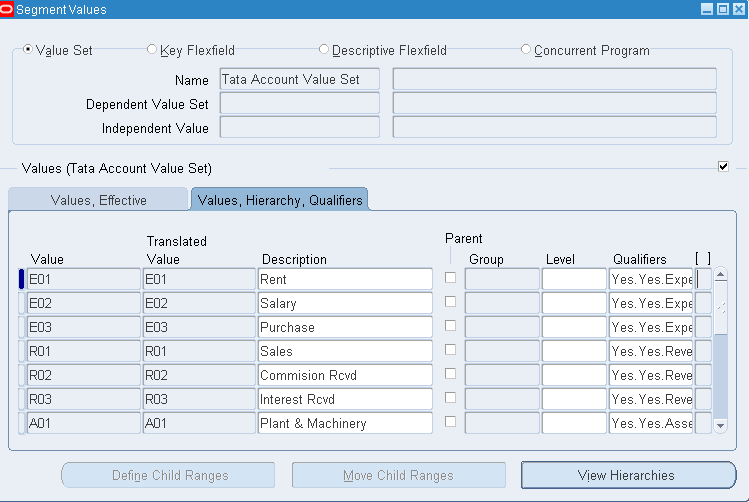

Similarly enter values for Account and assign segment qualifiers as this is mandatory for Account segment. We have following account types under segment qualifiers: Asset, Liability, Expense, Revenue, Ownership/ Stockholder’s Equity, Budgetary (CR), Budgetary (DR)

General Ledger is an application.

Ledger is an entity where we record the business information like selling and purchasing details. We define 4C’s in Ledger.

1. Chart of Accounts: Here we define structure, segments and segment values (attaching value set)

2. Currency: INR, AUD, USD, GBP

3. Calendar: We have two types

a. 01-Jan-2015 to 31-Dec-2015 — Calendar

b. 01-Apr-2015 to 31-Mar-2015 — Fiscal (Any calendar other than calendar {like above} is Fiscal calendar)

4. Convention: Also called Accounting method. We have two types

a. Cash Basis of Accounting – As on when transaction takes place. Immediate settlement.

b. Accrual Basis of Accounting – Not immediate settlement. Pay later.

Defining structure and segments:

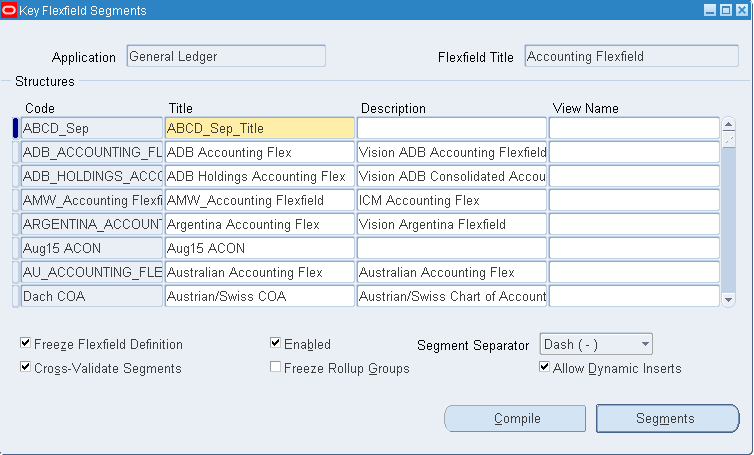

General Ledger Super User responsibility >> Setup >> Financials >> Flexfields >> Key >> Segments >> Query for Application ‘General Ledger’ and Flexfield Title ‘Accounting Flexfield’

Create your Structure as highlighted below and click on Segments

Creation of Segments and assigning value set to each segment

Click on Flexfield Qualifiers >> For Company select Balancing Segment >> For Department select Cost Center Segment >> For Accounts select Natural Account Segment

Flexfield Qualifier – Defines behavior of each segment.

After including the flexfield qualifiers come to main page. Check Allow Dynamic Inserts and Freeze Flexfield Definition and click on Compile. With this COA gets completed.

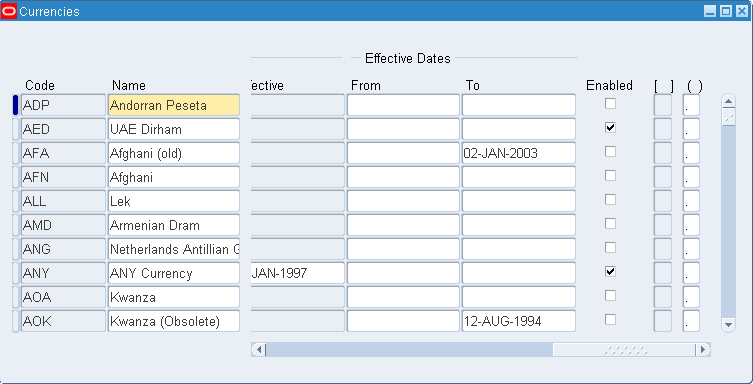

Currencies:

General Ledger Super User >> Setup >> Currencies >> Define >> Check the Enabled field for the currencies which you want to use. Also we can create our own currency if required.

Calendar:

We have two types:

1. Accounting Calendar (Mandatory) 2. Transaction Calendar (Optional)

Accounting Calendar are of two types

1. Calendar – 01-Jan-2015 to 31-Dec-2015

2. Fiscal Calendar – 01-Apr-2015 to 31-Mar-2016

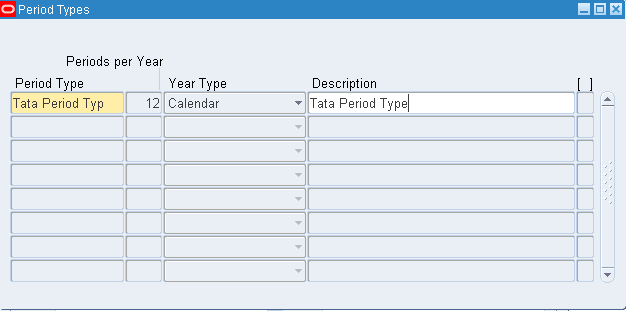

General Ledger Super User >> Setup >> Financials >> Calendars >> Types >> Create your custom period type

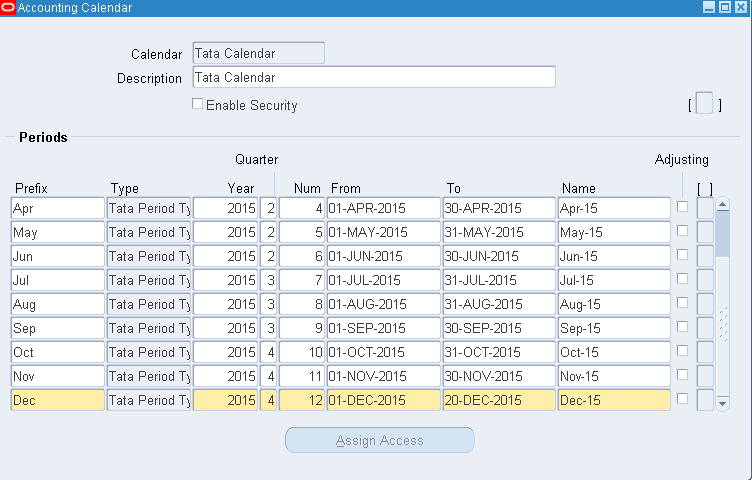

General Ledger Super User >> Setup >> Financials >> Calendars >> Accounting >> Create custom calendar

In case you would like to have adjustment period then create period having periods per year as 13 so that you can have the adjustment period in calendar.

When trying to close the form you have validation message. Go ahead and select Current. Ensure the program successfully gets completed.

Creation of Ledger

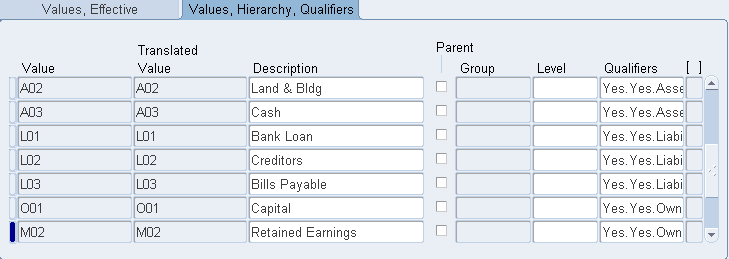

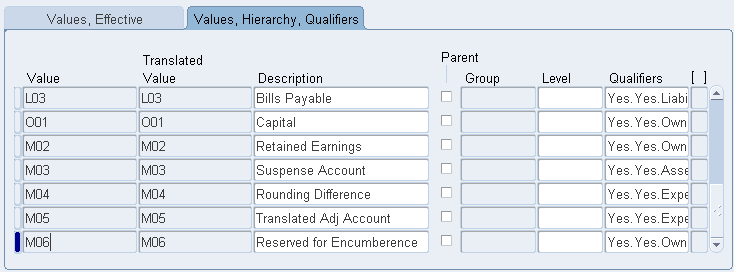

Along with three C’s, we need to have following six mandatory accounts.

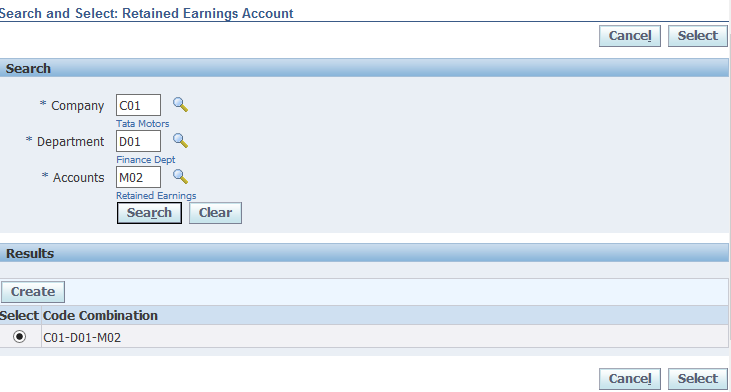

1. Retained Earnings (Ownership) — Mandatory = Accumulated profit

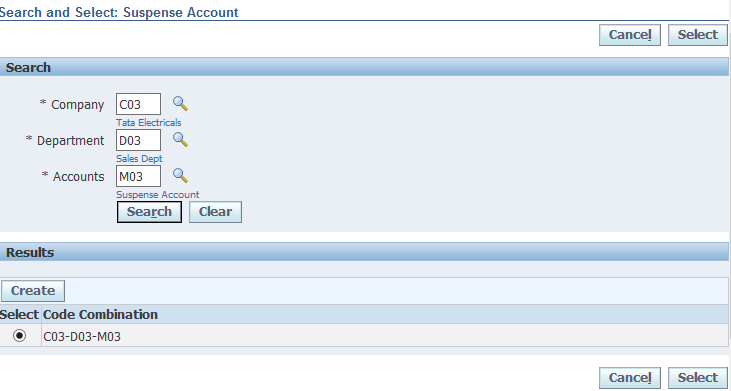

2. Suspense Account (Asset/ Liability) = Whenever user is going to enter debit w/o credit or credit w/o debit then that missed entry hits suspense account. In case we don’t define suspense account we get Error6: No suspense account defined.

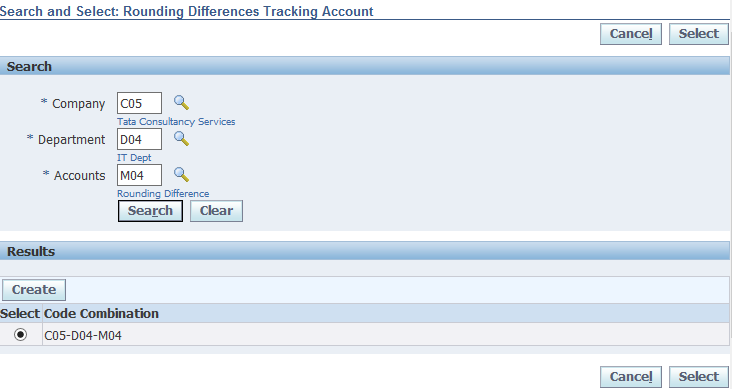

3. Rounding Difference (Expense/ Revenue) = Round off value to nearest integer (<50 then 0; >=50 then 1)

4. Translation Adjustment (Ownership/ Revenue) = Localization of currency

5. Net Income/ Net Earnings (Expense/ Revenue) = Current year profit

6. Reserve for Encumbrance (Ownership) = Whenever user is going to enter debit w/o credit or credit w/o debit for BUDGET JOURNAL then Reserve for Encumbrance line added by Posting

Actuals – Day to day transactions are Actuals. Like Salary A/C Dr to Suspense A/C; Rent A/C Dr to Suspense A/C; Purchase A/C Dr to Suspense A/C.

Budgets – Future/ Forecasting transactions are Budgets. Like 2016 or 2017 transactions, when we don’t have Dr or Cr entry then we get Reserve for Encumbrance.

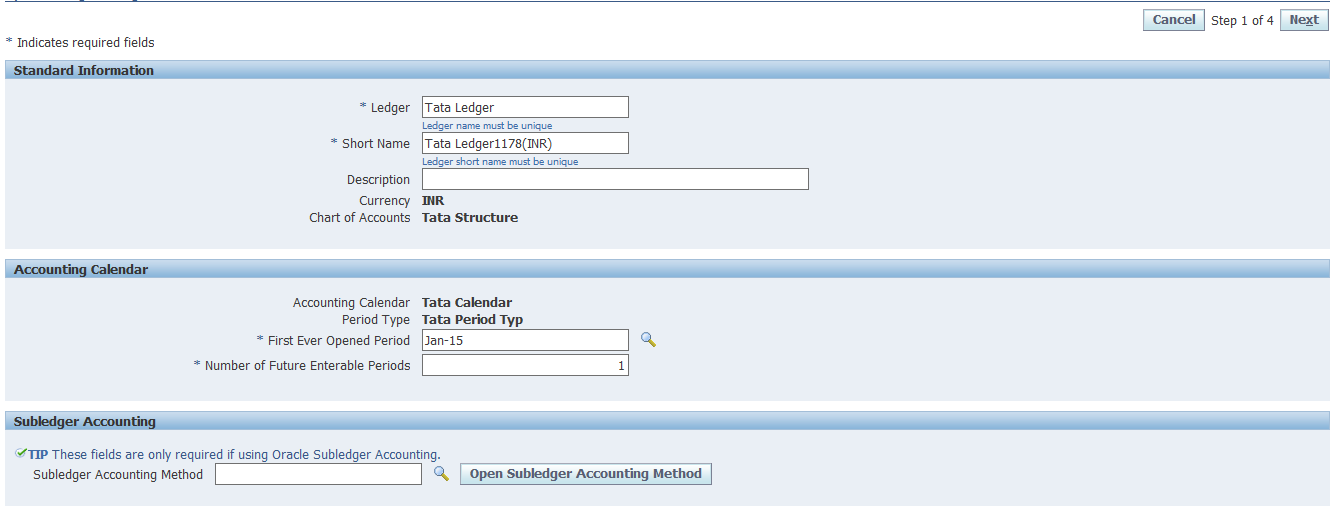

Creation of Ledger = Accounting Setup + Accounting Options (or) Ledger Options

Accounting Setup = Ledger Name + 3 C’s (COA, Currency, and Calendar)

Ledger options = Mandatory accounts like Retained earnings, Suspense account, Rounding difference, Translation adjustment, Net income, Reserve for encumbrance

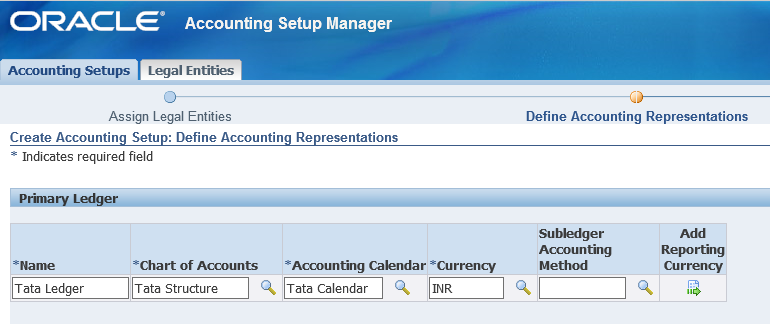

General Ledger Super User >> Setup >> Financials >> Accounting Setup Manager >> Accounting Setups >> Click on Create Accounting Setup >> Legal Entity creation can be taken later so click Next >> Enter details as below

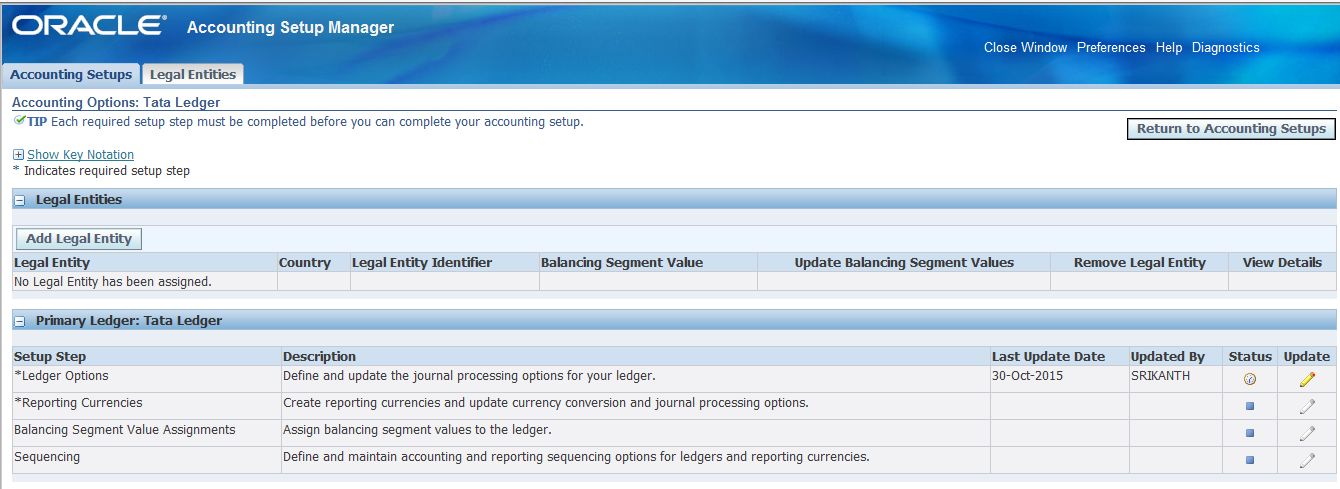

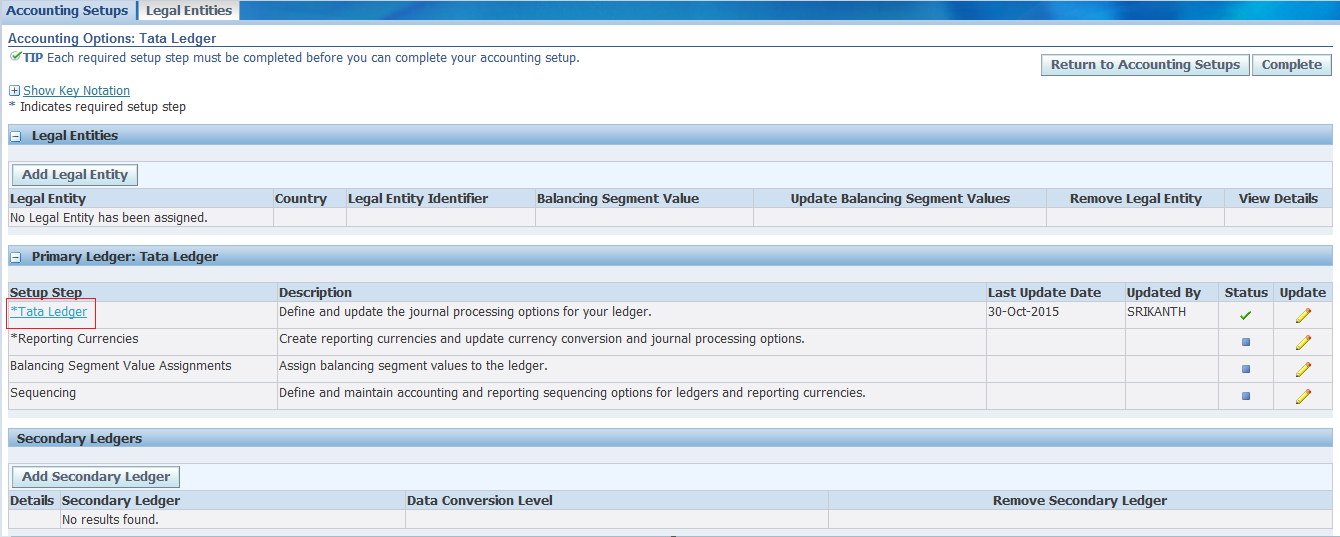

Click Next >> Click Finish >> In case you are willing to define accounting options then click Define Accounting Options else choose Return to Accounting Setups. Here I opted to create accounting options.

Click on update against Ledger Options >> Just review the values

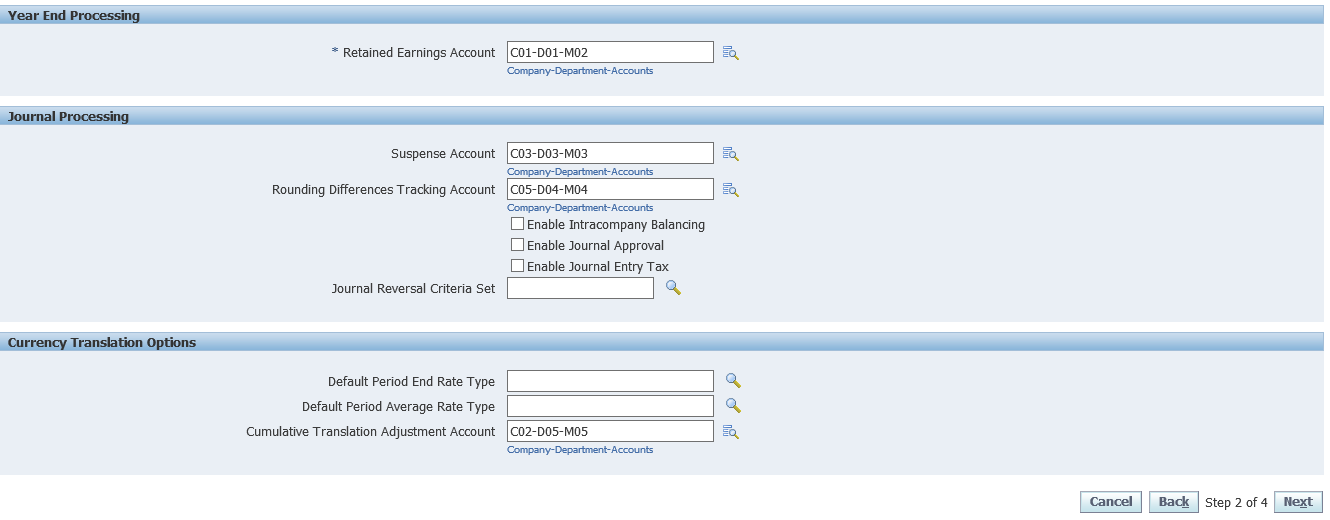

Click on Next >> Under Retained Earnings Account >> Select the values from LOV and ensure you selected retained earnings account value under Accounts segment. We can choose any company/ department >> Click on create to generate code combination

Similarly for Suspense account select the values

Similarly for rounding differences select the values

Similarly for Translated adjustment account

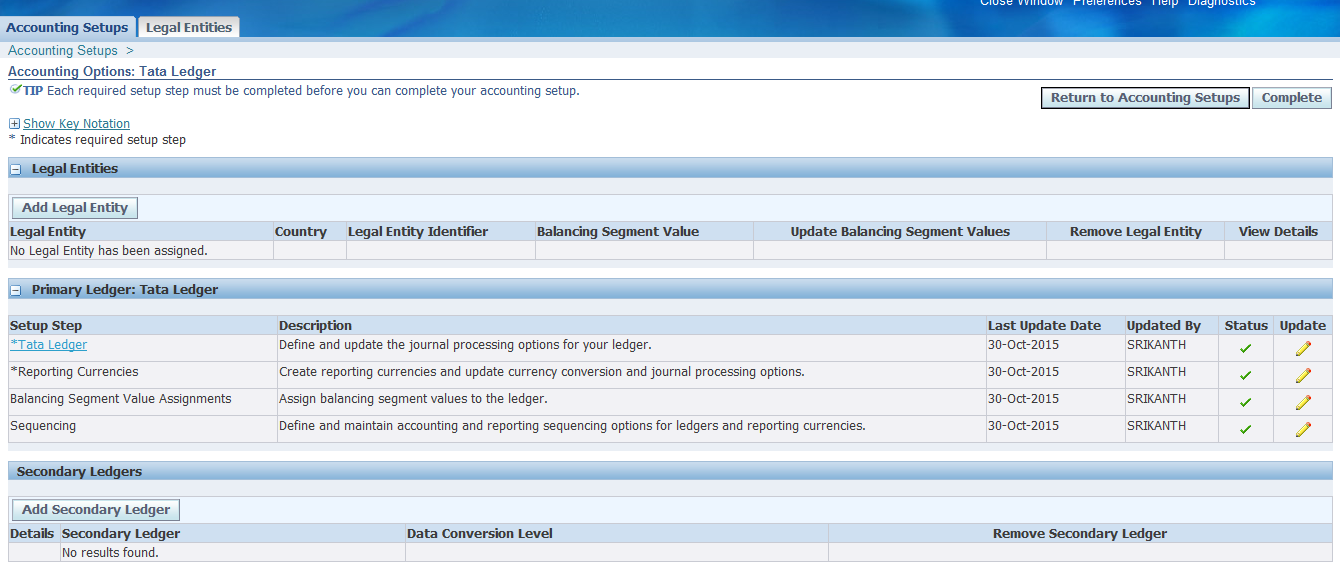

Click on Next >> Include Reserve for Encumbrance account if required >> Click on Next >> Review the details and click on Finish >> The status against Tata Ledger has to be Tick marked. And observe the difference which is highlighted with previous page. Earlier we have Ledger option which is now modified to Tata Ledger

Click on update against Reporting Currencies >> In case you use other reporting currencies then click on Add Reporting Currency, else click on Complete >> Ensure the status of Reporting Currencies to be Completed.

Click on update against Balancing Segment Values >> Click add balancing segment value >> In case we don’t select all values then we wont be able to use within this Ledger >> Select all balancing segment values and click on Complete >> Ensure the Balancing segment value to be in completed status.

Click on update against Sequencing >> Change the status from In Progress to Complete and click on Apply >> Ensure the status to be Completed.

Click on Complete for Ledger creation.

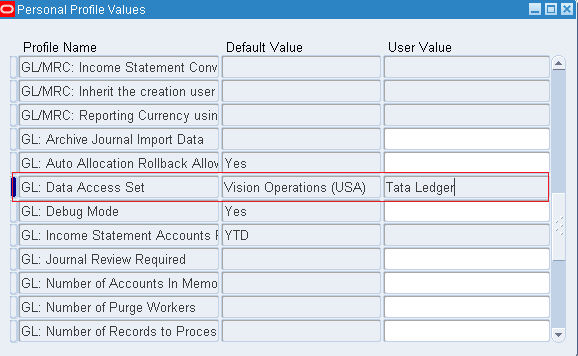

Now assign the created ledger to profile option: GL: Data Access Set

General Ledger Super User >> Other >> Profile >> Enter the ledger name under user value for GL: Data Access Set

The priority will be given to User Value. If no user value then default value will be picked.

Now verify which ledger we are connected to.

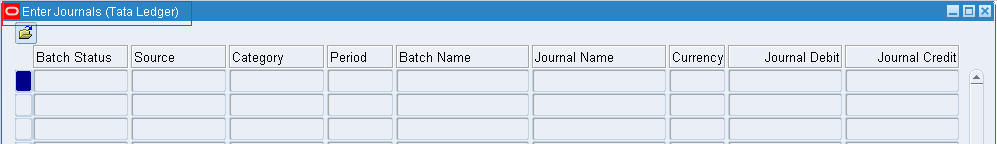

General Ledger Super User >> Journals >> Enter >> We should find the Ledger Name at Top of form.

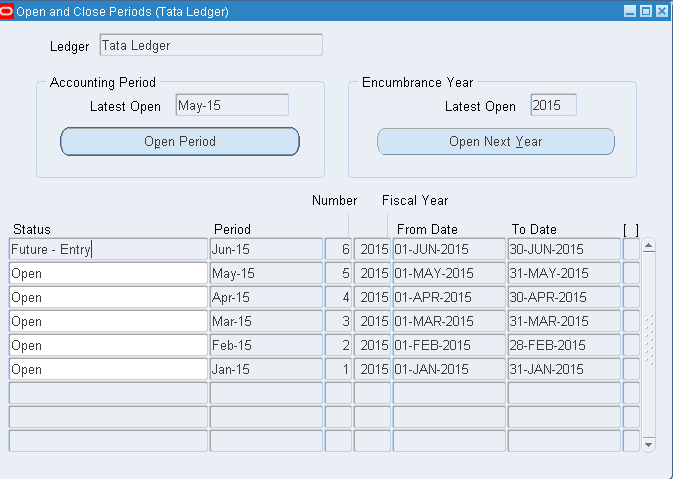

Open a Period:

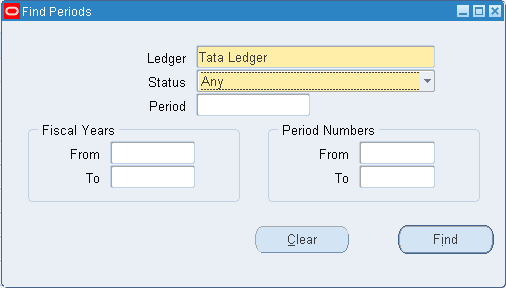

General Ledger Super User >> Setup >> Open/ Close

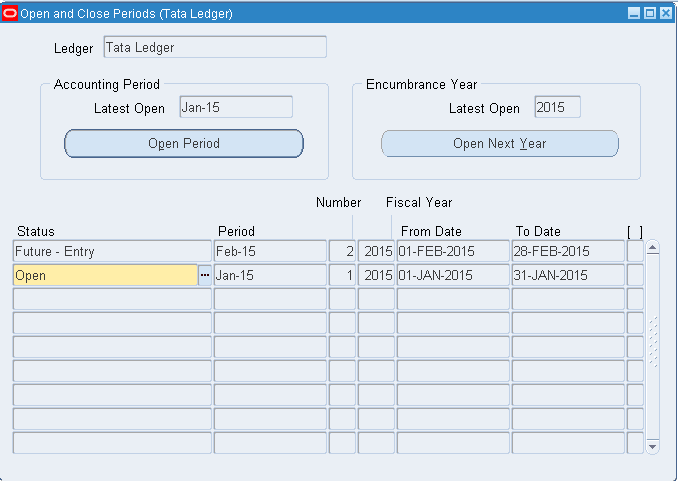

Click on Find >> Here you find First Period as ‘Jan-15’ >> This value can be changed. General Ledger Super User >> Setup >> Financials >> Accounting Setup Manager >> Accounting Setups >> Open the first ledger setup. There we have field as ‘First Ever Opened Period’ >>

If you want to proceed with ‘Jan-15’ click on Open >> Choose Yes >>

Here we have the Future – Entry for Feb since we gave Number of Future Enterable Periods as 1 in Accounting Setups

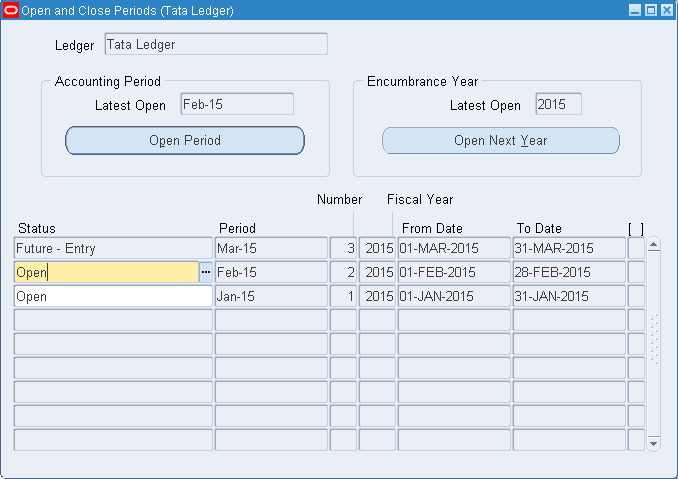

Opened the month of Feb

Open the month of May, leaving Mar and April unopened. Still all the periods get opened which are in between.

Journal Entry Structure

1. Batch Name (Optional) Expense Batch

2. Journals like Rent Journal, Salary Journal

3. Journal Lines like Office Rent, Salary to Office staff, Factory Rent, Salary to Factory staff,

Godown Rent, Salary to Godown staff, Guest House Rent, Salary to Guest House staff

Entering a Journal:

General Ledger Super User >> Journals >> Enter >> Click on New Batch >> Enter values as given below

Effective date in Journals:

1. Whenever user is going to enter journal for any previous period, system will consider the effective date as last date of previous period.

2. Whenever user is going to enter journal for any future period, system will consider the effective date as first date of future period.

3. Whenever user is going to enter journal for current period, system will consider the effective date as current date of current period.

Category in Journals:

Purpose of the Journal entry. Ex: Payments, Payroll

Click on Journals >> Enter details as below >> Save

We have the above violation message as we have difference in Control Total amount and Batch amount.

Click on Yes and save the transaction.

Create new Salary Journal as below and save the transaction. Observe the difference in message. In the above image we have journal batch but here we have journal.

Now changes the Dr/ Cr amounts to 10,000 and save. Here we don’t have any violation message.

Coz we have Batch control of 20,000. We created a rent journal of 10,000 and salary journal with 10,000 so when saving second record salary journal, we don’t have any violation.

Verifying the existing of Journals:

General Ledger Super User >> Journals >> Enter >> Find >> Here we should find the two Journal entries

Posting Rent Journal

Under Payments category >> Click on >> Review Journal >> Click on Post.

Here you find both the batch status as Posted since both the journals belong to same batch (Expense Batch)

Create individual batch for each journal in case you want to get posted all journals.

Suspense Journal

———————–

General Ledger Super User >> Journals >> Enter >> New Journal >> Enter details as below and save

After saving the transaction click on Post

The Journal entry gets posted as below.

Since we have suspense account enabled for Tata Ledger, we have suspense account triggered.

If the suspense account is not enabled in accounting setup while creating ledger then we wont be able to post the entry. The concurrent program errors out and we have Error 6

In case you have Dr entry without Cr entry and you don’t want to hit suspense account, rather you want cash account to trigger. Then follow below set up

General Ledger Super User >> Setup >> Accounts >> Suspense >> This works only when the entry is Manual and Category is Payments

In case Cr without Dr or Dr w/o Cr, since we defined the suspense account the source as manual and category as payments, we get cash account rather than suspense account. If any other mode we have suspense account.

The below example provide more details:

Created a Rent Journal account with category as Payments and source as Manual without Cr entry and posted. Then instead of default suspense account we have cash account. Anyother category or source we get suspense account (M03).

Document Sequence:

—————————–

Auto assigning of sequential numbers while creating Journals

By default we have Budget beneath effective date.

General Ledger Super User >> Other >> Profile >> For profile Sequential Numbering enter Partially Used value

Now query for new journal where you find Document Number in the place of Budget.

Now assigning initial value to document number. Here we have initial value as 100

General Ledger Super User >> Setup >> Financials >> Sequences >> Document >> Define

General Ledger Super User >> Setup >> Financials >> Sequences >> Document >> Assign

In Document Tab

Now create a journal having Payments category and save the details to get the document number

Auto Posting

—————–

Create a two new journals for posting.

General Ledger Super User >> Setup >> Journal >> AutoPost

Here we have category as Payment for period Feb-15, whereas we created a journal with category as Payroll for period Feb-15 so the below entry wont get posted.

This gets posted for the newly created journals

Also we have option as ALL which picks all unposted journals irrespective of source, category and periods >> If required enter the Journal effective dates which indicates post the unposted journals between these dates >> Click on Submit

Now check the status of unposted journals which have been modified to Posted.

Recurring Journals

————————-

Recurring journals are of three types:

1. Standard: User knows the entry and also the amount

Rent A/C Dr 1000/-

To Cash A/C 1000/-

2. Skeleton: User knows only the Entry, but don’t know the amount

Telephone Bill A/C Dr XXXX

To Cash A/C XXXX

3. Formula: User is going to use some formula (like +, -, *, /) within the journal

Rent A/C Dr 2400000/12 20000/-

To Cash A/C 20000/-

Standard recurring journal

———————————–

General Ledger Super User >> Define >> Recurring >> Enter values as below

Click on Lines and create two lines as below

Now generate this setup

Journals >> Generate >> Recurring >> Enter details as below

Click on Generate

Query for Journal and you find an unposted journal

We have Cash amount under Dr, which has to be under Cr.

To make that change, go to Journals >> Define >> Recurring >> Query for Rent Recurring Batch >> Lines >> For cash account enter amount as -12000

Now go to Journals >> Generate >> Recurring >> Select Period as Feb-15 >> Generate

Now search for Journal with period Feb-15 and you should have 12,000 under Cr.

2. Skeleton Recurring Journal

—————————————

Journals >> Define >> Recurring

Now generate a journal >> Journals >> Generate >> Recurring >> Enter Period as Jan-15 >> Click on Generate

Now query for journal . Here we have information only about accounts but no amount.

Now suppose I delete the rent recurring batch and purchase recurring batch from recurring journals.

Journals >> Generate >> Recurring >> Delete Rent Recurring Batch and Purchase Recurring Batch

Now query for journals which were created under those batches. Still you find the journals though we deleted recurring batches.

Only Unposted journals can be deleted. In case you want to delete, then select each journal and delete manually.

3. Formula Recurring Journal

—————————————

Journals >> Define >> Recurring

Ensure you use line number as 9999

Now generate this entry.

Journals >> Generate >> Recurring >> Generate for Jan-15 period.

Security Rules

——————-

General Ledger – (Application)

Responsibilities

1. General Ledger Super User – Has 8 Sub menus

2. General Ledger Supervisor – 5

3. General Ledger Controller – 4

4. General Ledger Budget User – 3

5. General Ledger User – 2

Here we are trying to secure account values so go to Account value set which is ‘Tata Account Value Set’ and modify the security type ‘Hierarchical Security’

Now to go Structure. General Ledger Super User >> Setup >> Financials >> Flexfields >> Key >> Segments >> Query for Tata Structure >> Unfreeze flexfield definition >> Segments >> Select Accounts segment >> Click on Open >> Enable Security Enabled >> Save

Freeze the Structure and compile

General Ledger Super User >> Setup >> Financials >> Flexfields >> Key >> Security >> Define >> Enter values as below and click on Find

Enter name and message. First include all the values under Include type then select the values which you want to exclude.

Here we excluded 2 assets and 3 liabilities.

Click on Assign >> Enter values as below

Now create a journal entry to test the above security values. Here we don’t find the values which were excluded.

To revoke back those values go back to Tata Structure >> uncheck Security enabled

And on Tata Account Value Set change the security type to No Security

Cross Validation Rules

——————————

Say we have 5 companies and 5 departments. Except C02 all companies have all 5 departments. The company C02 has only D01 and D02

C01 D01

C02 D02

C03 D03 X

C04 D04 X

C05 D05 X

Go to Tata Structure >> Unfreeze >> Check Cross Validate Segments >> Now freeze and compile

Now go to Setup >> Financials >> Flexfields >> Key >> Rules >> Enter values as below

Here company C02 is not allowed to enter departments D03, D04 and D05

Now test the journal entry for C02 and D03 department.

In case you don’t want the cross validation rule then uncheck in Tata Group Structure.

Calculation of Total Expenditure for a particular month

————————————————————————-

General Ledger Super User >> Inquiry >> Account >> Enter details as below

Here E01-E03 are expense account type.

We need to calculate the totals manually by selecting show balances. For system calculation go to Setup >> Financials >> Flexfields >> Key >> Values >> Enter values as below and click on Find

Create a new line as below and select Parent type

Now keeping the cursor at Total Expense line, click Define Child Ranges >> Enter range from E01 to E03 >> Save

Now go to Setup >> Financials >> Flexfields >> Key >> Groups >> Enter details as below and click on Find

Now again go back to values and assign the newly created group

Now go back to Structure >> Uncheck freeze and check freeze rollup groups >> Again Freeze and compile>> After Compilation we have Expense Rollup group gets uneditable

Summary Accounts

Setup >> Accounts >> Summary >> Enter the period as Jan-15 >> Save

Now go to Inquiry >> Account >> Enter Jan-15 period and select Expense Summary under Summary Template

In case we don’t need to access the roll up group then unfreeze the structure and uncheck the freeze rollup groups

MRC (Multi Reporting Currency)

——————————————-

Create a new Ledger for this activity

Setup >> Financials >> Accounting Setup Manager >> Accounting Setups >> Create Accounting Setup >> Next >>

Click on Add Reporting Currency

Go to Accounting Options >> Click on Update against Ledger Options >>

Enter Retained earnings account C01-D01-M02 >> Next >> Next >> Finish

Now click on update against Reporting Currencies >> Update >> Enter the default rate type as Corporate and click on Apply

Now click on update against Balancing Segment Value Assignments >> Click Add Balancing Segment Value >> Select All companies >> Complete

Now click on update against Sequencing >> Modify the status to Complete >> Apply

Once all the Setup steps are completed >> Click on Complete button

Here we created a Ledger Tata MRC Ledger and system has dynamically created a ledger Tata MRC Ledger(USD)

Now assign the Tata MRC Ledger to profile value GL: Data Access Set

Now open periods for new ledger.

Setup >> Open/ Close, say till Mar-15

Create another user and assign profile value of Tata MRC Ledger(USD) to GL: Data Access Set

And open periods for Tata MRC Ledger(USD), say till Mar-15

Corporate rate is fixed by Corporate head quarters.

Now create dollar rates in new user.

Setup >> Currencies >> Rates >> Daily >> Enter values as below (The below rate is applicable only for 31-JAN-2015)

Come back to old user and create a new ledger as below. Save and Post

Here the 2,75,000 INR gets converted into USD amount. Login to new user and search for Journal. There we will find both INR and USD values.

IntraCompany Journals

——————————-

When the transaction takes place between two companies then it is IntraCompany

For example:

C01 Purchase A/C Dr 5000/-

C01 Cash A/C Cr 5000/-

C02 Cash A/C Dr 5000/-

C02 Sales A/C Cr 5000/-

Here the C01 Cash A/C Cr and C02 Cash A/C Dr gets nullified and we get only

C01 Purchase A/C Dr 5000/-

C02 Sales A/C Cr 5000/-

Setup:

Open the ledger >> Click on update against Tata Ledger >> Next >> In step 2 of 4 check the ‘Enable Intracompany Balancing’ >> Finish >> Click on Return to Accounting options >> Click on update against Intracompany Balancing Rules >> Define Rules >> Create Rule >> Enter the details as given below

Now in options tab enter details and click on Apply >> Done

After posting we have below accounts enabled due to Intracompany balancing.

Ledger Set and Data Access Set

—————————————–

Other than TATA Ledger, create 2 more ledgers.

Enter the Retained Earnings Account C01-D01-M02 >> Next >> Finish

For Reporting Currencies click on Complete

For Balancing Segment values click on Add Balancing Segment value and select all >> Click Complete

For Sequencing >> Modify the status from In Progress to Complete >> Apply

Finally click on Complete

Now create one more Ledger Tata Ledger 2

Ledger Set: Setup >> Financials >> Ledger Sets

Now go to Other >> Profile >> for GL: Data Access Set enter user value as Tata Ledger Set 1

Now enter a Journal >> Here we have Default ledger as Tata Ledger with multiple ledgers assigned under Ledger field

Similarly change the profile value of GL: Data Access Set to Tata Ledger Set 2

Now enter a Journal >> Here we don’t have any default ledger but have multiple ledgers assigned under Ledger field

Data Access Set: Setup >> Financials >> Data Access Sets

Now go to Other >> Profile >> for GL: Data Access Set enter user value as Tata Data Access Set

Now enter a Journal >> Here we are able to find all 5 ledgers with the respective ledgers which are assigned under ledger set 1 and ledger set 2

The difference between ledger access set and data access set is we have read/ write or read only mode in data access set.

FSG (Financial Statement Generator)

| Mandatory Steps | Optional Steps |

| 1. Define Row Set 2. Define Column Set 3. Define Report (Row set + Column set = FSG report) |

1. Define Content Set 2. Define Row Order 3. Define Display Set |