Fusion General Ledger

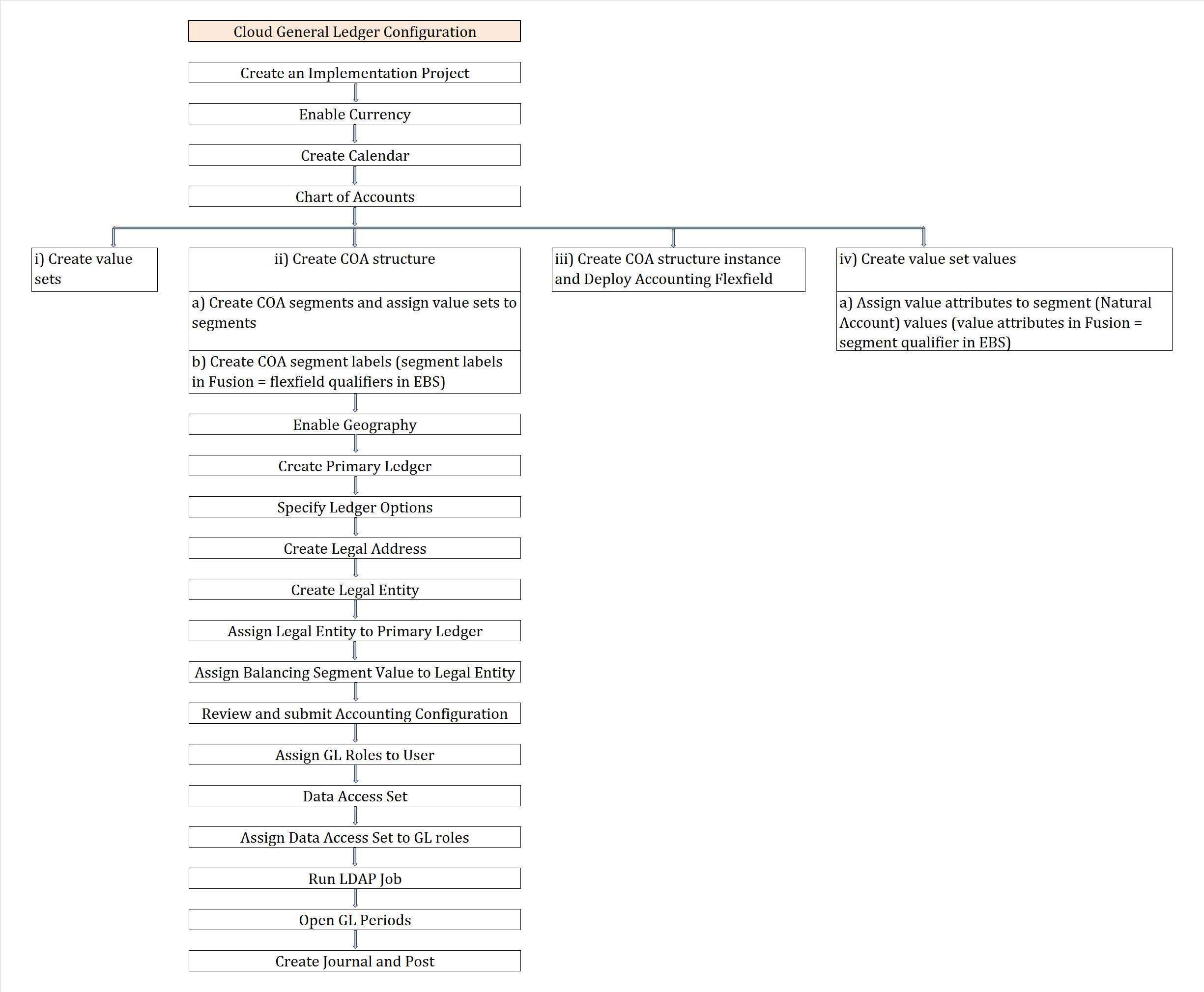

Fusion GL Configurations

1. Create Implementation Project by selecting Offerings/ Options

2. Enable Geographies

3. Create Accounting Calendar

4. Currencies

5. Chart of Accounts (COA)

i) Create value sets

ii) Create COA structure

a) Create COA segments and assign value sets to segments

b) Create COA segment labels (segment labels in Fusion = flexfield qualifiers in EBS)

iii) Create COA structure instance and Deploy Accounting Flexfield

iv) Create value set values

a) Assign value attributes to segment (Natural Account) values (value attributes in Fusion = segment qualifier in EBS)

6. Create ‘Primary Ledger’

7. Specify ‘Ledger Options’

8. Create ‘Legal Address’

9. Create ‘Legal Entity’

10. Assign ‘Legal Entity’ to ‘Primary Ledger’

11. Assign ‘Balancing Segment Values’ to ‘Legal Entity’

12. Review and submit ‘Accounting Configuration’

13. Assign GL Roles to User

14. Assign ‘Data Access Set’ to GL roles

15. Run LDAP Job

16. Open GL Periods

17. Create Journal and Post

18. Rapid Implementation

19. Foreign Currency Journals creation

20. Reverse Journals

21. Data Access Set

22. Cross Validation Rules

23. Security Rules

24. Create Ledger Set

25. Creation of Reporting Ledger

26. Creation of Secondary Ledger

27. Auto Posting

28. Auto Reversal

29. Create Budget

30. Journal Approval

31. 1z0-960 dumps

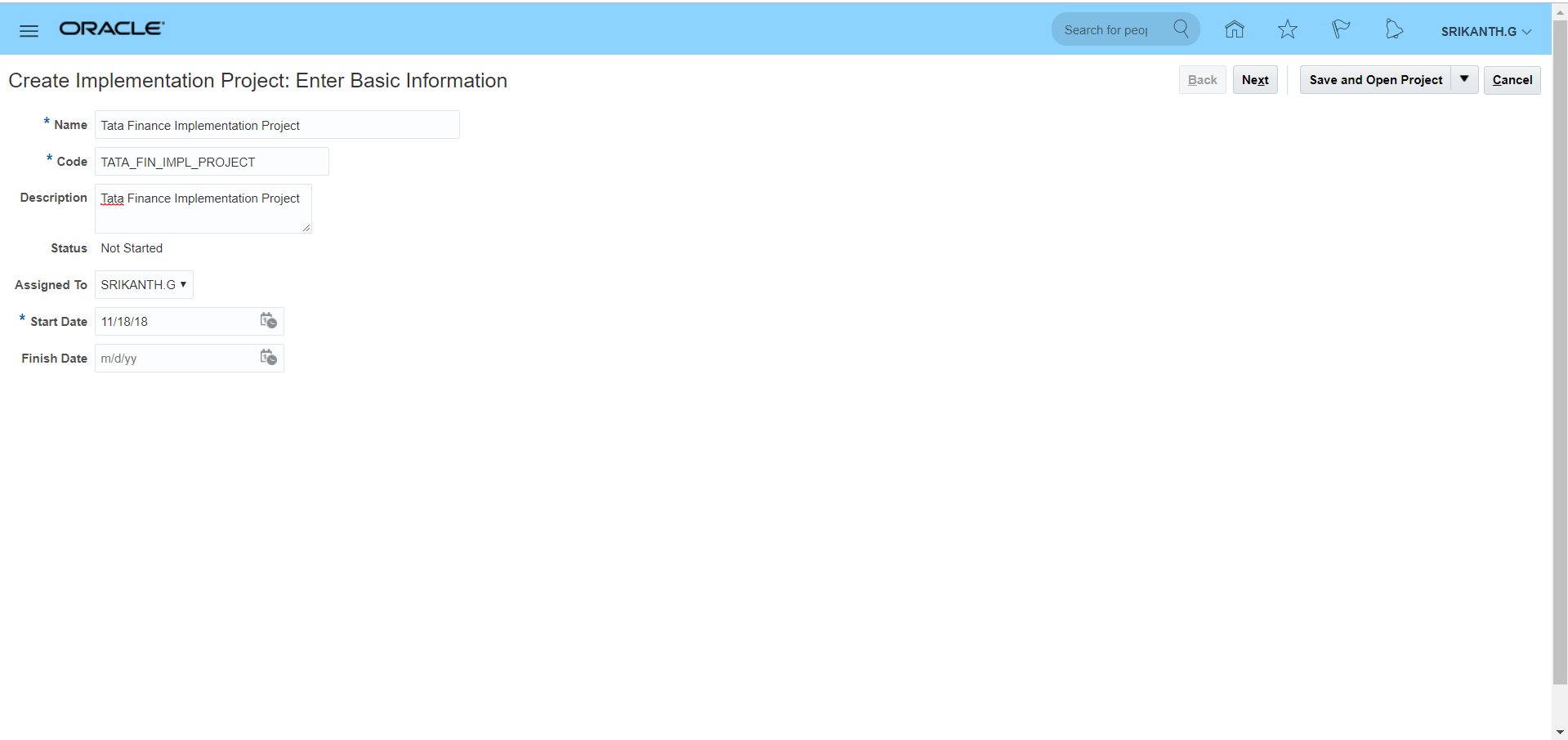

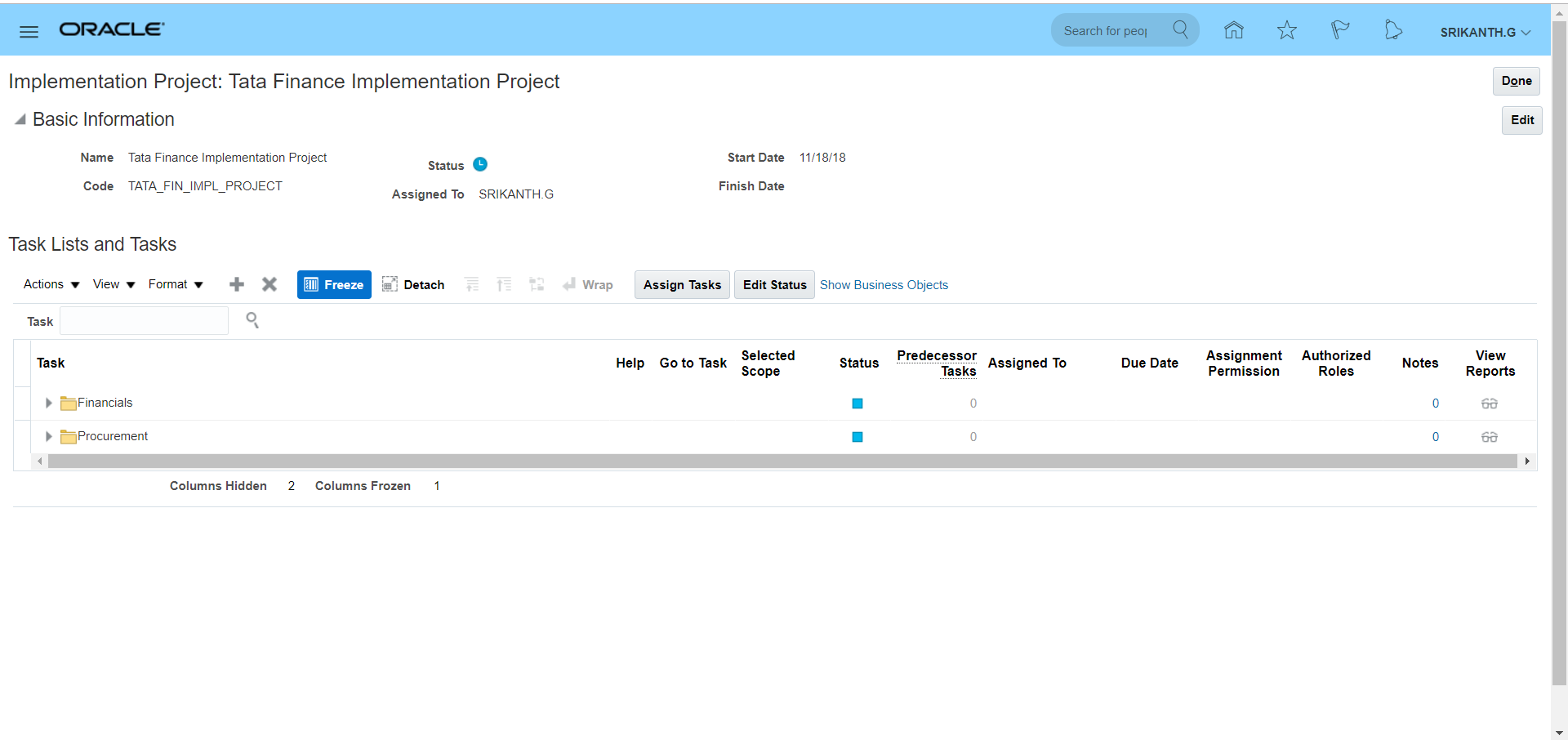

1. ‘Implementation Project’ creation

Navigation: User Name >> Setup and Maintenance >> Tasks >> Manage Implementation Projects >> Click on create (+) icon

**One project will be assigned to only one user. The offerings and options within the project can be assigned to multiple users.

Next >> Check ‘Financials’ offerings and select all options >> Also check ‘Procurement’ offerings and select all options >> Save and Open Project

System automatically creates ‘Task Lists and Tasks’ (List of setups).

We can change status from ‘Not Started’ to ‘In Progress’ click on ‘Edit’ and change status accordingly.

Different statuses at ‘Task Lists and Tasks’ level: Not Started, In Progress, Completed, Execution Frozen, Completed with Errors.

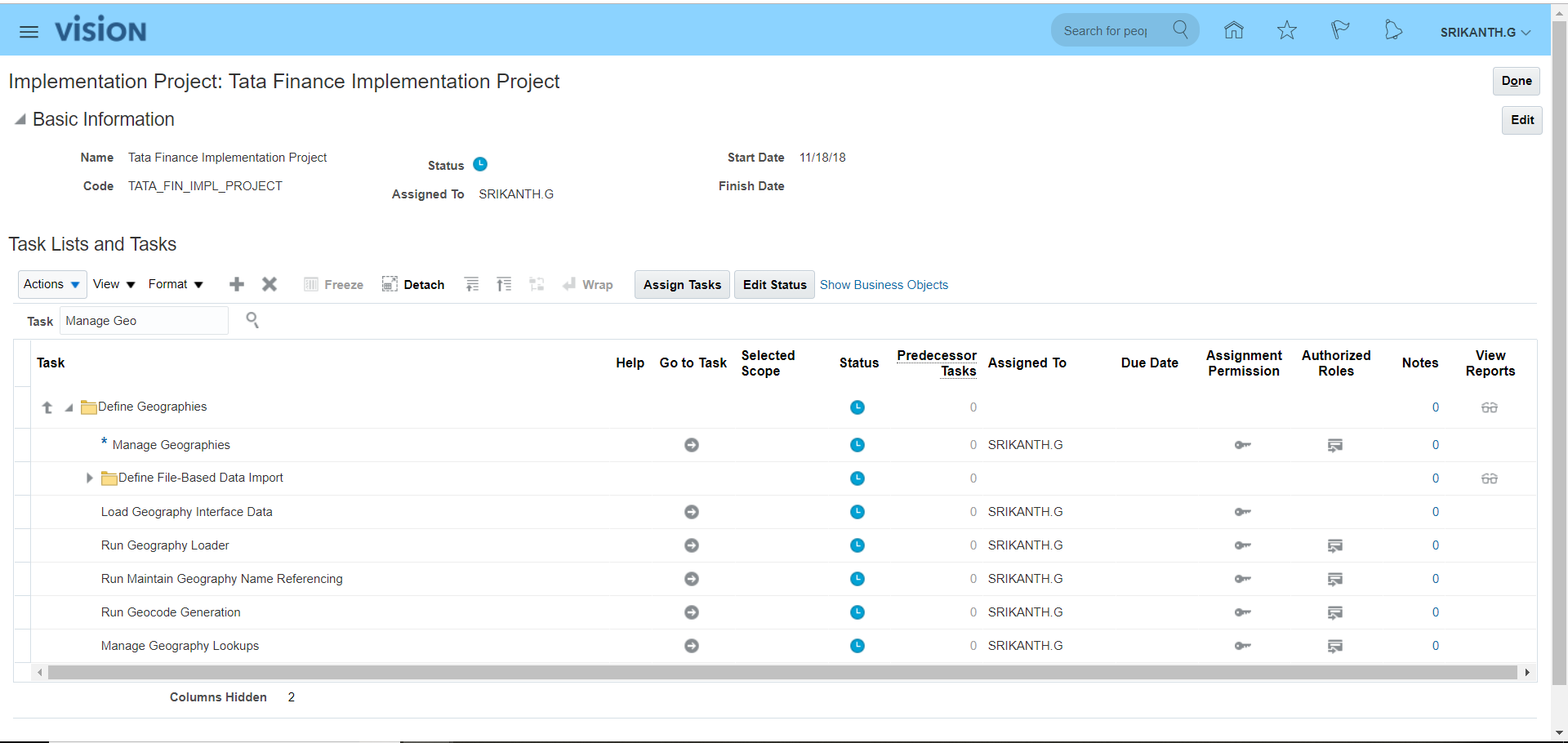

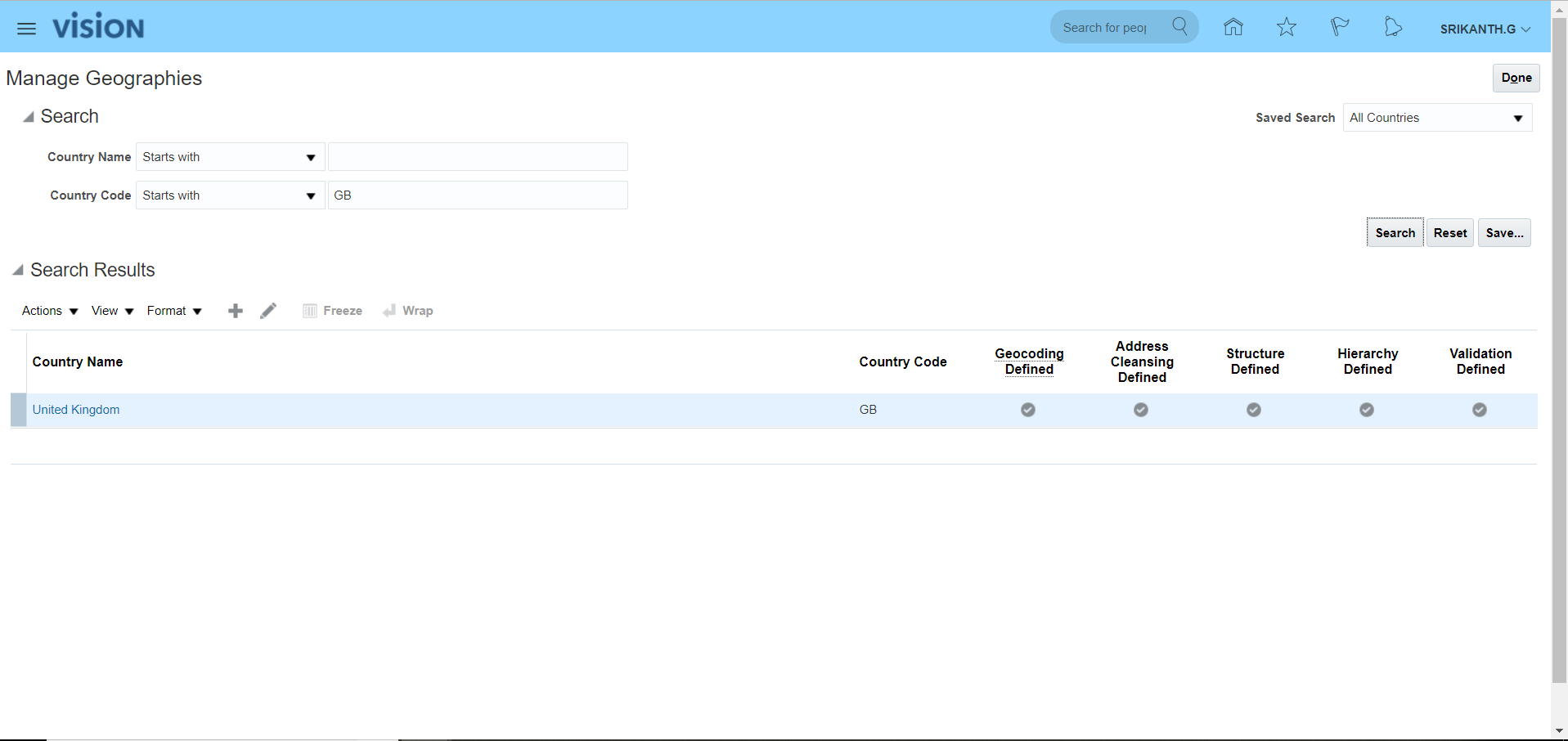

2. Geographies

Search for task ‘Manage Geographies’ in implementation project (Tata Finance Implementation Project).

Click on ‘Go to Task’ >> Search for Country Code >> Here for GB all the validations are completed.

Here ‘Structure Defined’, ‘Hierarchy Defined’ and ‘Validation Defined’ are important tasks. The ‘Geography Type’ which is defined in ‘Structure Defined’ reflects in ‘Hierarchy Defined’.

In case ‘Geocoding Defined’ is disabled then enable ‘Geocoding Defined’ and ‘Address Cleansing Defined. Later go to Actions and click on ‘Import Nokia Data’ (R13 old name) or ‘Import Geography Data’ (R13 new name). System will automatically upload the required Geography data. Few countries do not have this option then we have to complete these steps manually.

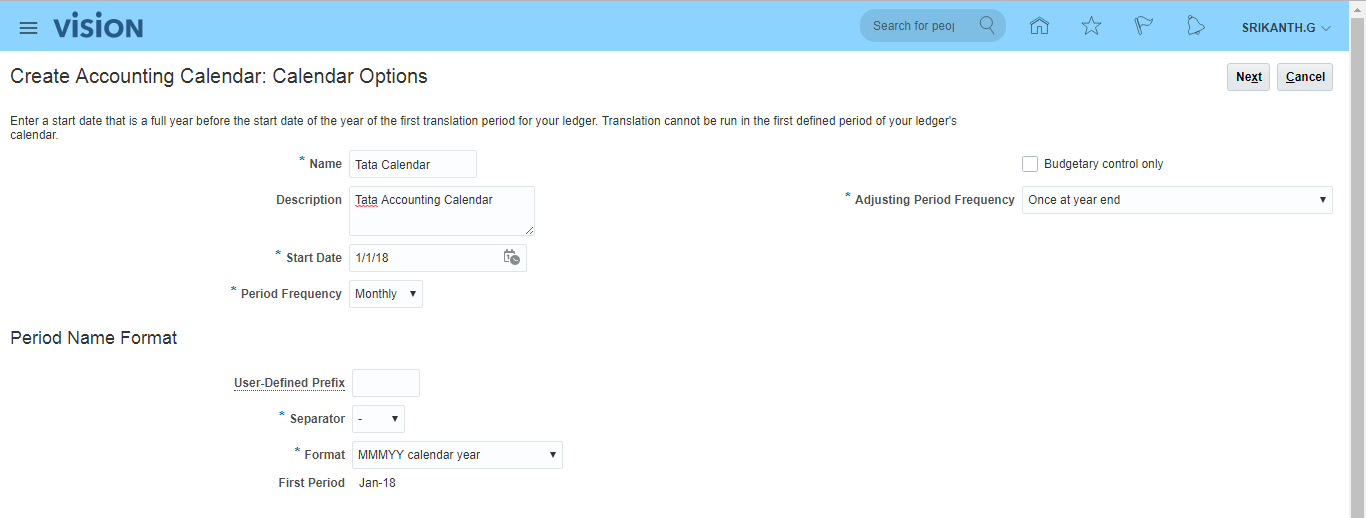

3. Accounting Calendar

Navigation: UserName >> Setup and Maintenance >> Tasks >> Manage Implementation Projects >> Search for your implementation project – Tata Finance Implementation Project >>Search for task ‘Manage Accounting Calendars’ (Select Financials offerings path)>> Go to Task >> Click on create icon >> Enter details as below >> Next >> Save and Close

**In EBS, we used to have same accounting calendar for ‘Budgetary Control’ whereas in Fusion we can have another calendar for ‘Budgetary Control’ (enable check box).

Next >> Just go through Period Details >> Save and Close.

To open next year period simply click on ‘Add Year’.

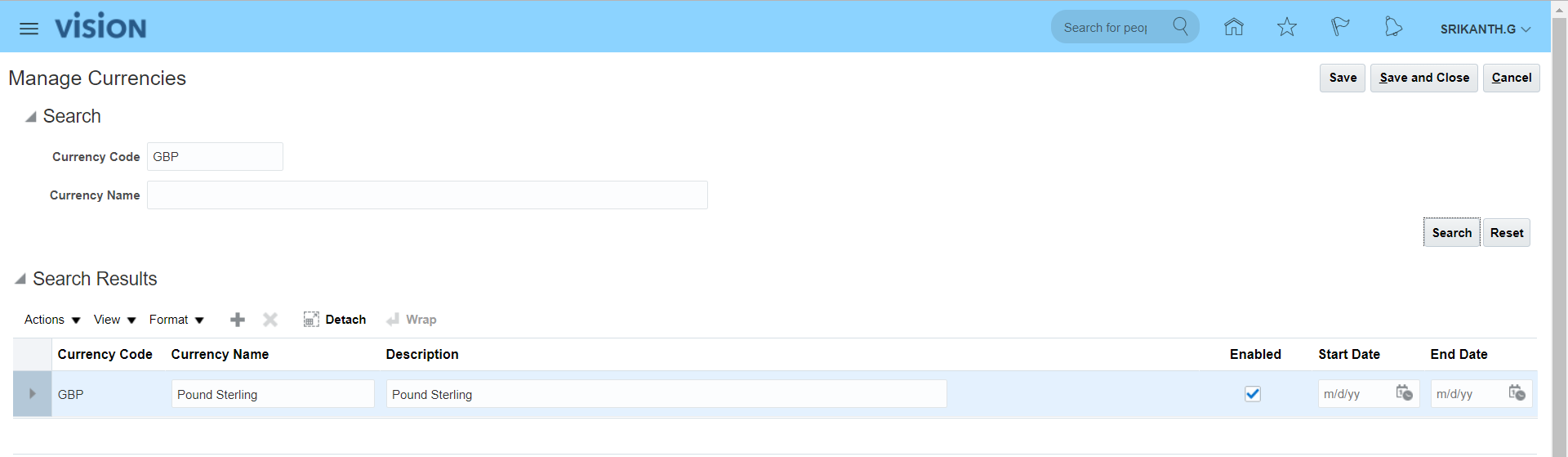

4. Currencies

In Fusion all the currencies are enabled by default.

Navigation: UserName >> Setup and Maintenance >> Tasks >> Manage Implementation Projects >> Search for your implementation project – Tata Finance Implementation Project >>Search for task ‘Manage Currencies’. Most of the standard currencies will be enabled by default.

5. Chart of Accounts (COA)

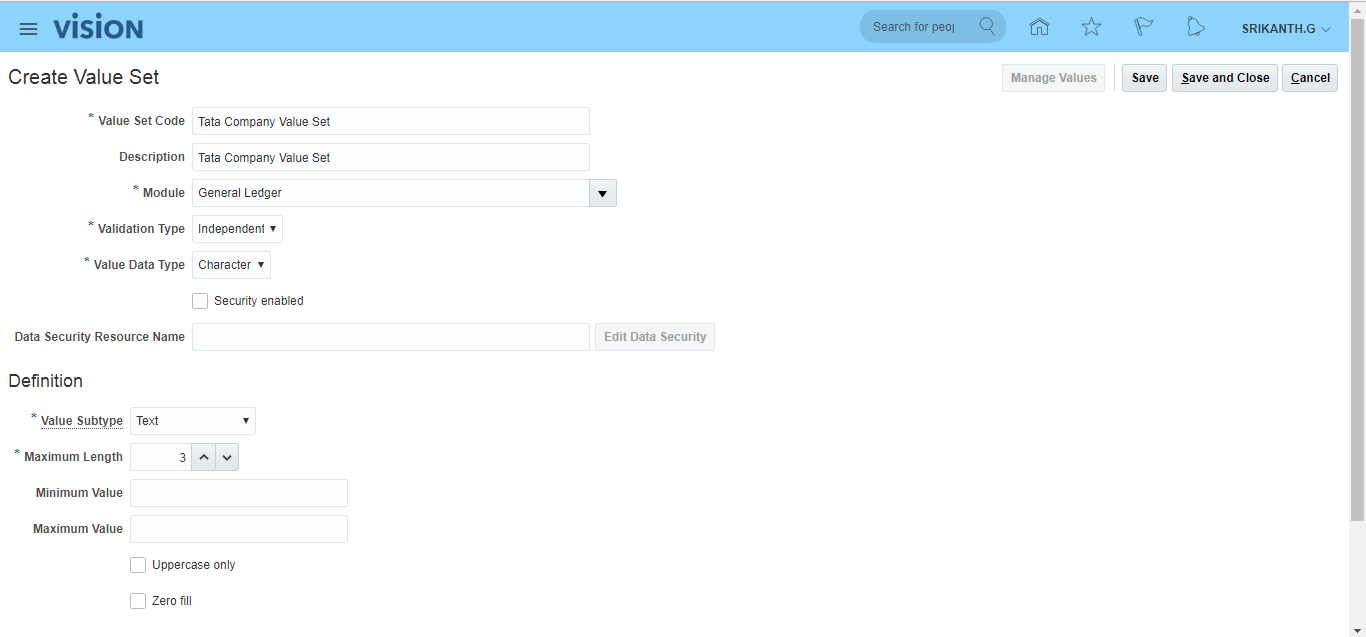

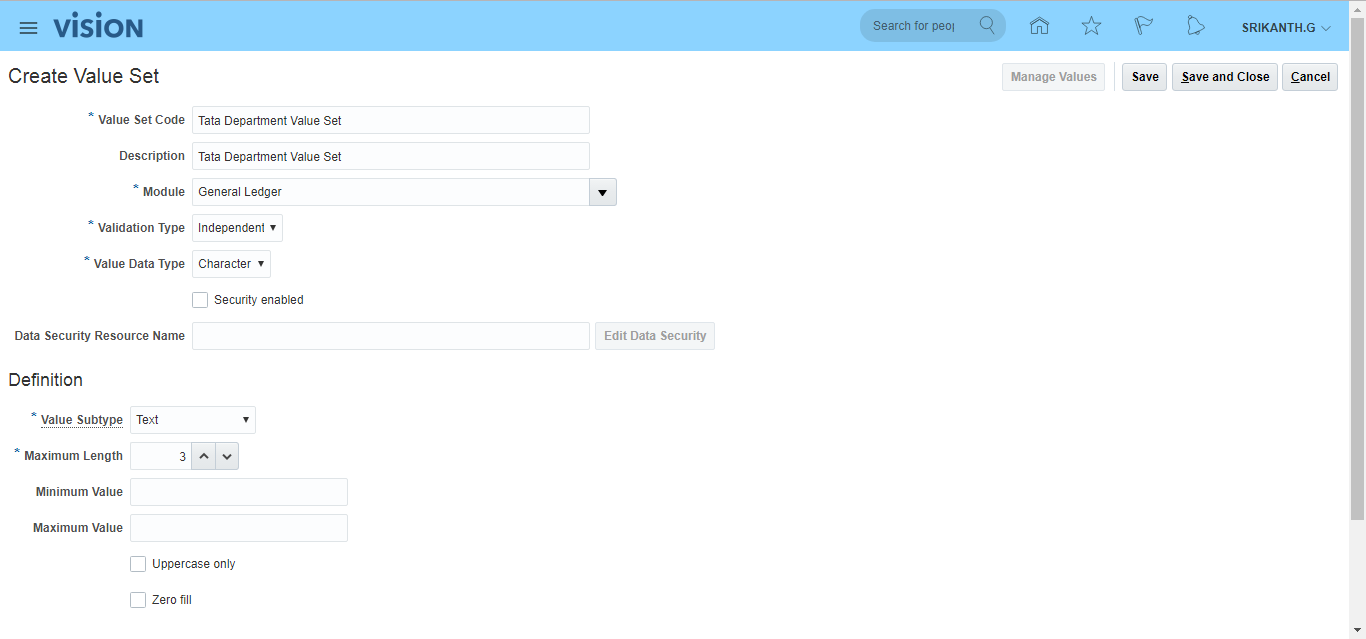

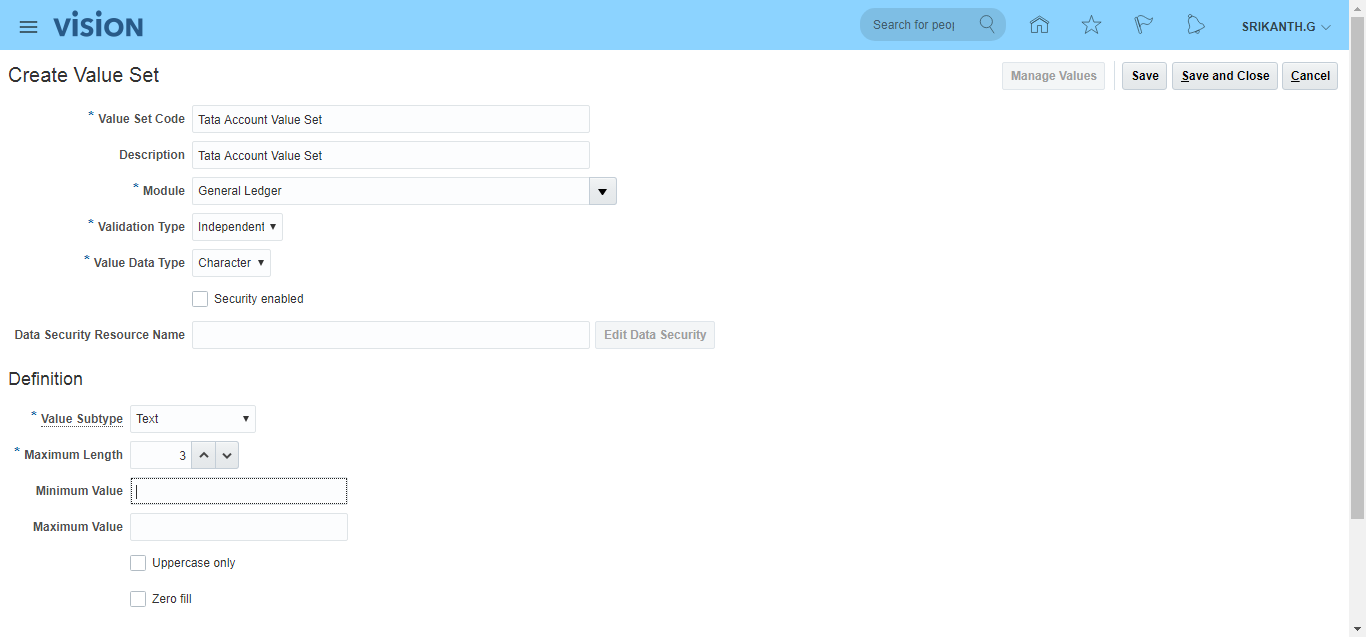

i) Create value sets

Navigation: UserName >> Setup and Maintenance >> Tasks >> Manage Implementation Projects >> Search for your implementation project – Tata Finance Implementation Project >>Search for task ‘Manage Chart of Accounts Value Sets’ >> Go to Task >> Click on create (+) icon.

**The pre-defined value sets provided by Oracle as ‘Corporate Company’, ‘Corporate Account’ and so on….

Lets create Company, Department and Account value set

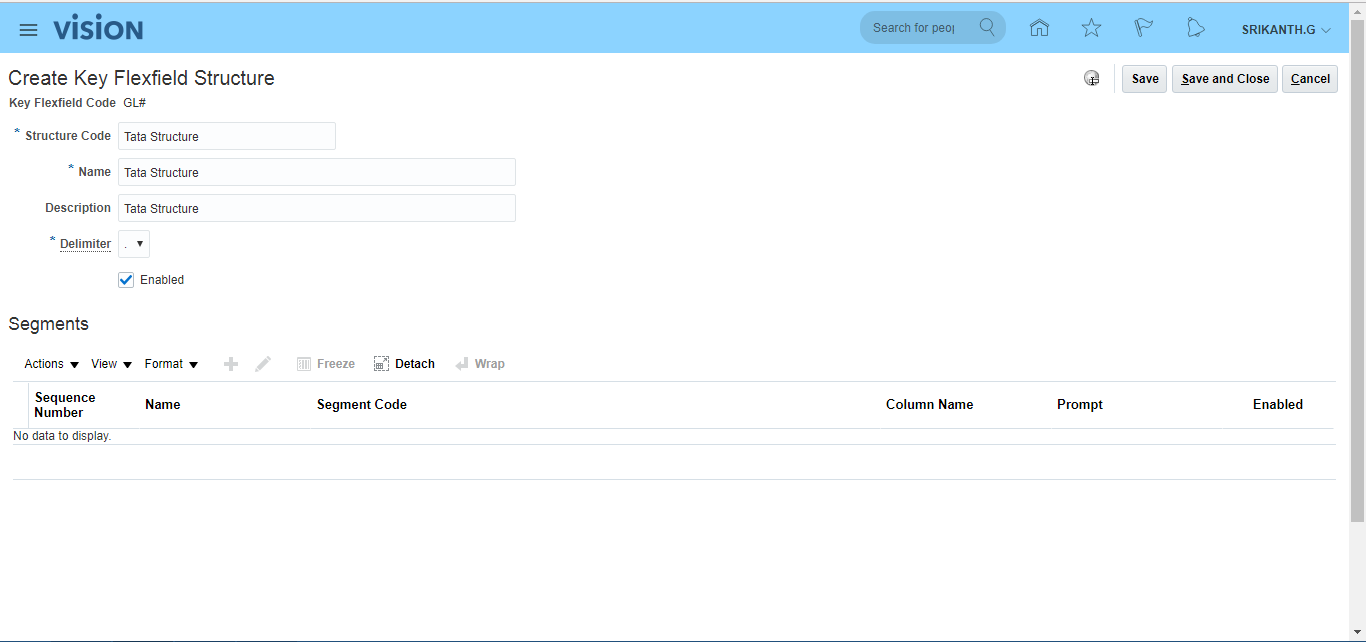

ii) Create COA structure

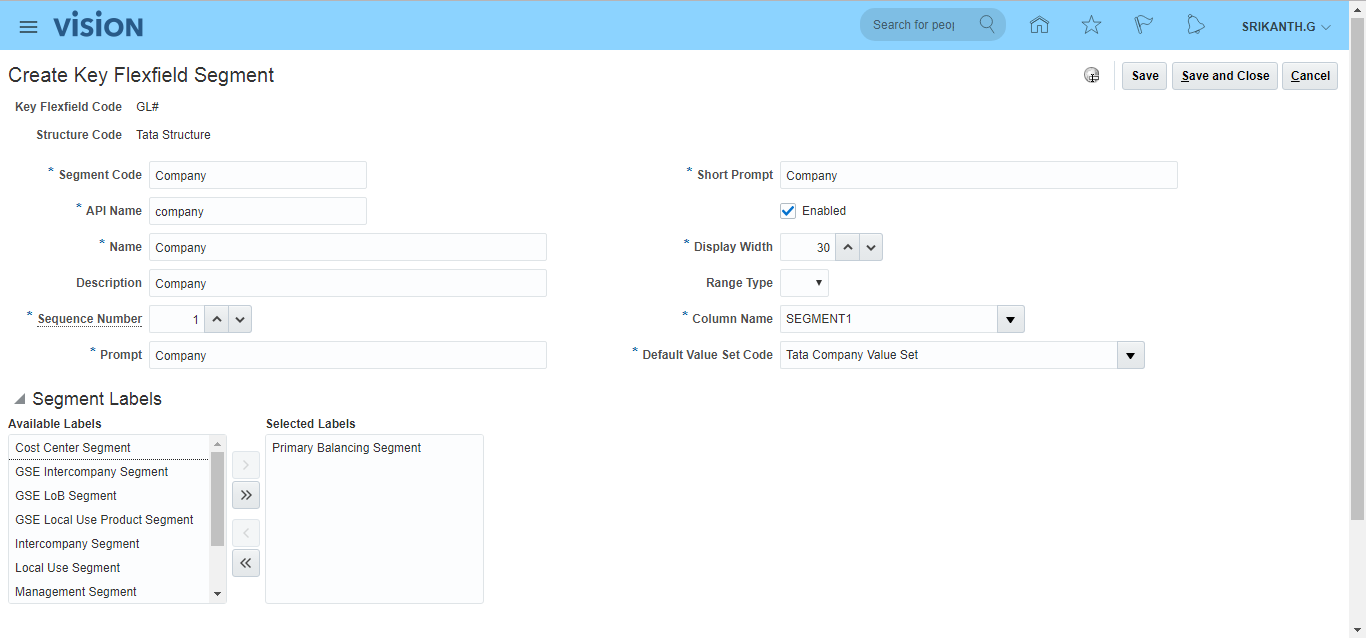

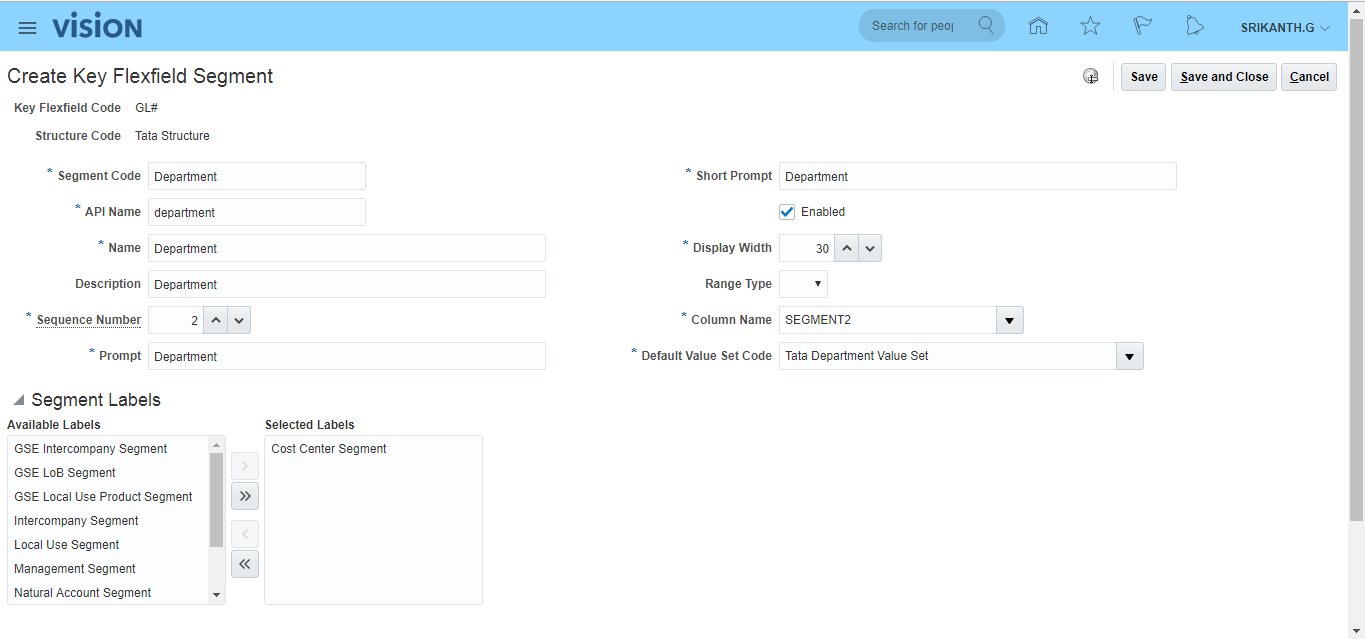

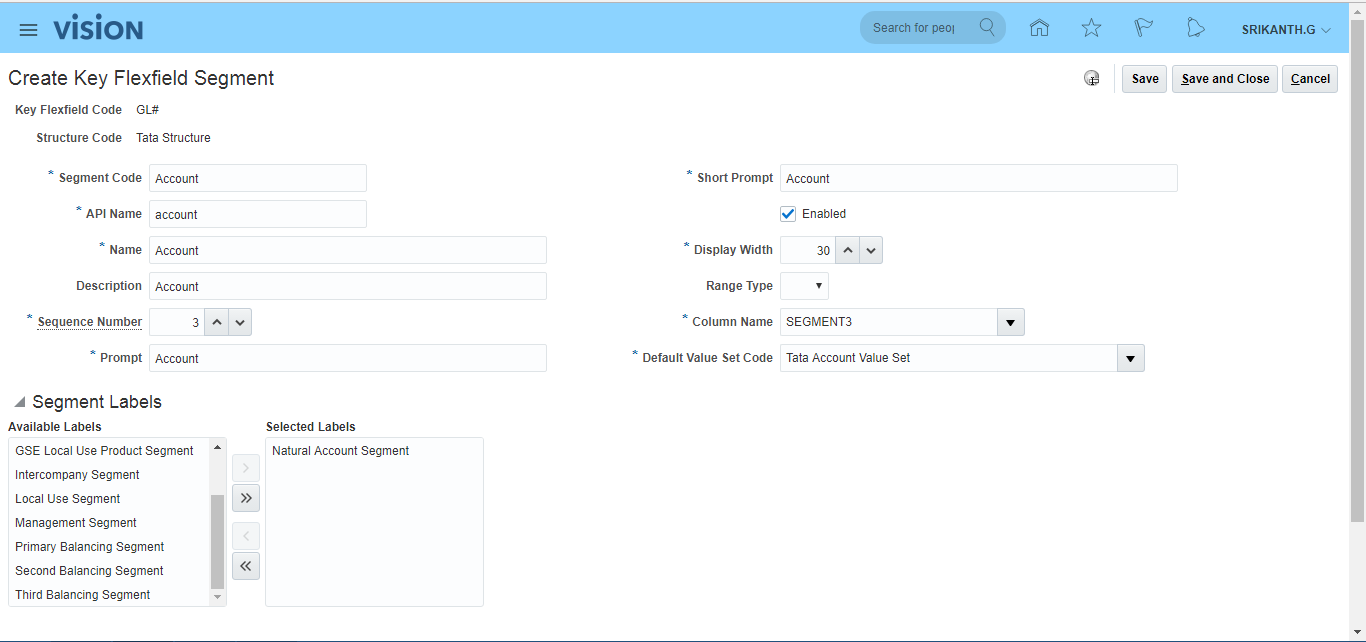

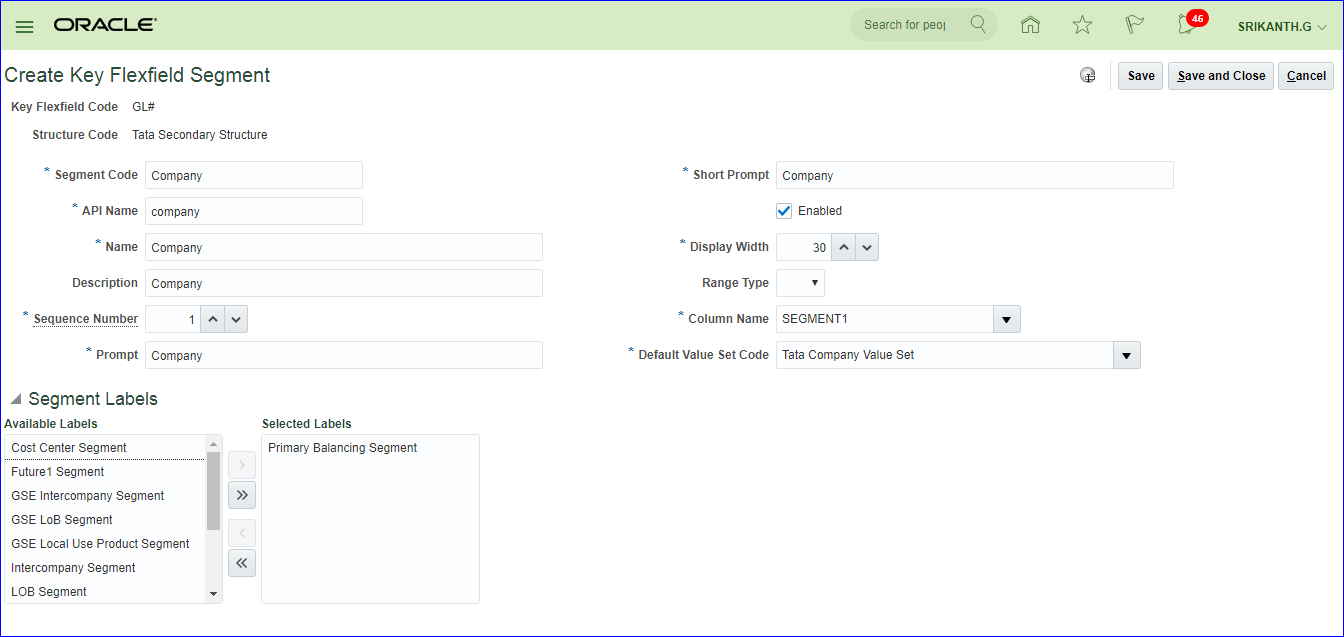

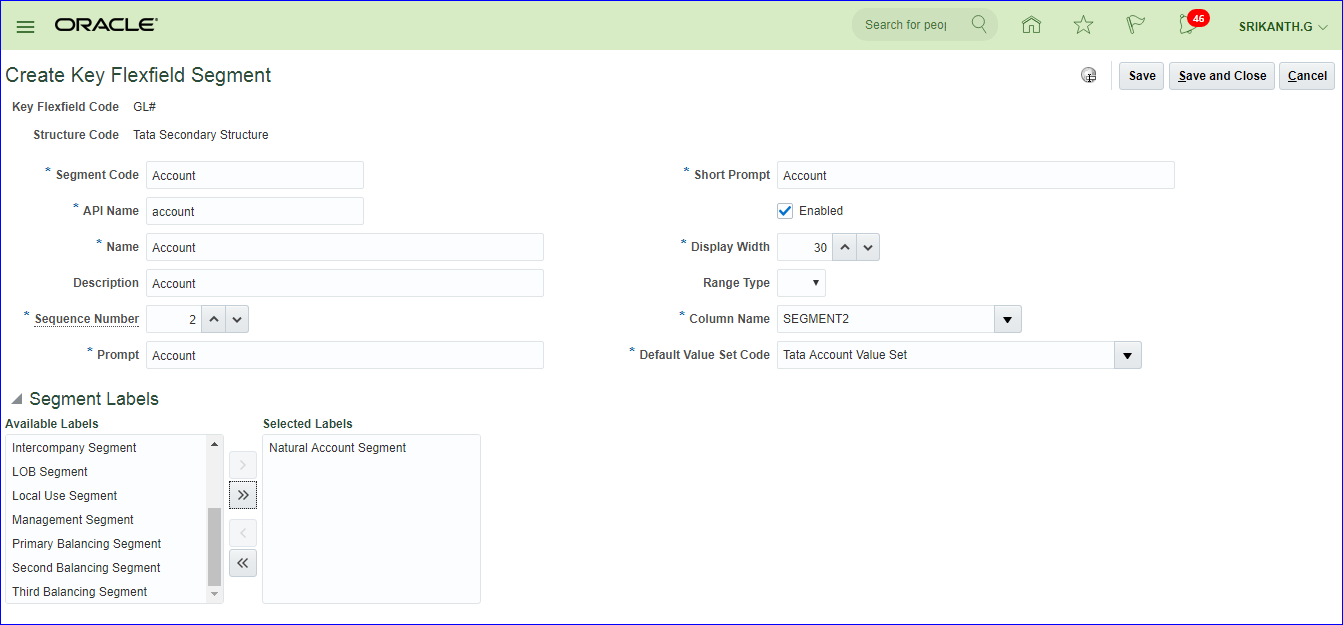

a) Create COA segments and assign value sets to segments

b) Create COA segment labels (segment labels in Fusion = flexfield qualifiers in EBS). Flexfield Qualifier = Defines behavior of each segment.

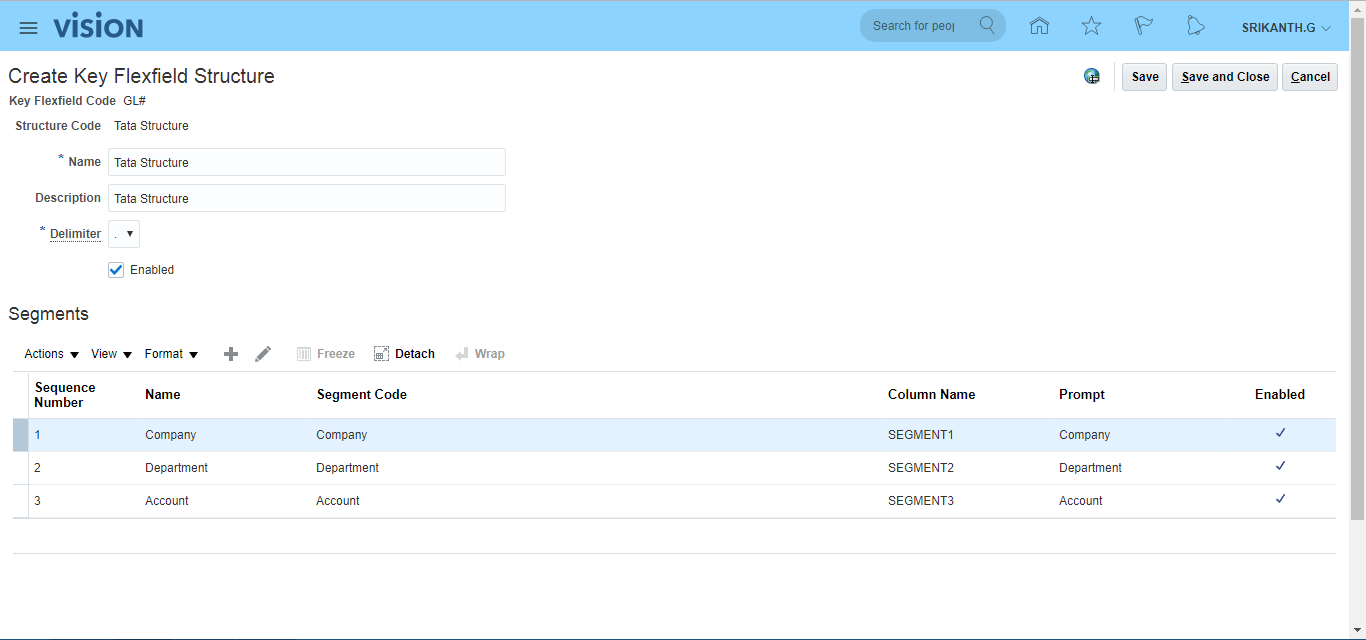

Search for task ‘Manage Chart of Accounts Structures’ >> Go to Task >> Search Key Flexfield Name with ‘Accounting Flexfield’ >> Click on ‘Manage Structures’ >> Click on Create icon (+).

After entering above details click on save to enter segment details.

Save and Close

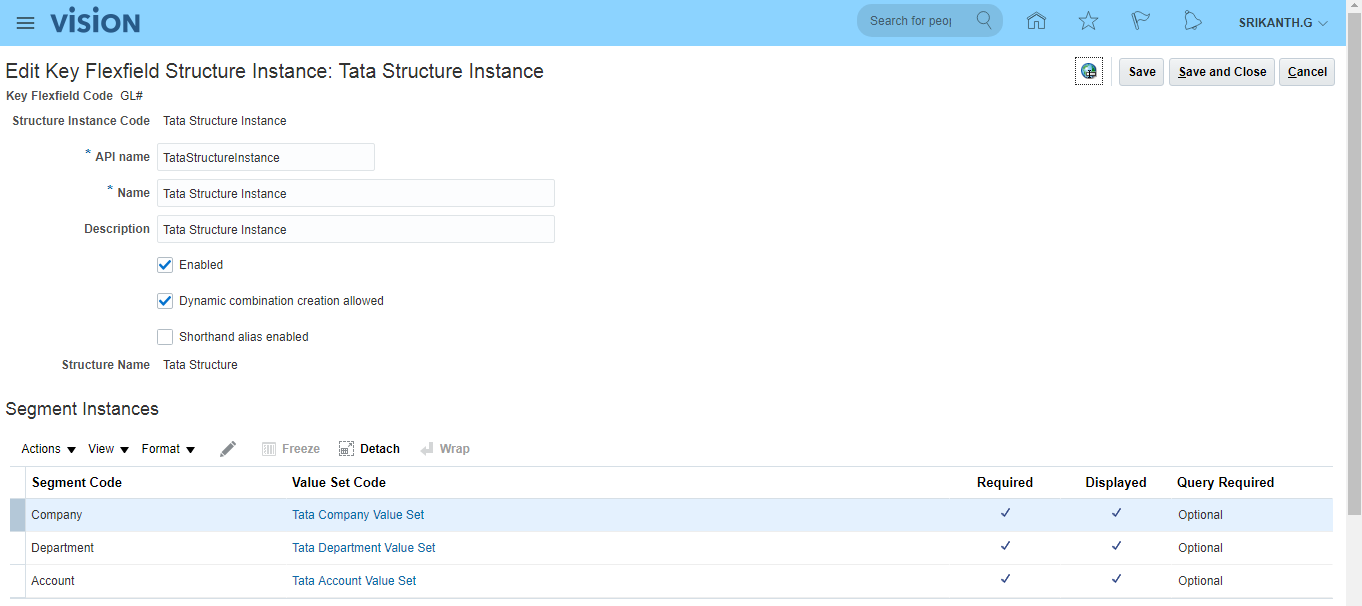

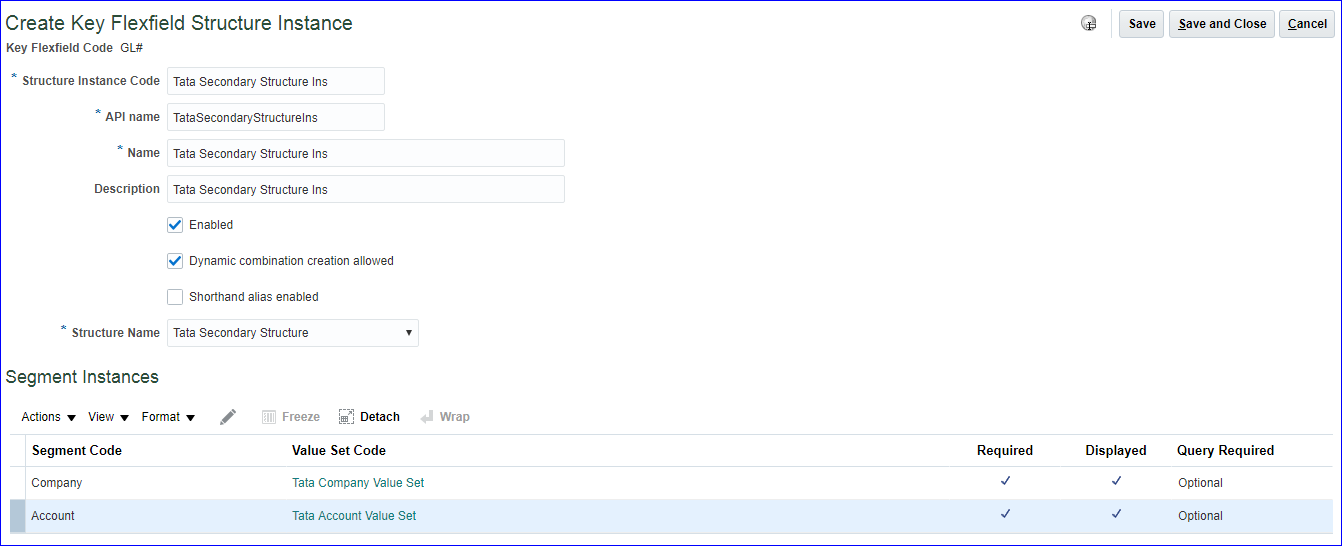

iii) Create COA structure instance and Deploy Accounting Flexfield

Search for task ‘Manage Chart of Accounts Structure Instances’ >> Search Key Flexfield Name with ‘Accounting Flexfield’ >> Go to ‘Manage Structures Instances’ >> Click on Create icon (+) >> Enter details as below and Save and Close. Select the Segment Code, click on edit and select Required to make it as required.

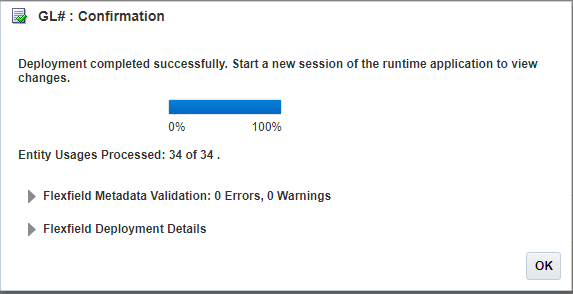

Click on ‘Deploy Flexfield’ tab for completion of process.

We need to create ‘Structure Instance’ since we will be using at Primary Ledger creation rather than direct Structure.

With one COA Structure, we can create multiple ‘Structure Instances’.

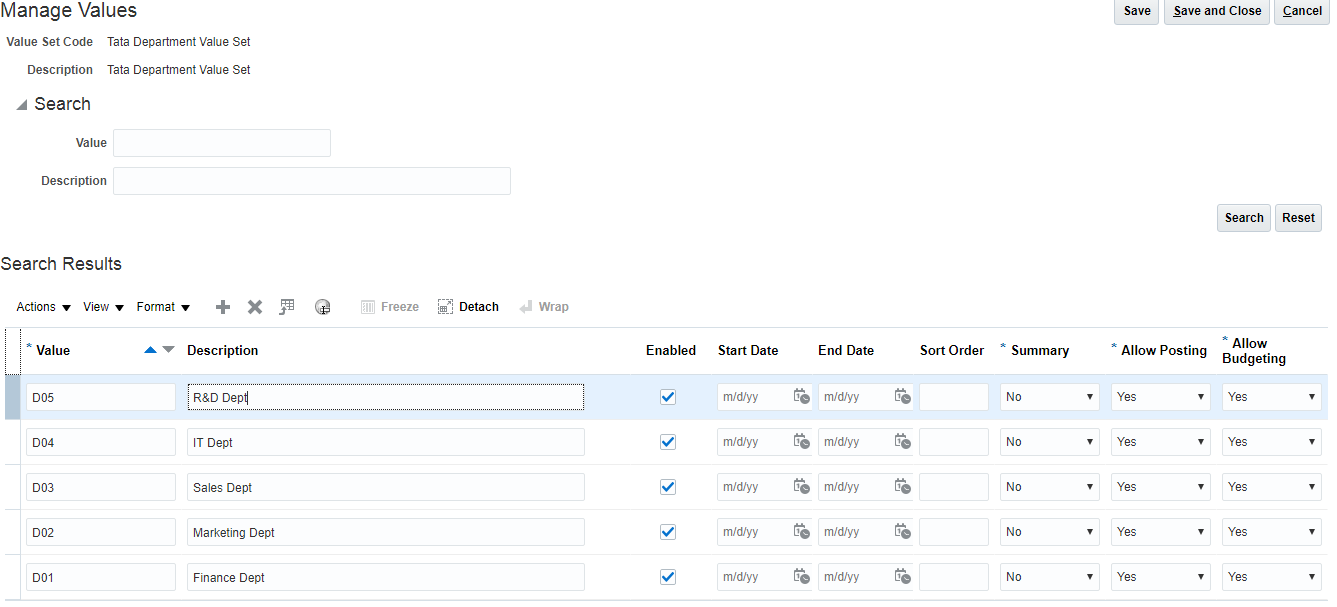

iv) Create value set values

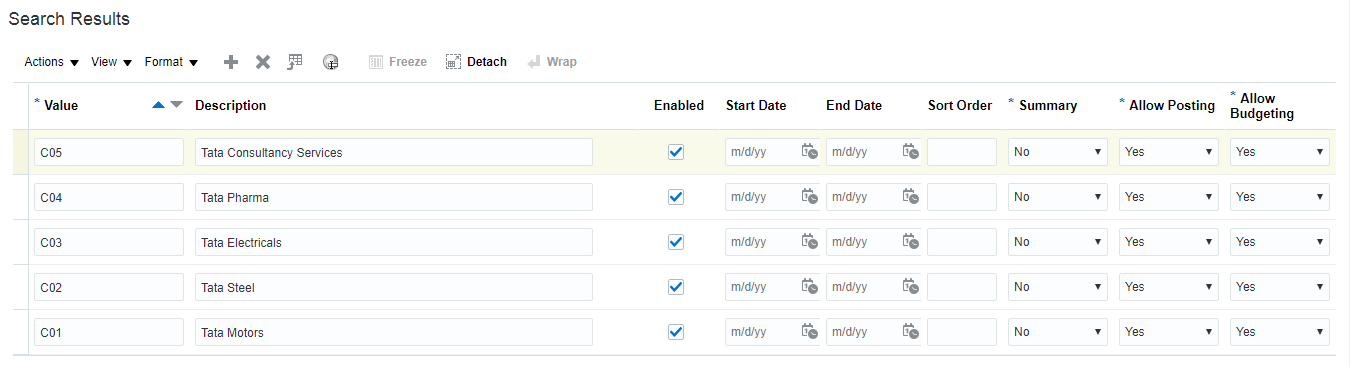

Search for task ‘Manage Chart of Accounts Value Set Values’ >> Click on ‘Go to Task’ >> Search for Value Set Code ‘Tata Company Value Set’ >> Click on ‘Manage Values’ >> Click on Create icon (+).

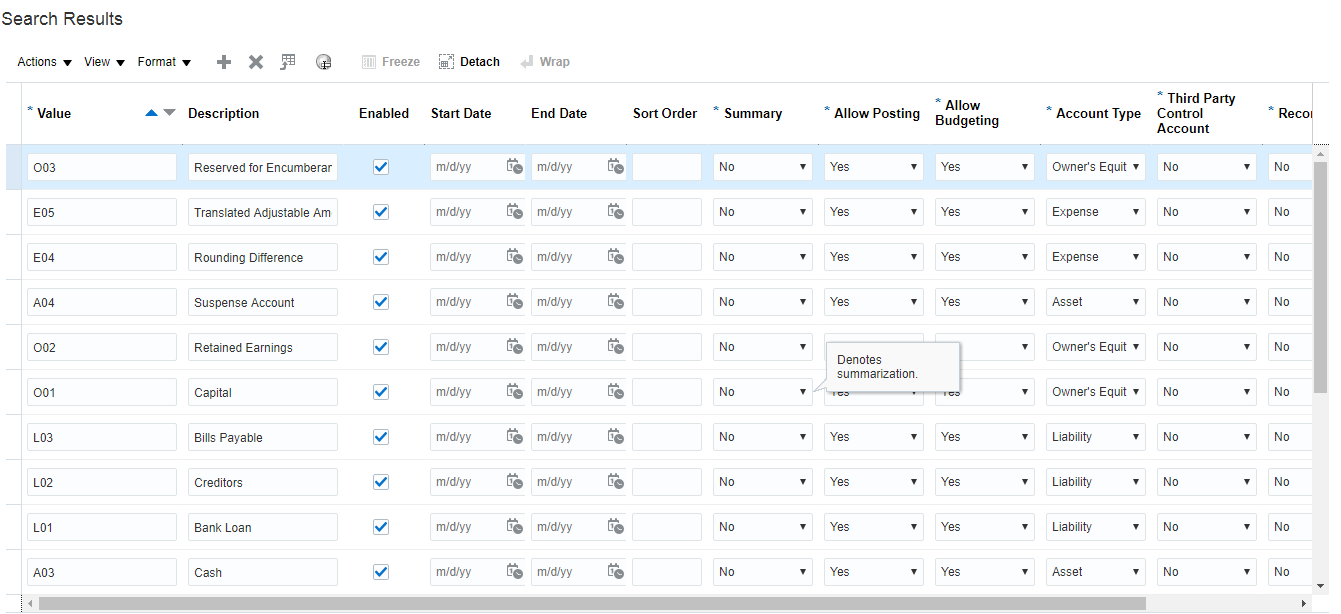

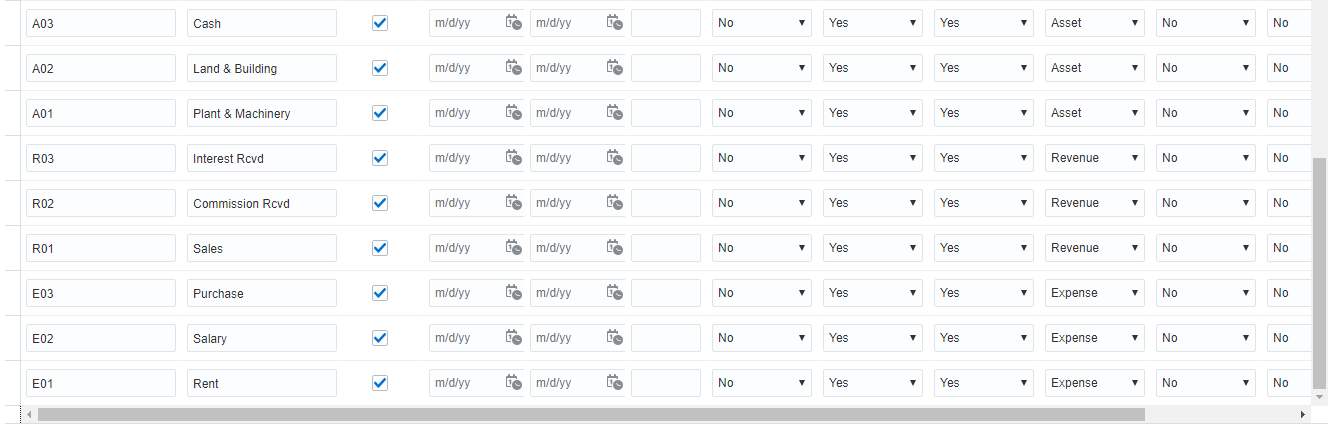

Tata Account Value Set

Assign value attributes to segment values (value attributes in Fusion = segment qualifier in EBS) (Segment Qualifier = Defines property of segment values). Here we have additional 4 columns (Account Type, Third Party Control Account, Reconcile, Financial Category) due to ‘Natural Account Segment’ Flexfield qualifier assigned to Account segment.

**Mandatory is ‘Retained Earnings’ account.

Save and Close

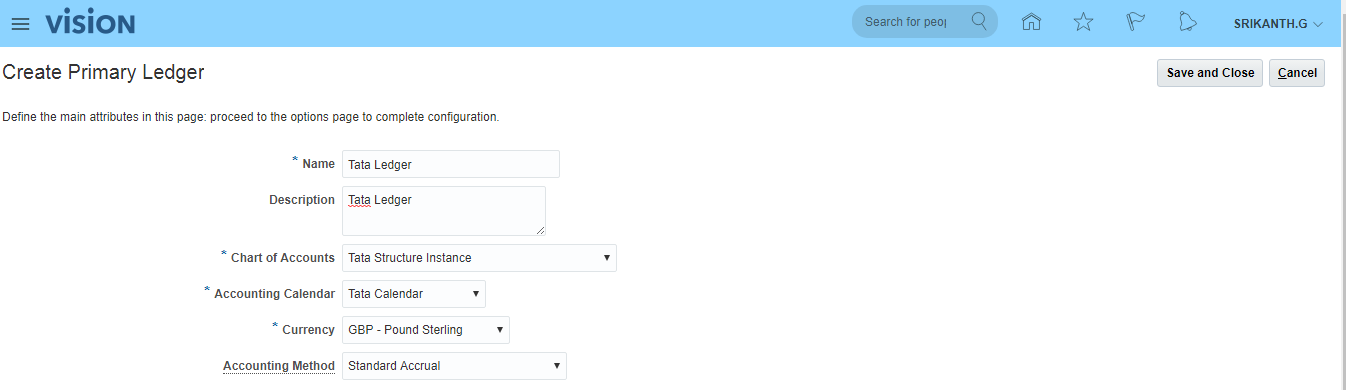

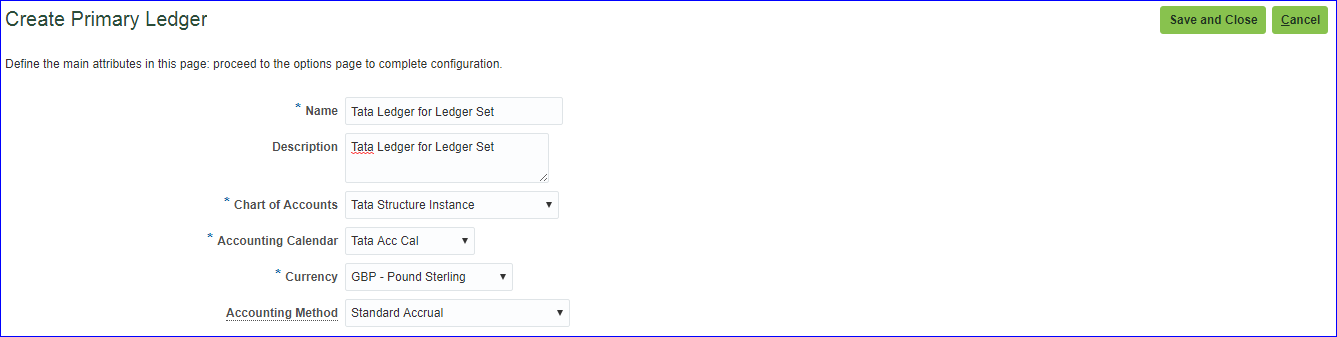

6. Create ‘Primary Ledger’

Navigation: Go to your implementation project (Tata Finance Implementation Project) >> Search for task ‘Manage Primary Ledgers’ >> Click Go to Task >> Click on Create icon (+) >> Enter details as below >> Save and Close

**Here Tata Structure Instance has been identified under COA. Hence instance is required.

**In case we want to record transactions only in GL then Accounting Method is not required but required when transactions happens in sub ledgers.

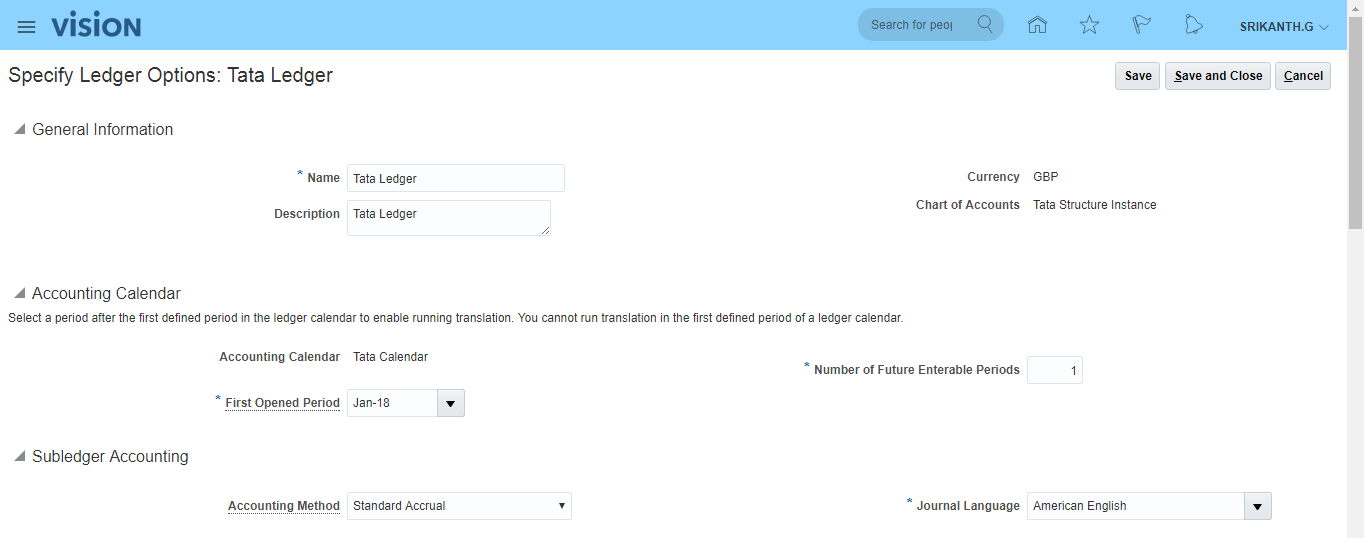

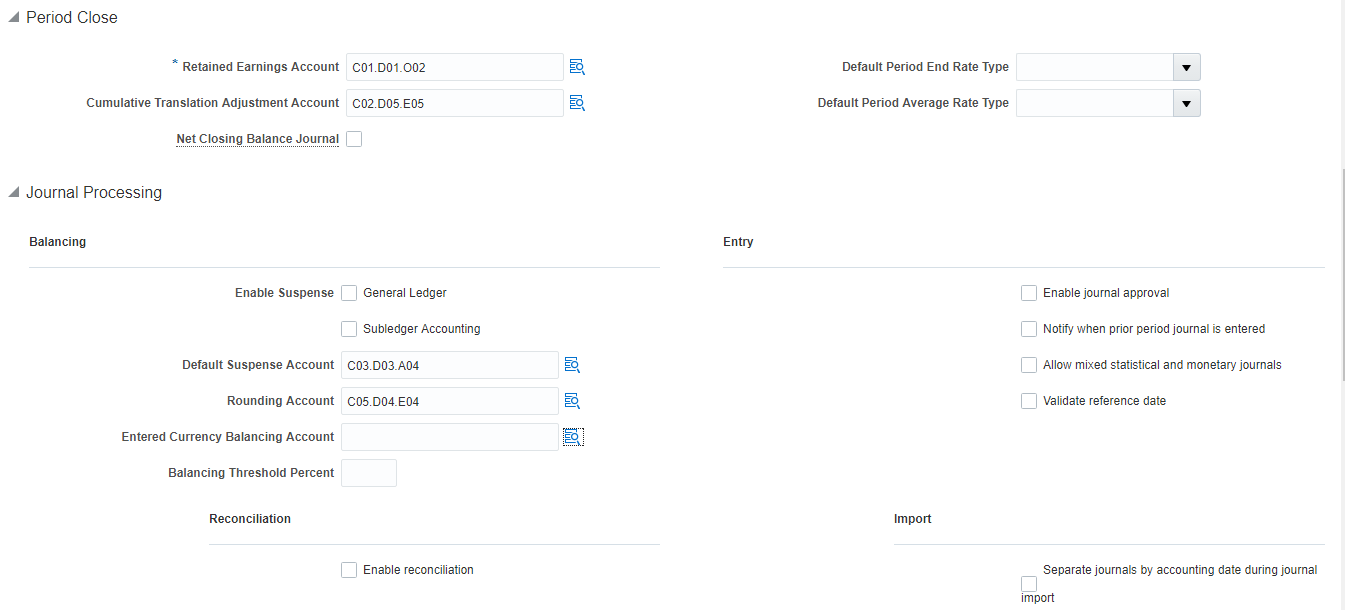

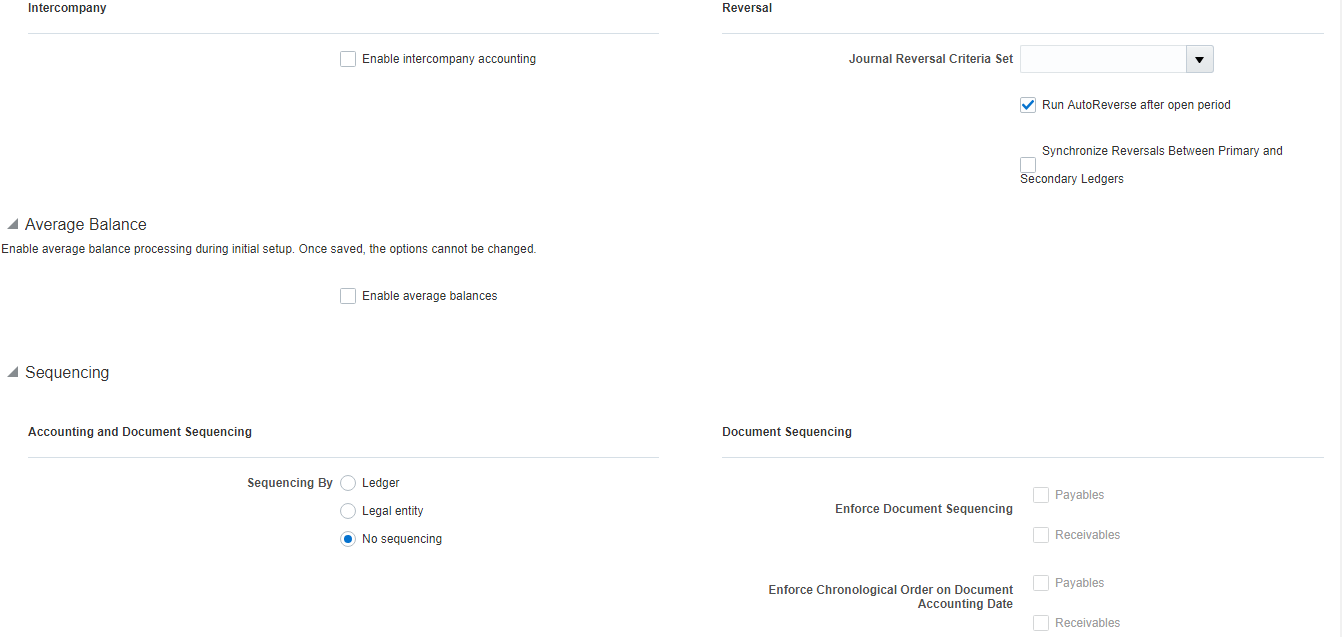

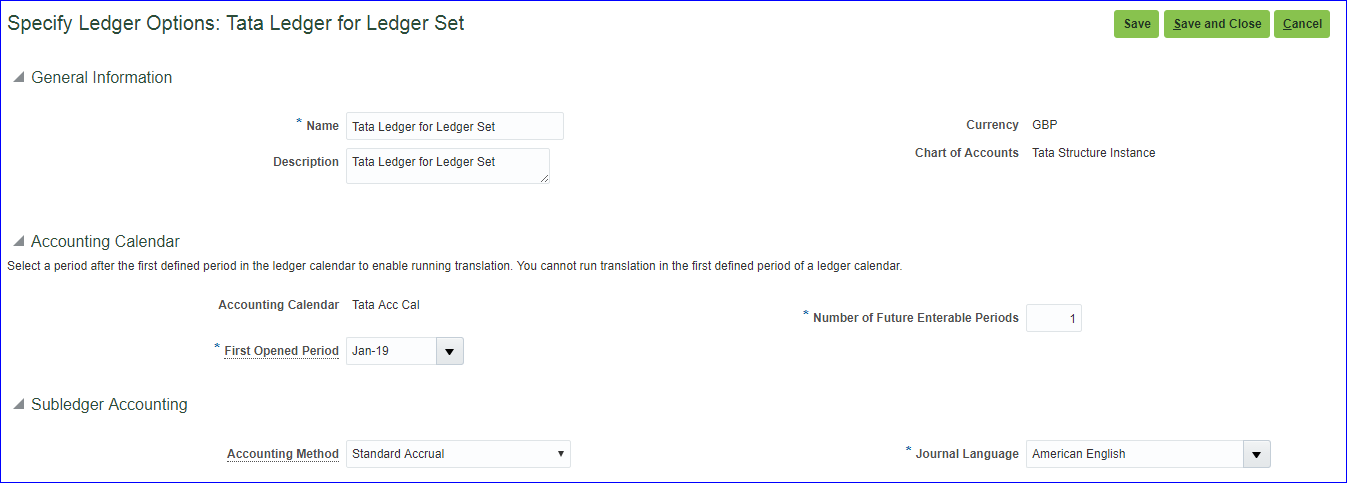

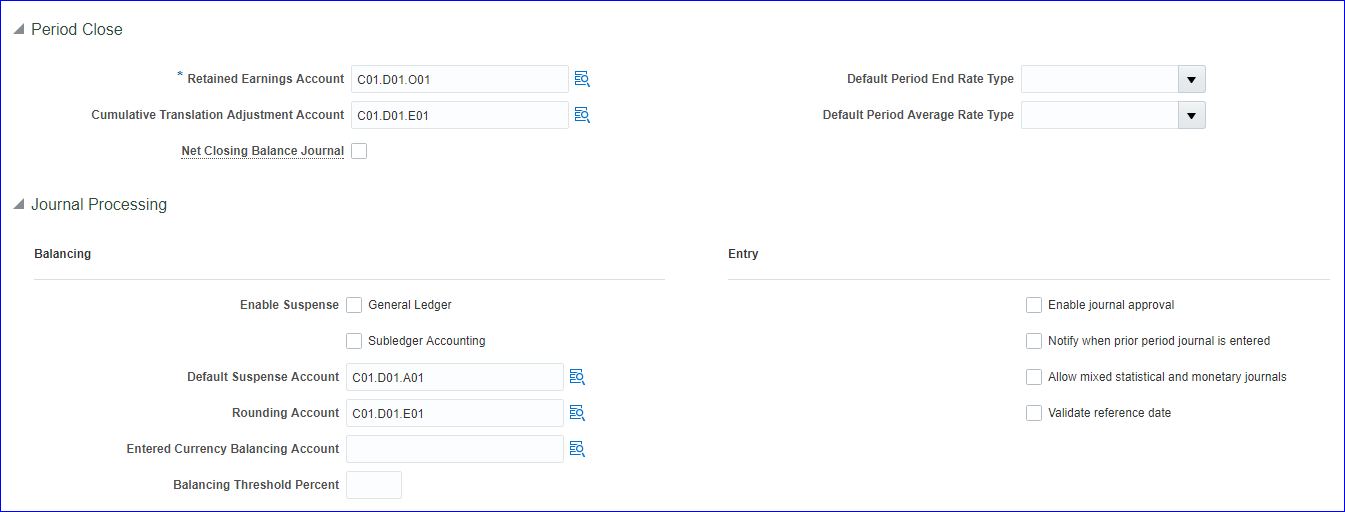

7. Specify ‘Ledger Options’

Search for task ‘Specify Ledger Options’ >> Choose path — ‘Financials>Define Common Applications Configuration for Financials>Define Ledgers>Define Accounting Configurations’ >> Click ‘Go to Task’ >> Choose ‘Specify Ledger Options’ scope and Primary Ledger as ‘Select and Add’>> Apply and Go to Task >>Search our Ledger (Tata Ledger) >> Save and Close >> Enter accounting values >> Save and Close

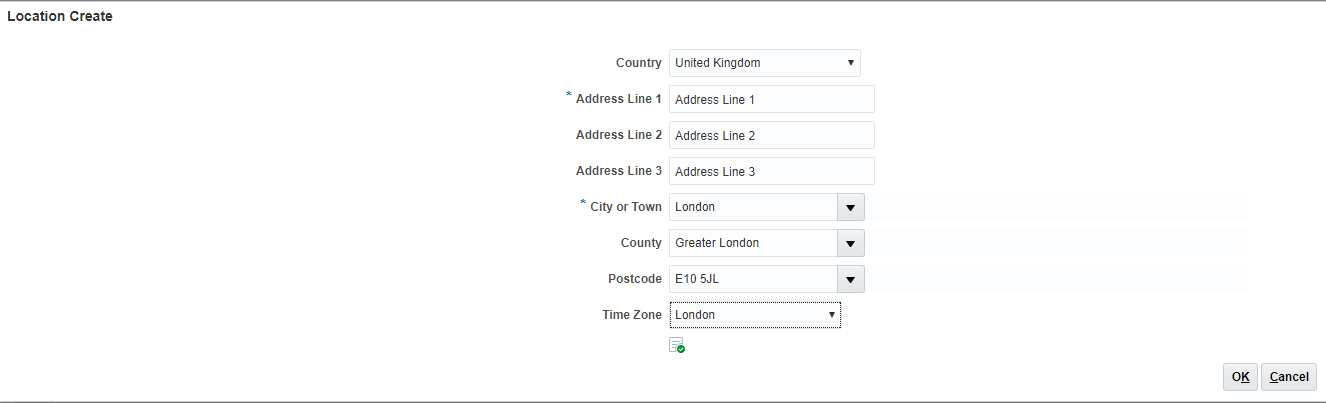

8. Create ‘Legal Address’

Search for task ‘Manage Legal Addresses’ >> Go to Task >> Click on Create(+) icon >> Enter details as below >> Save and Close

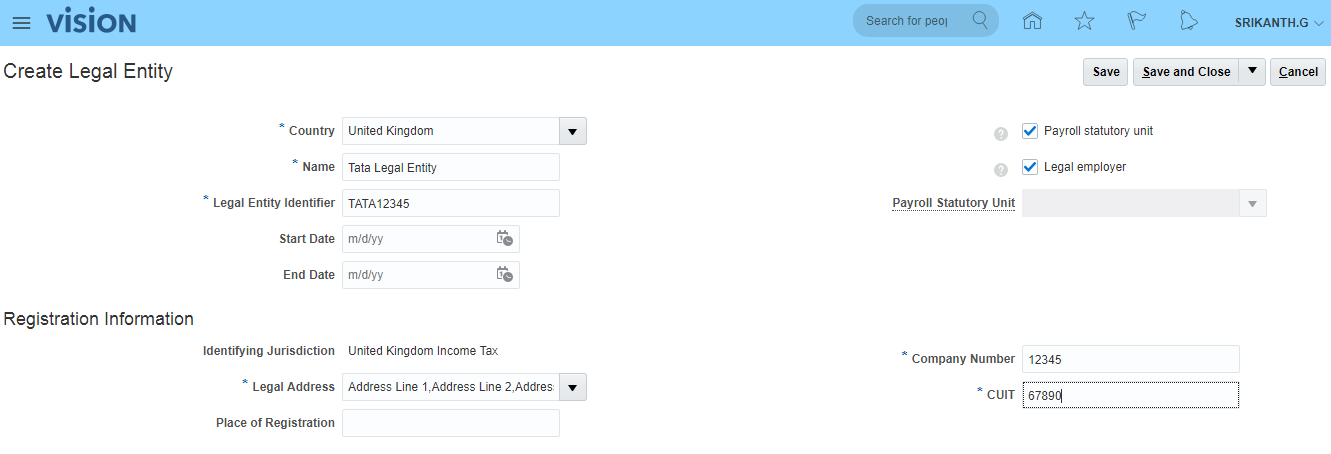

9. Create ‘Legal Entity’

Search for task ‘Manage Legal Entity’ >> Go to Task >> Select Scope: Manage Legal Entity and Legal Entity: Create New >> Apply and Go to Task >> Click on Create(+) icon

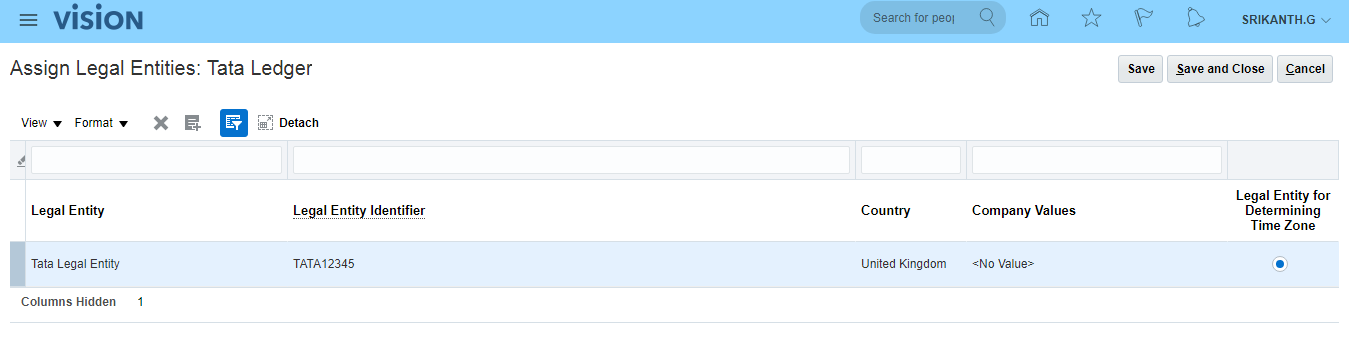

10. Assign ‘Legal Entity’ to ‘Primary Ledger’

Search for task ‘Assign Legal Entities’ >> Go to Task >> Click on ‘Select and Add’ >> Search for Legal Entity (Tata Legal Entity) >> Select >> Apply >> Done >> Save and Close

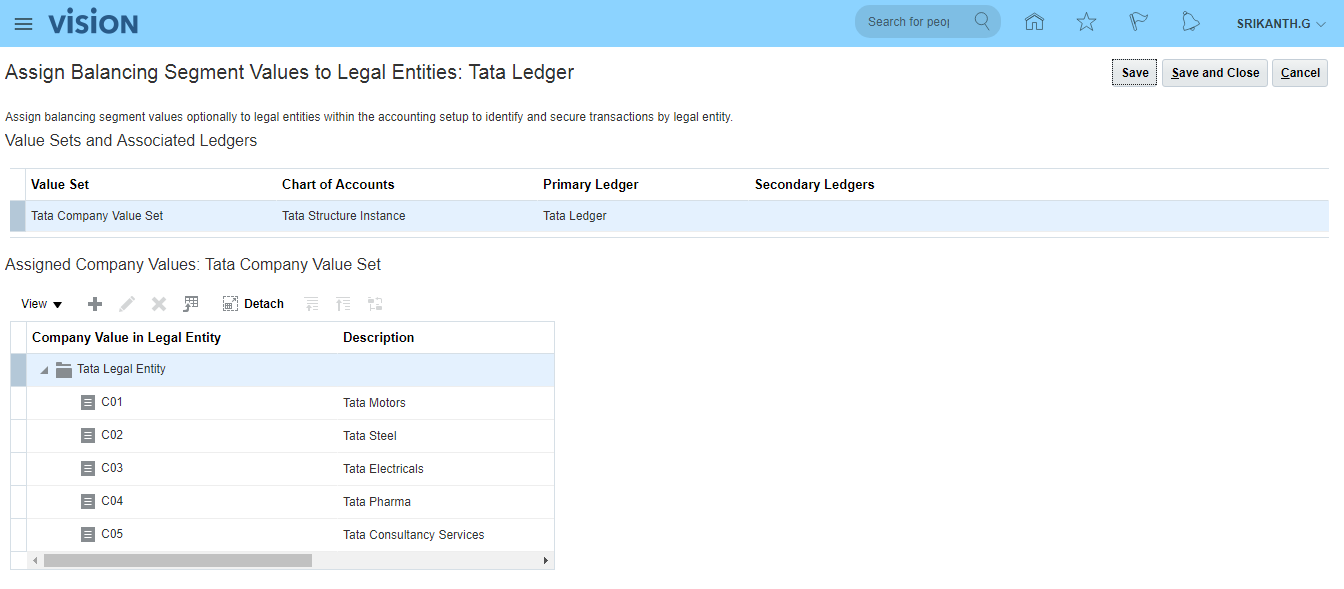

11. Assign ‘Balancing Segment Values’ to ‘Legal Entity’

Search for task ‘Assign Balancing Segment Values to Legal Entities’ >> Go to Task >> Click on Create(+) icon >> Select first Company Value and click on ‘Save and Assign Another’ >> Repeat this step for other companies as well. >> Save and Close

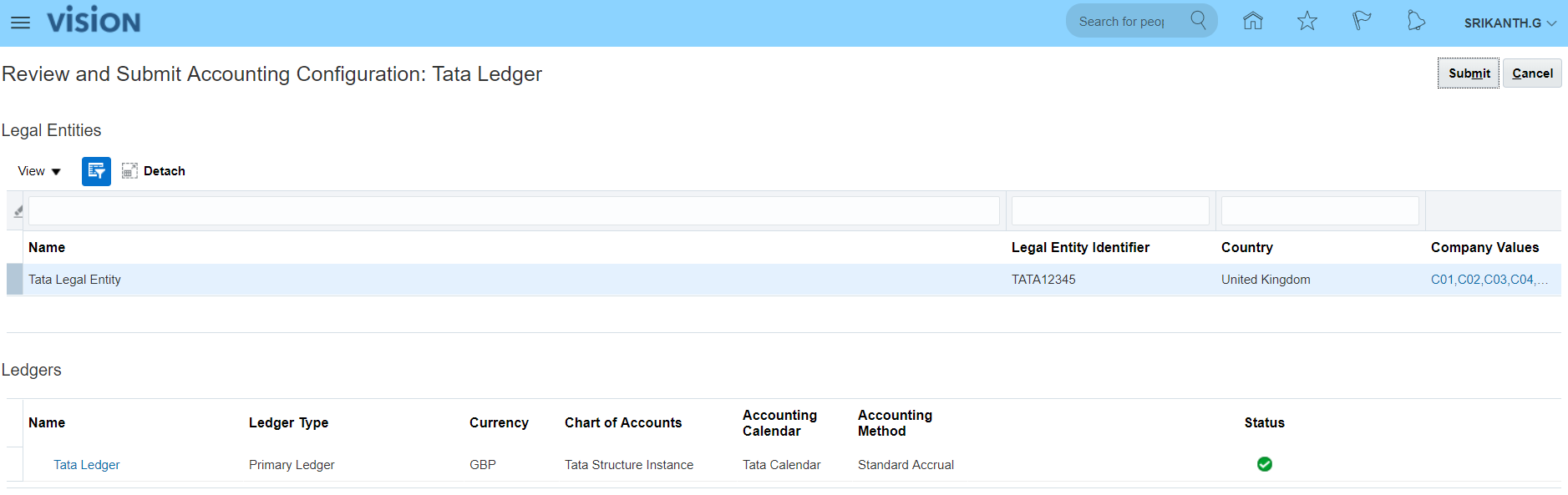

12. Review and submit ‘Accounting Configuration’

The primary Ledger data is stored in Oracle DB. Now this needs to be copied to Essbase Database. The whole GL set up data need to be synced with Essbase DB.

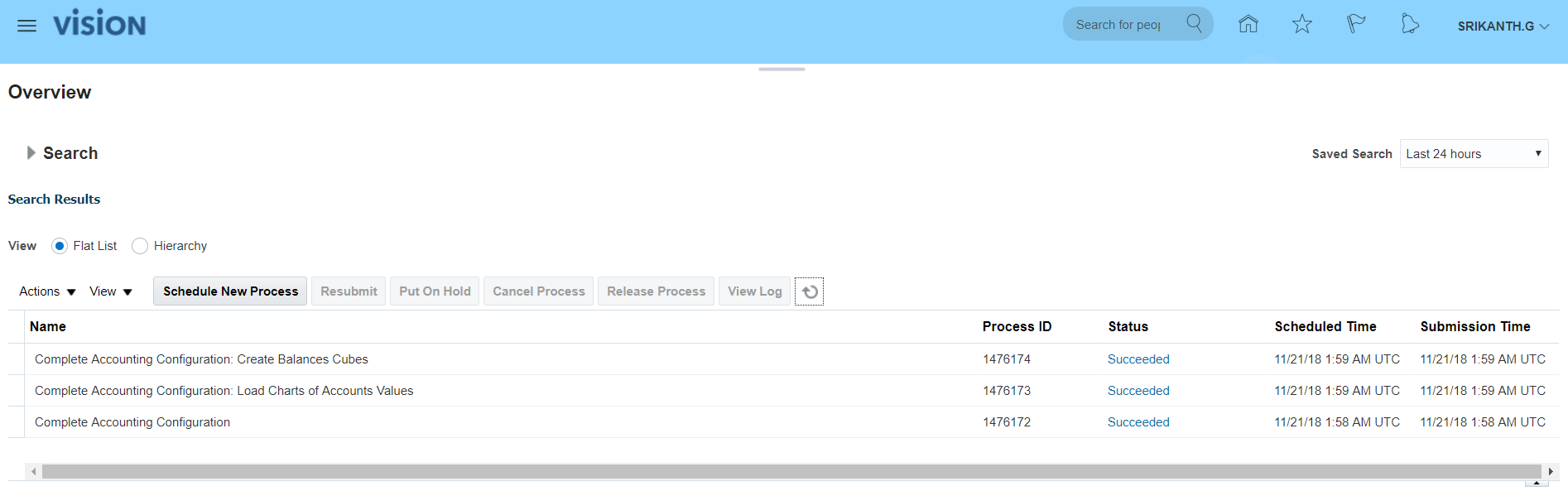

For that purpose, search for task ‘Review and Submit Accounting Configuration’ >> Click ‘Go to Task’ >> Submit. After submission you can see Confirmation message as

| The Create Accounting Configuration process 1234567 has been submitted. |

Since we have assigned Employee Job Role to User (ORA_PER_EMPLOYEE_ABSTRACT), we should be able to see requests. Navigator >> Tools >> Scheduled Processes (This is ESS job page)>> See the Succeeded status.

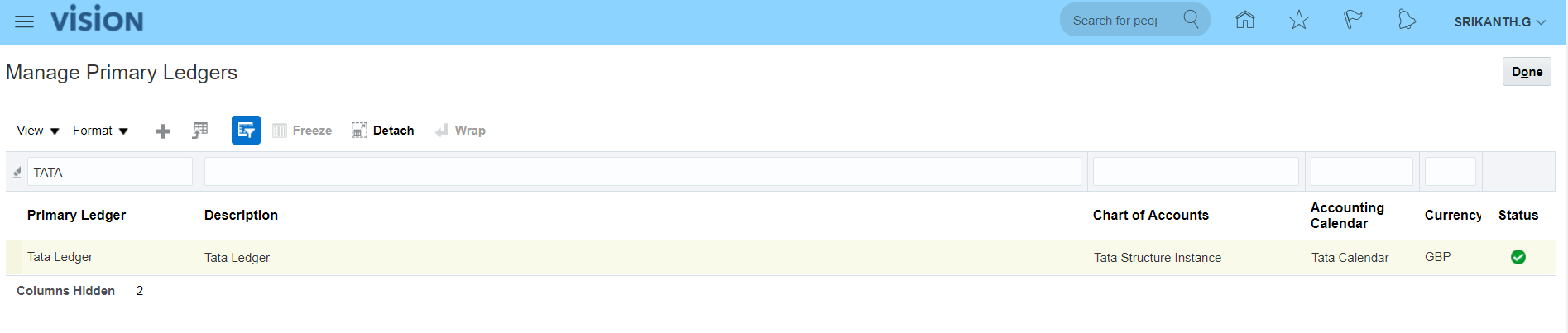

Verify status of Primary Ledger:

Go to task ‘Manage Primary Ledgers’ >> Search for your Ledger (Tata Ledger) >> The status is ‘Confirmed’

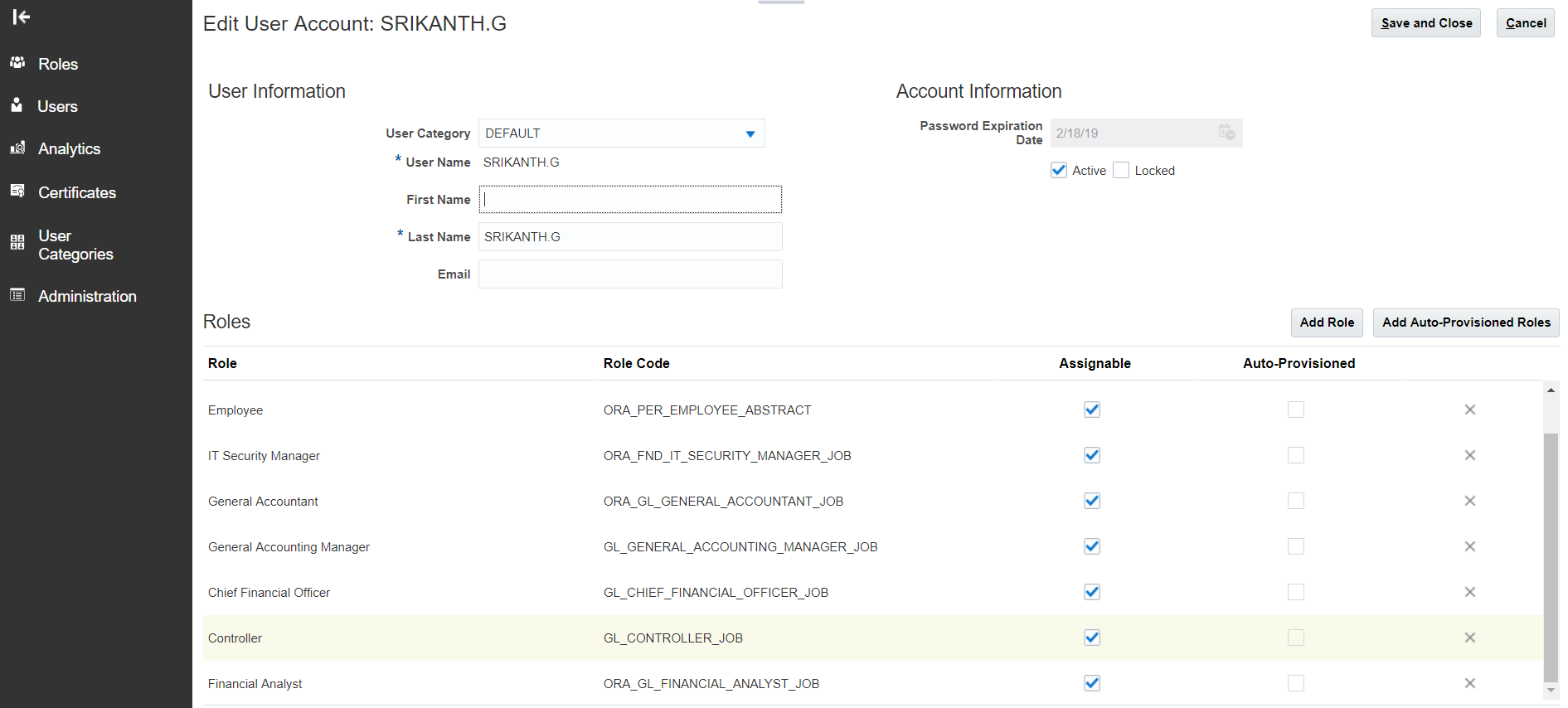

13. Assign GL Roles to User

We have 5 Job roles which need to be assigned to User to record the GL transactions.

Navigation: Navigator >> Tools >> ‘Security Console’ task >> Select Users tab >> Search for your User >> Click on hyperlink (User Login) >> Click on Edit >> Add Roles >> Search for

i) ‘General Accountant’ (Code: ORA_GL_GENERAL_ACCOUNTANT_JOB)

ii) ‘General Accounting Manager’ (Code: GL_GENERAL_ACCOUNTING_MANAGER_JOB)

iii) ‘Chief Financial Officer’ (Code: GL_CHIEF_FINANCIAL_OFFICER_JOB)

iv) ‘Controller’ (Code: GL_CONTROLLER_JOB)

v) ‘Financial Analyst’ (Code: ORA_GL_FINANCIAL_ANALYST_JOB)

>> Add Role Membership >> Save and Close

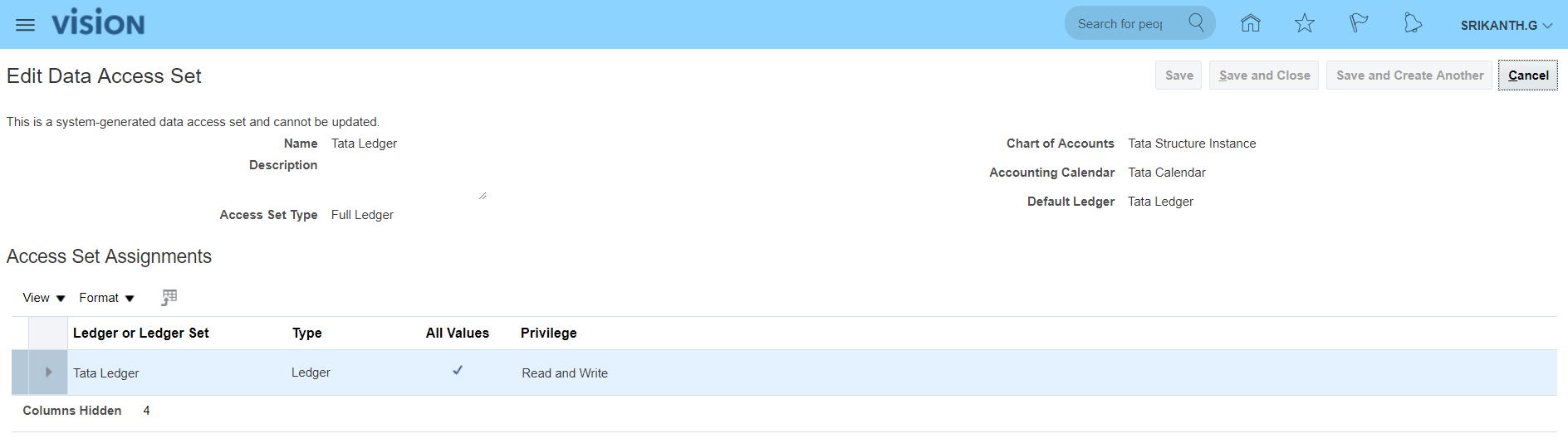

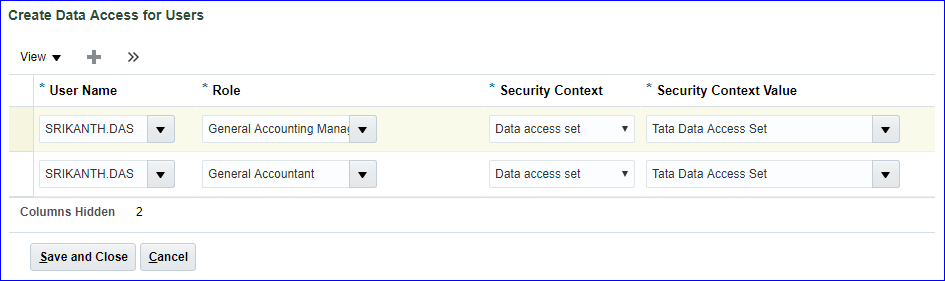

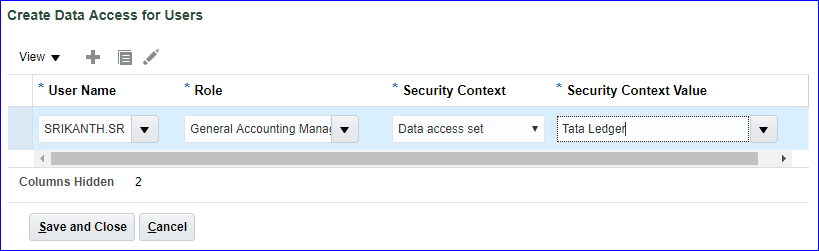

14. Assign ‘Data Access Set’ to GL roles

In EBS, we used to assign ‘Primary Ledger’ value to profile option ‘GL Ledger Name’ at responsibility level. Additionally once the ledger creation is completed, we will assign the ledger to profile option ‘GL: Data Access Set’.

Now go to your implementation project and search for task ‘Manage Data Access Sets’ >> Go to Task >> Search for your ledger (Tata Ledger) >> Here Name reflects Data Access Set (Tata Ledger) >> Click on edit for more details.

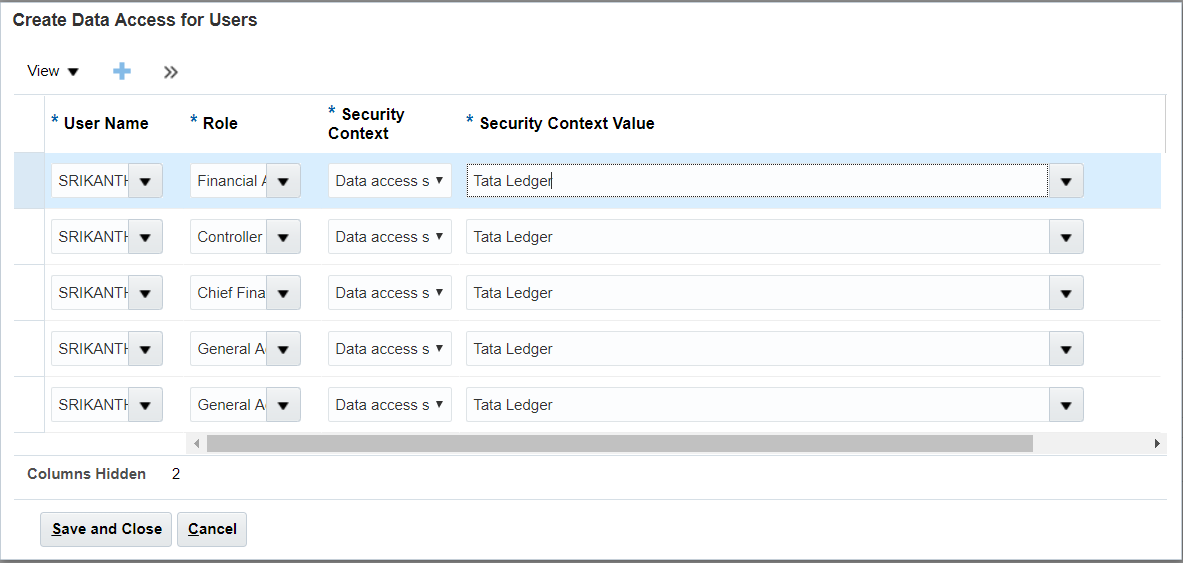

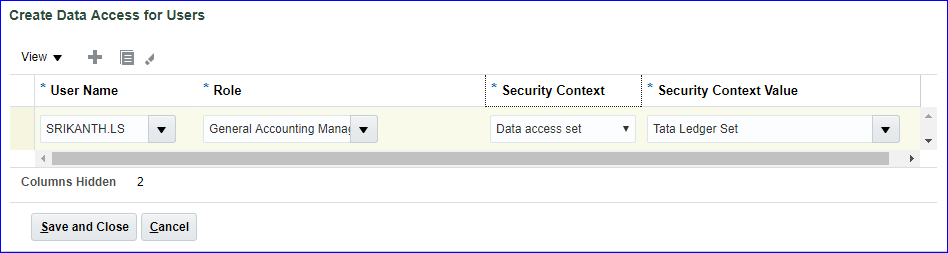

Search for task ‘Manage Data Access for Users’ >> Go to Task >> Create >> Select your User Name, select each 5 GL roles, Security Context: Data access set, Security Context Value: select your ‘Primary Ledger’ name. >> Just verify (Users without Data Access and Users with Data Access) by searching with User Name after completion of above steps.

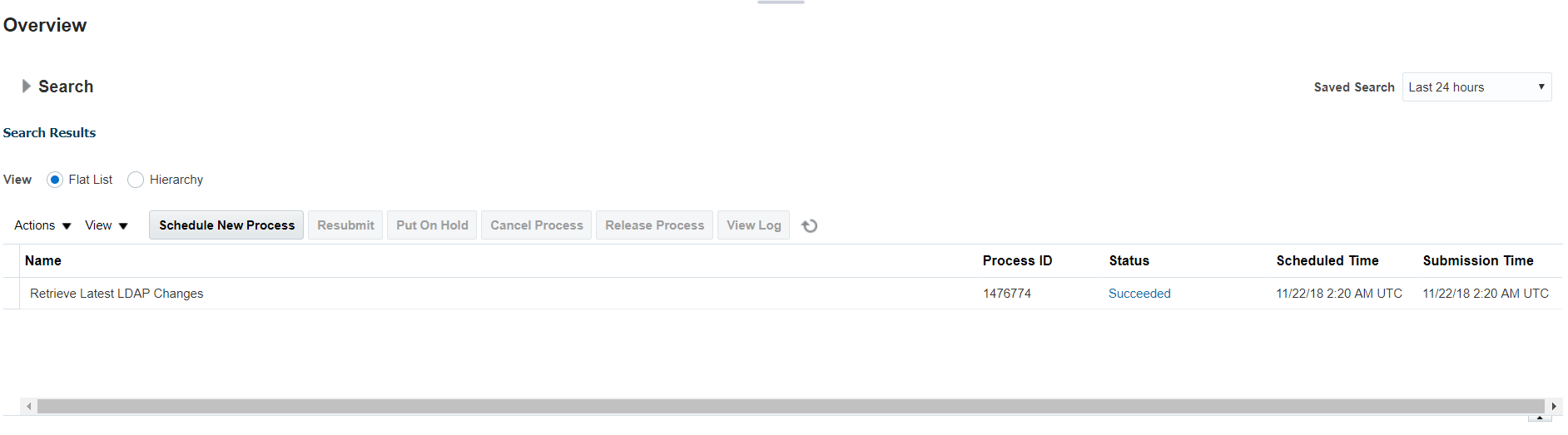

15. Run LDAP Job

Navigation: Navigator >> Tools >> Scheduled Processes >> This is ESS Job page >> Schedule New Process >> Type: Job; Name: Retrieve Latest LDAP Changes >> Submit >> Look for Succeeded status.

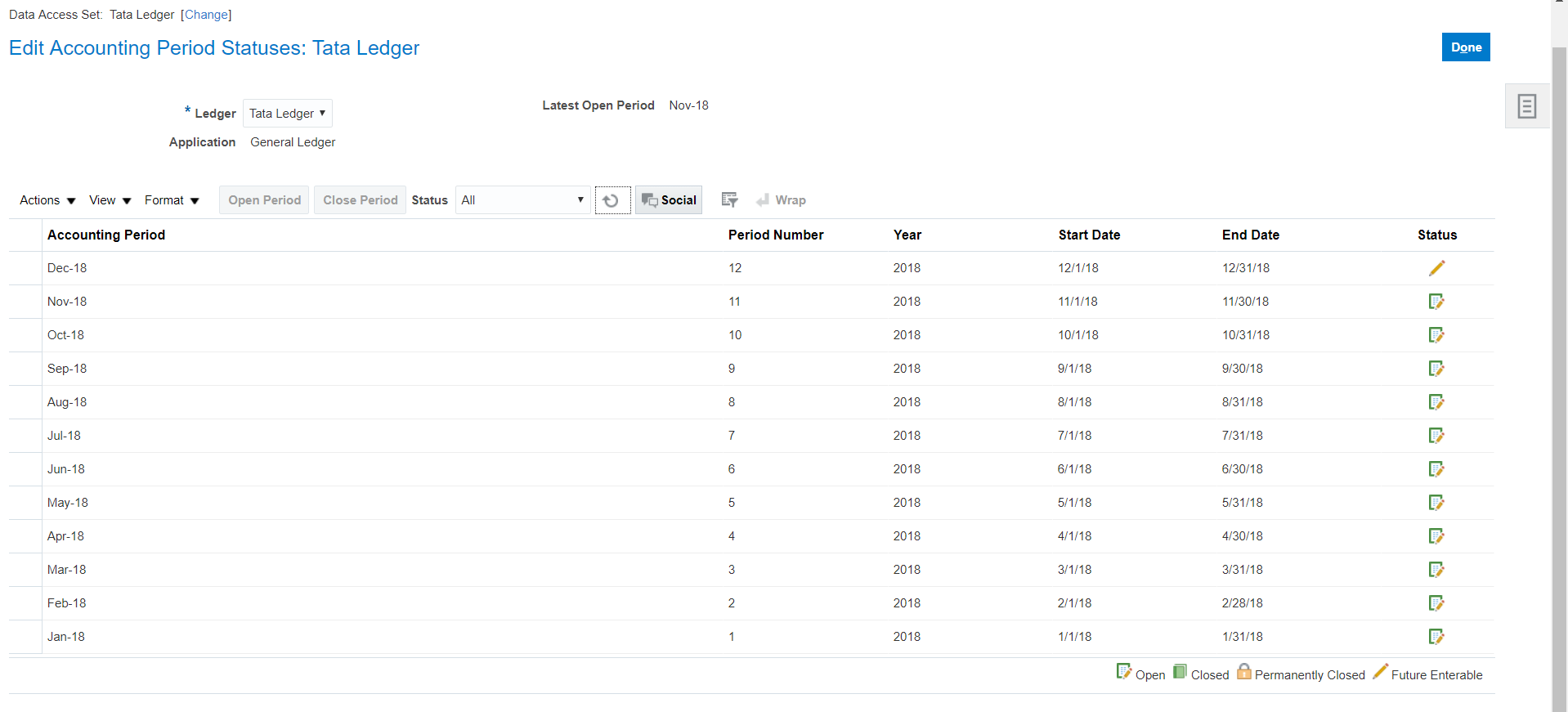

16. Open GL Periods

Post above changes sign-out and sign-in again to see ‘General Accounting’ task in Navigator.

In case you see error when you open Period Close ‘GL_PLL_INVALID_DATA_ACCESS_SET.oracle.javatools.resourcebundle.ResourceBundleRT’ then run the job ‘Import User and Role Application Security Data’.

Navigation: Navigator >> General Accounting >> Period Close >> Select your Data Access Set >> Click on General Ledger(Never Opened) icon >> Open first period and a request will be submitted>> Actions >> Open Target Period or we can open one-by-one period.

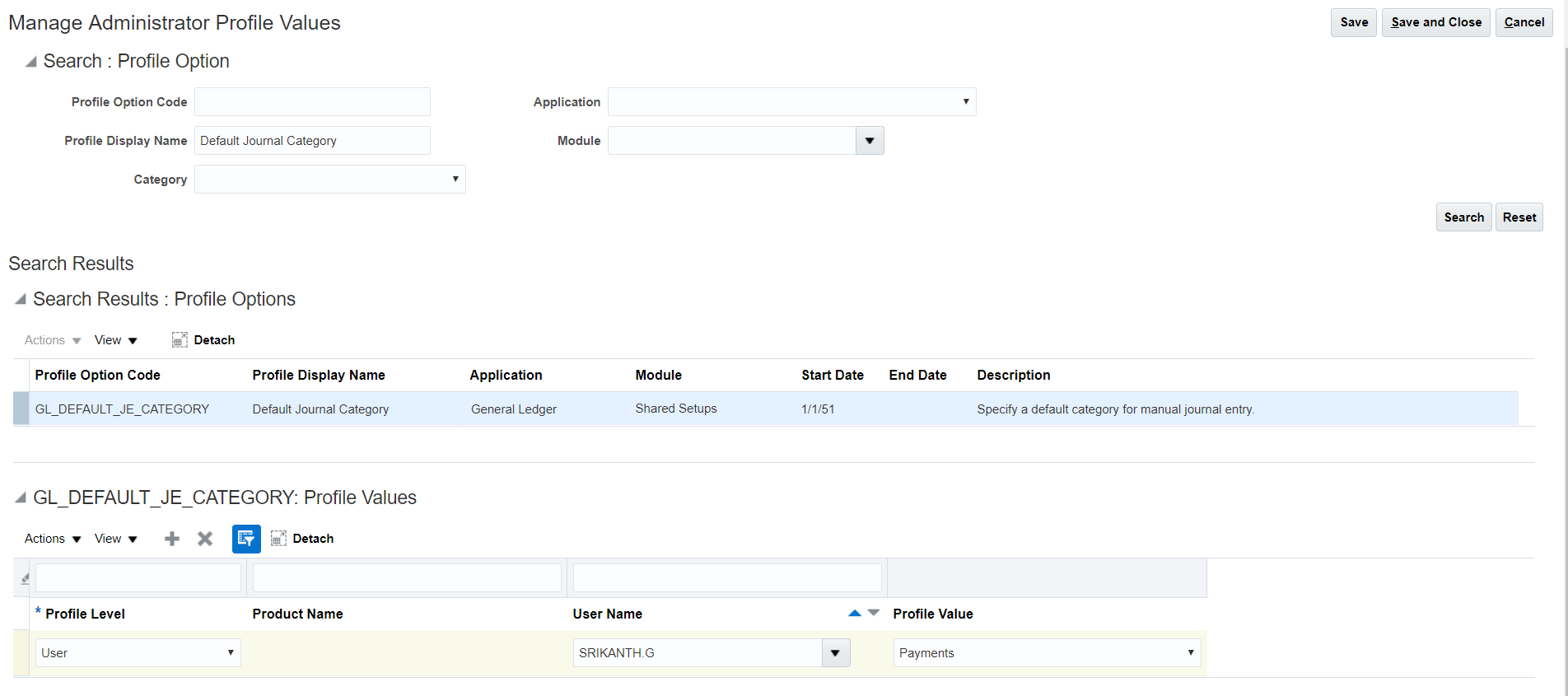

Set default ‘Category’ value in Journal at User level

This is an optional step. We need to set profile options to achieve this activity. We can set profile option using the task – ‘Manage Administrator Profile Values’

Navigation: Setup and Maintenance >> Tasks Panel >> Search (The tasks which are not mandatory to create from implementation project can be created here) >> ‘Manage Administrator Profile Values’ >> Search for Profile Display Name: Default Journal Category >> Click on Create >> Profile Level: User, User Name: SRIKANTH.G, Profile Value: Adjustment >> Save and Close

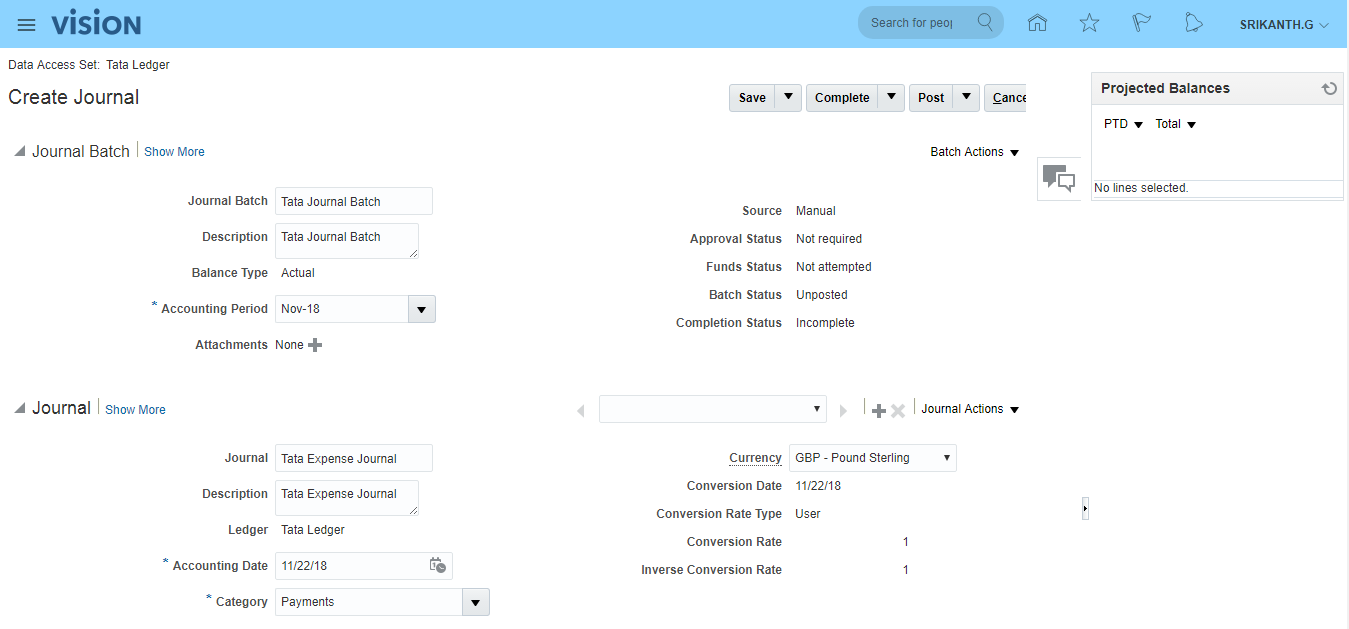

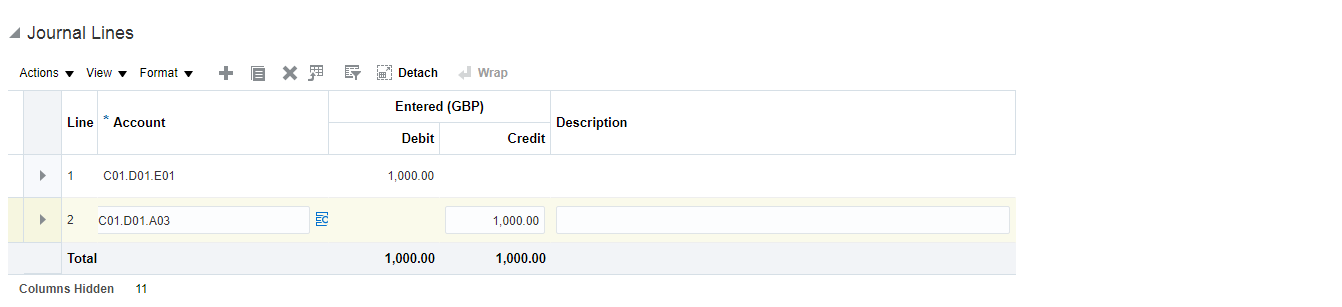

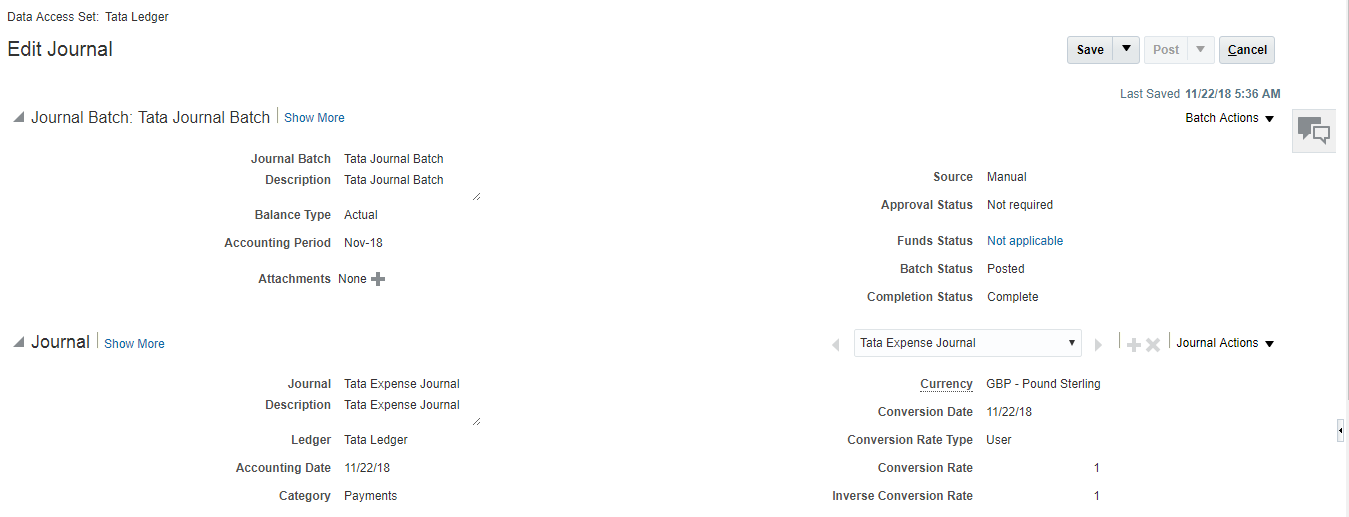

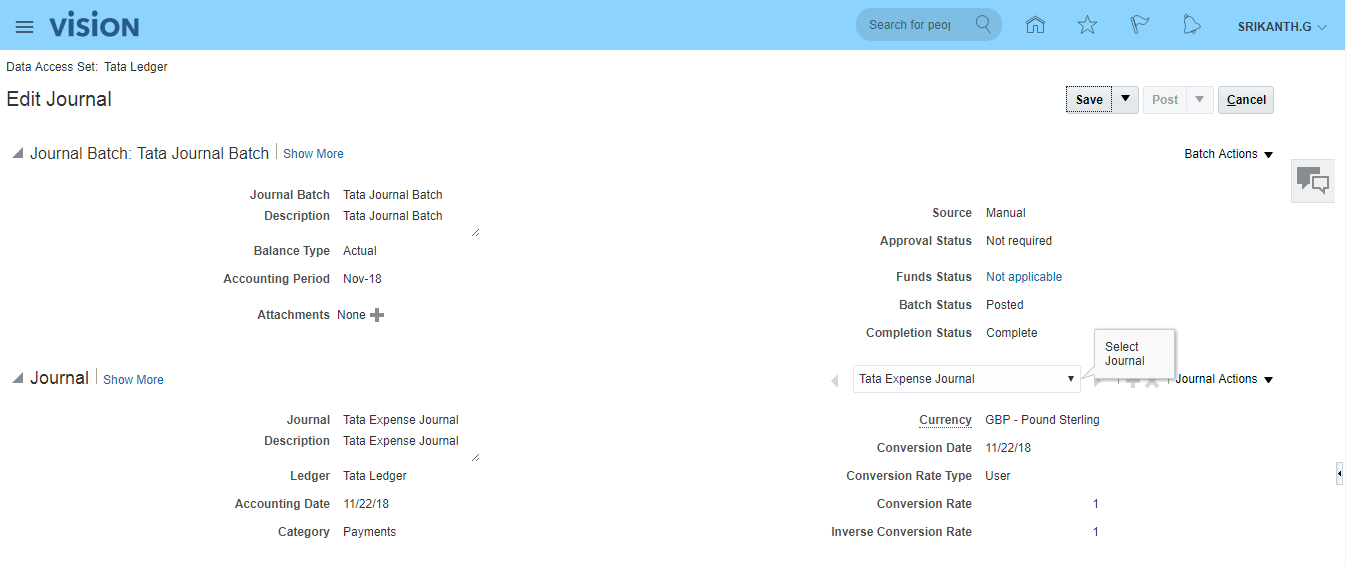

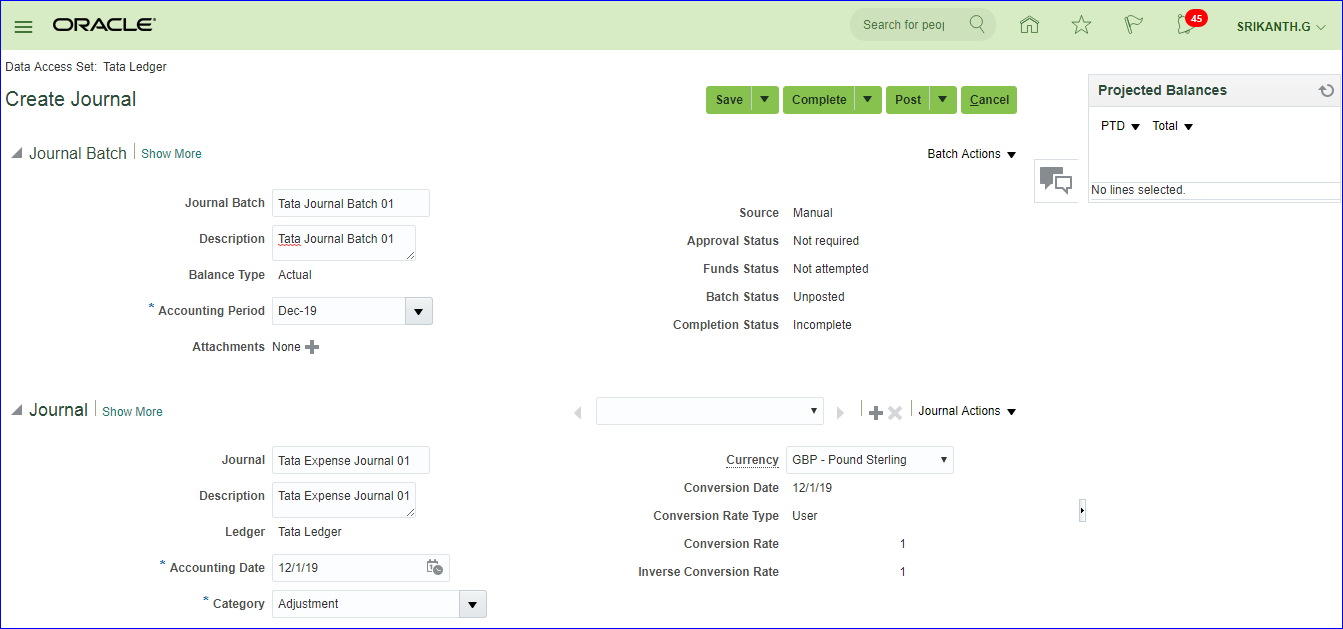

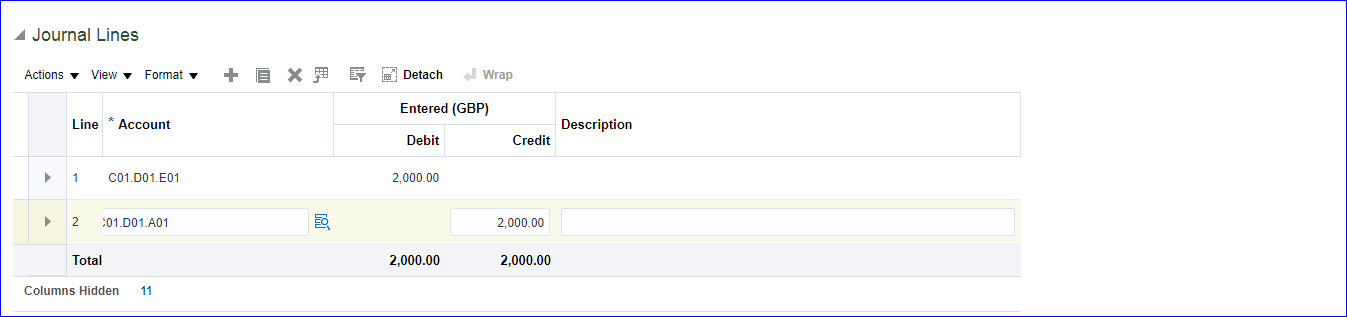

17. Create Journal and Post

Batch –> Journal –> Lines

Batch is not mandatory. Even Journal name will be auto-created if not given.

Navigation: Navigator >> General Accounting >> Journals >> Tasks Panel >> Create Journal

Notice the Category: Payments have been defaulted due to above set up.

Save >> Complete >> Post (A request will be submitted)

‘Post Journals for Single Ledger’ job status should be in ‘Succeeded’.

To see the Journal status: Navigator >> General Accounting >> Journals >> Tasks panel >> Manage Journals >> Search for your Journal >> Status is Posted.

**In case you want to search Journal with other than given 6 fields, we can click on ‘Add Fields’ button in ‘Manage Journals’ page.

One more Journal creation

Save >> Complete >> Post (A request will be submitted)

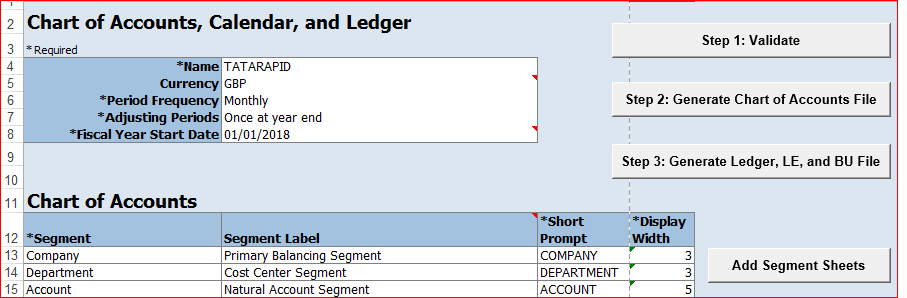

18.Rapid Implementation

i) Download Rapid implementation templates

ii) Enter data into sheets

iii) Create zip file

iv) Upload zip file into application

v) Find data definitions in application

i) Download Rapid implementation templates

In FSM page search for task ‘Define Common Financials Configuration for Rapid Implementation’ >> Click on ‘Create Chart of Accounts, Ledger, Legal Entities, and Business Units in Spreadsheet’ >> Save and Open excel

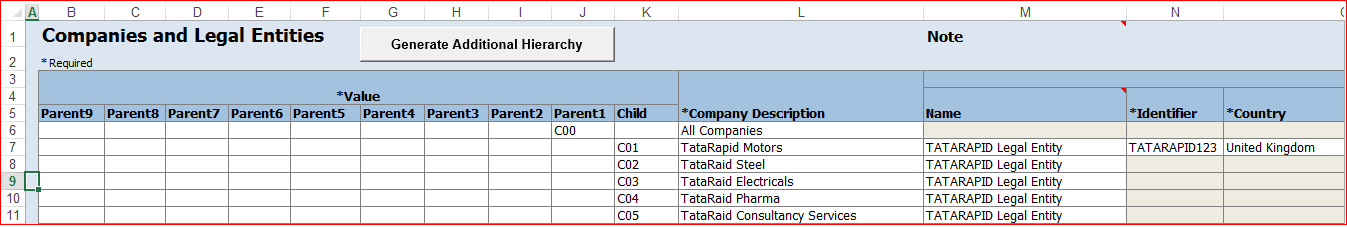

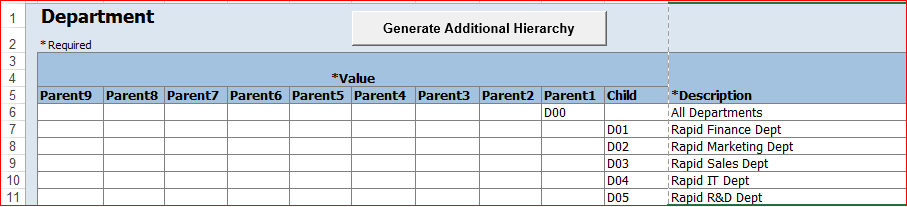

ii) Enter data into sheets

To add Department sheets click on Add Segment Sheets.

Business Units tab:

| Name | Default Legal Entity Name |

| TATARAPID Business Unit | TATARAPID Legal Entity |

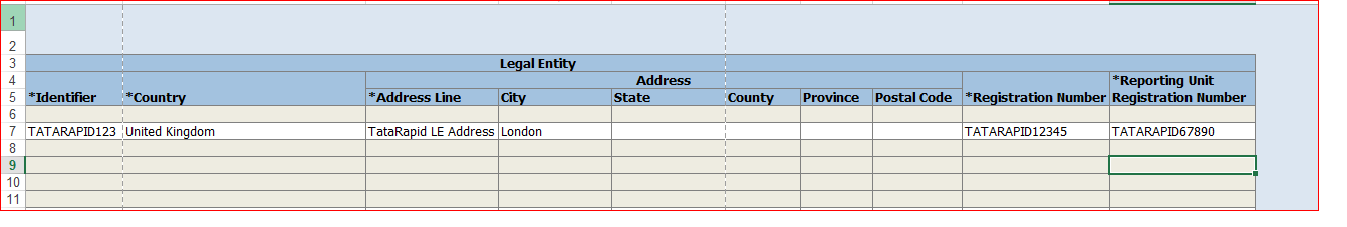

Companies and Legal Entities:

Department:

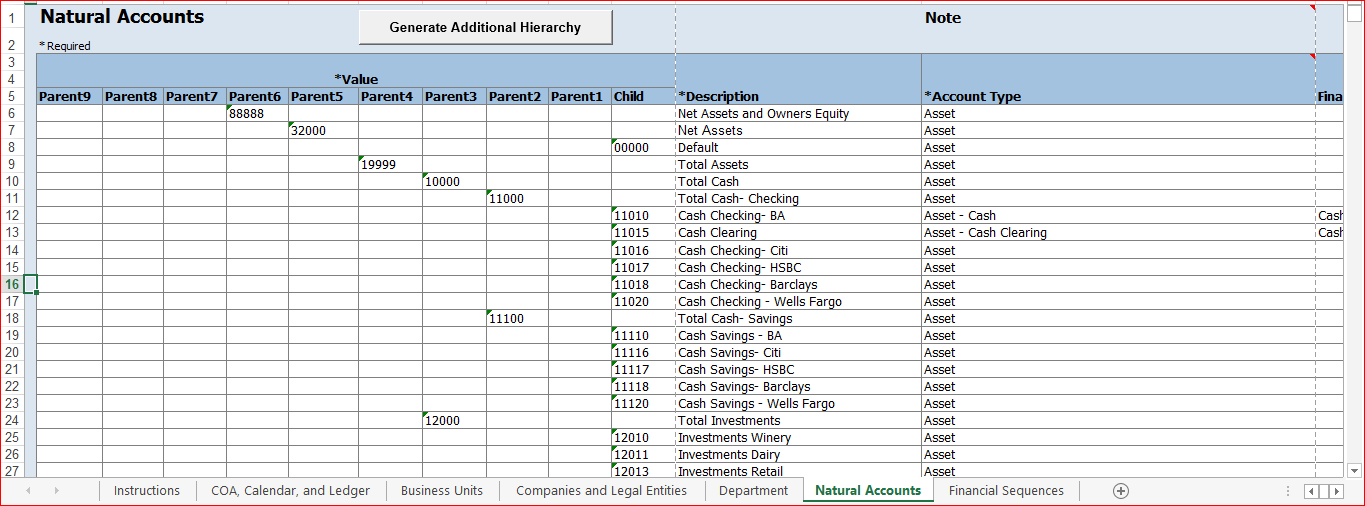

Natural Accounts:In Instructions tab we have ‘Rapid Implementation Template with Sample Data’ and I have used same data.

Financial Sequences: Even we can ignore this option

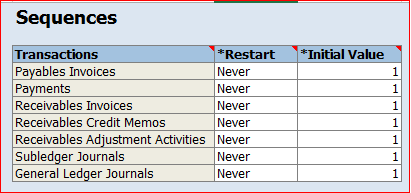

iii) Create zip file

Click on Step 1: Validate and look for confirmation message

Click on Step 2: Generate Chart of Accounts File >> Save the zip file

Step 3: Generate Ledger, LE, and BU File >> Save the zip file

iv) Upload zip file into application

In FSM page search for task ‘Define Common Financials Configuration for Rapid Implementation’ >> Click on ‘Upload Chart of Accounts’ >> Choose parameters: Upload Enterprise Structure >> Upload the ChartOfAccounts file >> Submit >> ‘Upload Enterprise Structures and Hierarchies’ should be succeeded.

v) Verifying in application

In FSM search for task ‘Manage Chart of Accounts Value Sets’ >> Search Value Set Code: Company TATARAPID and Department TATARAPID and Account TATARAPID >> Click on Manage Values and click on search to get all values.

In FSM search for task ‘Manage Chart of Accounts Structure Instances’ >> Search Key Flexfield Name: Accounting >> Manage Structures >> Structure Code: TATARAPID >> Edit >> Edit and see details

Next upload ‘FinancialsCommonEntities’ file using step iv navigation in ‘Upload Ledger, Legal Entities, and Business Units’ task.

In FSM search for task ‘Accounting Calendar’ >> Manage Accounting Calendars >> Search for TATARAPID (By default the process creates calendar for two years)

In FSM search for task ‘Manage Primary Ledgers’ >> Search for TATARAPID

In FSM search for task ‘Assign Balancing Segment Values to Legal Entities’ >> Search for TATARAPID

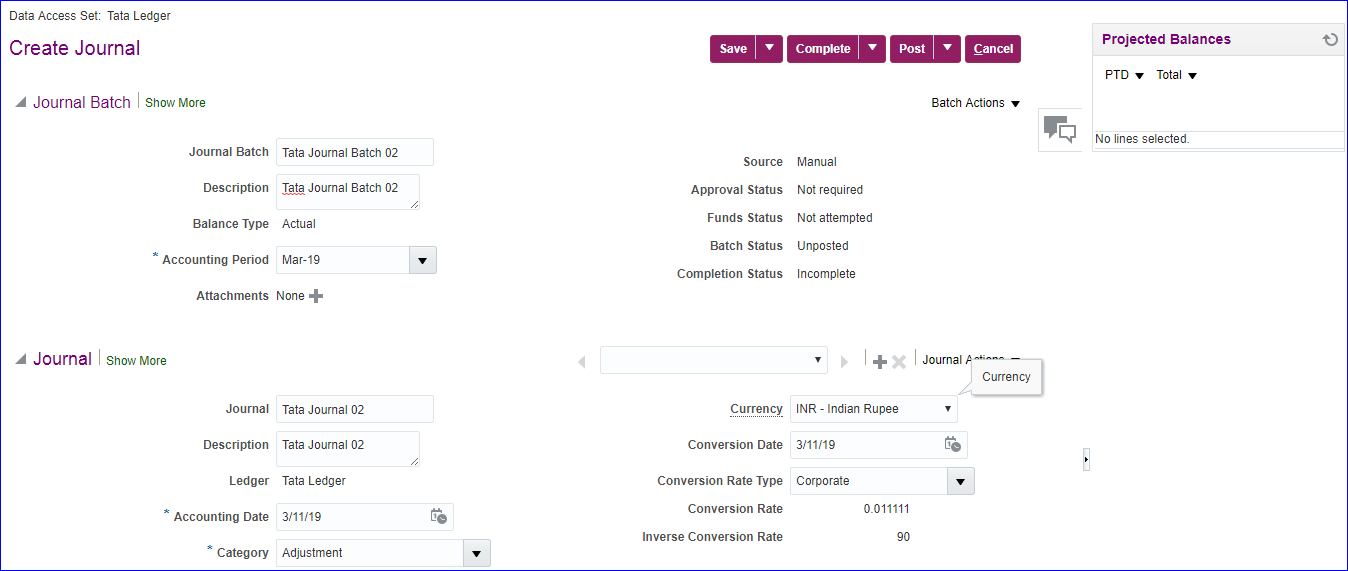

19. Foreign Currency Journals creation

FSM >> Tasks >> Search >> Define Currencies and Currency Rates >> Manage Daily Rates >> Daily Rates tab >> Create in Spreadsheet

| *From Currency | GBP |

| *To Currency | INR |

| *Conversion Rate Type | Corporate |

| *From Conversion Date | SYSDATE |

| *To Conversion Date | SYSDATE |

| Conversion Rate | 90.00 |

Save >> Create Daily Rates tab >> Submit

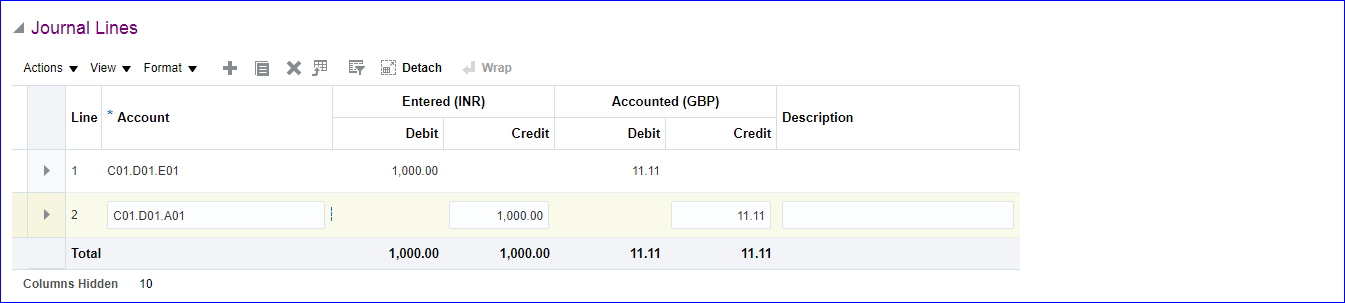

Now create Journal in foreign currency

General Accounting >> Journals >> Tasks >> Create Journal

Save >> Complete >> Post

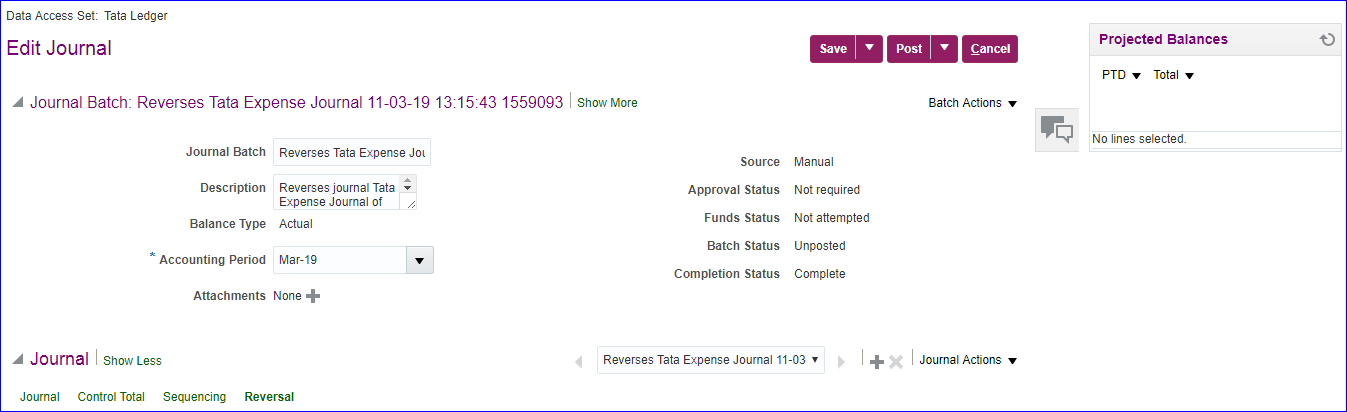

20. Reverse Journals

Manage Journals and take any Journal which is already Posted. When we enter incorrect information on Journal then we do Reversal and create new Journal.

Journal >> Show More >> Reversal tab >> Reversal Period: (Select your period); Reversal Method: Switch DR or CR >> Save >> Journal Actions >> Reverse >> Save >> The Reversal Status should be Reversed >> Again search your Journal >> Journal >> Show More >> Reversal tab. Here we get new Journal with lines reversed >> Finally Post

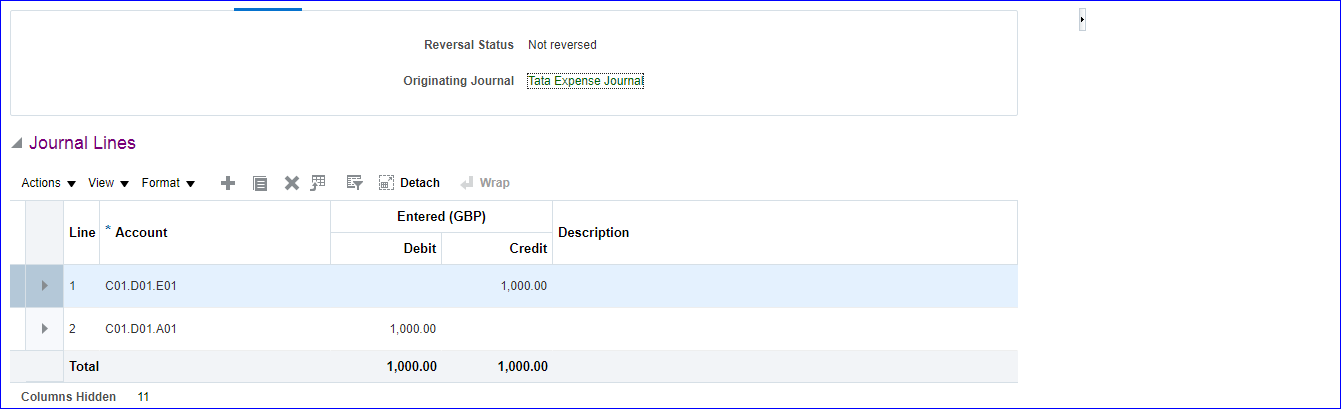

21. Data Access Set

Initially when we create primary ledger, the primary ledger name and data access set name will be same. Using custom data access set, we can specify few BSV’s in Read Only and few in Read & Write.

C01 – Read Only

C02 – Read & Write

i) Create Data Access Set

FSM >> Tasks >> Search >> ‘Manage Data Access Sets’ >> Create

Save and Close

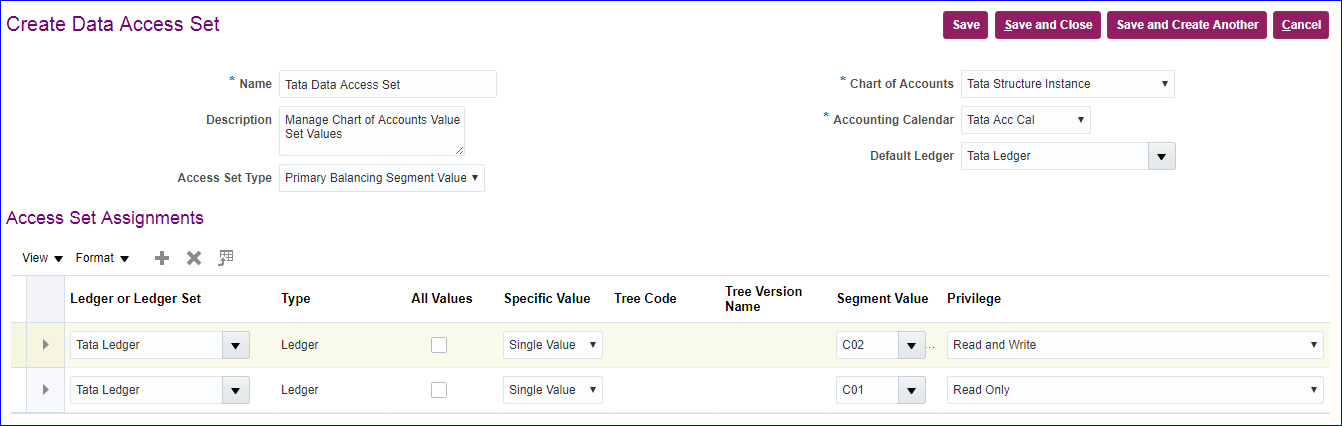

ii) Create new user & Assign GL role to user

SRIKANTH.DAS – General Accountant and General Accounting Manager (Both ORA_ codes)

iii) Provide Data access for user

iv) Run LDAP job — Retrieve Latest LDAP Changes

v) Create Journal

Login as SRIKANTH.DAS and for this user system should allow to create the Journals only with C02 BSV but not with C01.

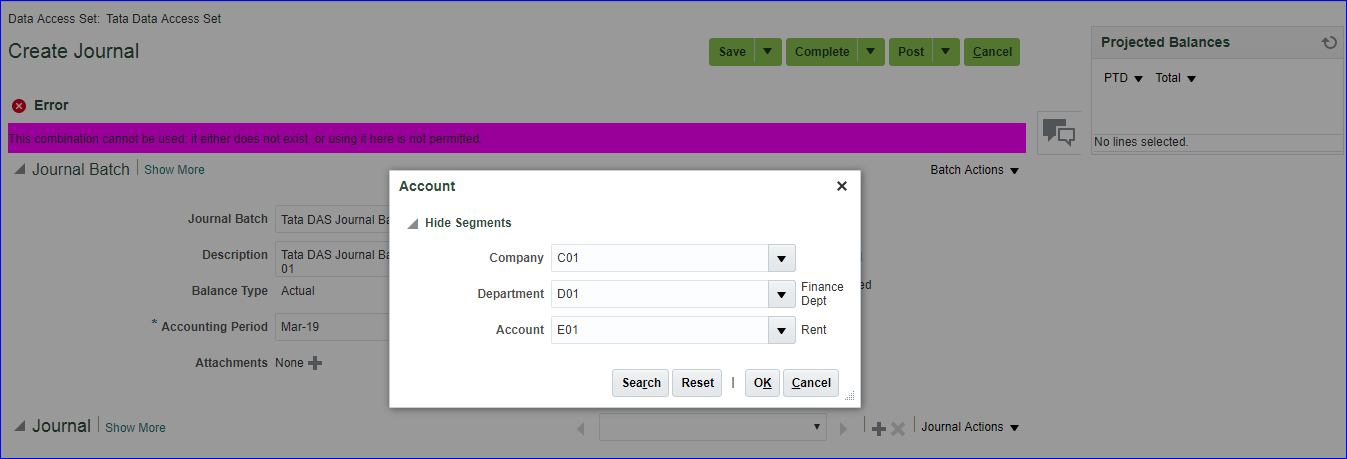

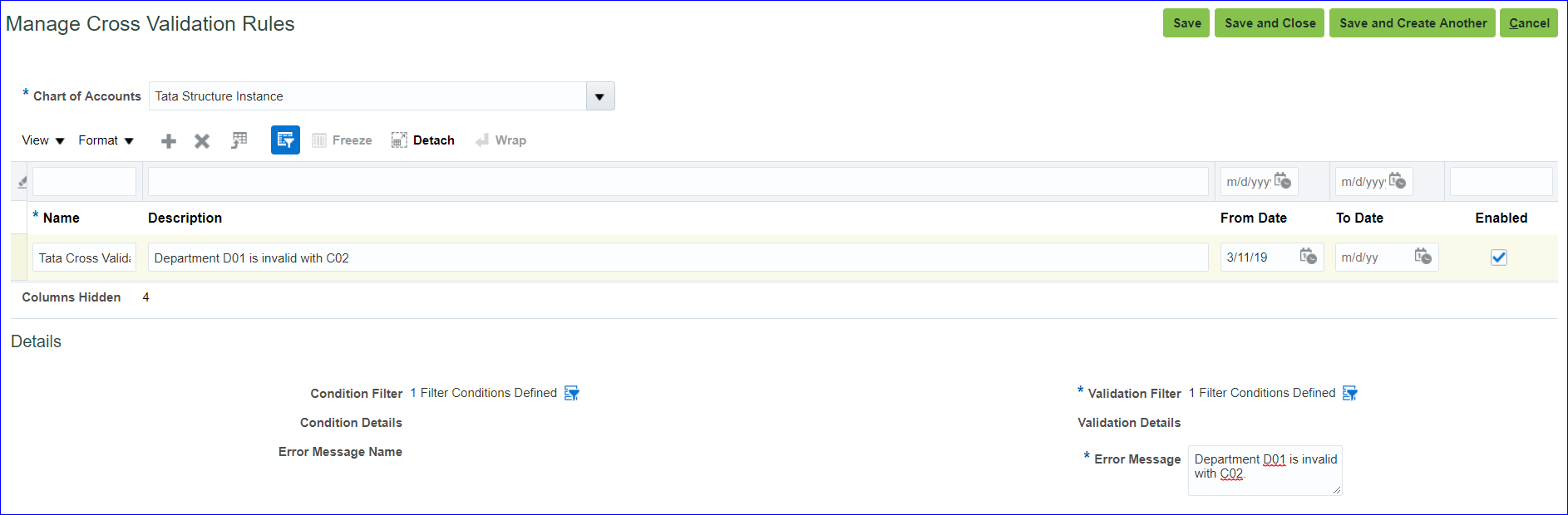

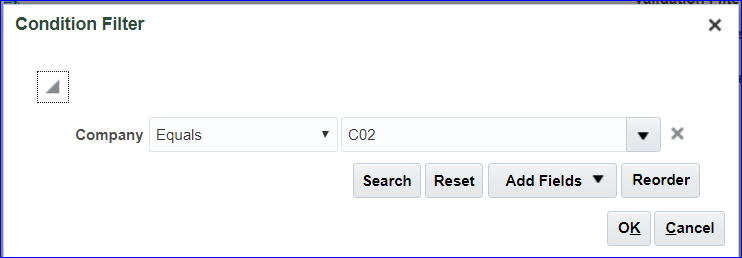

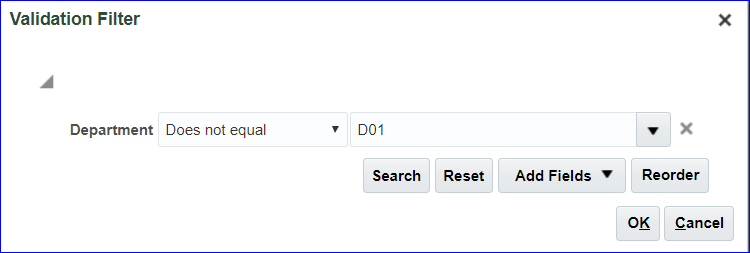

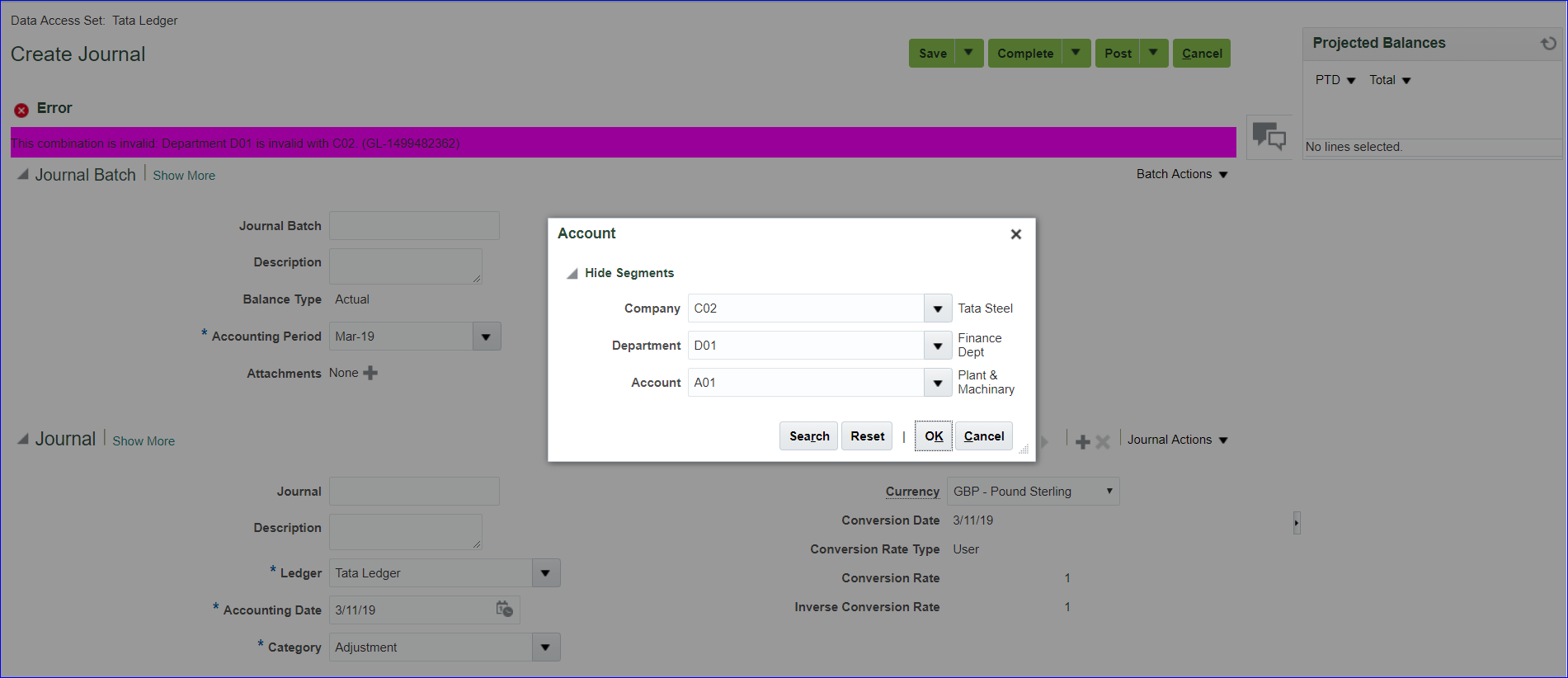

22. Cross Validation Rules

Setting up invalid code combinations. Say Company C02 should not possess D01 department.

FSM >> ‘Manage Cross-Validation Rules’ >> Select your COA >> Create

Save and Close

FSM >> ‘Manage Chart of Accounts Structures’ >> Key Flexfield Name: Accounting Flexfield >> Deploy Flexfield

General Accounting >> Journals >> Tasks >> Create Journal >> Now enter C02.D01 code combination to view our error message

We can disable simply by unchecking the enabled option in ‘Manage Cross-Validation Rules’ task and also deploy flexfield.

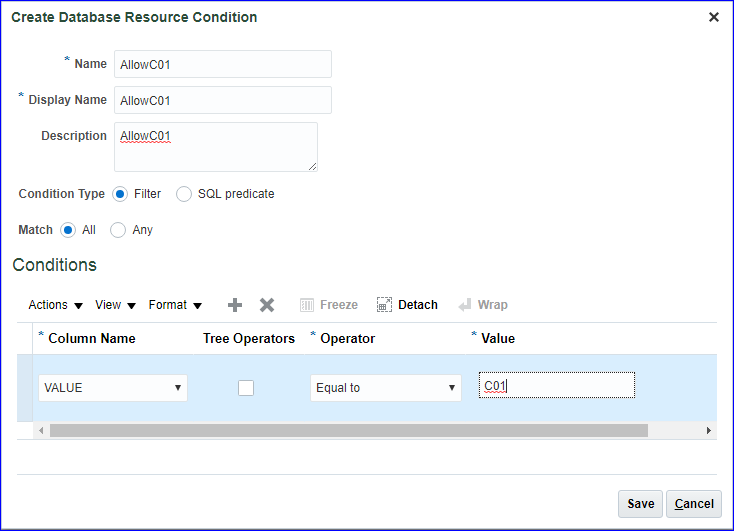

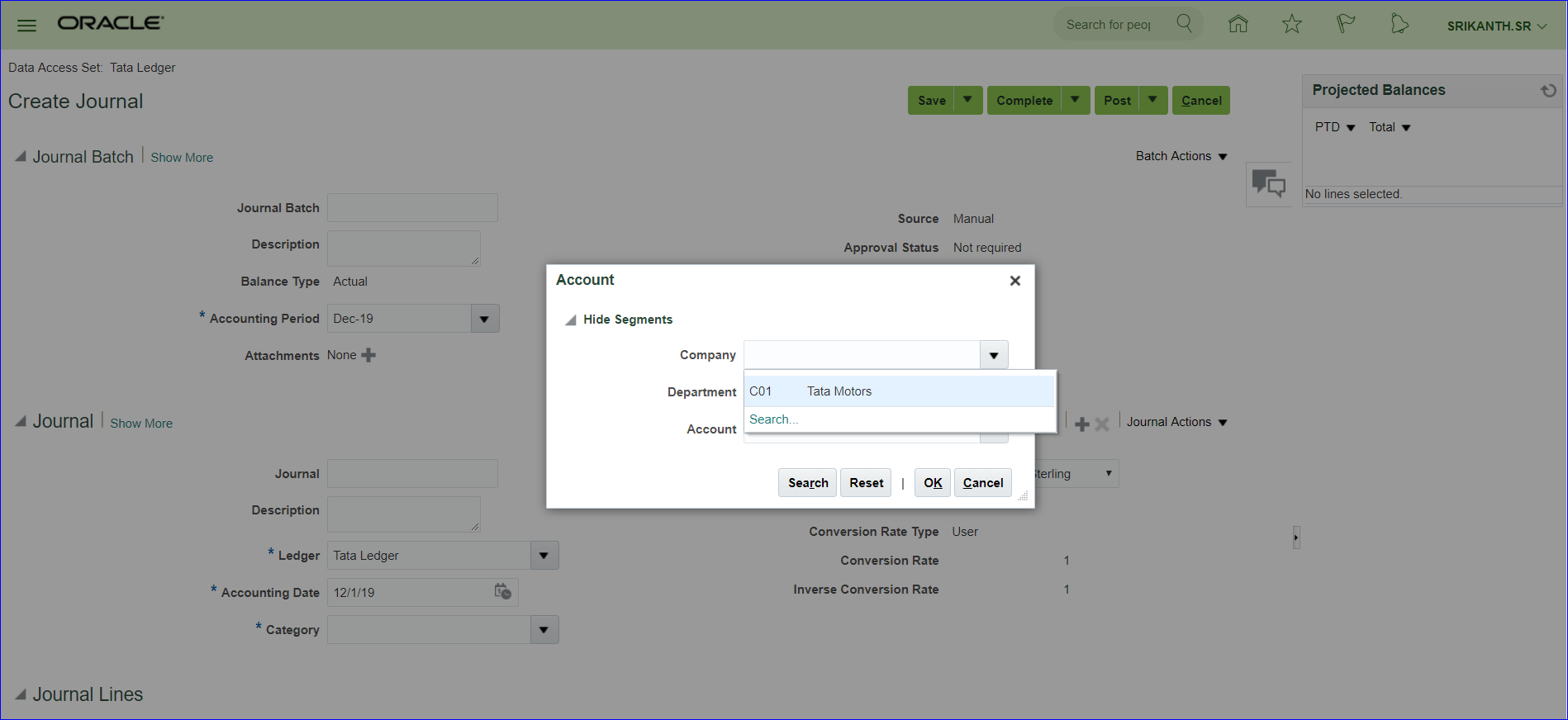

23. Security Rules

| EBS | Fusion |

| We enable at segment level | We enable at value set level |

i) Create Security rule

C01 – Allow; C02- Dont allow

FSM >> ‘Manage Chart of Accounts Value Set Values’ >> Search value set code: Tata Company Value Set >> Select the line and click on Edit >> Enable ‘Security enabled’ >> Data Security Resource Name: Tata_Security_Rule >> Save >> Click on Edit Data Security >> Condition tab >> Create

Save

Policy tab >> Create >> General Information tab – Name: Tata_Security_Rule; Start date: SYSDATE; Module: General Ledger >> Role tab >> Add >> Role name: General; Application: fscm >> Search >> Select General Accounting Manager >> Apply

Rule tab >> Row set: Multiple values; Condition: AllowC01; Description: AllowC01 >> Save and Close

Save and Submit

ii) Create new user (SRIKANTH.SR) and assign role (General Accounting Manager – ORA_ code) to user

iii) Provide data access for user

Save and Close

iv) Run LDAP

→ Retrieve Latest LDAP Changes

→ Import User and Role Application Security Data

v) FSM >> ‘Manage Chart of Accounts Structures’ >> Search Key Flexfield Name: Accounting Flexfield >> Deploy Flexfield if not deployed.

vi) Create Journal

Login as SRIKANTH.SR user and create Journal. In LOV we can see only C01.

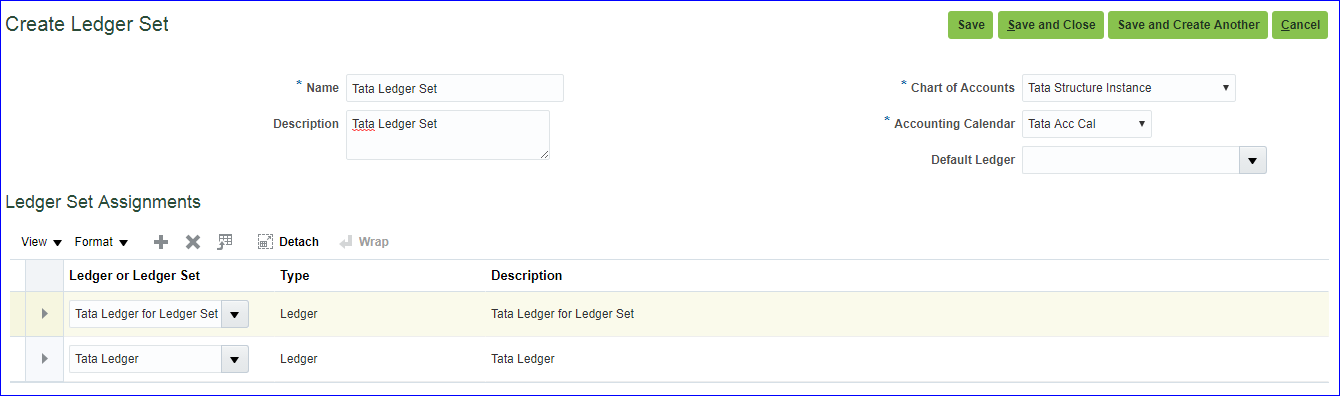

24. Create Ledger Set

Grouping of Ledgers which has same COA and Calendar (currency could be different). For this purpose we create one more ledger along with our Tata Ledger.

i) Create new Ledger (Tata Ledger for Ledger Set)

Implementation project >> ‘Manage Primary Ledgers’ >> Create

Save and Close

Specify Ledger Options >> Click on Select Scope value >> Primary Ledger: Select and Add >> Apply and Go to Task >> Select your new Ledger >> Save and Close

Save and Close

Review and Submit Accounting Configuration >> Submit >> After the successful completion of job, verify the status of Ledger ‘Manage Primary Ledgers’ and look for newly created Ledger.

ii) Create Ledger set (Tata Ledger Set)

Implementation Project >> ‘Manage Ledger Sets’ >> Create

Save and Close

iii) Create new user and assign GL role to user

User is SRIKANTH.LS and assigned role is General Accounting Manager (Code: GL_)

v) Assign data access for user

FSM >> ‘Manage Data Access for Users’ >> Create

Save and Close

vi) Run LDAP job – Retrieve Latest LDAP Changes

vii) Open periods in new Ledger (Tata Ledger for Ledger Set)

Login as SRIKANTH.LS user >> General Accounting >> Period Close

viii) Create Journal

For one ledger set we get two ledgers

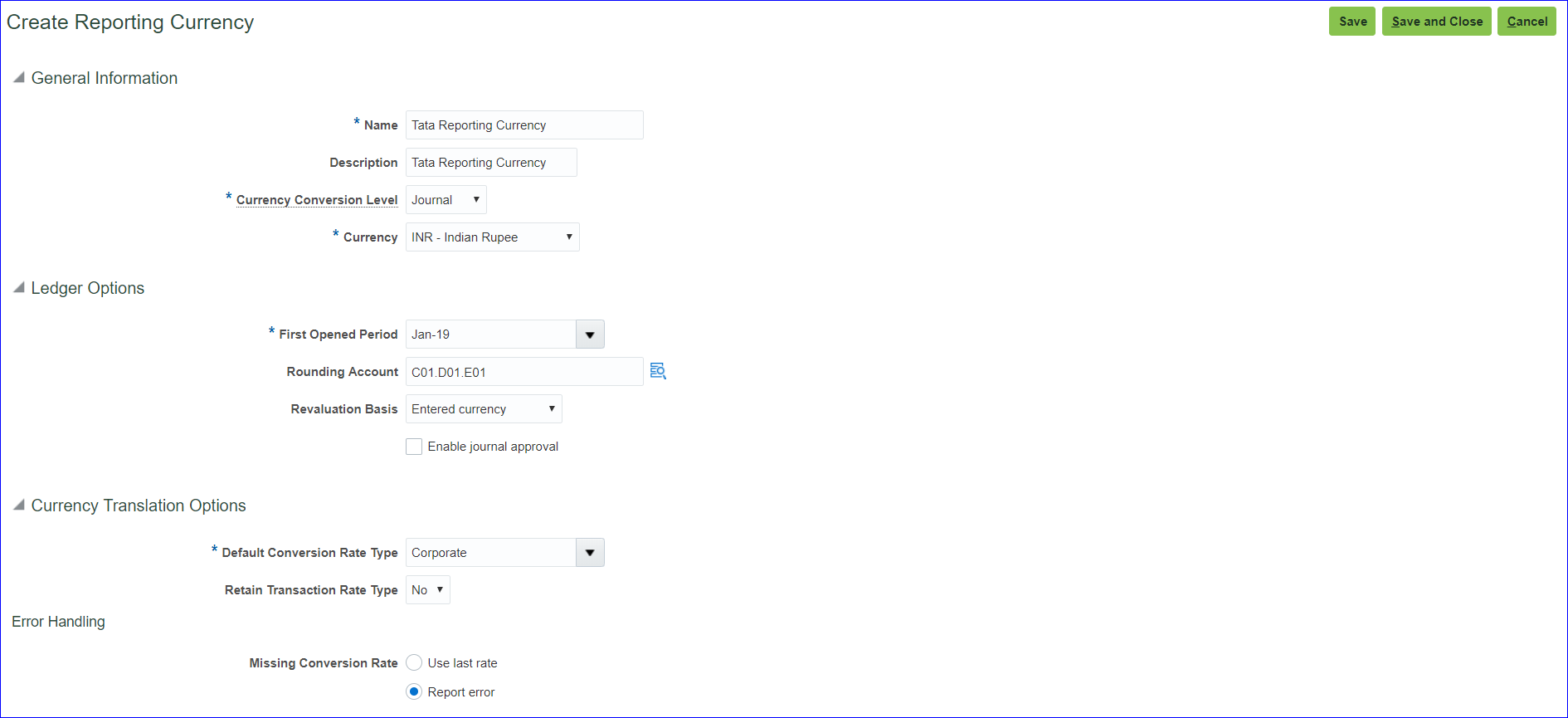

25. Creation of Reporting Ledger

i) Create reporting ledger (INR)

In implementation project >> ‘Manage Reporting Currencies’ >> Go to Task >> Create

Creation of reporting currency = Creation of reporting ledger

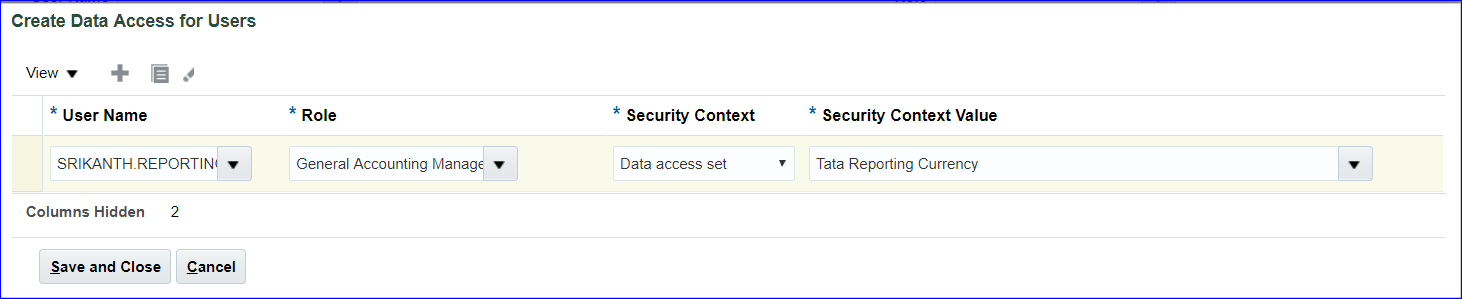

ii) Create new user & assign GL roles to user

SRIKANTH.REPORTING — General Accounting Manager (ORA_ code)

iii) Assign data access set for user

‘Manage Data Access for Users’ >> Create

iv) Run standard jobs

a) Retrieve Latest LDAP Changes

b) Import User and Role Application Security Data

v) Define daily rates (GBP & INR)

FSM >> Manage Daily Rates >> Daily Rates tab >> Create in Spreadsheet

| *From Currency | GBP |

| *To Currency | INR |

| *Conversion Rate | Corporate |

| *From Conversion | SYSDATE |

| *To Conversion Rate | SYSDATE |

| Conversion Rate | 90 |

Create Daily Rates tab >> Submit

vi) Open periods in reporting ledger

Login as SRIKANTH.REPORTING >> General Accounting >> Period Close >> Click on General Ledger (Never Opened) >> Open till current period

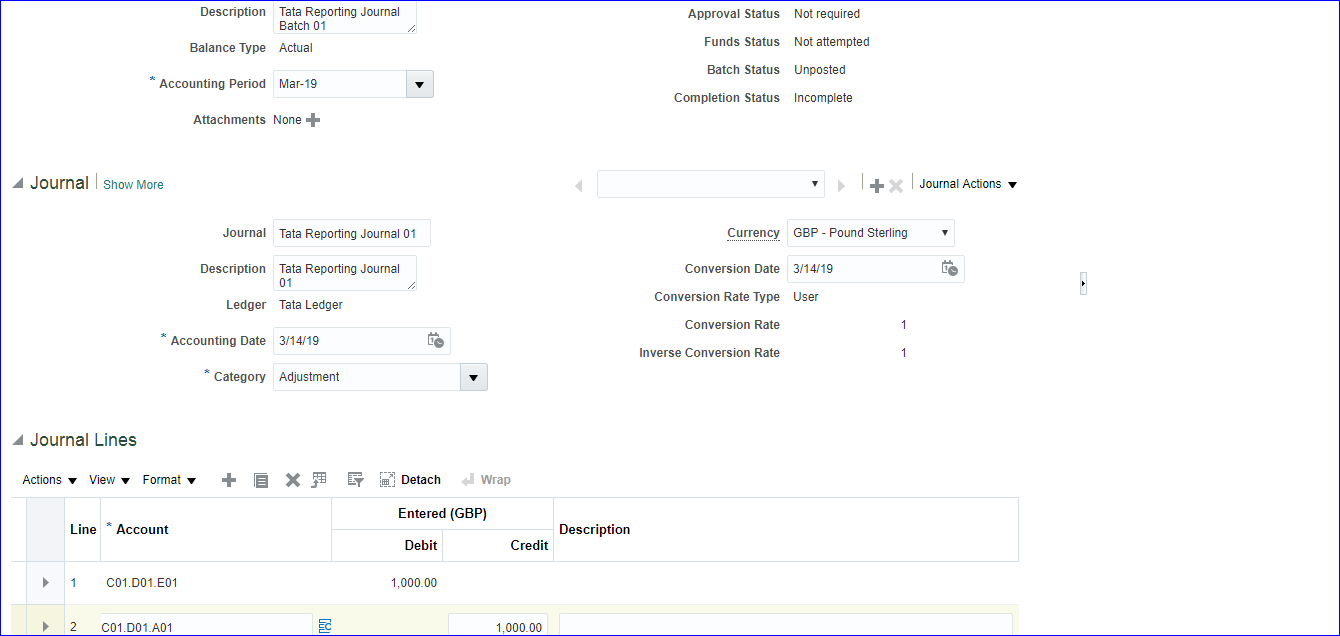

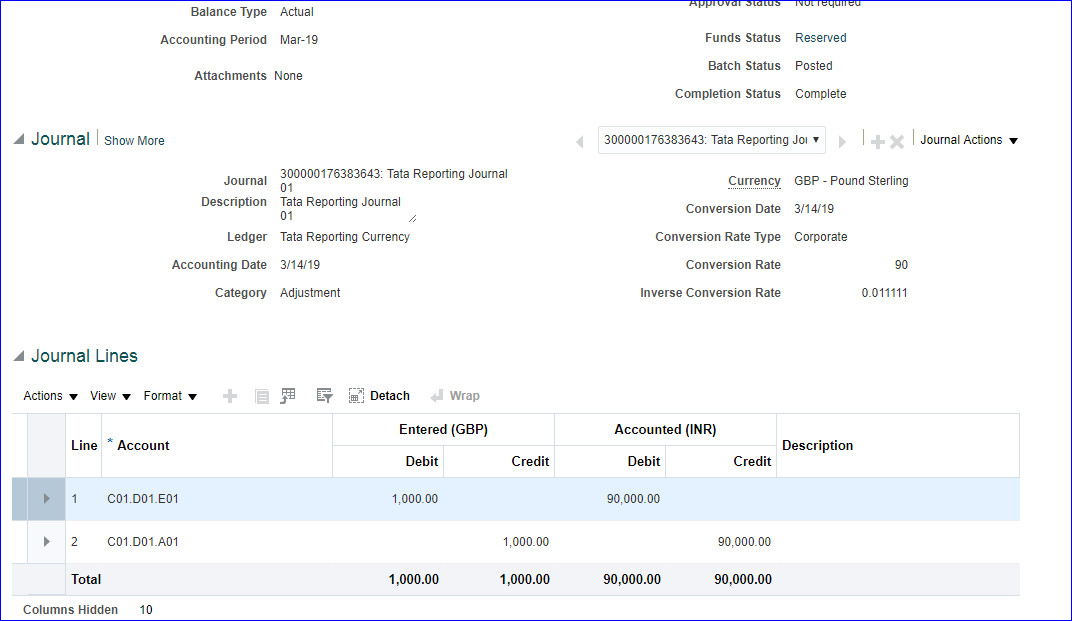

vii) Create Journal in primary ledger (Tata Ledger) & Post

Login as SRIKANTH.G >> Create Journal

Save >> Complete >> Post

Save >> Complete >> Post

viii) Find Journal in reporting ledger in reporting currency

Login as SRIKANTH.REPORTING >> General Accounting >> Journals >> Tasks >> Manage Journals >> Search your Journal

26. Creation of Secondary Ledger

i) Create COA with two segments

Manage Chart of Accounts Structures >> Search for Key Flexfield Name: Accounting Flexfield >> Manage Structures >> Create

Click on ‘Manage Structure Instances’ >> Create

Save and Close >> Deploy Flexfield

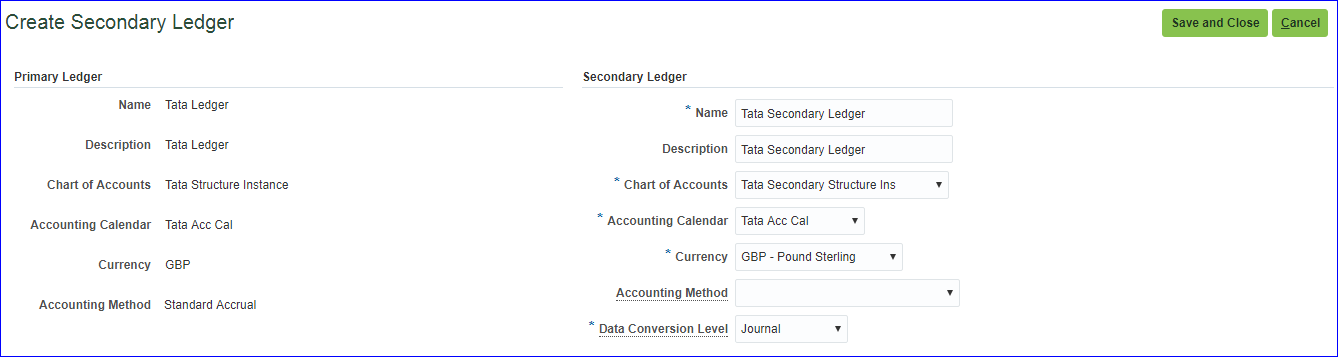

ii) Create secondary ledger

Implementation project >> ‘Manage Secondary Ledgers’ >> Go to Task >> Create

iii) Specify ledger options

Implementation project >> ‘Specify Ledger Options’ >> Go to Task >> Select Specify Ledger Options; Primary Ledger: Tata Ledger; Secondary Ledger: Select and Add >> Apply and Go to Task >> Select the line & Save and Close >> Enter the Retained Earnings Account: C01.O01 >> Save and Close

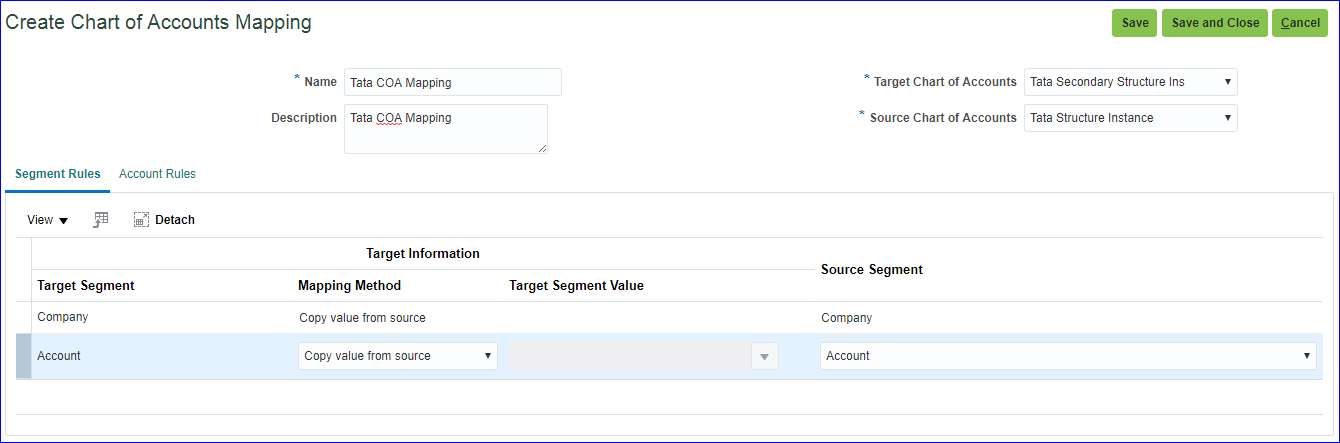

iv) Map primary and secondary ledger COA

Implementation project >> ‘Manage Chart of Accounts Mappings’ >> Go to Task >> Create

v) Create mapping between primary and secondary ledger

Implementation project >> ‘Complete Primary to Secondary Ledger Mapping’ >> Go to Task >> Select Chart of Accounts Mapping: Tata COA Mapping >> Save and Close

vi) Create user & assign GL roles to user

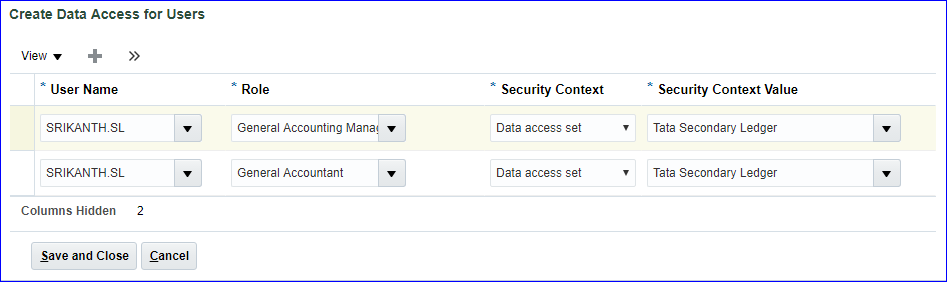

SRIKANTH.SL – General Accounting Manager & General Accountant (ORA_ codes)

vii) Provide data access for user

‘Manage Data Access for Users’

viii) Run LDAP job

a) Retrieve Latest LDAP Changes

b) Import User and Role Application Security Data

ix) Open periods in secondary ledger

Login as SRIKANTH.SL >> Period Close >> Click on General Ledger (Never Opened) >> Open till current period

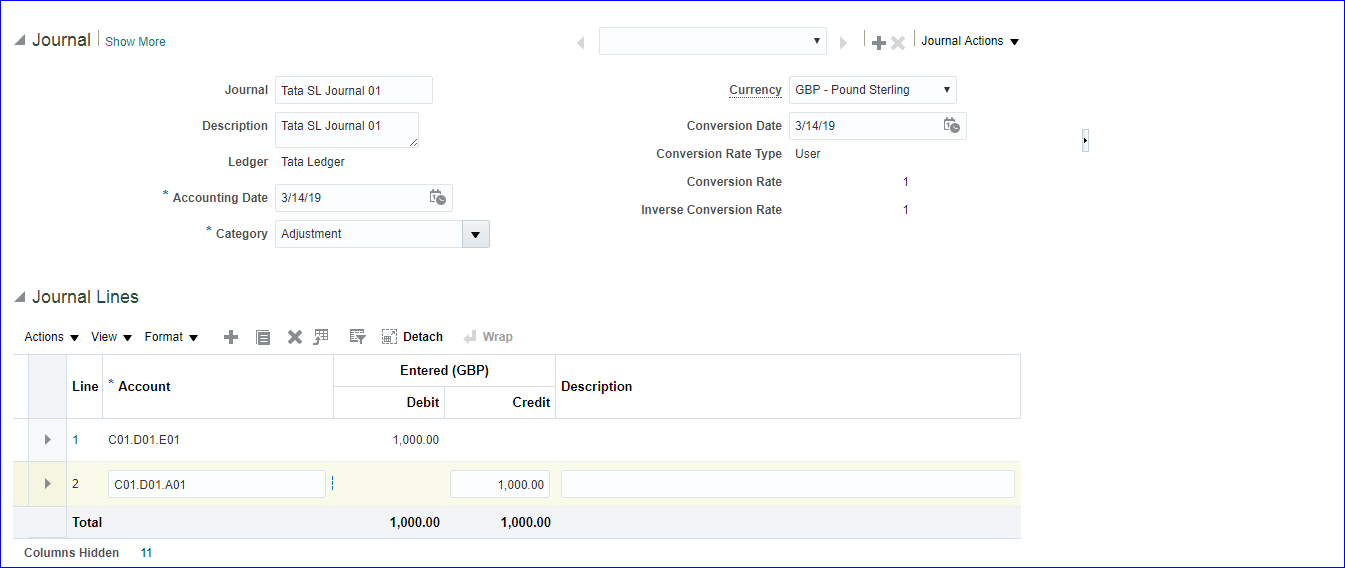

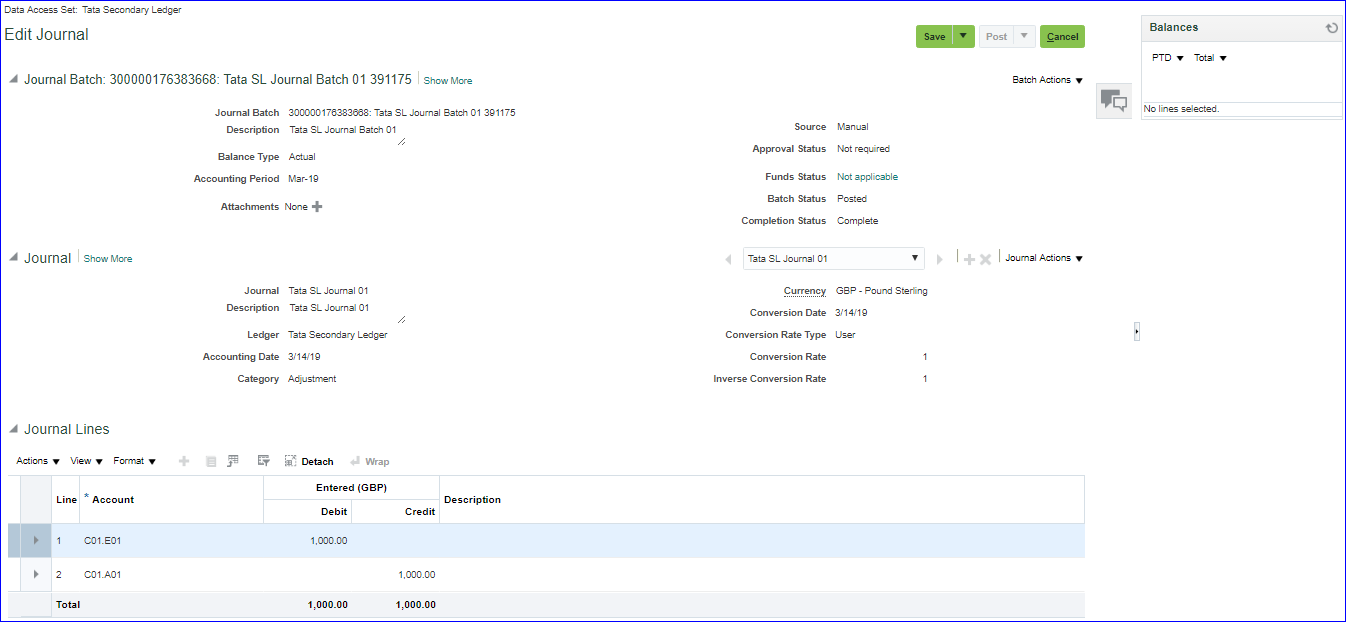

x) Create Journal in primary ledger

Login as SRIKANTH.G >> Create Journal

Save >> Complete >> Post

xi) Find Journal in secondary ledger

Login as SRIKANTH.SL >> Manage Journals >> You can post

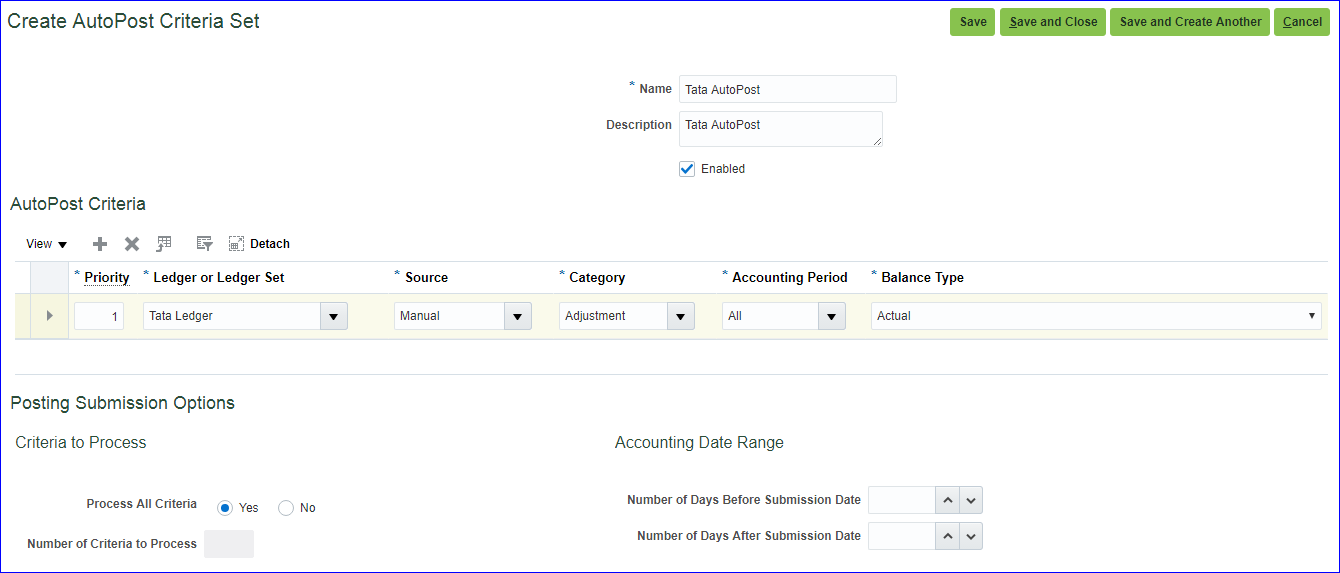

27. Auto Posting

Implementation Project >> Manage AutoPost Criteria Sets >> Create

Save and Close

Create Journal with Category as ‘Adjustment’ >> Save >> Complete >> Cancel (Do not post)

General Accounting >> Journals >> Tasks >> Run AutoPost >> AutoPost Criteria Set: Tata AutoPost

i) If you click on Submit all the eligible Journals will be posted.

ii) If you want to schedule this job then click on Advanced >> Schedule tab >> Run: Using a Schedule; Frequency: Select your frequency.

Finally after Submission verify your Journal batch status which should be Posted.

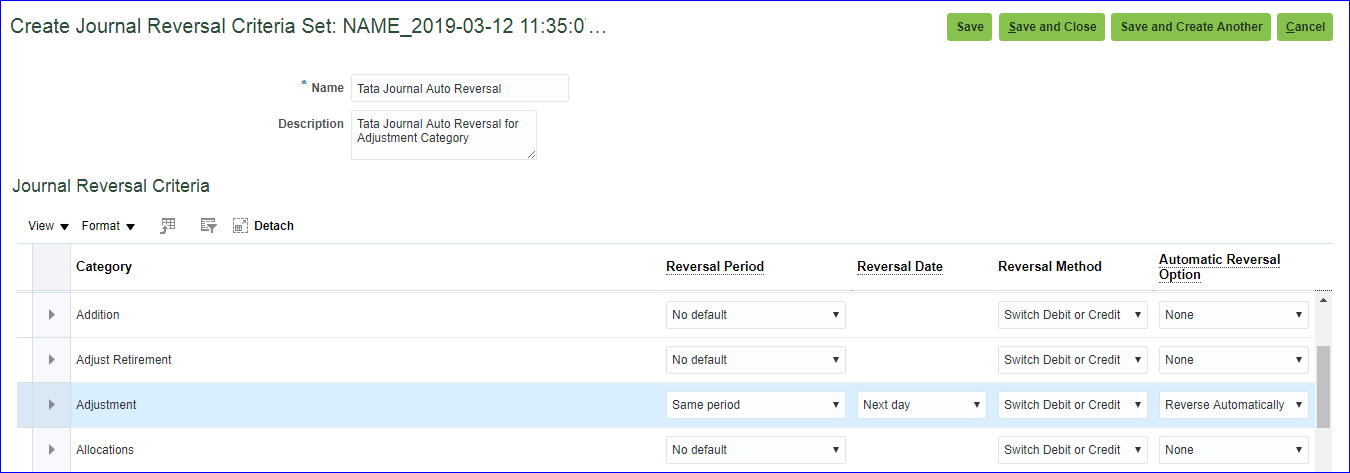

28. Auto Reversal

Implementation project >> ‘Manage Journal Reversal Criteria Sets’ >> Create

Save and Close

Implementation project >> ‘Specify Ledger Options’ >> Select Journal Reversal Criteria Set: Tata Journal Auto Reversal >> Save and Close

Create Journal with Category as ‘Adjustment’ >> Journal Batch: Tata Auto Reversal Journal Batch 01; Journal: Tata Auto Reversal Journal 01 >> Save >> Complete >> Post

General Accounting >> Journals >> Tasks >> Run AutoReverse >> Enter parameters >> Submit.

For scheduling go with Advanced

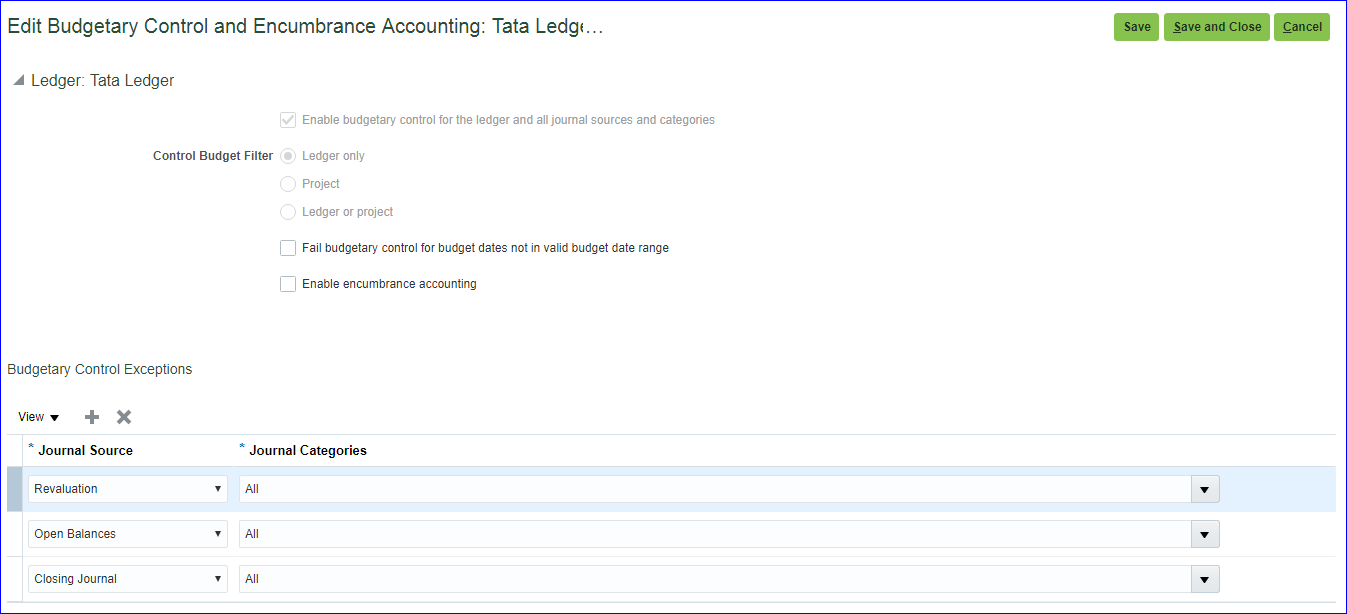

29. Create Budget

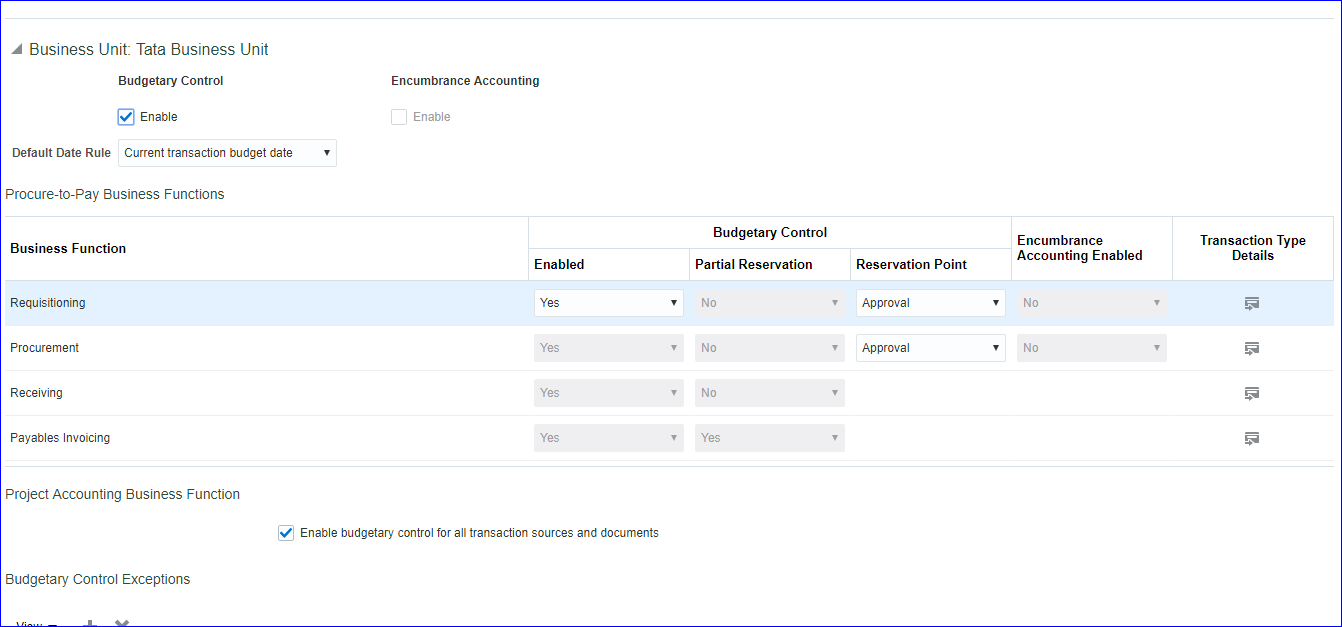

i) Define Budgetary Controls

Implementation project >> ‘Define Budgetary Controls’ >> Manage Budgetary Control >> Click on our Ledger name

Save and Close

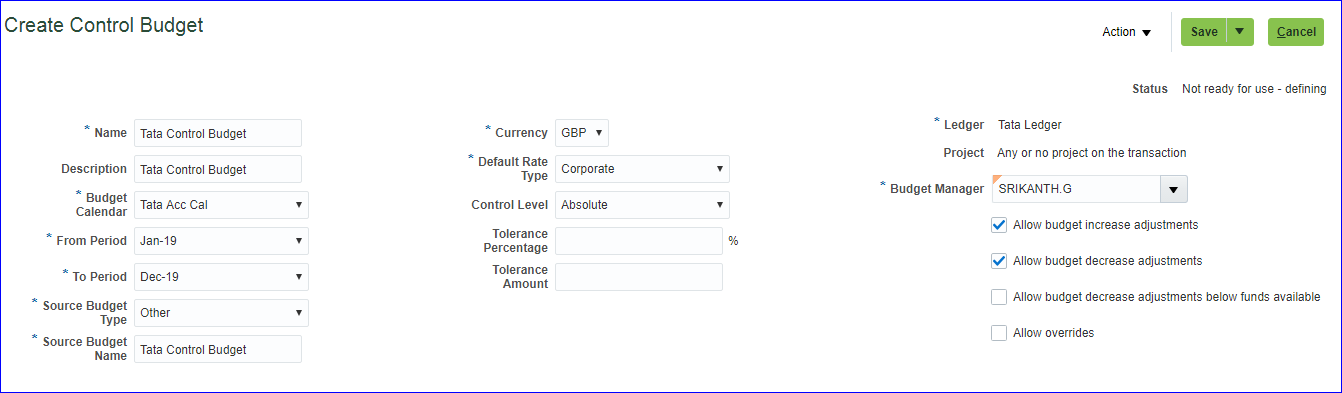

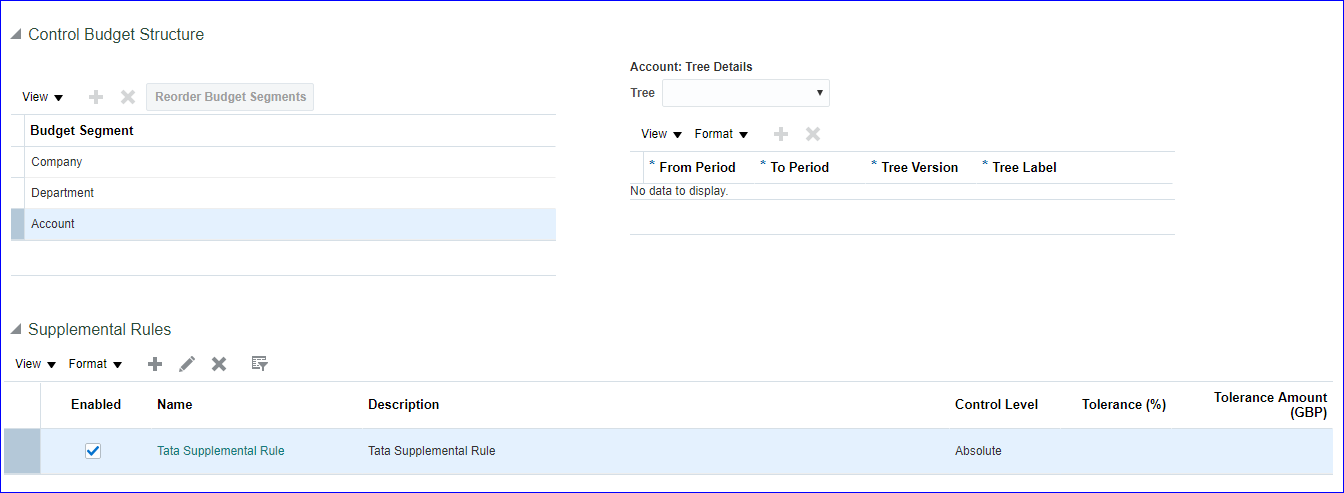

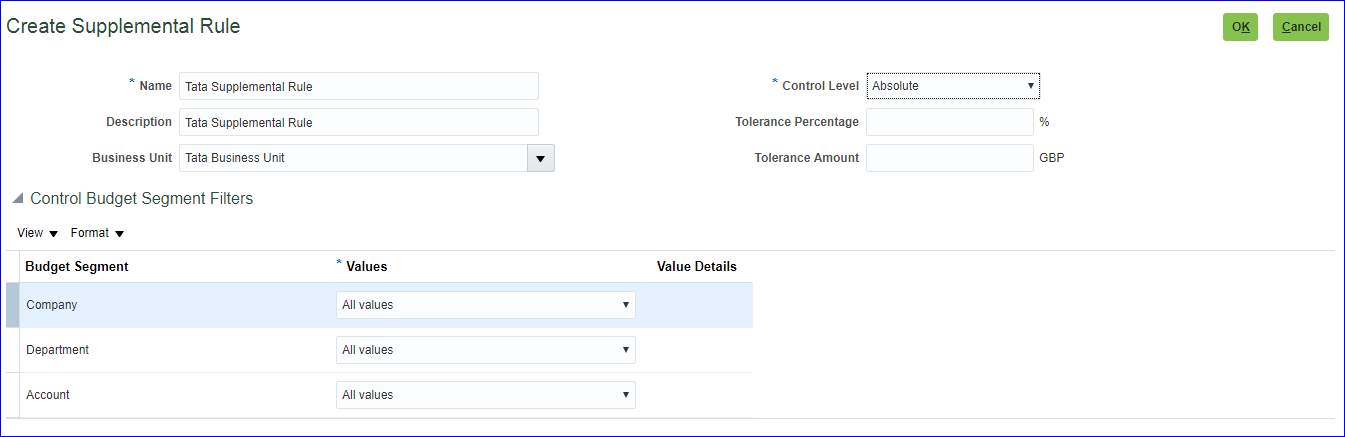

ii) Create Control Budget

‘Manage Control Budgets’ >> Create

Ok

Action >> Prepare for use

iii) Assign Budget role to User

Security Console and assign role ‘Budget Analyst’ and ‘Budget Manager’ to your user

iv) Assign data access for user

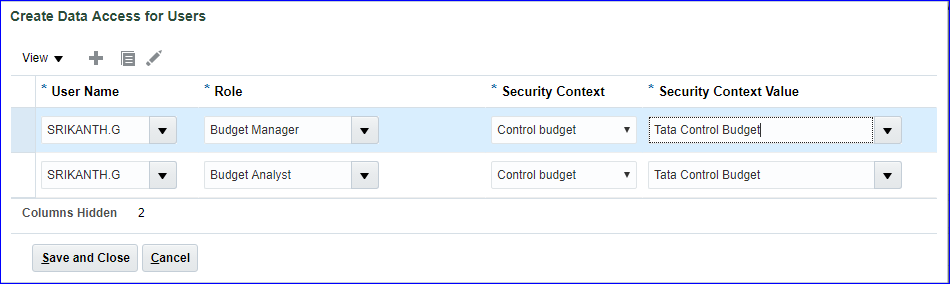

FSM >> ‘Manage Data Access for Users’ >> Create and above two roles to your user

v) Run LDAP job — Retrieve Latest LDAP Changes

vi) Open Budget periods

Budgetary Control >> Tasks >> Budget Period Statuses >> Click on Control budget name >> Change the status to Open for all periods >> Save and Close

vii) Prepare Budget data

Budgetary Control >> Tasks >> Enter Budgets in Spreadsheet >> Control Budget: Tata Control Budget; Start Period: Jan-19; End Period: Dec-19; Budget Entry Name: 2019 12-03-19 12:53:46 PM >> Create Spreadsheet

| *Company[..] | C01 |

| *Department[..] | D01 |

| *Account[..] | E01 |

| Jan-19 till Dec-19 enter same value | 25,000 |

Enter Budget Amounts >> Import Amounts as Entered

Budgetary Control >> Tasks >> Review Budget Entries >> Control Budget: Tata Control Budget; From Budget Period: Jan-19; To Budget Period: Dec-19 >> Search >> Here we can see the imported amount

viii) Create Journal

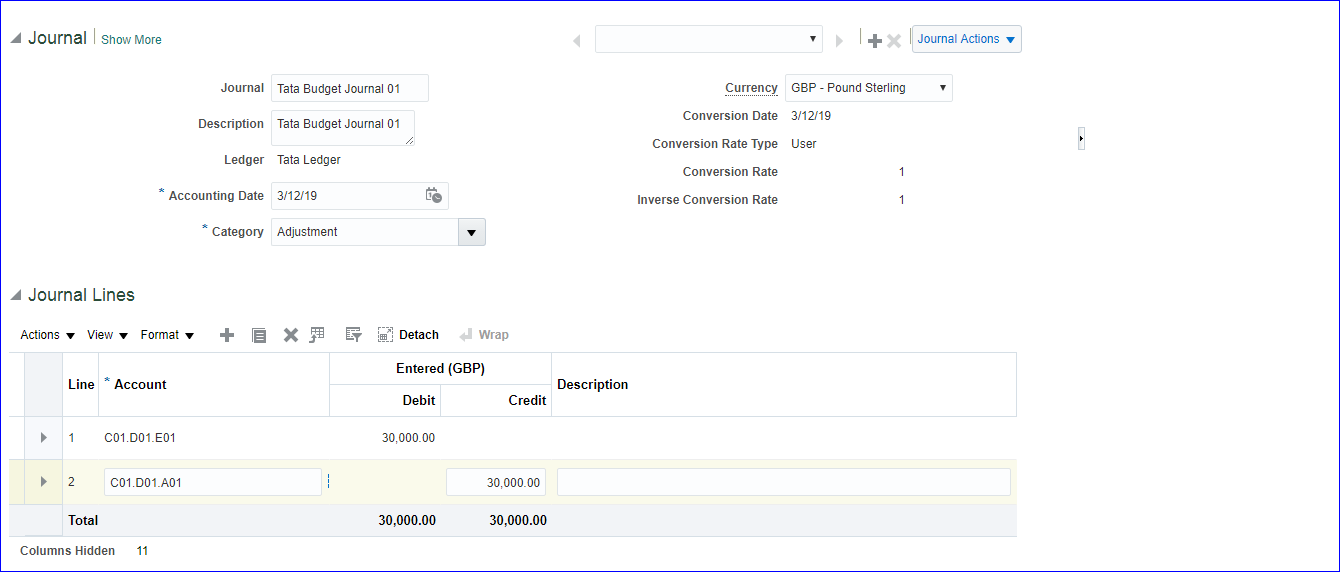

Create Journal with Category as ‘Adjustment’ >> Journal Batch: Tata Budget Journal Batch 01; Journal: Tata Budget Journal 01

Save >> Complete >> Post

30. Journal Approval + Revaluation + Translation + Consolidation Pending

i) Create Approval group

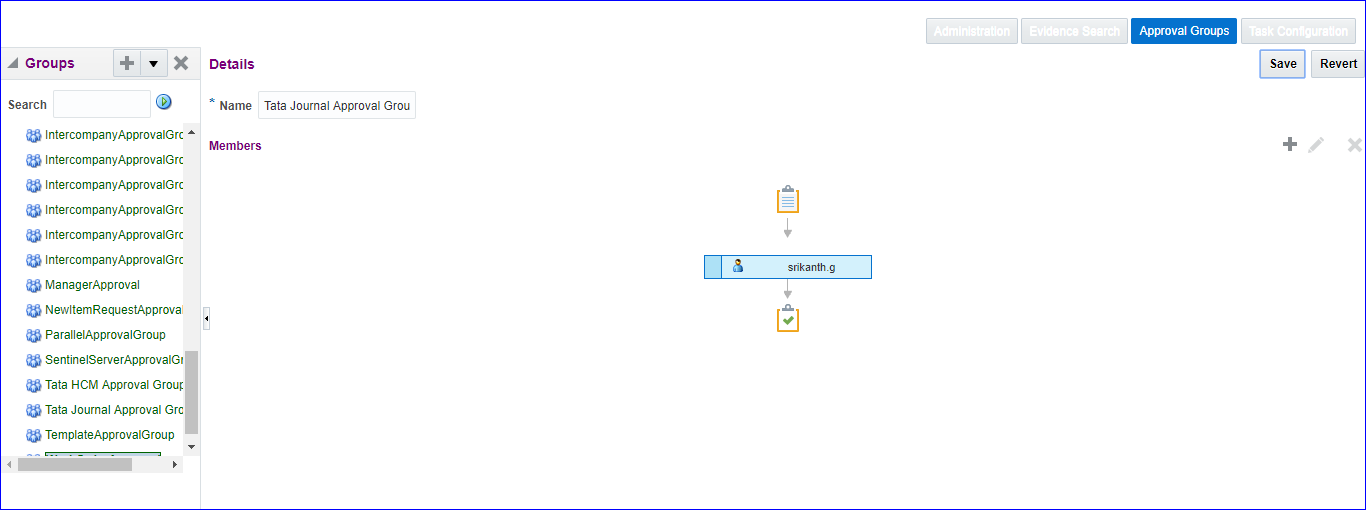

FSM >> ‘Manage Approval Groups’ >> Create

Save

ii) Create Approval rule

Rule is <= 10k.

On above click on Task Configuration >> Below search, select ‘FinGlJournalApproval’ and click on Edit >> Assigness tab

iii) Enable Journal approval for Ledger

iv) Enable Journal approval for Sources

v) Create Journal

31. 1z0-960 dumps

Below are correct:

NO.1 You need to integrate Fusion Accounting Hub with external source systems used for Billing.

Identity the step that is not correct when implementing this integration.

- Analyse external system transactions.

- Capture accounting events.

- Determine the accounting impact of transactions.

- Create the accounting in the source system and then import the journal entries into subledger accounting.

Answer: D

NO.2 You need to build a complex account rule. Which four value types can you use in your

Definition?

- Value Set

- Constant

- Existing Account Rule

- Account Combination

- Mapping Set

- Source

Answer: A,B,C,F

NO.3 Your customer wants to secure their primary balancing segment values to prevent employees of one company from entering or viewing data of another company. You only need this for General Ledger balances and reporting. What two security features should you use?

- Data Access Sets using an Access Set Type of Primary Balancing Segment

- Cross-Validation Rules

- Segment Value Security

- Balancing Segment Value Assignment to Legal Entities

Answer: A,C

Explanation:

https://docs.oracle.com/cd/E18727_01/doc.121/e13620/T450006T450009.htm

NO.4 How do you hide accounts with no balances showing #Missing in Smart view?

- Select the Data/Missing check box in the Data Options tab.

- Use Excel functions to hide rows with #Missing assigned

- Choose the Suppress Zeros option under Data options.

- This indicates a database connection issue. Try to reconnect to Fusion Applications.

Answer: A

Reference:

http://www.miamidade.gov/budget/library/bat/smartview-training-manual.pdf

NO.5 You entered a journal and the client is asking for the following information:

* The current account balance

* What the future account balance will be if the Journal is approved and posted

How will you get this information?

- View the Projected Balance region in the Create Journals page.

- Run a Trial Balance before and after posting.

- Use Oracle Transactional Business Intelligence (OTBI) to query General Ledger balances

- Query the account balance online.

Answer: C

NO.8 You are reconciling your subledger balances and you need a report that includes beginning and ending account balances and all transactions that constitute the account’s activities. What type of report will provide this type of information?

- An Online Transactional Business Intelligence (OTBI) report to create ad hoc queries on

transactions and balances

- Account Analysis Reports

- Journals Reports

- Aging Reports

Answer: C

NO.13 What are the two benefits of having the Essbase cube embedded in Fusion General Ledger?

- General ledger balances are multidimensional, allowing you to perform robust reporting and analysis.

- You can access real-time results for reporting and analysis because every time a transaction is posted in General Ledger, multidimensional balances are also updated simultaneously.

- You no longer need to create and maintain hierarchies because the Essbase cubes are created when you create your chart of accounts.

- Posting performance is much faster.

- Integrating with third-party systems is easier because the Essbase cube provides chart of accounts mapping rules.

Answer: B,D

NO.21 How can your Accounting Manager expedite Journal processing during the time critical month end close?

- by using the Close Status monitor to drill down on the close status across ledgers

- by using the Journals region to view journals Requiring Attention, Requiring Approval, and Pending Approval from Others

- by running the Journals report using Business Intelligence Publisher

- by creating an ad hoc query on journals using Oracle Transactional Business

Intelligence (OTBI)

Answer: C

NO.23 Identify three functions of Functional Setup Manager.

- Provide a central place to access and perform all of the setup steps across Fusion application product

- Automatically generate lists of setup tasks in the correct sequence with dependencies highlighted.

- Automatically mark the status of tasks as Completed after they have been completed.

- Assign setup tasks to individuals with due dates where users must manually update their

completion status.

- Centrally manage the close processes across subledgers and ledgers.

Answer: A,B,E

NO.30 Your new accountants have been making mistakes in reconciling accounts assigned to them. Your balances have either spiked or dropped 30-40% every period due to human error. This causes delays in reconciliation. What feature can you use to be proactively notified of account anomalies in a more timelymanner?

- Smart View

- Financial Reports with Embedded charts

- Account Monitor

- Account Inspector and its charts

Answer: A

NO.32 Your customer wants to prevent their department managers from viewing the results of other departments where they have no management authority.

What should be implemented for this type of security?

- Data Access Sets

- Cross-Validation Rules

- Segment Value Security

- Role-Based Access

Answer: C

NO.34 Who are the three primary Functional Setup Manager users?

- End Users that perform transaction processing

- Implementation Project Managers and Consultants

- System Administrators

- Application Developers

- C-Level Executives

Answer: A,B,C

Explanation:

http://docs.oracle.com/cd/E29505_01/fusionapps.1111/e20365/F530303AN100AE.htm

NO.35 Fusion Accounting Hub includes Hyperion Data Management. For which two tasks can Hyperion Data Management be used?

- chart of accounts hierarchy maintenance

- integration with transactions from external feeder systems

- chart of accounts master data maintenance

- data access and security

- cross-validation rules

Answer: A,C

Explanation:

http://docs.oracle.com/cd/E25178_01/fusionapps.1111/e20374/F484243AN100CE.htm

NO.38 Which three objectives must be considered when designing the chart of accounts?

- A. Effectively manage an organization’s financial business.

- Consider implementing a single, global chart of accounts

- Anticipate growth and maintenance needs as organizational changes occur.

- Limit the number of segments to those you need today to reduce data entry.

- Try to use all 30 segments and 25 characters per segment because you cannot change It later.

Answer: A,B,C

NO.40 You are required to change today’s daily rates for converting GBP to USD. What are three ways in which you can update existing daily rates?

- Use the spreadsheet loader from the Currency Rates Manager.

- Import daily rates through the Daily Rates open interface table.

- Update rates manually using the Currency Rates Manager, which can be accessed only from the Functional Setup Manager

- Update rates manually using the Currency Rates Manager, which can be accessed from the Functional Setup Manager or the General Ledger’s Period Close work area.

- Edit existing transactions and update the rates manually.

Answer: B,C,D

NO.42 You want to monitor the close process of all your financial subledgers and ledgers.

How can you quickly obtain this information?

- Access each subledgers’ calendar and General Ledger’s Manage Accounting Periods page to view the status of each period.

- Use the Manage Accounting Periods page to view the status of all subledgers and ledgers.

- Use Close Monitor in General Accounting Dashboard.

- Run Closing Status reports.

Answer: D

NO.43 You want to display OTBI reports and graphs in PowerPoint to show general ledger or subledger data. How do you accomplish this?

- Download OTBI reports and charts to a spreadsheet and then copy and paste the spreadsheet to PowerPoint

- Use SmartView to create reports and charts using general ledger and subledger subject areas embed the charts/reports into PowerPoint

- Use Smart View and Oracle BI EE View Designer to create reports in PowerPoint, Word, and Excel.

- Use Account Inspector and then export to Excel and copy and paste into PowerPoint.

Answer: C

Reference:

http://www.oracle.com/webfolder/technetwork/tutorials/obe/fmw/bi/biee/r1013/smartview/smart_view.htm

https://docs.oracle.com/cd/E51367_01/financialsop_gs/FASVO/ch16s02.html

NO.45 You defined a tree or hierarchy, but you are unable to set its status to Active.

What is the reason?

- Chart of accounts was not deployed.

- Accounting Configuration was not submitted-

- An Audit process needs to be successfully performed before a tree version can be set to Active.

- Two tree versions were not defined

Answer: D

NO.47 Which statement is true when creating an Implementation Project for Financials Cloud?

- The Implementation Project is preconfigured and cannot be deleted or changed.

- Plan your implementation project carefully because you cannot delete it or make changes later.

- You must select the Offering “Financials,” and each individual product or option to perform the setup for each product in Financials Cloud.

- Selecting the Offering “Financials,” automatically allows you to perform the setup for all

Financials Cloud products.

- You only need to make the project name unique, then you can perform the setup for any product family, such as Financials, Procurement, Human Capital Management and Supply

Cham Management.

Answer: C

NO.53 Your customer operates three shared services that perform accounting functions across 50 countries. What feature allows them to share setup data, such as Payment Terms, across Business Units?

- Reference Data Sets

- Business Units functions

- None. Setup data is partitioned by Business Unit and must be defined separately per Business Unit.

- Data Access Sets

Answer: B

NO.55 You want to automatically post journal batches imported from subledger source to prevent accidental edits of deletions of the subledger sources journals, which could cause an out – of-balance situation between your subledgers and general ledger.

Which two aspects should you consider when defining your AutoPost Criteria?

- Use the All option for category and accounting period to reduce maintenance and ensure that all imported journals are included in the posting process.

- Include all of your sub ledger sources in the AutoPost Criteria. Divide up criteria sets by subledger source only if you need to schedule different posting times.

- Create your AutoPost criteria using minimal source and categories.

- Schedule your AutoPost Criteria set to run during off-peak hours only

Answer: BC

NO.59 Which repot show you differences between your subledger balances and General Ledger balances?

- Payables Trial Balance, Receivables Trial Balance, and General Ledger Trial Balance reports

- Payables and Receivables Aging Reports with the General Ledger Trial Balance report

- C. Payables to Ledger Reconciliation Report and the Receivables to Ledger Reconciliation Report

- General Ledger Financial Statements and the Accounts Payable and Accounts Receivables Invoice Registers

Answer: C

NO.67 What’s the difference between subject areas that append the word “Real Time” and those that do not?

- There is no difference.

- The “Real Time” subject areas are based on real-time transactions and all others are based on Historical data.

- The “Real Time” subject areas are based on real-time transactions in Fusion Applications, and all others are based on data stored in the Oracle Business Intelligence Applications data warehouse.

- The “Real time” subject areas are based on sub ledger transactions and all others are based on general ledger balances.

Answer: B

NO.68 You are required to enter a high volume of users into the system. What does Oracle consider best practice to do this?

- Use SQL to populate the HR interface tables and load employees in bulk.

- Use the spreadsheet templates available in Oracle Enterprise Repository (OER) and then import users into Fusion Applications.

- Use the “Hire an Employee” user interfaceto inter each user manually.

- Use the spreadsheet available in Oracle Identity Manager (OIM) to import users.

- Use the “Enter a Supplier” user interface to enter each user manually.

Answer: D

NO.70 Journal approval uses Approvals Management Extension (AMX). Which AMX builder method is most effective in routing the journals to the Accounting Manager when the General Ledger Accountant enters the journal?

- Supervisory level based on HR Supervisors

- Job level

- Position

- Approval Group

Answer: D

NO.76 Your user forgot the password. How do you resolve this?

- Use the Manage Users page to update the user’s information and change the password.

- Use Oracle Identity Management (OIM) to reset the user’s password.

- Log in to the user’s machine as an Administrator and change the password from the login pa

- Use Access Policy Manager (APM) to reset the user’s password.

- Create a new user ID and password for the user.

Answer: B

Reference:

http://docs.oracle.com/cd/E21764_01/doc.1111/e15477/pwd.htm#IMINT236

NO.77 What type of user must be defined before you can create an Implementation Project?

- None. The Fusion Applications Superuser, FAADMIN, has full access to create an

Implementation Project.

- A full-time employee that has the FSM Superuser role assigned

- None. The OIM system administrator user ID, XELSYSADM, which is assigned by the person provisioning the system, has full access.

- Implementation Users

- All roles that will be used throughout the implementation

Answer: E

NO.78 What is the most efficient way to add a new year to the accounting calendar?

- Add the periods manually

- Use the Add Year button

- Import the periods from a spreadsheet

- The application automatically populates the next year when you open the first period a new fiscal year.

Answer: D

Reference:

https://docs.oracle.com/cd/E13228_01/fscm9pbr0/eng/psbooks/fspf/chapter.htm?File=fspf/ htm/fspf13.htm

NO.79 Alter submitting the journal for approval, you realize that the department value in the journal incorrect. How do you correct the value?

- Delete the journal and create a new journal.

- Update the journal through workflow

- Click the Withdraw Approval button in the Edit Journals page and edit the journal.

- Reverse the journaland create a new one.

Answer: B

NO.80 What Is Oracle Essbase?

- A robust reporting and analysis tool

- A relational database

- A data ware house

- A multidimensional Online Analytical Processing (OLAP) server that is embedded in

Fusion GeneralLedger

Answer: B

Reference:

http://docs.oracle.com/cd/E12825_01/epm.111/esb_dbag/frameset.htm?hybrid.htm

NO.81 You need to create a month-end reporting package for an upcoming Audit Committee meeting. You have 10 financial reports that you will need to share with executives and auditors. In which three ways do you accomplish this?

- Using Workspace, assemble multiple reports into a book.

- Use a Report Batch to run reports at a specific time to create set of snapshot reports based on accounting information at that specific point in time.

- Users can drill down on snapshot reports for future analysis.

- The report contained in the book can be printed or viewed individually or as an entire book that includes a table of contents.

- Snapshot reports can only be viewed online.

Answer: A,B,D

NO.82 Which two delivered roles can access the full functionality of Functional Setup Manager,

- A. Application Implementation Manager

- Functional Setup Manager Superuser

- Application Implementation Consultant

- Any functional user

- IT Security Manager

Answer: A,C

NO.84 What are the tables or views from which the Create Accounting program takes source data that is used in rules to create journal entries?

- Transaction Objects

- Event Entities

- Mapping Sets

- Accounting attributes

- Event Classes

Answer: A

Reference:

https://docs.oracle.com/cd/E18727_01/doc.121/e13420/T193592sdextchap.htm

NO.89 You operate in a country whose unstable currency makes it unsuitable for managing your day-to-day business. As a consequence, you need to manage your business in a more stable currency while retaining the ability to report in the unstable local currency.

What would be your recommendation when defining ledgers?

- Define Balance-Level Reporting Currencies in the more stable currency and run

Translation as often as you need.

- Use Journal-Level or Subledger-Level Reporting Currencies denominated in the more stable currency.

- Run Revaluation as often as you need to the more stable currency and report on the more stable currency’s balances.

- Create a secondary ledger that uses a different chart of accounts that is denominated in the more stable currency.

Answer: B

Reference:

http://docs.oracle.com/cd/E15586_01/fusionapps.1111/e20374/F484499AN16AFA.htm

NO.90 Which two types of journals can be automatically routed through the journal approval process?

- Allocation journals

- Revaluation journals

- Manual journals

- Sub ledger journals

- Journals imported from third-party systems

Answer: C,E

NO.98 The budget managers specify the budget accounts they want to monitor and decide on percentage threshold of funds availability. Where must you define the details while analyzing budget balances in the Budget Account Monitor page?

- Budget Group

- Application Development framework Desktop Integral ion (ADFdi)

- Account Group

- Budget Controller

- Budget Account Group

Answer: C

NO.101 Your customer wants to create fully balanced balance sheets for the Company, Line of Business, and product segments for both financial and management reporting.

What is Oracle’s suggested best practice for doing this?

- Create a segment that acts as the primary balancing segment and create values that represent a concatenation of all three business dimensions.

- Use account hierarchies to create different hierarchies for different purposes and use those hierarchies for reporting.

- Create three segments and qualify them as the primary balancing segment, second, and third balancing segments, respectively.

- Create two segments where the first segment represents the concatenation of Company and Line of Business, and then enable secondary tracking for the Product Segment.

Answer: C

Reference:

http://docs.oracle.com/cd/E15586_01/fusionapps.1111/e20374/F484498AN122F4.htm

NO.102 Your Company has complex consolidation requirements with multiple general ledger instances. You are using Oracle Hyperion Financial Management to consolidate the disparate General Ledgers. You can typically map segments between your general ledger segment to a Hyperion Financial Management segment, such as Company to Entity, Department to Department, and Account to Account. What happens to segments in your source general ledger, such as Program, that cannot be mapped Hyperion Financial Management?

- The data is not transferred.

- Data is summarized across segments that are not mapped to Hyperion Financial Management

- Errors occur for unmapped segments. You must map multiple segments from source general ledgers to the target segment in Hyperion Financial Management.

- The unmapped segments default to future use segments in Hyperion Financial Management

Answer: C

NO.105 You want to be notified of anomalies in certain account balances in real time. What is the most efficient way to do this?

- Perform an account analysis online.

- Open a Smart View file saved on your desktop.

- Create an Account Group using Account Monitor.

- Use Account Inspector.

Answer: A

Below are partial correct

NO.104 Which two General Ledger work would you assign to all your entry-level General Ledger accountants?

- Journals Work Area

- Period Close Work Area

- Financial Reporting Center

- General Accounting Dashboard

Answer: A,D

NO.103 You are reconciling your Payables the Receivables balances against the General Ledger. You are using the Payables to Ledger Reconciliation report. You notice discrepancies between the balances in the subledgers, subledger accounting, and general ledger.

Which three factors are responsible for these out-of-balance situations?

- All sub ledger transactions have been entered but do not have complete accounting.

- Subledger transactions have been accounted and transferred to General Ledger but have not been posted.

- There were manually entered journals against the Payables and Receivables accounts that were posted in General Ledger.

- Intercompany transactions have not been fully processed.

- Period Close processes, such as Revaluation, Translation, and Consolidation have not

Been performed yet

Answer: B,D,E

NO.100 The Accounting Manager requests that a schedule be created to automatically post journals from subledgers at different times. Which journal attribute should you use to set the automatic posting criteria?

- Journal Category

- Journal Source

- Journal Batch

- Journal Description

Answer: C

NO.99 All of your subsidiaries reside on the same application instance, but some of them require a different chart of accounts and/or accounting calendar and currency. There is no minority interest or partial ownerships. What is Oracle’s recommend approach to performing consolidations?

- Use Oracle Hyperion Financial Management for this type of complex consolidation.

- Translate balances to the corporate currency, create a chart of accounts mapping to the corporate Chart of accounts, then transfer balances to the corporate consolidation ledger using the balance transfer program.

- Translate balances to the corporate currency for ledgers not in the corporate currency, use General Ledger’s Financial Reporting functionality to produce consolidated reports by balancing segment where each report represents a different subsidiary.

- Create separate ledgers for each subsidiary that shares the same chart of accounts, calendar, currency and accounting method. Create a separate elimination ledger to enter intercompany eliminations, then create a ledger set across all ledgers and report on the ledger set.

Answer: D

NO.97 You need to define multiple allocation rules as efficiently as possible.

Which three components can be reused across allocation rules?

- Point of View (POV)

- Run Time Prompts (RTP)

- Formulas

- RuleSets

Answer: B,C,D

NO.92 You entered users who are both employees and contingent workers. You want an automated way to assign, reassign, and remove roles from users. What feature do you use?

- Oracle Identity Manager Roles Assignment

- Access Policy Manager’s Role Generation

- Role Mappings

- Data Roles

- You cannot reassign contingent workers.

Answer: C

NO.93 You are implementing Fusion Accounting Hub for your external Accounts Receivables system. The external system sends invoices billed and cash receipts in a flat file, along with the customer classification information. You want the accounting amounts to be tracked by customers too but you do not want to add a Customer segment to your chart of accounts. What is the solution?

- Use the Open Account Balances Listing report that has balances by customer.

- Use the Third Party Control Account feature.

- Use Supporting References to capture customer classification information.

- Capture customer information as the source and develop a custom report using Online

Transactional Business Intelligence (OTBI).

Answer: C

NO.94 Which two methods can your General Ledger accountants use to more easily view large amounts of contained in the tables in their work areas?

- Detach the table to resize it to the maximum size of the monitor

- Export the table to Excel.

- Run a Business Intelligence Publisher report with Excel as the output format.

- Use the Freeze feature on the tables to scroll through large amounts of data.

Answer: A,B

NO.95 You’ve set up the standard accrual with encumbrance accounting for your ledger and you realized that the encumbrance journals are defaulting with current date as the accounting date. What is causing this?

- The subledger accounting option Is set to system date.

- The actual accounting date was set up under the encumbrance accounting Default Date

Rule.

- The system date was set up under the encumbrance accounting Default Date Rule.

- The current transaction accounting date was set up under the encumbrance accounting

Default Date Rule.

- The prior related transaction accounting date was set up under the encumbrance accounting Default Date Rule.

Answer: D

NO.96 Identify three differences between Oracle Transactional Business Intelligence (OTBI) and Oracle Business Intelligence Applications (OBIA).

- OBIA is based on the universal data warehouse design with different prebuilt adapters that canconnect to various source application

- Both OBIA and OTBI provide a set of predefined reports and dashboards and a library of metrics that help to measure business performance

- OBIA works for multiple sources including E-Business Suite, PeopleSoft, JD Edwards, SAP,

andFusion Applications.

- OTBI allows you to create custom reports from real-time transactional data against thedatabase directly

- Cloud customers can use both OTBI and OBIA.

Answer: B,C,D

NO.91 Your customer has a large number of legal entities. The legal entity values are defined in the company segment and the primary balancing segment. They want to easily create eliminating entries for the intercompany activity. What should you recommend?

- Define an intercompany segment in the chart of accounts. The Intercompany module and the intercompany balancing feature in general ledger and sub ledger accounting will automatically populate the intercompany segment with the balancing segment value of the legal entity with which you are trading.

- There is no need to define an intercompany segment. You can track the Intercompany trading partner using distinct intercompany receivable/payable natural accounts to identify the trading partner.

- Define an intercompany segment and qualify it as the second balancing segment to make sure all entries are balanced for the primary balancing segment and intercompany segment.

- There is no need to define an intercompany segment, the Intercompany module keeps track of the trading partners for you based on the Intercompany rules you define.

Answer: B

NO.88 Most of the accounting entries for transactions from your source system use

TRANSACTION_AMOUNT as a source of the entered amount accounting attribute. For some events, you need to use TAX_AMOUNT as the source. At what level can you override the default accounting attribute assignment?

- Event Type

- Journal Line Rule

- Event Class

- Journal Entry Rule Set

- Journal Entry

Answer: D

NO.85 In which two ways can your users customize the Dashboards and Work Areas to suit their individual working styles?

- They can format each table by hiding and showing columns, moving columns, and resizing columns.

- They can use Personalization to move and remove regions from those pages.

- Users have very little control customizing their Dashboards and Work Areas; they can only resize columns.

- They can have the System Administration customize pages for them using Page Composer.

Answer: AB

NO.86 Your customer has many eliminating entries to eliminate intercompany balances.

The General Ledge does not include a purpose-built Consolidation feature.

How would you automate the process of creating eliminating entries, assuming your customer is not using Oracle Hyperion Financial Close Management?

- Use the spreadsheet template that is accessed from the “Create Journal in Spreadsheet” task and import the spreadsheet with the eliminating entries every period.

- Use the General Ledger’s Calculation Manager to define an allocation definition to eliminate entries that you can generate every period.

- There is no way to automate this process if the customer is not using Oracle Hyperion Financial Close Management.

- Create a manual journal that includes the eliminating entries, and then create a copy of the Journal batch every period.

Answer: C

NO.87 Your customer uses Financials Cloud, Projects, Inventory and Procurement.

Which two statements are true regarding intercompany accounting tor these products?

- Each product has its own Intercompany Accounting feature that needs to be set up separately.

- Intercompany Balancing Rules are defined centrally and applied across Financials,

Portfolio Project Management and Supply Chain Management products.

- Within Financials Cloud, Intercompany Balancing Rules are used to balance both cross- ledger intercompany transactions and single ledger intercompany journals.

- They need to license a separate stand-alone Intercompany product that acts as the

Intercompany Accounting Hub.

Answer: A,D

NO.83 Your customer is closing their period and they are using Fusion Intercompany to create physical invoices in Fusion Payables and Receivables. What is the correct order of steps to close Fusion sub ledgers, Fusion Intercompany, and Fusion General Ledger?

- Close Fusion Payables and Receivables periods, close the related intercompany period, and then close the Fusion General Ledger’s period.

- Close Fusion Payables and Receivables periods, close Fusion General Ledger, and then close the related intercompany period

- Close the related intercompany period, close Fusion Payables and Receivables periods, and then Fusion General Ledger.

- You only need to close Fusion Payables and Receivables periods followed by the

Fusion GeneralLedger’s period.

Answer: C

Reference:

NO.71 While troubleshooting the encumbrance entries created for the requisition for your business unit, you noticed that only a few events are triggering the encumbrance journals when you submit he create accounting program.

What are the two events?

- Funds check

- Requisition approved

- Requisition rejected by the buyer

- Submit the requisition for approval

- Checkout and Save the requisition

- Create change request on the requisition after submitting requisition for approval

Answer: B,F

NO.72 Your customer requires physical invoices to be generated in Fusion Payables and Fusion Receivables for the intercompany payables and receivables transactions.

What statement is correct with regard to setting this up?

- You must assign the corresponding Receivables and Payables Business Units.

- You only need to assign the Legal Entity and Organization Contact.

- You must perform additional setup steps for Fusion Payables and Fusion Receivables.

- You can only associate one Intercompany Organization per Legal Entity.

Answer: A

Reference:

http://docs.oracle.com/cd/E27605_01/fscm91pbr2/eng/psbooks/sbil/chapter.htm?File=sbil/htm/sbil25.htm

NO.73 You are implementing Segment Value Security rules. Which two statements are true?

- You can use hierarchies to define rules.

- The Segment Value Security rules do not take effect until you assign the rules to users and products.

- When you enable Segment Value Security on a segment, users will not be able to access any values until you grant access to users and products.

- When you enable or disable Segment Value Security, you do not need to redeploy your chart of accounts.

Answer: A,C

Explanation:

https://docs.oracle.com/cloud/farel8/financialscs_gs/FACSF/F1004387AN145CC.htm

NO.74 You want to define an allocation rule where segment values are constants for rules and formulas. What should you do?

- Specify Run Time Prompts (RTP).

- Always use the Outer Point of View (POV).

- Never use the Outer Point of View (POV).

- Only specify segment values in formulas.

Answer: D

NO.75 Your customer is using budgetary control and encumbrance.

You have an open purchase order for $500 USD, which you decide to match to an invoice for $300 USD. What will be the fund status of the purchase order and invoice?

- The purchase order is Partially Liquidated and the invoice is Partially Reserved.

- The purchase order is Partially Liquidated and the invoice will be reserved.

- Both are reserved.

- The purchase order is liquidated and the invoice is Partially Reserved.

- Both are Partially Reserved.

- The purchase order is Open and the invoice is validated.

Answer: C

NO.69 Your customer has enabled encumbrance accounting. You have a control budget with the advisory level set at control. For November 2015, your budget for a given combination is $5,000 USD. You have an approved requisition of $900 USD and you have an approved purchase order of $2,500 USD. An adjustment encumbrance journal is created in the General Ledger for the obligation type for $1,600 USD. You then cancelled the approved

PO line of $400 USD. For November 201b, you created a new invoice by matching to the

PO for $2,100 USD. Which two statements are true?

- Purchase order encumbrance will be released for $2100 USD.

- As there are cancellations for $400 USD, the system will partially reserve the funds in

November 2015 and fully reserve it in December 2015.

- As you are matching to a purchase order, the system will allow the user to create an invoice with the reservation status of Reserved.

- Encumbrance entries are created only for nonmatched Invoices, so the system will not create any encumbrance accounting entries.

- The system always consumes budget of future periods if the limit for the current period is expired, so December 2015 budget will be considered for reservation.

Answer: C,E

NO.63 You want to define a tree or hierarchy for use in reports and allocations.

What three aspects should you remember when creating the tree?

- You need to flatten the rows to be able to use drilldown in Smart View and you must publish tree to view the hierarchy in Essbase cubes.

- You must flatten the columns and publish the tree to view the hierarchy in Essbase cubes.

- The tree should have at least two tree versions to reduce report and allocation maintenance.

- You only need to flatten the columns if you plan to use the hierarchy in Oracle

Transactional Business Intelligence (OTBI).

- It is fine to have the same child value roll up to two or more different parent values.

Answer: B,C,E

NO.64 You create a prepayment for USD l00 and validate it to consume the budget and reduce available funds under the prepayment account. You then pay the prepayment of USD 100 create an invoice for USD 300, and validate the* invoice to consume the budget and reduce available funds for the expense-accounts used in the invoice. You then apply the prepayment fully on to the invoice and revalidate it. What happens to the available funds when you apply a prepayment that requires budgetary control?

- The prepayment application was already released at the time of payment and the invoice

consumes funds of 300 USD.

- The prepayment application releases funds of 200 USD ^nd the invoice consumes funds of lOO USD, with a net decrease to available funds of 200 USD.

- Available funds will not change till invoice is approved.

- The prepayment application releases funds of lOO USD and the invoice consumes funds of 300 USD, with a net decrease to available funds of 200 USD.

- The prepayment application releases funds of 300 USD and the invoice consumes funds of 300 USD, with a net decrease to available funds of 100 USD.

- The budget will be released only foi the USD 30O invoice amount.

Answer: F

NO.65 Your customer is having issues transferring intercompany transactions to General Ledger.. Identify three reasons for this.

- The intercompany transaction is not approved.

- The corresponding Payables and Receivables invoice have not been generated.

- If they are different, then the exchange rate is missing between the intercompany and ledger currency.

- The intercompany period is closed.

- Both the intercompany and general ledger periods are open.

Answer: A,B,C

NO.66 You are defining intercompany balancing rules that are applied to a specific source and category, such as payables and invoices, or a specific intercompany transaction type, such as Intercompany Sales. Which two statements are correct?

- You must define rules for every combination of specific categories and sources. Otherwise, theintercompany balancing will not work.

- You can create a rule for all sources and categories by selecting the source “Other” and the category “Other.”

- If you choose to have rules at various levels, then intercompany balancing evaluates the rules in this order: Ledger, Legal Entity, chart of accounts, and primary balancing segment value.

- Set up a chart of accounts rule for every chart of accounts structure you have in order to

ensurethat Intercompany Balancing will always find a rule to use to generate balancing accounts.

Answer: A,C

NO.62 You need to distribute departmental expense reports to 100 department managers in your organization. The report format is the same, but the department values differ.

What in the most efficient way to achieve this?

- Set the Department segment as a User Point of View (POV) and submit a report batch and schedule it: to run for every department. Send the different batch outputs as PDF attachments via email to different users.

- Create a single report for all departments. When department managers log in to

Financial Reporting Center, they will only be able to view their department’s data based on

Segment Value Security Rules.

- Set up Bursting Options for your batch to prepare multiple versions of a report from a single process.

- When defining the report, make the Department Segment a prompt and when users view the report, they can change the prompt to their department.

Answer: D

NO.60 Your company wants to change the Cumulative Translation Adjustment (CTA) account to record gains/losses from varying currency rates. What steps must you perform to achieve this objective without causing data corruption?

- Purge all translated balances, change the CTA account in the Ledger page, and rerun

Translation for all periods required.

- Open the Ledgers page and update the CTA account and then rerun Translation for all periods required. The system will automatically update the translated balances.

- Query the Translation journals and delete all of them, then change the CTA account in the Ledger page, and rerun Translation for all periods required.

- Define a new ledger and accounting configuration. The CTA account cannot be updated after the ledger has been in use.

Answer: B

Reference:

http://docs.oracle.com/cd/E15586_01/fusionapps.1111/e20375/F350915AN25358.htm

NO.61 You want to process multiple allocations at the same time. What feature do you use?

- RuleSets

- Point of View (POV)

- Formulas

- General Ledger Journal entries

Answer: C

NO.58 Your foreign currency transactions need to be revalued every month. For balance sheet accounts, you reverse the revaluation journals in the next period. You are using the period- to-date (PTD) method of revaluation tor your income statement accounts.

When should you reverse revaluation journals, if at all required?

- Reverse them in the same period as the revaluation run.

- Both balance sheet and income statement revaluation journals should be reversed in the next period.

- Never, because each period’s revaluation adjustment is just for that period.

- The reversals must be done at the end of each quarter.

Answer: B

NO.57 You are creating financial statements and want to have charts, such as a bar graph,

Automatically inserted to improve the understanding of the financial results. What’s the most efficient way to achieve this?

- When viewing the report, download to Excel and use Excel’s Charting features to create your bar graph.

- When designing your financial statement using Financial Report (FR), embed a chart into your report

- Use Account Inspector that automatically creates graphs on financial balances.

- D. Use Smart View, which is and Excel Add-on

Answer: C

https://docs.oracle.com/cd/E37017_01/doc.1115/e22893/F479559AN10590.htm

NO.56 Your customer wants to have balance sheets and income statements for their cost center and program segments. That is, they want to have three balancing segments.

Which two recommendations would you give your customer?

- When entering journals manually, the customer will need to make sure that the debits and credits are equal across all balancing segments because the system will not automatically balance the journal.

- Every journal where debits do not equal credits across the three balancing segments will result in the System generating extra journal lines to balance the entry.

- Additional intercompany rules will need to be defined for the two additional balancing segments.

- Ledger balancing rules will need to be defined to instruct the system on how to generate

balancing entries for the second and third balancing segments.

Answer: A,D

NO.54 Invoices received from a source system need to use a specific account based on 30 different expense types. However, if the invoice is from a specific supplier type, it needs to go to a default account regardless of the account type. What is the solution?

- Create two journal line rules with a condition of supplier type.

- Create an Account Rule with 31 rule elements using one condition for each expense type and another for supplier type.

- Create an Account Rule with two rule elements using one for expense type mapping and the other for the condition of supplier type.

- Create an Account Rule with three rule elements using one for expense type mapping, one for condition of supplier type, and the other without any conditions.

Answer: C

NO.48 You are implementing Financials Cloud and are using spreadsheets to load Legal Entities, Business Units, and Account Hierarchies. Which three setup objects can be loaded via a spreadsheet from Functional Setup Manager?

- complete Accounting Configuration

- Suppliers and Customers

- Banks, Bank Accounts, and Branches

- chart of account values, accounting calendar, and ledger

- setup data for Receivables and Payables product.

Answer: B,C,D

Explanation:

https://docs.oracle.com/cloud/latest/financialscs_gs/FACSF/FACSF1004386.htm#FACSF1

236038

NO.49 Which two statements are true regarding how Intercompany Balancing Rule, are defied?

- All ledgers engaged in an intercompany transaction must share the same chart: of accounts in order to define balancing rules

- You can only define balancing rules for different journals’ sources. You cannot define balancing rules for different journal categories.

- You can define different balancing rules for different combinations of journal sources, journal categories, and transaction types

- You can define different rules for different charts of accounts, ledgers, legal entities, and primary balancing segment value.

Answer: A,D

NO.50 Your customer is implementing budgetary control with encumbrance accounting.

Your customer has businesses in Australia, New Zealand, and Singapore with a ledger in each country with a Corporate chart of account instance that has four segments.

Which two statements are true regarding the creation of a control budget?

- Control budgets are always absolute to generate encumbrance accounting.

- A control budget can allow override rules only if the control level is absolute.

- The control budget structure has all the chart of account segments as budget segments.

- A control budget is associated to a ledger and creates three control budgets for Australia, New Zealand, and Singapore.

- A control budget can be associated with a different calendar than accounting calendar.

Answer: B,E

NO.51 You just submitted the Accounting Configuration. Which two statements are correct?

- You must define a Data Access Set to obtain full read/write access to the ledgers in the Accounting Configuration.

- A Data Access Set with full read/write access to the ledger is automatically created.

- Open the ledger’s period to begin entering transactions.

- Verify the data roles created and assign them to the General Ledger users.

Answer: C

NO.52 You want to specify Intercompany System Options.

Which three factors should you consider?

- Whether to enforce an enterprise-wide currency or allow in intercompany transactions in local currencies

- Whether to allow receivers to reject intercompany transactions

- Automatic or manual batch numbering and the minimum transaction amount

- Automatic or manual batch numbering and the maximum transaction amount

- The approvers who will approve intercompany transactions

Answer: A,B,D

NO.46 Which two statements are true regarding the export/import of reports?

- A set of reports are provided for both exported and imported setup data to validate the

export/import processes and setup data.

- Reports on setup data can be used to compare and analyze how the data might have changed over time.

- To view errors encountered during the export or import Process, you must use SQL queries to obtain that data because no reports exist.

- A set of reports lists user names, suppliers, and customers that have been exported/imported

- The export/import reports are available only for Fusion Customer Relationship

Management.

Answer: C,E

NO.44 Your customer wants to use a clearing company to automatically balance Intercompany entries. Which three statements are true regarding the use of a clearing company value?

- Clearing companies are not supported.

- If you map legal entities to balancing segment values, then a clearing company can only be applied within a legal entity.

- You must map legal entities to balancing segment values in order to use a clearing company.

- If you do not map legal entities to balancing segment values, then a clearing company can be applied to any journal within the ledger.

- If you choose to use a clearing company, you can define a default clearing company value or select the clearing company value directly in the general ledger journal.

Answer: A,C,E

NO.41 You need to define a chart of accounts that includes an intercompany segment. Your

customer plans to use segment value security rules for the Company segment.

What does Oracle consider as best practice to define this chart or accounts?

- Share the same value set for the company and intercompany segments to reduce chart of accounts maintenance.

- Use two different value sets for the company and intercompany segment because segment value security rules are at the value set level.

- Define the company segment only and qualify it as both the primary balancing segment

And intercompany segment.

- Define two different charts of accounts.

Answer: C

NO.39 Before implementing Fusion Financials, your customer used to manually reconcile their intercompany payables and receivables accounts. What is a more automated approach to do this?

- Run the BI Publisher reports called Intercompany Transaction Summary and Account

Details to automatically reconcile intercompany balances.

- Create a query using Oracle Transactional Business Intelligence (OTBI) that will match the

intercompany payables and receivables balances.

- Run the Intercompany Reconciliation report, which shows pairs of intercompany receivables and payables accounts that are out of balance.

- In Fusion Financials, you must manually reconcile your intercompany account balances.

- Use Oracle Hyperion Close Manager to automatically reconcile intercompany account balances.

Answer: B

NO.36 Your customer has three legal entities, 50 departments, and 10,000 natural accounts. They use intercompany entries. What is Oracle’s recommended best practice when implementing; a new chart of accounts? How many segments and what segment qualifiers should be used?

- Define three segments for the company, department, and natural account. The qualifiers shouldbe primary balancing segment, cost center segment, and natural account segment, respectively

- Define four segments for the company, department, natur.il account, and intercompany segment. The qualifiers should be primary balancing segment, cost center segment, natural account segment, and intercompany segment, respectively.

- Define five segments for the company, department, natural account, intercompany, and future use segment. The qualifiers should be primary balancing segment, cost center segment, natural account segment, intercompany segment, and no qualifier, respectively.

- Define three segments tor the company, department, and natural account. The qualifiers for the first segment should be primary balancing segment and intercompany segment, cost center segment, and natural account segment, respectively.

Answer: C

NO.37 Your Financial Analyst needs to interactively analyze General Ledger balances with the ability drill down to originating transactions. Which three features facilitate this?

- Account Inspector

- Smart View

- Account Monitor

- Online Transactional Business Intelligence

- Financial Reports published to Excel

Answer: BCD

NO.33 You customer is a financial Institution that needs to maintain average daily balances (ADB). Which two statements are true regarding this functionality in Fusion Applications?

- ADB provides organizations with the ability to track average and end-of-day balances,

Report average balance sheets, and create custom reports using both actual and average balances.

- Average balances are stored for both subledger balances and general ledger balances.

- Average balances are stored in the Essbase cube.

- Average balances are maintained for both actual and budget balances.

- When using ADB, you must define a daily calendar and assign it to your ADB ledger.

Answer: A,D